Table of Contents

In response to this increasing demand, we will outline in this blog the ins and outs of How Economic Substance Regime Works through a very typical example of Marshall Islands ESRs. Let’s explore the details below!

Where did “Economic Substance Rules” come from?

Economic Substance Rules act as a driving force behind the battle between the EU and the OECD against tax havens.

Economic Substance rules originated in 2017 as the criterion so that the EU Council has adjudicated the tax practices of jurisdictions deemed low or free tax. ESRs hinder such favorable tax jurisdictions in their facilitation of growing offshore business structures that do not reflect real economic activity in the jurisdiction.

A year later, the OECD in 2018 also published its Base Erosion and Profit Shifting, aka BEPS, Action 5 for the similar purpose of avoiding substantial activities regarding geographically mobile activities granted for preferential tax treatments within relevant jurisdictions.

Many inclusive countries and territories have steadily introduced legislation regarding economic substance requirements for tax purposes effective from early 2019, namely the BVI, Cayman Islands, Jersey, the Isle of Man, etc.

The Marshall Islands does not lie beyond this list, but clear guidance to its ESRs has just been brought forward recently. In what follows, we help you clarify the Marshall Islands Economic Substance-related requirements and entities.

What is Economic Substance Requirement?

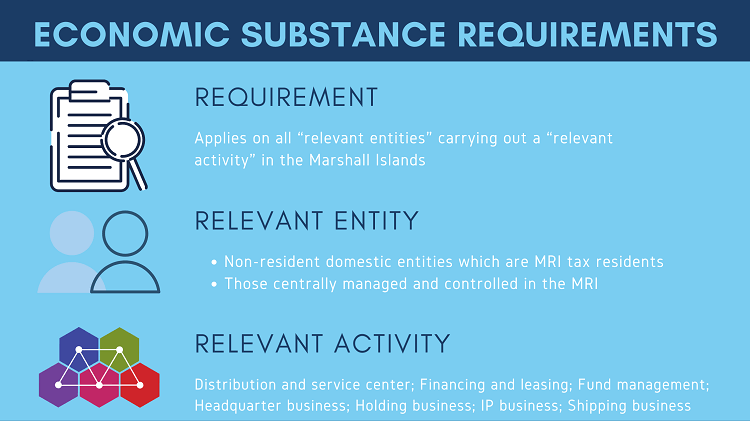

The Marshall Islands Economic Substance Regulations of 2018 (the “Regulations”) mandate that all “relevant entities” carrying out a “relevant activity” in the Marshall Islands must satisfy reporting requirements regarding their actual level of economic substance in the jurisdiction.

ESRs published by the Registrar of Corporations came into force on 1st January 2019. It then adopted further amendments on 21 February 2019 and 29 August 2019. The Regulations affect financial periods starting on or after 1 January 2019.

Who is covered by Marshall Islands ESRs?

As the aforementioned, covered in the scope of the Marshall Islands ESRs is “relevant entities” that generate profits from a “relevant activity”.

Relevant entities are defined under the Marshall Islands ESRs as including:

Non-resident domestic corporations, partnerships, and limited liability companies (Non-resident domestic entities – NRDEs) which are tax residents in the Marshall Islands;

Foreign corporations, partnerships, limited partnerships, and limited liability companies, including foreign maritime entities (FMEs) which are centrally managed and controlled in the Marshall Islands;

Relevant activities, according to the wording of the Regulations, consists of:

- Distribution and service center business;

- Financing and leasing business;

- Fund management business;

- Headquarter business;

- Holding company business;

- Intellectual property (IP) business;

- Shipping business;

Even though Banking and Insurance businesses are still falling into the category of “Relevant Activities” under the Marshall Islands ESRs, it should be noted that the Marshall Islands Associations Law have listed business associating with banking or granting policies of insurance as prohibited business activities applicable to all NRDEs as well as FMEs.

Who can be excluded from the Marshall Islands ESRs?

Any NRDE or FME that can provide objective evidence for the fact that it is NOT a tax resident inside of the Marshall Islands, will be deemed as a Non-Relevant Entity and kept outside the scope of the Marshall Islands ESRs. In other words, that entity will not be affected to have economic substance in the Marshall Islands.

To prove the status of tax residency outside of the Marshall Islands, the Registrar requires the entity to submit sufficient objective evidence as to the followings:

- Tax identification number

- Tax residence certificate

- Tax assessment or tax payment proofs

If a portion of total income is derived from a relevant activity, the entity must comply with the economic substance requirement only for that portion of its business. And in case a relevant entity does not participate in any relevant activities, it still has to submit an annual report to the Registrar.

