Table of Contents

Personal income tax obligations for Delaware non-residents

Delaware non-residents who earn income from sources within the state may have to comply with personal income tax obligations.

Taxable income

Personal income tax applies to various sources of income, including:

- Wages and salaries: Income earned through formal employment whether full-time, part-time, or temporary jobs is subject to personal income tax

- Self-employment income: Non-residents who work for themselves, like freelancers, entrepreneurs, or sole proprietors, must pay personal income tax on the profits generated by their businesses. This includes income from consulting, freelancing, or any self-operated venture.

- Interest: Income earned from interest-bearing financial instruments, like savings accounts, certificates of deposit (CDs), or bonds, is taxable.

- Dividends: If you own stocks or shares in companies, you may receive dividends as a distribution of profits. These dividend earnings are subject to personal income tax.

- Rental income: Individuals who own and rent out properties, such as apartments, houses, or commercial spaces, must report and pay taxes on the rental income they receive. This includes both residential and commercial rental income.

- Capital gains: When you gain profit from the sales of investment, such as stocks, real estate, or other assets, the gain is taxable.

- Other forms of income: This can encompass things like alimony, lottery winnings, prizes, and any income not specifically covered elsewhere in the tax code.

Some types of income may be exempt from taxation or eligible for deductions and credits such as mortgage interest, medical expenses, and charitable contributions, reducing the taxable income.

Requirement for non-residents

To comply with personal income tax obligations, non-residents of Delaware must fulfill specific requirements:

- File a non-resident income tax return: Non-residents are typically required to file a Delaware Non-Resident Income Tax Return (Form 200-02). This form serves to report and remit state income tax on the income earned within Delaware.

- Pay the Delaware state income tax: Non-residents are responsible for paying the applicable state income tax, which is determined based on Delaware’s tax rates and regulations.

Deadline for payment and filing

Non-residents must file their Delaware non-resident income tax returns and make tax payments by the specified deadline, which is on or before April 30th each year. You can extend the time of filing by submitting Form 200EX before the due date.

Federal personal income tax for Delaware non-residents

In addition to Delaware’s state personal income tax, non-residents are also required to adhere to the Federal personal income tax, enforced by the Internal Revenue Service (IRS). This federal tax applies to all individuals, regardless of their state of residence.

Personal income tax rates for non-residents in Delaware

Personal income tax rates in Delaware are based on 7 tax brackets, from 0% to 6.6%. As mentioned, those having income from a Delaware source, including a resident, or a Delaware non-resident but received income from the state source, will be subject to personal income tax.

Specifically, Delaware’s personal income tax rate depends primarily on your taxable income. Your applied tax rate shall be as follows:

- 0% for taxable income under USD 2,000

- 2.2% for taxable income from USD 2,000 to 5,000

- 3.9% for taxable income from USD 5,000 to 10,000

- 4.8% for taxable income from USD 10,000 to 20,000

- 5.2% for taxable income from USD 20,000 to 25,000

- 5.55% for taxable income from USD 25,000 to 60,000

- 6.6% for taxable income exceeding USD 60,000

A detailed breakdown of Delaware taxation in just under 10 minutes

Get a closer look into the taxation system of Delaware with our detailed and easy-to-understand article. It has all the information you need to stay compliant with the regulation in Delaware.

How to file your personal income tax return online?

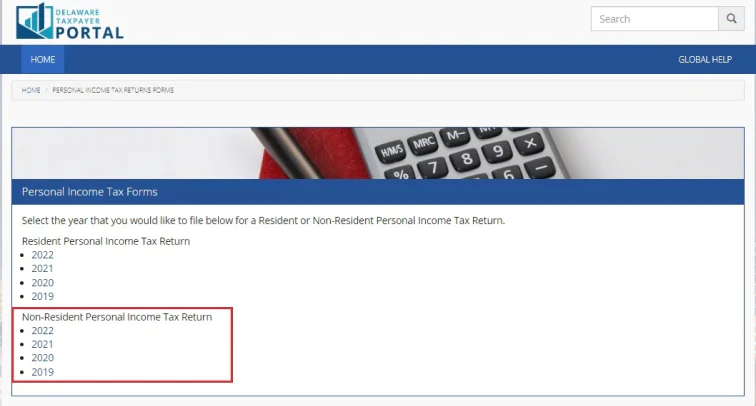

To file your Delaware state tax return online as a non-resident, you can use the Delaware Taxpayer Portal, which is the official online platform provided by the Delaware Division of Revenue.

