About BBCIncorp

Hong Kong Budget 2026–2027: Recovery, Reform, and Renewed Momentum

Hong Kong Budget 2026–2027 marks a return to fiscal balance and outlines strategic priorities shaping the global business hub’s next phase of growth.

BBCIncorp named Gold Partner for 2025 by Aspire

BBCIncorp named Gold Partner 2025 by Aspire, recognizing strong partnerships, compliant corporate services, and continued support for global business growth.

BBCIncorp Receives Airwallex’s Outstanding Partner Award 2025

BBCIncorp was presented with the Outstanding Partner Award 2025 by Airwallex, a leading global fintech provider and our long-term partner. Read more.

Hong Kong Food Delivery Market Outlook 2026

The Hong Kong food delivery market has moved beyond the pandemic-driven hypergrowth phase and is now entering a period defined by consolidation, operational discipline, and structural realism. After several years of heavy subsidies, aggressive customer acquisition, and rapid platform expansion, 2026 is emerging as a year where efficiency and sustainable profitability matter more than headline…

Practical Guide on Hong Kong Global Minimum Tax for MNEs

Global minimum tax is no longer a policy discussion. It is a permanent feature of how international business operates. Under the OECD BEPS 2.0 framework, large multinational enterprise groups now face an effective tax rate of 15 percent across jurisdictions. According to the Hong Kong Inland Revenue Department and the OECD, Hong Kong has implemented…

Hong Kong Talent Visa: Latest Immigration Updates

Hong Kong continues to position itself as one of Asia’s leading hubs for business, innovation, and international careers. To strengthen its global talent pool, the Hong Kong SAR Government introduced the Top Talent Pass Scheme (TTPS), commonly referred to as the Hong Kong Talent Visa. This immigration pathway is designed to attract high-income professionals and…

What are the Top Hong Kong AI Startups in 2026?

Hong Kong AI startups are capturing global attention as the center solidifies its reputation as one of Asia’s most dynamic innovation hubs. In 2026, the rise of artificial intelligence has created unprecedented opportunities, and investors, entrepreneurs, and tech enthusiasts are closely watching the Top AI startups 2026 HK incorporation. These companies are not only developing…

SME Export Marketing Fund Application for Grant Guide

Expanding into overseas markets is a strategic priority for many Hong Kong SMEs, yet international marketing often requires substantial upfront investment. To ease this burden, the Hong Kong Government established the SME Export Marketing Fund (EMF), a long-standing scheme that subsidizes eligible export promotion activities and lowers the financial barrier to market entry. For businesses…

Q1 2026 Tax Filing Deadline for Corporations

For corporations operating in or through Hong Kong, the Q1 2026 tax filing deadline for corporations represents a critical compliance milestone rather than a routine administrative task. Corporate profits tax obligations are governed not only by statutory deadlines, but also by accounting year-ends, Inland Revenue Department (“IRD”) filing practices, and the availability of extension mechanisms….

Why Hong Kong matters as China US tariff uncertainty reshapes trade

Since 2018, the China-US trade conflict has moved from rapid tariff escalation to prolonged negotiation cycles, with few structural reversals. The US-China tariff timeline shows how Section 301 measures reshaped supply chains, while later talks delivered pauses and narrow exemptions. Examples of tariffs in the US continue to affect electronics, machinery, and consumer goods, keeping…

What is BUD Fund in Hong Kong? How It Supports SMEs

The BUD Fund Hong Kong is driving growth for local SMEs as the city strengthens its position as a leading hub for business innovation and international expansion. Since its launch, the fund has opened new opportunities for companies to upgrade operations, build brand recognition, and explore markets beyond Hong Kong. Its support for marketing initiatives,…

Maximizing Tax Rebate in Hong Kong Following the 2025–26 Budget

As we enter 2026, understanding the tax rebate Hong Kong provisions from the 2025–26 budget is more important than ever for both businesses and individuals. Since the Hong Kong government introduced significant HK budget tax rebates, including one‑off reductions in salaries tax, profits tax, and tax under personal assessment for the 2024/25 year of assessment,…

Lunar New Year 2026 Holiday Notice

Happy Lunar New Year 2026 from BBCIncorp. We wish our clients and partners a year filled with growth, success, and new opportunities in 2026.

Reflecting on 2025: BBCIncorp’s Progress and Achievements

Celebrate BBCIncorp’s 2025 journey of growth, partnerships, and achievements, and join us as we look forward to an exciting 2026 together.

Review The Top 5 Hong Kong Company Service Providers

A review of the Top 5 Hong Kong company service providers, covering incorporation, compliance, pricing, and client feedback of BBCIncorp and other options.

The U.S.-China Trade War and Its Impact on the Asia Trade War

The U.S.-China trade war began as a bilateral dispute over tariffs and market access. Right now, it has evolved into a defining force in regional economic strategy. Originally focused on imbalances of the two nations, the trade war between China and the U.S. now drives broader realignment throughout Asia as companies and governments adjust to…

Audit and Assurance – Knowing Their Role in Business Success

Hong Kong remains a leading hub for international business and finance, attracting companies from across the globe seeking a transparent and well-regulated environment. In this context, audit and assurance play essential roles in ensuring corporate accountability, building stakeholder trust, and supporting strategic decision-making. While audits focus on the accuracy and reliability of financial statements, assurance…

Business Registration Fee in Hong Kong: 2025 Breakdown

Setting up a company in Hong Kong requires more than just a great business idea, it starts with proper registration. Every business operating in the city must obtain a Business Registration Certificate (BRC) from the Inland Revenue Department, serving as official proof of legal operation. Along with this requirement comes the business registration fee in…

Change of Company Name in Hong Kong: A How-to guide

A change of company name in Hong Kong refers to the formal process of amending a company’s registered name under Section 107 of the Companies Ordinance and updating the corresponding Business Registration Certificate with the Inland Revenue Department. Businesses may undertake the change for various reasons, including rebranding, legal compliance, mergers and acquisitions, or business…