If my company is a relevant entity conducting a relevant activity in the Marshall Islands, how can I demonstrate economic substance?

If you have determined that your company is a relevant entity engaging in a relevant activity specified in the above discussion, please take note of preparing for the “economic substance test”.

An economic substance test is conducted to guarantee that the relevant entity has sufficient economic substance concerning relevant activity in the Marshall Islands.

All in-scope entities, therefore, must satisfy the following requirements:

Directed and managed test

- Hold board meetings with an adequate frequency in the Republic;

- Have a quorum of persons physically present at such meetings;

- Have the minutes to record all relevant decisions during the meeting.

- Keep all minutes of meetings and records within the Marshall Islands, with the Registered Agent if needed;

- Ensure the governing body of the entity has the necessary knowledge and expertise to discharge its duties.

Adequate employees and presence test

- Have an adequate number of qualified employees in the jurisdiction;

- Incur adequate expenditure with the level of activity;

- Have an adequate physical presence in the jurisdiction.

Note

The determination of the “adequate” term here relies heavily upon the level of relevant activity that your entity is conducting.

CIGA test

CIGA stands for Core Income-Generating Activities, which are activities carried out in the jurisdiction and significantly contributing to the generation of income to a relevant entity.

As its definition suggests, the entity which wants to satisfy CIGA Test must prove that the entity’s CIGAs are being undertaken in the Marshall Islands.

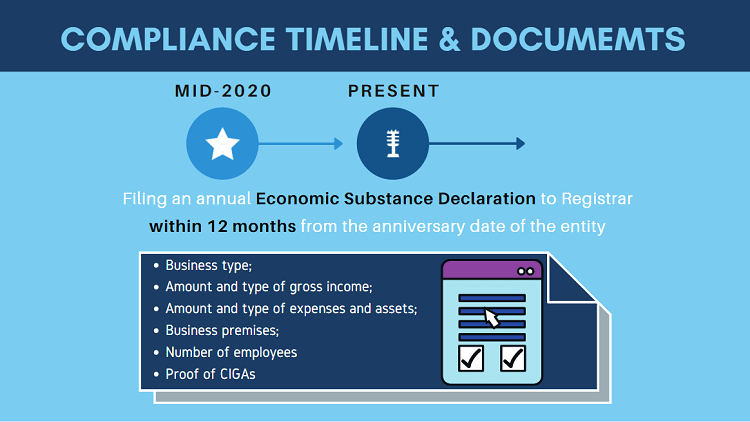

When and what documents should relevant entities prepare for complying with ESRs?

Starting from mid-2020, all NRDEs and FMEs as relevant entities under the Marshall Islands ESRs are required to prepare and file an annual Economic Substance Declaration to the Registrar within 12 months from the anniversary date of the entity. The declaration must be completed through the Registrar’s online portal which is predicted to open soon in the upcoming time.

tips

BBCIncorp offers Marshall Islands Economic Substance Filing services for companies in need. You can visit this page to get more details about the price and our service.

In addition to clarifying whether it is a relevant entity and whether it has any income derived from the relevant activity, the in-scope entity should entail the required information in the report for each relevant activity as below:

- Business type;

- Amount and type of gross income;

- Amount and type of expenses and assets;

- Business premises;

- Number of employees inclusive of those working full-time;

- Relevant proof of CIGAs to be carried out within the RMI.

It is worth noting that all required reports, return, or relevant information for submission to the Registrar should be in respect of the corresponding financial period. Additional documents may reasonably be required by the Registrar, depending on NRDEs and FMEs’ relevant activity.

What happens if relevant entities fail to satisfy ESRs?

Non-compliance or failure to economic substance requirements in the Marshall Islands can result in certain penalties:

- A relevant entity that fails to comply with the reporting requirements or not meeting the economic substance test for a financial period as required shall be fined up to $50,000, or lead to revocation and dissolution.

- If for the next financial period, the in-scope entity still does not pass the economic substance test, as determined by the Registrar, then the financial penalty can be added up to $100,000, or lead to revocation and dissolution.

Under Section 7, the Marshall Islands Economic Substance Regulations, 2018 clearly stated that the Registrar will deliver a notice to the entity for the determination, clarification of reasons why the entity has not satisfied the economic substance requirements, and applicable penalties together with other relevant information.

What are the requirements for holding business, IP business, and shipping business?