Below are the steps to file your Delaware state tax return online:

Step 1: Log into the Delaware Taxpayer Portal

Go to the official website of Delaware Taxpayer Portal.

If you haven’t used the Portal before, you’ll need to create an account. Click on “Register now” and follow the prompts to set up your account. If you already have an account, simply log in using your username and password.

Once logged in, select your residency status (non-resident) and specify the tax year for which you intend to file your Delaware state tax return.

Step 2: Complete the online form

Once you access the online system, it will guide you to the appropriate tax form based on your filing status and residency. As a non-resident, you will likely use Form 200-02.

Simply follow the on-screen instructions to complete the form accurately, including entering your income sources, deductions, and any eligible tax credits.

After completing the form, be sure to attach any required supporting documents to your Delaware tax return. You’ll find a detailed list of the documents to attach in the next section.

For in-depth instructions on how to complete the form, you can refer to the comprehensive guide provided by the Delaware Division of Revenue.

Step 3: File your income tax return

After reviewing and confirming your return, electronically submit it through the Portal. You may also be required to electronically sign the return.

If you have tax liabilities, use the Portal to make electronic payments through available methods, such as electronic funds transfer or credit/debit card.

Upon successfully filing your return, you should receive a confirmation indicating that your return has been received by the Delaware Division of Revenue.

What documents to include with your Delaware income tax return?

The following documents are necessary to attach to your Delaware income tax return:

- DE Schedules I and III, if completed

- W-2 Form(s) issued by your employer and all 1099R Forms to receive credit for Delaware tax withheld

- A copy of your Federal 1040 Page 1 and 2 and all 1040 schedules (1, 2, 3, etc.)

- A copy of all federal schedules you are required to file with your federal return (for example, Schedule C, D, E, etc.)

- Delaware Schedule A (PIT-NSA), if itemizing deductions

- A signed copy of other states’ income tax return(s), if you claim credit for taxes paid to another state. Note: Don’t use the amount from your W-2 form(s)

- A copy of Form 1100S, Schedule A-1, if you take a credit for taxes paid by an S corporation

- A copy of Form DE2210, pages 1 and 2, if you completed Part 3 of the DE2210 or if the calculated estimated tax penalty is greater than zero

- A copy of Form 700, Delaware Income Tax Credit Schedule, Form 1801AC, and/or Form 2001AC, if applicable

- A copy of the Delaware Schedule W Apportionment Worksheet, if applicable. You must include pages 1 and 2

- A copy of Form 5403, Real Estate Tax Return, if individuals declared and paid estimated taxes on the sale of real estate owned in Delaware

What is the possibility to extend the time of filing?

Though there is no way you a non-resident can extend the time of the payment of tax, the extension for the time of filing is possible.

You can extend the time of filing by filing the Application for Automatic Extension (Form 200EX) before the due date of your income tax return.

Conclusion

In conclusion, a solid understanding of Delaware’s personal income tax is crucial for any non-resident looking to conduct business within the state. Although it may initially appear overwhelming, fear not, as the process becomes more manageable with familiarity.

Should you have any questions regarding Delaware personal income tax matters, simply get in touch with one of our friendly consultants, who will be sure to offer the most practical advice and helpful guidance for your queries.

Frequently Asked Questions

Are past-year residents subject to personal income tax in Delaware?

Part-year residents are required to file a tax return under the following circumstances:

- If they earned income within Delaware while they were residents of the state.

- If, as a non-resident, they received income from Delaware sources.

Part-year residents have the flexibility to choose whether to file a non-resident tax form or a resident tax form based on their specific circumstances.

Is it possible to extend the filing deadline?

While non-residents cannot extend the deadline for tax payment, they do have the option to extend the deadline for filing their tax return.

To do so, you can submit Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return before the original due date of your income tax return.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.