Essential Accounting Entries Every Business Needs to Master

Accounting entries form the foundation of bookkeeping in Hong Kong, and every global business operating here relies on accurate records to meet compliance requirements and maintain financial clarity. The Inland Revenue Department highlights that proper books and records are essential for audits and tax filings, and companies must retain them for at least seven years…

A Complete Compliance Guide to Hong Kong Business Registration Search

How can businesses know for sure that they are engaging with legitimate companies in Hong Kong? A business registration search Hong Kong offers a dependable method for companies, investors, compliance teams, and foreign entrepreneurs to check registered business details and verify official status. Performing a business registration number search adds to thorough due diligence, reduces…

Hong Kong Corporate Tax Rates and Business Tax Efficiency

Hong Kong is widely regarded for its simple, low, and business-friendly tax regime, making it an attractive hub for foreign investors and international companies. Hong Kong corporate tax rate, which is transparent, competitive, and designed to support sustainable business growth. This favourable structure has played a key role in drawing regional headquarters, trading companies, and…

Hong Kong Income Tax Guide: Rates, Calculator & Filing Rules

Under the Hong Kong tax system, income is taxed on a territorial basis, meaning only income sourced in or derived from Hong Kong is subject to tax. This makes Hong Kong attractive to residents, expats, freelancers, and business owners looking for a transparent and efficient tax environment. Understanding personal income tax Hong Kong rules is…

Hong Kong Tax Deadline 2026: Corporate & Individual Guide

Global businesses operating in Hong Kong work in an environment where timing shapes compliance, and missing a Hong Kong tax filing deadline can lead to penalties and closer review. As companies move toward the 2026 cycle, the Inland Revenue Department continues to refine its framework after recent reforms, and this makes it even more important…

PLC Meaning: Structure, Benefits, and How to Set Up

A public limited company is a recognised business structure in Hong Kong and many major markets, defined by its ability to offer shares to the public and raise capital at scale. Understanding PLC meaning gives entrepreneurs a clear view of what is required to grow beyond private ownership. In Hong Kong, a public limited company…

A Complete Guide to Hong Kong TIN Number for Individuals

Navigating Hong Kong’s tax system begins with understanding the Hong Kong personal tax identification number. Unlike many countries, Hong Kong does not issue a separate TIN card. Instead, an individual’s Hong Kong Identity Card (HKID) number acts as the official TIN equivalent. This unique identifier is essential for taxation and compliance, facilitating seamless communication with…

Hong Kong Business Registration and Company Registration

If you aim to set up a prominent business in Asia, business registration and company registration in Hong Kong can provide a solid foundation. By registering your company with the Companies Registry and obtaining a Business Registration Certificate, you gain formal legal status under Hong Kong law, allowing you to operate in and from the…

Multinational corporation: Structure, Benefits & Expansion Guide

Hong Kong has firmly established itself as a leading hub for MNC company headquarters across Asia. Its strategic location at the heart of the region provides quick access to Mainland China and the broader Asia‑Pacific market, making it an ideal base for multinational corporation Hong Kong operations. The city’s pro‑business environment, transparent legal framework, and…

Mastering Provisional Tax in Hong Kong: Complete Guide

What is provisional tax in Hong Kong? It is a prepayment of income tax based on your estimated earnings for the next assessment year. The Inland Revenue Department (IRD) uses this system to ensure a steady flow of tax revenue while spreading taxpayers’ obligations more evenly. However, many individuals and businesses misunderstand how provisional tax…

Redefining the Role of Accountant in Enterprise Growth

As one of the world’s most dynamic financial hubs, Hong Kong has become a proving ground for how finance shapes business growth. Within this landscape, enterprises face mounting pressure to balance speed, compliance, and strategic clarity across multiple jurisdictions. At the center of this balance stands the enterprise accountant, no longer confined to preparing statements…

BBCIncorp receives the 2025 OCBC Valued Partner Award in Hong Kong

BBCIncorp receives the 2025 OCBC Valued Partner Award in Hong Kong, recognizing our excellence and trusted partnership in global corporate service solutions.

BBCIncorp x Aspire: Claim US$999 for Hong Kong Company Formation with Business Account

Get US$999 cashback when you incorporate your Hong Kong company with BBCIncorp and open an Aspire business account. All essential company services available.

BBCIncorp Awarded Xero Gold Partner Status, Enhancing Business Accounting Solutions

BBCIncorp is delighted to announce that we have officially become a Gold Partner of Xero for providing expert Hong Kong accounting services.

Keeping your business in good standing by avoiding poor accounting

Avoid the hidden costs of poor accounting. Discover how BBCIncorp’s enterprise accounting solutions keep your business compliant, efficient, and growth-ready.

Setting Up a Company Limited by Guarantee in Hong Kong

A company limited by guarantee in Hong Kong is a unique type of legal entity widely used by non-profits, charities, clubs, and associations. Unlike traditional companies, this structure has no share capital and is not designed for profit-making purposes. Instead, members act as guarantors and contribute a symbolic amount in the event of winding up….

Certificate of Incumbency in Hong Kong: A Complete Guide

A certificate of incumbency in Hong Kong is an official document that verifies the identity of a company’s directors, shareholders, and other key officers. It also confirms the company’s legal structure and current standing. In Hong Kong’s competitive and highly regulated business environment, this certificate is often required for opening bank accounts, entering into contracts with…

Designated Representative Hong Kong: Complete Guide

In Hong Kong, the concept of a designated representative has become increasingly important under the city’s evolving regulatory framework. Introduced as part of the Companies Ordinance and tied closely to the Significant Controllers Register (SCR) requirements, the designated representative plays a key role in ensuring transparency and corporate accountability. Every company incorporated in Hong Kong—unless…

Why Top Partners Choose BBCIncorp Connective Hub: 5 Key Advantages

Struggling with multiple company management? Discover 5 advantages of BBCIncorp Connective Hub for effortless cross-border operations.