Take a look into the Economic Substance Regulations, you will recognize that holding business and shipping business entities may be subject to a slightly different regime:

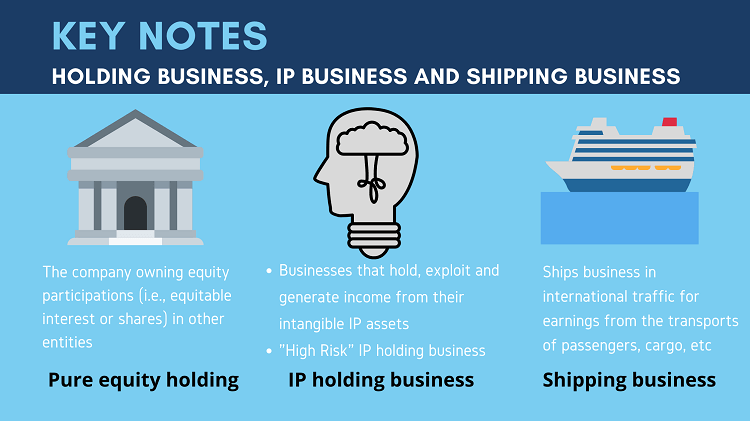

Pure equity holding companies

Refers to the company owning equity participation (i.e., equitable interest or shares) in other entities. The company is not allowed to conduct any commercial activity and its income derives from only dividends and capital gains.

Under Section 4 (5) of the Marshal Islands ESRs 2018, a pure equity holding company may suffer less complicated requirements of economic substance test as below:

- Have adequate employees and premises in the Marshall Islands; and

- Maintain compliance with all filing requirements as prescribed in the Business Corporations Act, Revised Partnership Act, Limited Partnership Act, or LLC Act, not exclusively paying all applicable fees;

Note: A pure equity holding company does not need to adhere to the directed and managed test, nor the requirement of carrying out CIGA in Marshal Islands. It can satisfy these reduced substance requirements by maintaining a registered agent in the Republic.

Intellectual property holding business

Refers to businesses that hold, exploit, and generate income from their intangible IP assets such as trademarks, copyright, patents, brand, or technical know-how.

It is noted that IP holding business in a manner defined as “High Risk” will be subject to some heightened requirements so that it is sufficient to show economic substance in the Marshall Islands. Accordingly, added requirements for a high-risk IP business include:

- Concrete evidence that a high degree of control over the development, exploitation, maintenance, enhancement, and protection of the asset has been used by full-time skilled employees who permanently locate and perform their core function inside of the Marshall Islands;

- Supporting evidence like a detailed business plan showing its commercial rationale of holding the IP asset in the Marshall Islands or particulars of employees.

Shipping business

Refers to ships business in international traffic for earnings from the transports of passengers, cargo, or Marshall Islands-flagged ship-related activities such as owning, financing, managing the crew, chartering the ship, and many others prescribed under the Marshall Islands ESRs, 2018.

Recognizing the unique character of the shipping business performing most of its core income-generating activities in transit outside of the Republic, a shipping business is considered to satisfy the economic substance by evaluating on following aspects:

- The relevant entity operates the vessels business in international traffic including crew management, ship maintenance, overseeing voyages, and other related activities;

- The relevant entity maintains compliance with all obligations under the Marshall Islands Associations Law and Maritime Act 1990, International Labor Organization regulations, and other related applicable laws.

Note: Private yacht lies outside the scope of the abovementioned “shipping business”; therefore, the ownership, operation, or management of a private yacht is not considered a relevant activity under the Marshall Islands ESRs. As a result, the private yacht relevant entity will be exempted from the economic substance test.

Key Takeaways

- A relevant entity engaging in a relevant activity in the Marshall Islands must be subject to economic substance requirements under the Marshall Islands ESRs unless it is a tax resident outside of the jurisdiction.

- Relevant entities under the Marshall Islands ESRs include non-resident domestic entities and foreign maritime entities.

- Relevant activities under the Marshall Islands ESRs include distribution and service center business, financing, and leasing business, find management business, headquarters business, holding company business, IP business, and shipping business.

- Economic substance test comprises three requirements that all in-scope entities must comply with economic substance in the Marshall Islands. They include the Directed and Managed Test, Adequate Test, and CIGA Test.

- All relevant entities, beginning from mid-2020, are required to submit an annual Economic Substance Declaration to the Registrar within 12 months from their anniversary date. The declaration should entail specific documents as required and must be done through the secure web portal.

- Holding business and shipping business entities may be subject to different requirements to demonstrate economic substance under the Marshal Islands ESRs. Please be fully aware and alert to the Regulations to take appropriate actions if you are an RMI-based entity engaging in these specific groups.

Any further concerns about the economic substance requirements in the Republic of Marshall Islands, feel free to contact us via service@bbcincorp.com!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.