- Types of accounting firms in Singapore

- Top 12 audit and accounting firms in Singapore

- How to choose the right accounting firm for your business

- Services offered by most Singapore accounting firms

- Regulatory bodies and standards for accounting firms

- Why businesses choose BBCIncorp for accounting services

- Conclusion

Singapore’s reputation as a world-class business hub is built on transparency, reliability, and financial discipline. In such a competitive environment, every decision a company makes, from investment to expansion, depends on accurate financial insight and strict compliance with local regulations. This is where professional accounting firms in Singapore play a crucial role.

A trusted SG accounting firm does more than record numbers; it helps businesses interpret them, align with ACRA and IRAS standards, and uncover opportunities for growth. As compliance demands evolve in 2026, the expertise of an audit firm in Singapore becomes vital for maintaining credibility and operational efficiency.

This article explores the leading accounting firms shaping Singapore’s financial landscape in 2026, how their expertise continues to support compliance, transparency, and business growth.

Types of accounting firms in Singapore

Singapore’s accounting landscape is as diverse as its economy. From global networks serving multinational corporations to boutique firms guiding emerging startups, accounting firms in Singapore offer distinct strengths tailored to different business needs. Understanding these categories helps enterprises identify the right level of expertise and partnership required for their growth.

Global vs. local accounting firms

Global firms, including the Big 4 (Deloitte, EY, KPMG, and PwC) and other international networks such as BDO, RSM, and Baker Tilly, dominate the list of top accounting firms in Singapore. They are known for their extensive resources, advanced technology, and cross-border expertise. Local firms, in contrast, build their reputation through personalized service, in-depth understanding of Singapore’s regulatory environment, and competitive pricing.

| Criteria | Global Accounting Firms | Local Accounting Firms |

| Reputation | Strong international brand recognition, often part of global networks | Trusted within domestic markets, rely on local expertise and referrals |

| Pricing | Premium fees reflecting global scale and expertise | Competitive and flexible rates |

| Service scope | Wide range of services including audit, advisory, tax, and risk management | Focused on statutory accounting, bookkeeping, and compliance |

| Client base | Multinational corporations and listed entities | SMEs, startups, and private companies |

| Regulatory experience | Deep knowledge of IFRS and cross-border reporting | Specialized in Singapore’s local framework (ACRA, IRAS) |

For large multinational corporations, these audit firms in Singapore offer global consistency and network reach. Meanwhile, SMEs and growing businesses often find that local firms provide the agility and attention necessary for hands-on support.

Boutique and mid-tier firms

Apart from global and local providers, Singapore’s accounting market is also home to a dynamic group of boutique and mid-tier firms that offer specialized and flexible services. These smaller yet highly skilled teams combine technical expertise with client-centered service. They often work with startups, e-commerce companies, and fast-growing enterprises that value adaptability and direct communication.

Their key advantage lies in flexibility, with tailored service packages, industry-specific knowledge, and faster response times. For many businesses, these firms represent the perfect balance between affordability and sophistication, offering the professionalism of large providers without excessive formality.

As Singapore continues to promote innovation and entrepreneurship, boutique and mid-tier firms are increasingly becoming trusted partners for companies seeking scalable and practical accounting support.

Top 12 audit and accounting firms in Singapore

Singapore’s accounting landscape remains one of the most developed in Asia, shaped by both international networks and reputable local firms that provide essential professional services. Together, they support Singapore’s reputation for financial transparency and business integrity.

This section presents 12 leading audit and accounting firms in Singapore, ranging from Big 5 international providers to reputable mid-tier and local firms. Each plays a key role in helping businesses manage compliance, ensure accuracy, and achieve sustainable growth in 2026.

BBCIncorp Singapore

BBCIncorp Singapore is a professional accounting and corporate service provider dedicated to helping businesses maintain transparent, accurate, and compliant financial management.

Operating within Singapore’s highly regulated business landscape, the firm has built a strong reputation among startups, SMEs, and foreign-owned companies for its technology-driven and client-focused approach.

BBCIncorp provides a comprehensive suite of accounting and compliance solutions designed to meet the diverse needs of modern enterprises:

- General ledger and financial statement preparation ensuring accuracy and alignment with Singapore Financial Reporting Standards (SFRS).