Hong Kong Limited Liability Company Formation: What to Know

Setting up a limited liability company (LLC) is a smart move for entrepreneurs aiming to protect their assets while running a business. An LLC limits owners’ financial risk, separating personal liability from company obligations—a major advantage for startups and growing enterprises alike. In Hong Kong, this structure is especially powerful, offering businesses a gateway to…

Hong Kong Company Registry: Guide to Business Registration

Starting a business in Hong Kong begins with understanding the Hong Kong Companies Registry (HKCR), the official body responsible for company registration and compliance. As the backbone of Hong Kong’s corporate landscape, the company registry ensures that businesses operate transparently, meet legal requirements, and maintain proper documentation throughout their lifecycle. Whether launching a startup or…

Starting a Business in Hong Kong: A Step-by-Step Guide

Hong Kong continues to solidify its status as one of the world’s premier business hubs, offering unrivaled access to the Asia-Pacific market and beyond. In 2024 alone, 1,079 new non-Hong Kong companies were established, and by year’s end, the total number climbed to 15,126, marking a 2% increase over 2023(1). These figures prove that Hong Kong…

How to Integrate a Payment Gateway in Your Website?

Ecommerce payment processing is the backbone of any successful online business. It refers to the method of managing and processing digital transactions between customers and businesses on ecommerce platforms. For online entrepreneurs, ensuring a seamless payment experience for customers not only builds trust but also boosts sales. One key aspect of ecommerce payment processing is…

Finding a Niche Market to Unlock Global Success

Think small to grow big. That’s the essence of what makes niche markets so powerful. A niche market represents a focused, unique segment within a broader industry, allowing businesses to target customers with precision and build stronger connections. For companies looking to expand beyond local borders, these markets can serve as the launching pad to…

Global Sales Showdown: Physical Storefront or E-Commerce Model?

Grow globally in 2025: Compare physical storefronts and e-commerce. Learn advantages, challenges, and the best model for your business.

Managing Asian Branches from North America? How to Do It Right

Expanding to Asia? Learn how North American companies can effectively manage remote branches. Key strategies for success revealed.

How to Start an Ecommerce Business in 2025

Launching an ecommerce business has evolved from being a bold decision to becoming an essential choice for budding entrepreneurs and small businesses. With 2025 on the horizon, the digital landscape promises even more rapid innovation, creating immense opportunities for online retailers. If you’re wondering how to start an ecommerce business, this guide is here to…

Exciting News! BBCIncorp Launches New Ecommerce Solutions

We are proud to announce the launch of our latest service BBCIncorp Ecommerce Solutions. Streamline market entry, payments, and website development to empower your business growth.

Best Bookkeeping Services for SMEs in Hong Kong 2026

Effective bookkeeping is the backbone of every successful business, especially small and medium-sized enterprises (SMEs). Accurate financial records not only ensure compliance with Hong Kong’s stringent regulations but also provide critical insights to drive growth and profitability. For SMEs navigating the fast-paced and competitive Hong Kong business landscape, expert bookkeeping services are essential for making…

7 Best Accounting Software in Hong Kong for SMEs

Keeping businesses competitive requires leveraging the right accounting software in today’s fast-paced environment. Accounting software helps automate bookkeeping, manage financial records, and ensure compliance with local regulations, saving time and reducing errors. In this article, we discuss the benefits of accounting software in Hong Kong for SMEs, the key criteria for choosing the right solution,…

Hong Kong Budget 2025-2026: Insights For Businesses, Expats, And Investors

Explore how Hong Kong’s 2025-2026 Budget supports businesses with tax relief, e-commerce programs, global expansion funds, AI R&D, and cross-border opportunities.

Lunar New Year 2025 Holiday Notice

Dear valued customers and partners, Time truly flies! The 2025 Lunar New Year is fast approaching, bringing with it a fresh start and renewed energy. This year, we welcome the Snake, a symbol of wisdom, resilience, and transformation. The Snake encourages us to shed old layers and embrace new opportunities with grace and patience. It’s…

Cheers to the Holidays: Merry Christmas and Happy New Year 2025

Wishing you a Merry Christmas, Happy New Year & success in 2025! Explore our 2024 highlights recap and important details about our office closure.

Business Recordkeeping In Hong Kong: What Are The Requirements?

Read about the legal requirements for business recordkeeping in Hong Kong, penalties for non-compliance, and best practices to ensure smooth operations.

Navigating Hong Kong Balance Sheets: Key Insights For Entrepreneurs

Learn what makes up a balance sheet, why it matters, and how it empowers your Hong Kong business. Entrepreneurs, here’s your guide to financial clarity.

Master Cash Flow Statements: Effective Strategies For Hong Kong Entrepreneurs

Learn actionable strategies to prepare and manage cash flow statements tailored for Hong Kong entrepreneurs. Unlock the key to growth today.

BBCIncorp’s Latest Report Uncovers Vital Trends Shaping Asia Pacific’s E-commerce Landscape

Unlock Asian market potential with BBCIncorp’s e-commerce report. Discover insights, strategies, and download the full report online for expansion success.

Product And Pricing Strategies: Insights For Asia-Pacific Businesses Selling To The US

Optimize U.S. market entry for Asia-Pacific businesses with product and pricing strategies. Drive growth through data analytics and innovative approaches.

Official Release Of Client Portal’s Revamped Version

Discover BBCIncorp’s revamped Client Portal, designed for enhanced productivity with a user-centric interface and continuous innovation for effective business management.

Mastering Amazon Selling: Strategies For Businesses Entering The U.S. Market

Navigate Amazon’s marketplace confidently with strategic planning, optimized product listings, and smart pricing strategies for long-term success.

Crossing Borders: Understanding American Consumer Behavior For Asia-Pacific Brands

Key strategies for Asia-Pacific brands to capture the promising U.S. market by understanding American consumer behavior. Read more.

Building A Strong Brand Presence In The US: Tips For Asia-Pacific Companies

Explore strategies for Asia-Pacific companies to build a strong brand presence in the U.S., including cultural adaptation, digital marketing, and entity formation.

