Why registering your company in Vietnam

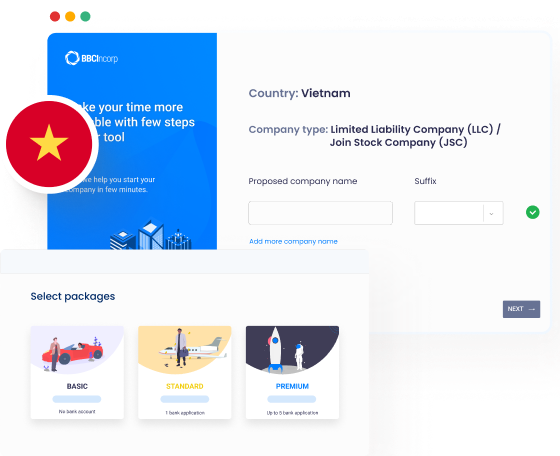

Limited Liability Company (LLC) / Joint Stock Company (JSC)

Limited Liability Company (LLC) / Joint Stock Company (JSC)

At least one member / 3 shareholders

Required local registered address

No local legal representative requirement

No minimum capital requirement for most cases

No upfront paid-up capital

Steps of registering your Vietnam company

Vietnam Company Formation Packages

Banking support package for Vietnam companies

Basic Banking Support

- One-time fee for application of one bank

- Consulting on the preparation of your chosen bank's requirements

- Preparing certified translated corporate documents for the bank (if needed)

- Making appointments with your chosen bank in the supported list

US$299

Premium Banking Support

- One-time fee for application of up to 3 banks OR until the account is opened, whichever comes first

- Consulting on the preparation of your chosen bank's requirements

- Preparing certified translated corporate documents for the bank (if needed)

- Meeting at the registered office address for all applications

US$599

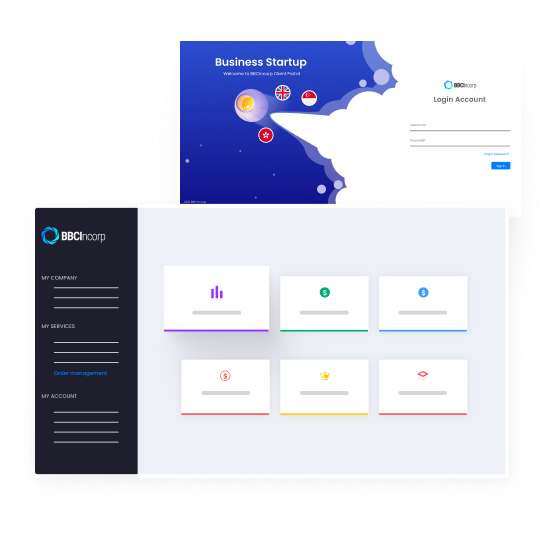

Bring your next business venture online

Streamlined process

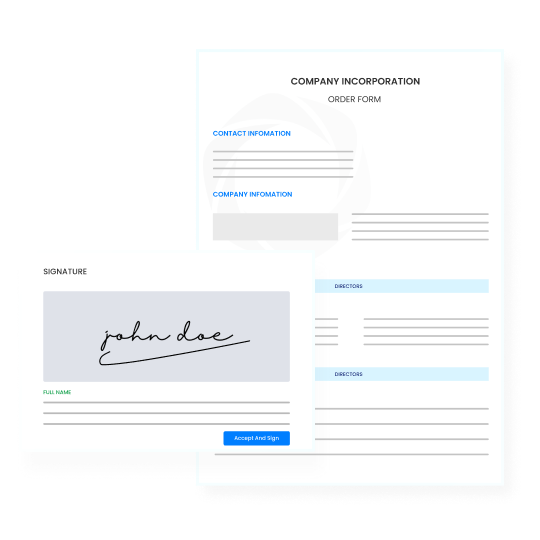

E-signature

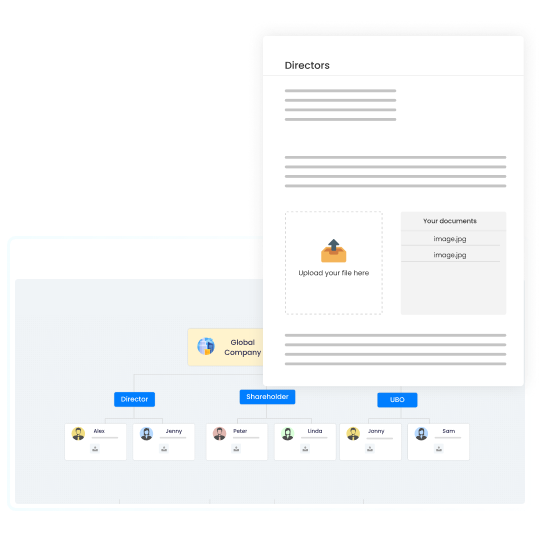

Digitized KYC

Centralized management portal

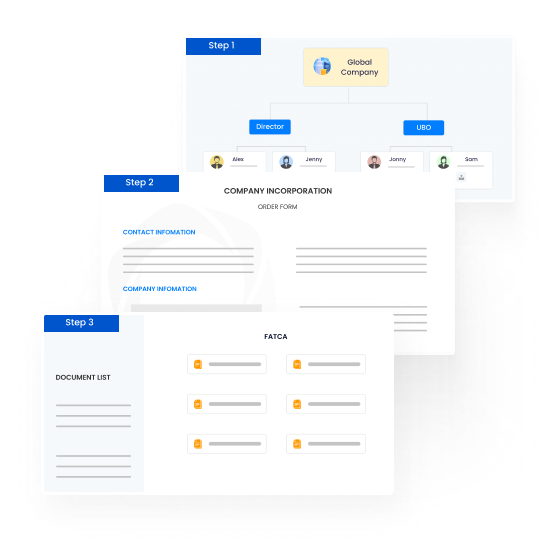

Vietnam Company Incorporation Process

Create online order

Enter our online order platform for easy onboarding experience and tailor your orders. We have different packages of Vietnam company formation and additional services that suit your goals. During this process, we also provide free consulting to help you set up the right company structure per your need.

Make payment

Your settlement can be made online via Credit card, Debit Card. Bank wire transfer is also acceptable.

Collect and Verify KYC documents

After receiving your order and payment, our customer service will contact you on the same day to confirm the order information and gather the required documents for incorporation in Vietnam.

Proceed the incorporation

The foreign corporate registration in Vietnam could be finished in 10 days or span from 2 to 3 months contingent on your selected business entity types, business sectors, and project's scale.

KYC Documents Checklist

*Note that the list provided, while comprehensive, may not encompass all requirements.

For further personalized consultations tailored to your specific case, please reach out to our support team anytime