- Monthly, quarterly, or annual bookkeeping services tailored to business size and reporting cycles.

- Preparation of profit projections and cash flow forecasts to support financial planning and investment decisions.

- Payroll assistance covering salary computation, CPF submission, and statutory compliance.

- XBRL preparation for efficient ACRA filing.

- Personal and corporate tax filing handled in compliance with IRAS requirements.

- Mandatory tax and GST registration to meet local obligations.

- Auditing coordination to help businesses fulfill annual audit requirements with external partners.

Pros:

- Transparent pricing and efficient, cloud-based accounting system.

- Specializes in startups, eCommerce, and foreign-owned SMEs requiring cross-border compliance.

- Integrated workflow connecting accounting, incorporation, and legal support.

Cons:

- Less suited for listed or large-scale corporations requiring full-service audits.

- Limited focus on complex assurance or transaction advisory projects.

Ideal clients:

BBCIncorp Singapore is ideal for startups, regional entrepreneurs, and SMEs seeking reliable, technology-enabled accounting solutions. With an expanding presence across multiple international financial hubs, the firm continues to strengthen its cross-border expertise.

Contact information:

Website URL: https://bbcincorp.com/

Email: service@bbcincorp.com

BBCIncorp’s Office in Singapore:

Address in Singapore: 9 Raffles Place, #29-05 Republic Plaza, Singapore (048619)

Phone in Singapore: (+65) 6011 8200

BBCIncorp’s Headquarters in Hong Kong:

Address in Hong Kong: Office 3906, 39th, The Center, 99 Queen’s Road Central, Central, Hong Kong

Phone in Hong Kong: (+852) 9889 3529

BBCIncorp’s Office in Vietnam:

Address in Vietnam: 39-41 Ngo Thi Bi Street, Him Lam Area, Tan Hung Ward, Ho Chi Minh City

Phone in Vietnam: 18006338

Deloitte Singapore

Deloitte Singapore is recognized as one of the five largest audit and accounting firms in Singapore, delivering a comprehensive range of services across audit, risk management, tax, and consulting.

As part of Deloitte’s global network, the Singapore office combines deep technical expertise with cutting-edge technology to serve complex business needs across industries.

Pros:

- Deep global network and extensive technical resources.

- Strong reputation in audit, risk, tax, and consulting practices.

- Robust internal controls and proven expertise in regulatory compliance.

Cons:

- Premium pricing not suitable for small businesses.

- Longer onboarding times due to high demand and large client volume.

Ideal clients:

Deloitte Singapore is best suited for large and complex organizations such as multinational corporations, publicly listed companies, and government-linked entities. These businesses typically require structured audit processes, strong internal control reviews, and global coordination.

Website URL: https://www.deloitte.com/southeast-asia

Email: enquiries@deloitte.com

Tel: +65 6224 8288

Address: 6 Shenton Way OUE Downtown 2 #33-00, Singapore 068809

Ernst & Young (EY) Singapore

Standing among Singapore’s five largest accounting and audit firms, Ernst & Young (EY) Singapore delivers innovation-driven audit, tax, and advisory services that combine digital transformation with regulatory expertise. The firm’s approach emphasizes the use of technology and data analytics to enhance financial transparency and compliance efficiency.

Pros:

- Digital-first audit and advisory solutions supported by advanced data tools.

- Industry-focused teams specializing in finance, real estate, and energy sectors.

- Strong capabilities in cross-border tax planning and transfer pricing.

Cons:

- Higher service costs and limited flexibility for smaller clients.

- May prioritize larger or long-term corporate engagements.

Ideal clients:

EY Singapore is suitable for enterprises undergoing digital transformation or regional expansion. Its technology-driven audit framework and international tax expertise make it a practical choice for companies that require data-enabled financial reporting and cross-border compliance alignment.

Website URL: https://www.ey.com/en_sg

Tel: +65 6535 7777

Address: Level 18 North Tower, One Raffles Quay, Singapore 048583

KPMG Singapore

Ranked within Singapore’s five major audit and accounting firms, KPMG Singapore, part of KPMG International, is widely recognized for its depth of expertise in assurance, governance, and sustainability reporting. The firm provides comprehensive audit, tax, and advisory services supported by large multidisciplinary teams specializing in ESG, IPO readiness, and financial due diligence.