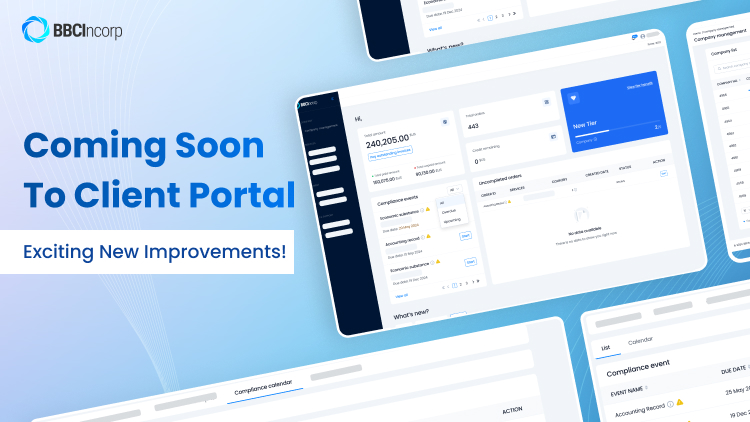

Coming Soon To Client Portal: Exciting New Improvements

Discover our redesigned Client Portal with modern design, enhanced navigation, and a comprehensive Help Center to streamline and boost your productivity.

Hong Kong: The Maritime Gateway In One Belt, One Road Initiative

Explore Hong Kong’s pivotal role in global trade through the Belt and Road Initiative. Discover strategies to leverage its strategic advantages for business growth.

BBCIncorp To Participate In Vietnam Interior & Build Expo (VIBE) 2024

Explore BBCIncorp’s role at VIBE 2024, offering innovative e-commerce solutions and global market expansion strategies for Vietnamese businesses.

Celebrating Mid-Autumn Festival 2024: Time Of Unity And Joy

BBCIncorp extends our warmest greetings to our esteemed clients and partners this Mid-Autumn Festival. May your celebrations be filled with joy, prosperity, and unity.

BBCIncorp Participates In UOB “Gateway To ASEAN” Conference 2024

BBCIncorp participated in the UOB Gateway to ASEAN Conference 2024, focusing on growth opportunities in ASEAN through innovation, sustainability, and investment strategies.

BBCIncorp At Forbes Business Forum 2024: Key Highlights

BBCIncorp participated in the Forbes Business Forum 2024, where we connected with business leaders, fostering dialogue on innovation and business growth opportunities.

Best Practices For Ensuring Corporate Governance In Hong Kong

Discover the definition, key strategies, and best practices for strong corporate governance in Hong Kong. Read more to stay compliant with local laws easily

Digital Document Management Simplifying Compliance And Record-Keeping

Optimize compliance and record-keeping with a Digital Document Management System. Enjoy seamless access, automation, and e-signatures through BBCIncorp Client Portal today.

BBCIncorp Joins Global Leaders At Forbes Business Forum 2024

BBCIncorp will join global leaders at Forbes Business Forum 2024 in Vietnam to discuss trends, innovations, and strategies for business growth. Join us at this influential event on Aug 22, 2024.

Streamlining Tax Compliance: Essential Digital Solutions For Businesses

Discover how digital solutions can simplify tax compliance, reduce errors, and save time for businesses. Streamline your tax processes with the latest tools and expert guidance.

Digital Transformation In Company Incorporation: Streamlining The Startup Process

Explore how digital transformation streamlines global company incorporation, enhancing accuracy, compliance, and efficiency while saving time and resources. Read more.

Revolutionizing Compliance: Digital Tools For Bookkeeping And Accounting

Explore how digital tools are revolutionizing compliance in bookkeeping and accounting. Discover automation, streamlined management, and more insights for business success!

Navigating The Complexities Of Digital Payments In Asia

Explore the complexities of digital payments in Asia. Discover how businesses can turn challenges into opportunities with strategic insight and adaptability.

Strategies For Maintaining Cultural Identity While Growing Globally

Explore strategies to maintain cultural identity while expanding globally. Learn effective methods from global brands to ensure your heritage thrives internationally.

Expanding Your Business Globally: Key Considerations And Strategies

Expanding your business globally requires these considerations. Learn key strategies for utilizing cultural differences, legal requirements, and logistics to achieve success now.

Governance And Ethical Practices For Global Enterprises In Asia

Global enterprises in Asia can enhance reputation and sustainability with key areas of effective governance and ethical practices. Learn key strategies here.

The Impact Of Smart Cities On Business Growth In Asia

Discover how smart cities in Asia are driving digital transformation and creating opportunities for business innovation and sustainable growth.

Fintech Innovations In Asian Markets: Things Businesses Should Watch Out For

Explore major fintech innovations and trends that are transforming business operations in Asia, and learn how to embrace them to stay ahead of the competition.

Top 5 Innovative Trends Shaping The Future Of Asian Startups

Innovative trends like AI, cloud computing, and fintech are empowering startups in Asia to thrive in the modern business landscape. Explore in detail now!

Accounting Errors SMEs Make In Hong Kong: How To Stay Compliant

Accounting errors in Hong Kong can be extremely fatal. Boost your Hong Kong SME’s resilience with insights into avoiding common mistakes with us today!

TCSP License In Hong Kong For Trust Company Service Providers: The Guide You Need

TCSP Licenses are mandatory for Trust and Company Service Providers in Hong Kong. Who must hold this license and how to apply for your license? Read all in our article!

BBCIncorp x Airwallex Unveil The New Package For Hong Kong Business Setup And Global Banking

Launch your Hong Kong business with an Airwallex global banking account through BBCIncorp and enjoy a $260 rebate. All essential corporate services included and more!

Currency Exchange In Hong Kong: How To Optimize Your Finance

Discover how to optimize currency exchange in Hong Kong with practical tips and insights in this comprehensive guide. Equip yourself with the knowledge now!

Virtual Office In Hong Kong: Save Costs And Streamline Your Business

Establishing your virtual office in Hong Kong is the best way to save on physical location costs. Find out why this is the best option for you and what to consider.

Hong Kong ID: When And How To Apply For Your Identity Card

A Hong Kong ID or Identity Card is a must for individuals planning to stay in the city for more than 180 days. Here’s how you can obtain yours with ease.

Tips For Thriving As A Freelancer In Hong Kong

Thinking about launching your freelancer career in Hong Kong? Dive into these essential tips for achieving both wealth and work-life balance.

Electronic Signature In Hong Kong: Why Is It Important?

Electronic signature is a crucial tool for Hong Kong businesses to streamline operations with full legal validity. Discover how to obtain your e-signature today.

Renew Your Hong Kong Business Registration: A Detailed Guide

Hong Kong Business Registration renewal is a strict requirement for enterprises here. Explore how to renew your registration and stay compliant with ease.

Proof Of Address In Hong Kong: How to Confirm Your Valid Residence?

Proof of address in Hong Kong is a vital document to verify your residence, required in both personal and business life. Find out what is acceptable and what’s not.

Hong Kong Standard Industrial Classification Code: Know Where Your Business Stands

Knowing which Hong Kong Standard Industrial Classification Code your business belongs to is crucial for operating legally in HK. Read now.

Cost Of Living In Hong Kong: A Complete Breakdown With Infographic

Discover the cost of living in Hong Kong, covering housing, transportation, utilities, and tips for financial management amidst the vibrant city life.

Hong Kong Budget 2024/25: What It Means For You & Your Business

Key points of Hong Kong Budget 2024/25, from profit tax incentives and property measures to support initiatives for residents. Explore now!

Property Tax Hong Kong: A Guide to Understanding Your Obligations

Unclear about the property tax Hong Kong? Then here is the guide you can’t ignore to get a clear dive into the matter. Start your journey now.

SME Funding: All About Government Funding For SMEs in Hong Kong

Find out what SME funding programs your business can benefit from and how the Hong Kong government nurtures such a robust environment for success.

Non Profit Organization Hong Kong: Key Steps For Aspiring Changemakers

Looking to create a positive impact in Hong Kong? It’s crucial to thoroughly know how the non profit organization operates there. Find out now.

Hong Kong Driving License: A Pocket Guide To Obtaining Your License

How to get a Hong Kong driving license and start traveling in this robust city? Read more for eligibility criteria and instructions on the process.

Stamp Duty Hong Kong: Everything Property Investors Need to Know

Discover the essentials of stamp duty in Hong Kong, including its key principles, main types, and payment methods. Ensure compliance with our comprehensive guide.

Tax Return Hong Kong: A Guide For Individuals Taxpayer

Grasp the essentials of the Hong Kong personal tax return: eligibility, forms, rates, deadlines, and how to complete online tax filing on your own.

The Expat’s Guide: Mastering Hong Kong Culture & Lifestyle

Hong Kong is a city of boundless opportunities with a blend of rich culture and modern lifestyle, Ready for an expat adventure? Explore our guide now!

Hong Kong Profit Tax: A Must-Read For Business Owners

Discover the profit tax Hong Kong, learn how to calculate your tax liability, file your tax return, and obtain tax exemption with our comprehensive guide on Hong Kong profit tax.

Trust Company In Hong Kong: A Promising Business To Opt For

Explore the trust company in Hong Kong through its benefits, eligibility criteria, and registration process in our article.

Special Purpose Vehicle (SPV) in Hong Kong: Whats And Hows

In Hong Kong, the Special Purpose Vehicle (SPV) is a powerful entity formed by businesses to safeguard vital assets and hold investments efficiently. Explore this model now.

Issue & Allotment Of Shares: A Helpful Guide For Hong Kong Businesses

The issue of shares and allotment of shares in Hong Kong are critical processes for increasing your company’s share capital. Read more to understand.

Hong Kong Salary Tax Guide: Your Compass to Tax Compliance as an Expat

Understanding the Hong Kong salary tax can help expats more in control of their income and financial planning. Read our article to find out more.

Payroll Outsourcing In Hong Kong: Making The Right Decision

Payroll outsourcing is a popular option for Hong Kong businesses to alleviate the hassles. See how this decision benefits your company today.

Hong Kong’s Passes Inland Revenue (Amendment) Bill 2023 To Enhance Tax Certainty

Hong Kong unveils Inland Revenue (Amendment) Bill 2023, offering tax certainty for investors. Learn about key provisions and eligibility criteria.

Hong Kong Annual Return Essentials: Your Comprehensive Cheat Sheet

Hong Kong’s annual return is a crucial legal obligation for businesses to stay comply with the region law. Discover more key insights here.

Appointment And Resignation Of Directors In Hong Kong: Key Details

Understanding the process of appointment and resignation of directors in Hong Kong is essential for maintaining effective corporate governance and smooth operation. Read more.

Hong Kong Intellectual Property Law: Your Business’s Creative Assets’ Shield

To safeguard your intellectual property when doing business in Hong Kong, yours need to have a deep knowledge of the IP law. All can be found here.

Employer’s Return Filing: Ensuring Tax Compliance In Hong Kong

Filing the employer’s return annually to the IRD is a mandatory requirement for Hong Kong businesses. Read more to learn about the process and important takeaways.

Hong Kong 2023: A Robust Year In Review

Here’s a quick overview of the evolving business landscape in Hong Kong through our infographic article. Updated tax regulations, supporting incentives, the UBI implementation, and more.

Starting A Restaurant In Hong Kong: What Licenses To Get?

To launch a restaurant business in Hong Kong, securing the appropriate license is a must. Find out which license best fits your business needs here.

Joy of the Season: Merry Christmas & Happy New Year 2024!

Celebrate the season with BBCIncorp! Join us in reflecting a remarkable year and embrace the joy of Christmas and the hope of a New Year in our warm holiday message.

Power Of Attorney In Hong Kong: Why It Matters To Your Business

The power of attorney in Hong Kong is a legal document that enables an individual or company to act on behalf of another. Learn how crucial this document is to your business.

Change Of Business Registration Address In Hong Kong: What And How?

In essential cases, how can you adjust your registered Hong Kong company address? Can you change your business address online in Hong Kong? Let’s find out through our article.

Hong Kong SFC License Essentials: A Comprehensive Overview

Obtaining an SFC license in Hong Kong is a critical requirement for conducting regulated financial activities. Discover all you need to know here.