Pros:

- Excellent ESG, sustainability, and governance reporting capabilities.

- Strong reputation for IPO readiness and financial due diligence.

- Large technical teams equipped for specialized and complex engagements.

Cons:

- Higher operational costs, making it less accessible to SMEs.

- Rigid service structures with limited flexibility for smaller clients.

Ideal clients:

KPMG Singapore primarily serves large enterprises, IPO-ready businesses, and regional headquarters that require structured financial due diligence, governance support, and ESG reporting in line with international standards.

Website URL: https://kpmg.com/sg

Tel: +65 6213 3388

Address: Asia Square Tower 2, 12 Marina View, #15-01, Singapore 018961

PricewaterhouseCoopers (PwC) Singapore

As one of Singapore’s Big 5 accounting and audit firms, PricewaterhouseCoopers (PwC) Singapore delivers comprehensive services across assurance, tax, and advisory. The firm is known for its strong industry focus and ability to provide end-to-end financial and strategic solutions for complex corporate structures.

Pros:

- End-to-end financial, audit, and strategic advisory services.

- Trusted expertise in M&A, valuation, and regulatory compliance.

- Extensive industry coverage and sector-specific experience.

Cons:

- Premium pricing and resource-intensive processes for smaller firms.

- Less tailored solutions for early-stage startups or small private entities.

Ideal clients:

PwC Singapore primarily serves corporations with international structures, institutional investors, and large conglomerates that require advanced audit quality, transaction support, and regulatory guidance across multiple jurisdictions.

Website: https://www.pwc.com/sg

Tel: +65 6236 3388

Address: 7 Straits View, Marina One, East Tower, Level 12, Singapore 018936

BDO Singapore

BDO Singapore, also listed among Singapore’s Big 5 accounting and audit networks, bridges international expertise with a strong mid-market focus. The firm delivers practical and partner-led audit, tax, and advisory services, making it a popular choice among growing businesses seeking global standards with personalized attention.

Pros:

- Mid-market focus combined with international experience.

- More accessible pricing compared to the Big 4.

- Personalized service from partners and senior managers.

Cons:

- Less global brand recognition than the Big 4.

- Limited service depth for highly complex or multinational structures.

Ideal clients:

BDO Singapore is well-suited for growing SMEs, subsidiaries, and family-owned businesses that value direct partner involvement, cost efficiency, and internationally recognized audit quality without the overhead typically associated with the Big 4.

Website: https://www.bdo.com.sg

Email: info@bdo.com.sg

Address: 600 North Bridge Road, #23-01 Parkview Square, Singapore 188778

Baker Tilly TFW

Baker Tilly TFW is a well-established mid-tier accounting and audit firm in Singapore and a member of the Baker Tilly International network, one of the world’s top 10 global accounting associations. The firm is known for its expertise in audit, assurance, and IPO advisory, serving both local and regional clients seeking dependable financial reporting and compliance services.

Pros:

- Strong capabilities in IPO advisory, financial audits, and assurance services.

- Member of a global network, allowing seamless support for cross-border transactions.

- Broad service portfolio with execution tailored to local regulations.

Cons:

- May experience slower response times during peak reporting seasons.

- Limited automation in routine accounting workflows.

Ideal clients:

Baker Tilly TFW is suitable for mid-sized companies preparing for public listing, family-owned businesses, and organizations requiring reliable audit and advisory services supported by an international network.

Website: https://www.bakertilly.sg

Email: general@bakertilly.sg

Address: 600 North Bridge Road, #05-01 Parkview Square, Singapore 188778

RSM Singapore

RSM Singapore is one of the leading mid-tier accounting and advisory firms in Singapore and a member of RSM International, the sixth largest global network of independent audit firms. The firm offers a wide range of assurance, tax, and consulting services with a strong presence in the financial, trading, and services sectors.

Pros:

- Strong regional network and expertise in tax restructuring.

- Extensive experience with mid-cap and regional enterprises.

- High reputation in financial services and trading industries.