Exciting Update: New Features Unveiled On Our Client Portal

We are thrilled to introduce two remarkable additions to our Client Portal that are poised to transform how you interact with us: the Company Dashboard and Additional Services. These new features are a direct reflection of our steadfast commitment—to simplify and streamline the company incorporation and management process, all while providing you with the flexibility…

Share Capital In Hong Kong: Understanding Definitions And Key Considerations

A Hong Kong company’s share capital represents the total amount invested via the issuance of shares or stocks. Find out why share capital is vital by reading more now.

Hong Kong Certified True Copy: 4 Key Questions To Help You Understand

What’s a Certified True Copy in Hong Kong? Why do you need one for banking, property, loans & legal matters? Read our article for insights on staying compliant.

[Nov 2023 Update] Adopting The BRN As The New Unique Business Identifier For Hong Kong Entities

Read about the implementation of the Unique Business Identifier (UBI) second phase across various entities under the administration of the Registrar of Companies.

Hong Kong MPF Contribution: Financial Security For the Future

Discover essential insights about MPF contributions for both employers and employees to ensure compliance with Hong Kong’s regulations. Learn more here.

Limited Partnership In Hong Kong: A Potential Choice For Running A Business

A limited partnership in Hong Kong can likely be the ideal business structure if you’re aiming for limited liability and partnering with other reputable entities. Read more now.

Workplace Compliance In Hong Kong: All About The Employment Ordinance

Understanding the Employment Ordinance is crucial for one planning to enter the employment relationship. Discover all the vital information here.

Certificate of Resident Status: Complete Guide & Requirements

The Certificate of Resident Status is crucial for legal compliance, especially if you are a non-resident aiming to conduct business and stay in Hong Kong. Read all about it in our article.

Hong Kong Work Visa Simplified: What Foreigners Need To Know

Understanding Hong Kong’s work visa requirements is essential for a smooth application process. Discover the needed info for your application right here.

Hong Kong Certificate Of Good Standing: Proof Of Continuing Registration

The Certificate of Good Standing, or Certificate of Continuing Registration, in Hong Kong, means that your company is legally incorporated and currently in good compliance. See more.

Path To Becoming A Hong Kong Permanent Resident: Fully Explained

Navigating the Hong Kong permanent residency application can be challenging without proper information. Find all the crucial details you need right here.

Certificate of Incorporation In Hong Kong: The Complete Guide

A Certificate of Incorporation is a legal document that officially acknowledges your Hong Kong company’s existence. Find out more about the certificate and how to obtain it in our article.

A Guide To Articles Of Association In Hong Kong

Articles of Association are mandatory for establishing a Hong Kong business. Read more about what this document includes and how to stay compliant in our article.

Hong Kong Dependant Visa Explained: From Application to Approval

Understanding the dependent visa is crucial for one wanting to relocate to Hong Kong along with their sponsor to ensure a smooth transition. Explore here.

The ABCs Of Employment Contracts For Hong Kong Businesses

Understanding crucial information about employment contracts in Hong Kong for legal compliance and healthy employee relations. Learn more here.

What Is Employee Compensation In Hong Kong?

Employee compensation in Hong Kong is the amount an employee can claim for work-related injuries or illnesses. What should the employer do in such cases? Let’s find out!

Termination Of Contract: Ending An Employment Contract In Hong Kong

In Hong Kong, are there any special requirements for the termination of contract? How can you, as an employer, end an employment contract safely? Read more to find out!

Beyond The Calendar: Understanding Hong Kong Public Holidays As Expats

Knowing about the Hong Kong public holidays helps expats understand more about the culture and their working rights. Read on to find out more.

Top 12 Accounting Firms in Hong Kong Ranked by CPA Quality

Accounting firms in Hong Kong are not something new. But to stay compliant with regulations in this port city, this is a topic you should not ignore.

Price Adjustment Update: Company Formation and Corporate Services in Multiple Countries

Dear Valued Customers, We would like to inform you that BBCIncorp will be making a price adjustment to the company formation service and other corporate services in several countries, effective from April 1, 2023. The decision to adjust pricing has been made after careful consideration of various factors, including operational costs and changes in government…

Setup Offshore Company in Hong Kong: Guide for Entrepreneurs

Looking to open an offshore company in Hong Kong? Learn about the benefits, requirements, and steps involved in this comprehensive guide. Start your business today!

Hong Kong Budget 2023–2024: Highlights For Businesses

Many interesting policies for businesses are promised in the Hong Kong Budget for 2023–24. Let’s highlight these benefits!

2022 Year In Review: Highlights Of Hong Kong Markets

Let’s take a look back at the most significant business events in Hong Kong for 2022 and anticipate an even brighter 2023 ahead!

Revised Foreign-sourced Income Tax Exemption Regime In Hong Kong: MNE Entities’ Tax Alert

Crucial information on the new Hong Kong Profit Tax Policies regarding foreign-sourced income tax for MNE entities. Read now!

Hong Kong New Inspection Regime: Directors’ Information Is Not Public

Overview of Hong Kong New Inspection Regime The Companies Ordinance (Cap. 622) (“CO”), legislation governing the incorporation and operation of companies in Hong Kong, has recently implemented a new inspection regime. The objective of this regime is to enhance security for the directors’ and other relevant person’s information. Three phases to the New Inspection Regime’s…

Happy Mid-Autumn Festival 2022

On the 15th of each lunar calendar month, the moon is at its roundest and brightest which is symbolizing togetherness and reunion. Though time passes away, the ancient beauty of the moon is still gorgeous in any context, and Kowloon – the capital of festivities dotted with lights is now stunning. During the exciting atmosphere…

Lowering The Hong Kong Business Registration Levy Rate

By enacting economic stimulation policies like decreasing the levy on business registration, Hong Kong hopes to attract potential investors to the country.

Hong Kong Company Audit: How To Ensure Your Business Is Compliant

Looking to get your company audited? Here’s everything you need to know about audit requirements, benefits, and types of audits.

Hong Kong Holding Company: Everything You Need to Know

This guide will teach you everything you need to register a Hong Kong holding company and how it benefits your investment portfolio.