Cons:

- Less budget-friendly for micro-enterprises.

- Focuses more on advisory and restructuring than basic compliance.

Ideal clients:

RSM Singapore caters to mid-tier corporates and foreign companies with operations in Singapore that require structured audit, tax, and advisory support coordinated across regional markets.

Website: https://www.rsm.global/singapore

Email: Info@RSMSingapore.sg

Address: 8 Wilkie Road, #03-08 Wilkie Edge, Singapore 228095

AG Singapore

AG Singapore is a locally established accounting firm providing cost-effective compliance and bookkeeping services for startups and small businesses. The firm emphasizes accessibility and efficiency, offering straightforward accounting solutions that meet Singapore’s statutory requirements.

Pros:

- Affordable pricing for basic compliance and accounting needs.

- Efficient handling of GST filing, payroll, and tax returns.

- Responsive client support for early-stage companies.

Cons:

- Limited advisory and strategic planning capabilities.

- Not suited for complex audits or multinational entities.

Ideal clients:

AG Singapore is suitable for small local companies, freelancers, and sole proprietors seeking affordable accounting and tax compliance support delivered with reliability and speed.

Website: https://ag-singapore.com/

Email: johnwoo@ag-singapore.com

Address: 111 N Bridge Rd, #07-11 Peninsula Plaza, Singapore 179098

Tan, Chan & Partners PAC

Tan, Chan & Partners PAC is an ISCA-registered public accounting corporation specializing in statutory audits and internal control reviews for SMEs. With strong local expertise, the firm provides dependable assurance and compliance services tailored to Singapore’s business environment.

Pros:

- Reliable audit and compliance services for SMEs.

- Local expertise with focus on audit and internal control systems.

- ISCA-registered and compliant with professional standards.

Cons:

- Traditional work processes with limited technology adoption.

- Less support for digital or cloud-based accounting systems.

Ideal clients:

Tan, Chan & Partners PAC primarily serves local SMEs in retail, manufacturing, and services sectors that require consistent, relationship-based audit support.

Website: https://www.tanchan-cpa.com/

Email: info@tanchan-cpa.com

Address: 26 Eng Hoon Street, Singapore 169776

WLP Group

WLP Group is a one-stop corporate service provider offering company incorporation, accounting, tax, and audit services under one roof. Its cloud-based bookkeeping tools and digital workflow make it a preferred option for businesses seeking efficient, technology-enabled accounting support.

Pros:

- Comprehensive one-stop service combining incorporation, accounting, and tax.

- Cloud-based bookkeeping and XBRL filing tools.

- Strong appeal to businesses looking for digital-first accounting solutions.

Cons:

- Limited expertise in complex tax or strategic advisory.

- Generalized service scope may lack niche specialization.

Ideal clients:

WLP Group is suited for startups, SMEs, and digital-first businesses that value speed, affordability, and integrated financial management tools within a single platform.

Website: https://www.wlp.com.sg/

Email: info@wlp.com.sg

Address: 10 Woodlands Square #04-53 / 55 Woods Square, Singapore 737714

Casey Lin & Co

Casey Lin & Co is a boutique accounting and audit firm in Singapore that focuses on providing efficient, cost-effective services to small enterprises. The firm is recognized for its responsiveness and reliability in meeting statutory audit and tax filing requirements.

Pros:

- Fast turnaround for audit and tax compliance.

- Good customer service with transparent communication.

- Cost-effective pricing for small businesses.

Cons:

- Limited brand recognition in the broader market.

- Basic service offerings with a few advanced advisory options.

Ideal clients:

Casey Lin & Co serves sole proprietors, partnerships, and small private limited companies that need dependable audit and compliance support delivered quickly and affordably.

Website: https://www.caseylinco.com.sg/

Email: casey@caseylin.com.sg

Address: 10 Anson Rd, #35-11 International Plaza, Singapore 079903

How to choose the right accounting firm for your business

Selecting the right accounting firm in Singapore is not only about compliance—it’s a strategic decision that can influence the financial clarity, efficiency, and growth of your business. With numerous accounting companies in Singapore offering diverse pricing, tools, and expertise, it is important to evaluate which firm aligns best with your company’s size, structure, and long-term objectives.