Our New Website Is Ready To Launch

BBCIncorp is excited to announce the release of our new website. Be the first to experience it!

Everything About Hong Kong Sole Proprietorship – A Foreign Entrepreneurs Guide

If you’re running your business as an individual, incorporating it as a sole proprietorship in Hong Kong might be the best option. Let’s discover more!

Hong Kong Directors Duties: What Exactly Are Their Roles?

Ensure your company will run smoothly and comply with the law by understanding Hong Kong directors’ duties and responsibilities in a Hong Kong company.

Transfer Of Share In Hong Kong – Requirements, Procedures, And More!

As your company grows and new investors come on board, the transfer of shares will become a common event. Let’s discover the various aspects of share transfer in Hong Kong and prepare yourself for the process.

Common Seal vs Company Chop in Hong Kong

Company chop or company seal, which one do you need to validate your company’s legal documents? Let’s find out through this article.

Shareholders Of A Hong Kong Company – What Are Their Rights And Roles?

If you are a shareholder in a Hong Kong company or are thinking of becoming one, make sure you seek legal advice for understanding your rights and duties.

Paying Your Shareholders: How Dividend Payments Work in Hong Kong?

In this post, we’ll look at how dividends are paid in Hong Kong, as well as some of the things you should consider about dividend payment.

Holding Annual General Meetings (AGM) In Hong Kong

An annual general meeting in Hong Kong is when directors or shareholders must gather yearly to review the company’s financial report, business situation, or strategy. Read now!

Nominee Director in Hong Kong – The Ultimate Guide You’ll Ever Need

A nominee director is a common practice in Hong Kong, which can help you conceal your identity, protect yourself from the public gaze, and bring certain tax advantages for your business. Discover more in detail now!

7 Cost-Saving Tips For Your Hong Kong Trading Business

Despite free ports, trading in Hong Kong, or importing in particular, can cost you a pretty penny if you don’t import the right way. Customs fees are deemed to be the most popular cost when it comes to buying goods overseas. Still, it only accounts for a small portion of your total importing costs. Without…

How to Manage Logistics and Accounting When Trading in Hong Kong

Trading in Hong Kong requires you to effectively manage logistics & accounting to keep the business running smoothly & profitably. Read this article to start

Tax Practices for Your Hong Kong Trading Company: How to Leverage

Trade in Hong Kong is typically free of excise duties, and tariffs and enjoys a competitive tax regime. Learn more about common taxes on trading in Hong Kong.

[April/2022 Update] Profits Tax Return [BIR51, BIR52, & BIR54] Keynotes for the 2021/22

Profits Tax Return [BIR51, BIR52, & BIR54] Keynotes for 2021/22 included tax concession for eligible carried interest and engagement of service provider to furnish tax return. Find out more!

6 Tips For Successfully Running Your Trading Business In Hong Kong

You are planning to start trading in Hong Kong. You can’t miss these useful tips before launching your trading business to increase your chances of success.

Top 3 Banks For Your Hong Kong Trade Company: Which One To Choose?

Top 3 banks you should consider when setting up your Hong Kong trade company are Citibank, HSBC, DBS. Still, banks are not your only option. Discover now!

The Only Guide You Need To Start A Hong Kong Trading Company

You are fascinated by the Hong Kong trade landscape. Let’s get started with this guide on how to start a Hong Kong trade company in just a few easy steps.

Hong Kong Offshore Companies For Oversea Trading: What To Know?

Hong Kong offshore companies are great structures for international trade due to its numerous benefits. Let’s get into detail with our article!

Business Registration Certificate in Hong Kong: Guide & Sample

A business registration certificate is an important document that proves your business is registered and legally operating in Hong Kong. Learn more about how to obtain it in this article.

What Is A Business Registration Number In Hong Kong?

Almost all types of businesses must get business registration number in Hong Kong to pay taxes and fulfill relevant administrative tasks. Let’s find out more.

Hong Kong Budget 2022/23: $21 Billion Anti-pandemic Support Package, One-off Reduction Of Profit Tax

Hong Kong budget 2022/23 unveiled efforts to mitigate COVID-19 impacts on businesses and citizens. Tax breaks, e-vouchers and financial aids are key measures.

Hong Kong Trade Outlook: What to Expect

Trading in Hong Kong can be a prime gateway towards trading for new businesses. Read on for an in-depth guide on Hong Kong trading.

Hong Kong Financial Statements – How To Avoid Costly Mistakes

Your company and report compliance go hand in hand. Let’s dive into some useful concepts that help you produce perfect Hong Kong company financial statements.

Your Handbook Guide To Finding A Sourcing Agent

Having a sourcing agent in Asia is critical to establishing a link to the region’s suppliers. Watch our article to get briefed on the basics.

Top Issues & Tips For Running An eCommerce Business In Hong Kong

Let’s find out some most common difficulties of running an eCommerce business in Hong Kong and useful tips to overcome them with BBCIncorp.

BBCIncorp To Put An Emphasis On Ensuring AML/CFT Compliance

BBCIncorp has been taking initiatives to ensure that our product offerings and services coincide with international AML guidelines.

Is Dropshipping In Hong Kong The Right Move?

Kickstart your journey to the world of dropshipping in Hong Kong using our comprehensive guide. Discover detailed steps for success (2024 update).

Top 6 Financial Service Options For eCommerce Businesses In Hong Kong

Wondering what financial service to choose for your eCommerce business in Hong Kong? Explore our top 6 recommended financial service options!

Hong Kong eCommerce: Endless Opportunities Are Waiting For You

Hong Kong’s eCommerce ecosystem is growing with no sign of slowing down. Let’s explore opportunities for eCommerce companies in Hong Kong.

Hong Kong Plans New Tax Measures To Be Out Of EU’s Grey List

Hong Kong is planning to alter and implement new taxation measures in response to the inclusion of this jurisdiction in the EU’s grey list.

Warning: Fraudulent Skype Account

We make this notice to inform all of our clients that BBCIncorp has been made a target of malicious spoofing attacks.