Key considerations in firm selection

When choosing an SG accounting firm, business owners should assess three main aspects: specialization, cost transparency, and technology readiness.

Industry specialization

Each business operates under unique regulatory and operational frameworks. An accounting firm experienced in your industry, be it eCommerce, manufacturing, or financial services, will understand your reporting requirements and compliance risks. Specialized firms can also provide tailored advisory insights that go beyond standard bookkeeping.

Budget and pricing transparency

Pricing structures among accounting companies in Singapore vary significantly. Some firms offer bundled packages for startups and SMEs, while others charge by transaction or volume. Look for firms that provide clear, upfront quotations without hidden fees. Transparent pricing not only helps manage budgets but also builds trust between the client and the accountant.

Technology adoption

Modern accounting firms leverage cloud-based platforms and automation tools to streamline bookkeeping, reporting, and tax filing. Technology reduces human error, enhances collaboration, and provides real-time visibility of your company’s financial health. Businesses should prioritize firms that integrate digital accounting systems for accuracy and efficiency.

Questions to ask before hiring

Before engaging an accounting partner, it is essential to ask a few key questions that reveal the firm’s competence and compatibility:

What services are included?

Determine whether the engagement covers bookkeeping, audit preparation, tax filing, or payroll management. Clarify the scope to avoid paying for overlapping services later.

Who will manage your account?

Confirm if your account will be handled by a senior accountant or a junior associate. Consistent contact with a qualified professional ensures better continuity and accountability.

Are there value-added advisory services?

Beyond compliance, leading accounting firms in Singapore often offer strategic insights on tax planning, cash flow forecasting, or corporate restructuring. These services can significantly enhance decision-making and long-term financial performance.

The right accounting firm should not only ensure compliance but also act as a reliable financial partner that supports growth. Whether you are a startup seeking affordability or an established company looking for advisory depth, choosing the right SG accounting firm is an investment in sustainable business success.

Services offered by most Singapore accounting firms

The majority of accounting firms in Singapore offer a wide range of professional services that go beyond traditional bookkeeping. These firms support businesses in maintaining compliance, improving operational efficiency, and gaining financial clarity. The following are the most common services provided by both large and mid-sized audit firms in Singapore.

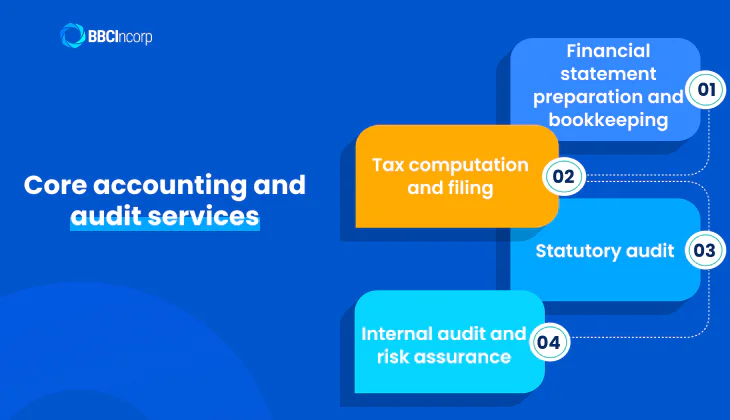

Core accounting and audit services

At the foundation, accounting firms deliver essential services that ensure financial accuracy and compliance with local laws.

These include:

- Financial statement preparation and bookkeeping: Maintaining accurate ledgers and reports in accordance with Singapore Financial Reporting Standards (SFRS).

- Tax computation and filing: Calculating and submitting corporate income tax to the Inland Revenue Authority of Singapore (IRAS).

- Statutory audit: Independent verification of financial statements for companies that meet audit thresholds under the Companies Act.

- Internal audit and risk assurance: Evaluating internal controls, identifying potential risks, and strengthening corporate governance practices.

Such services form the backbone of any professional audit firm in Singapore, ensuring that businesses remain transparent and compliant with statutory obligations.

Advisory and business support services

Beyond compliance, many accounting firms in Singapore extend their expertise to broader business support and advisory solutions:

- Corporate secretarial services: Handling company filings, annual returns, and board resolutions required by ACRA.

- Payroll processing: Managing salary computation, CPF submission, and statutory contributions.

- GST registration and filing: Assisting clients in registering for Goods and Services Tax and ensuring accurate monthly or quarterly submissions.

- XBRL reporting and IRAS filing: Preparing financial data in XBRL format for ACRA and handling tax documentation with IRAS requirements.

These services allow companies to manage administrative obligations seamlessly while focusing on strategic priorities.

Outsourced accounting and cloud software integration

Outsourcing has become increasingly common among SMEs and startups in Singapore. By partnering with accounting firms that use digital platforms, businesses can reduce overhead costs while gaining real-time access to financial data.

Modern accounting firms in Singapore often integrate with popular software like Xero, QuickBooks, enabling automation in reconciliation, expense tracking, and report generation. This approach helps companies:

- Save time on repetitive administrative work.

- Ensure data accuracy and regulatory alignment.

- Scale their accounting systems easily as the business grows.

By leveraging cloud technology, an audit firm in Singapore can deliver efficiency and transparency that would otherwise require significant in-house resources.

Regulatory bodies and standards for accounting firms

Operating an accounting firm in Singapore requires adherence to strict legal and professional frameworks that safeguard transparency, investor confidence, and financial integrity. Singapore’s accounting industry is known globally for its credibility, a reputation maintained through consistent oversight by regulatory authorities and professional bodies.

Every audit firm in Singapore must comply not only with statutory obligations but also with the ethical and technical benchmarks that define the nation’s accounting profession. Two key institutions play this central role: the Accounting and Corporate Regulatory Authority (ACRA) and the Institute of Singapore Chartered Accountants (ISCA).

Oversight by the Accounting and Corporate Regulatory Authority (ACRA)

ACRA serves as Singapore’s primary regulator for accounting firms and corporate service providers. All public accountants and audit entities must be registered under ACRA before providing statutory audit or assurance services.

The authority oversees:

- Licensing and registration: Public accountants must hold valid licenses issued by ACRA, renewed annually upon meeting continuing professional education and quality control requirements.

- Compliance monitoring: Regular inspections and practice reviews ensure that audit firms in Singapore uphold international auditing and reporting standards.

- Public register: ACRA maintains an online directory where companies can verify licensed firms and their partners before engagement.

By enforcing these standards, ACRA ensures that accounting practices remain transparent, reliable, and aligned with Singapore’s status as a trusted financial hub.

Role of the Institute of Singapore Chartered Accountants (ISCA)

ISCA acts as the national professional body for accountants, setting technical, ethical, and educational benchmarks for accounting firms in Singapore.

Its responsibilities include:

- Professional standards and certification: Overseeing Chartered Accountant (CA Singapore) qualifications and continuing professional development.

- Ethics and conduct: Enforcing a code of professional ethics to ensure objectivity, independence, and integrity.

- Public directory: Maintaining the ISCA Firm Directory where businesses can identify registered firms that meet national standards.

Together, ACRA and ISCA uphold Singapore’s reputation as a trusted financial hub, ensuring that every audit firm in Singapore operates under transparent, globally aligned standards.

Why businesses choose BBCIncorp for accounting services

As Singapore remains a financial hub attracting both startups and global enterprises, businesses increasingly seek accounting firms that combine reliability, scalability, and technological expertise. BBCIncorp distinguishes itself as an SG accounting firm that delivers modern, transparent, and compliance-driven accounting solutions aligned with Singapore’s evolving regulatory landscape.

Accounting and tax services tailored for SMEs and trading/e‑commerce

BBCIncorp recognizes that SMEs, trading, and e-commerce businesses operate in fast-moving environments where financial clarity and compliance can directly impact growth. Managing multi-currency transactions, GST reporting, and real-time inventory updates often stretches the limits of traditional bookkeeping.

To solve this, BBCIncorp offers scalable, technology-enabled accounting and tax packages tailored to modern business models. The services are structured for flexibility, allowing companies to scale up or streamline their accounting scope as they grow.

Core features include:

- Cloud-based accounting systems (such as Xero) for real-time financial tracking and performance visibility.

- Comprehensive bookkeeping and tax reporting covering monthly accounts, Estimated Chargeable Income (ECI), and Form C filings.

- E-commerce and trading-specific packages designed to manage multi-currency transactions, cross-border payments, and IRAS-compliant reporting.

- Financial services sector support, ensuring data accuracy, risk control, and audit readiness.

By combining automation with expert oversight, BBCIncorp enables businesses to reduce manual errors, maintain continuous compliance, and access financial data anytime, anywhere. Unlike many accounting firms in Singapore, the firm’s integrated digital ecosystem empowers entrepreneurs to transform accounting from a back-office task into a real-time decision tool.

Cross-border and compliance expertise

As an international corporate service provider, BBCIncorp understands the complexity of operating across multiple jurisdictions. The firm assists clients with tax reporting, group structuring, and maintaining compliance with Singapore and regional regulations.

Its cross-border support extends to regional expansion, helping companies align accounting systems and statutory filings when establishing subsidiaries or holding entities abroad. This expertise makes BBCIncorp a trusted partner for businesses that operate across Asia’s key markets, where understanding both local compliance and international standards is essential.

Commitment from BBCincorp

At BBCIncorp, commitment means consistency, accuracy, and trust – the values that define how we serve every client. Our accounting approach combines precision with partnership, ensuring businesses not only stay compliant but also operate with full financial clarity.

- Precision and reliability in every report

Every statement and filing is reviewed by certified accountants, ensuring accuracy, compliance, and readiness for audit at all times.

- Data clarity that drives confident decisions

Real-time dashboards and structured reports provide a complete picture of your company’s performance, helping you plan and act strategically.

- Seamless processes built on technology

BBCIncorp’s digital accounting ecosystem integrates bookkeeping, payroll, and tax workflows to deliver efficiency and control from one secure platform.

- Transparent pricing, long-term value

Our packages are structured for predictability – no hidden charges, only clear, scalable solutions tailored to business growth.

This level of consistency and attention to detail sets BBCIncorp apart among accounting firms in Singapore, giving clients a dependable partner that supports compliance today and strategy tomorrow.

Conclusion

Choosing the right accounting partner is a strategic decision that shapes how effectively your business manages compliance, reporting, and financial growth. With the wide range of accounting firms in Singapore, from global leaders to specialized boutique providers, each company has the opportunity to find a partner that truly matches its structure, size, and long-term goals.

Business owners should always perform due diligence: assess the firm’s licensing, technology capabilities, industry experience, and pricing transparency before engaging. The right collaboration can transform accounting from a routine obligation into a valuable business asset.

Today’s market shows that innovation and accessibility are redefining what clients expect from professional accountants. Firms like BBCIncorp exemplify this shift, combining digital tools with tailored service models to offer flexibility, responsiveness, and compliance precision.

Whether you require a public accounting firm for audit in Singapore or a local accounting specialist, the key is to partner with professionals who deliver both accuracy and insight, turning financial management into a foundation for sustainable success.

Kindl y reach out to our team today at service@bbcincorp.com to explore how BBCIncorp can support your Singapore business. We are ready to provide timely assistance!

Frequently Asked Questions

Why should I consider BBCIncorp or other mid-sized firms instead of only the Big 5?

Big 5 firms are well-known but often expensive and more focused on large corporations. Mid-sized firms like BBCIncorp provide a better fit for startups, SMEs, and foreign-owned companies with affordable pricing, flexible solutions, and personalized support.

They also leverage cloud accounting and digital tools for efficiency, while ensuring compliance with ACRA and IRAS. For businesses seeking cost-effective, responsive, and end-to-end accounting services, mid-tier firms are a smarter and more practical choice.

Can foreign-owned companies engage local accounting firms in Singapore?

Yes, foreign-owned companies can engage local accounting firms in Singapore. Local firms are well-equipped to support compliance with ACRA and IRAS requirements, offering cost-effective and tailored services for international businesses.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- Types of accounting firms in Singapore

- Top 12 audit and accounting firms in Singapore

- How to choose the right accounting firm for your business

- Services offered by most Singapore accounting firms

- Regulatory bodies and standards for accounting firms

- Why businesses choose BBCIncorp for accounting services

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.