Hong Kong Business Trends After Mid-2021: New Updates [Infographic]

Check out our infographic capturing Hong Kong’s economic recovery post-Covid-19 outbreak and the top five business trends to rise in 2021.

BBCIncorp Limited Maintains to be OCBC Valued Partner 2020/2021

BBCIncorp has just received the honor award “OCBC Valued Partner Award” for the 6th time. Learn more about the partnership between BBCIncorp and OCBC!

BBCIncorp x Neat: Incorporation and Account Setup with Ease

Forming a business in Hong Kong on your own is never an easy task. But with a trusted service provider namely BBCIncorp and an efficient financial solution like Neat, your business is in good hands.

Hong Kong Budget 2021/22: Review of Proposed Tax Measures

On Wednesday, 24 February 2021, Financial Secretary Paul Chan Mo-po released the Hong Kong budget initiatives for the fiscal year 2021/22.

BBCIncorp To Release Client Portal: All-in-one Dashboard To Manage Your Company

BBCIncorp’s Client Portal is a totally new and easy-to-use online portal to help you streamline your company management with great experience.

How To Kick-Start Your Ecommerce Business In Hong Kong

How to start an eCommerce business in Hong Kong? This blog gives you insights into what to consider and key steps for setting up a Hong Kong eCommerce company.

Choosing Hong Kong For An Ecommerce Business: Is It The Right Option?

Hong Kong is a prospective and bustling market for most online business owners. So why is Hong Kong an ideal location for an eCommerce business? Find out with us!

Hong Kong Private Limited Company: Benefits & Setup

Looking for an entity type in Hong Kong that is best suited for SMEs? With numerous benefits, Hong Kong private limited company remains the top choice of investors.

How To Comply With Hong Kong Accounting Standards Efficiently: Guide For SMEs

Hong Kong accounting standards are applicable to any financial statements of Hong Kong companies. BBCIncorp will be informing you with essential standards and accounting requirements.

Alternatives To Traditional Bank Accounts In Hong Kong

Opening traditional bank accounts in Hong Kong causes hassle for business owners, then alternatives to bank accounts promise to be a solution for yours.

Doing Business In Hong Kong: The Ultimate Guide For Foreigners

Here is the guide to doing business in Hong Kong for foreigners! The blog covers all you need to know about the benefits of forming a business in Hong Kong and how to start.

How To Choose Hong Kong Financial Year End

Wonder how to determine the financial year end in Hong Kong? In this article, we will shed light on everything about Hong Kong financial year. Learn more with us!

Transfer Pricing In Hong Kong: 10 Frequently Asked Questions

Hong Kong transfer pricing legislation requires all relevant companies to file transfer pricing documentation. Below are the 10 most frequently asked questions about this topic!

Useful Checking Tools For Your Hong Kong Company Registration

Several tools are available to help you check your Hong Kong company status and what licenses are needed before registering. Check out this detailed guide to those useful tools!

Hong Kong Tax Haven: Interesting Facts You Might Not Know

Beyond Hong Kong tax haven, the only impression many people still have of this city, there are more of Hong Kong that you should know for your enterprise’s well-being. Find out now.

Hong Kong Business Trends After Mid-2020: New Updates [Infographic]

Check it out! Below infographic helps you to capture Hong Kong situations and update top five business trends to be worth expected in a post Covid-19 outbreak

3 Reasons Why Hong Kong Banks May Reject Your Application

Hong Kong banks may reject your application for opening a bank account due to 3 main reasons. Learn more with Sheryl, our Relationship Manager from BBCIncorp!

Best Banks In Hong Kong That You Must Know

Which is the best bank in Hong Kong for expats? Let BBCIncorp help you find out the answer with top 4 banks: DBS, HSBC, Standard Chartered and Citibank.

A General Guide To Winding Up Of Hong Kong Companies

A Hong Kong company may be wound up by either voluntary or compulsory winding up by the court. Below guide clarifies the procedure for winding up Hong Kong companies through these two types.

Hong Kong Company Annual Compliance Requirements

A Hong Kong private limited company must comply with annual compliance and filing requirements prescribed by relevant laws to maintain its good standing. Go through the fundamental information on these requirements now!

Hong Kong Tax System – A Helpful Guide For Entrepreneurs

This article helps you understand Hong Kong’s tax system by providing clear explanations of the four basic taxes and applicable tax rates.

6 Benefits Of Setting Up A Company In Hong Kong

Setting up a business in Hong Kong yields many advantages such as a pro-business environment, attractive tax regime, strategic location and much more.

How To Set Up A Company In Hong Kong: A Step-by-Step Guide

A general guide including steps and key notes for entrepreneurs who wish to know how to set up a company in Hong Kong.

Hong Kong Business Entity Types: Pros And Cons

When going to set up a business in Hong Kong, there are different types of entities you may want to consider i.e. private limited, public company, sole proprietorship, partnership,…

Offshore Tax Exemption: How It Works & How To Qualify?

Hong Kong adopted a territorial tax regime, under which foreign-sourced income is exempted from tax. You can find helpful tips for applying offshore tax claim in this post.

How To Open A Bank Account In Hong Kong

How to open a bank account in Hong Kong from overseas – Here BBCIncorp Limited will provide you with everything you need to know about this process!

Requirements For Registration Of A Hong Kong Company Name

Company name is a prerequisite for any company registration in Hong Kong. Below are some certain requirements for a Hong Kong company name registration to get approval.

Branch Vs. Subsidiary Vs. Representative Office In Hong Kong: Key Differences

Find out differences among branch office, representative office and subsidiary company and choose the best suited registration option for your foreign company!

Understanding Hong Kong Three-tier Banking System

Hong Kong banking system has a three-tier system including licensed banks, restricted license banks, and deposit-taking companies. Read more to understand their features!

DBS Hong Kong now supports remote bank account opening

DBS Hong Kong now caters the need of business owners who cannot afford a trip to Hong Kong for registering a business account by way of temporarily suspending requirement to visit Hong Kong.

Representative Office in Hong Kong: 6 Features & Setup Process

Hong Kong representative offices mainly set up for promotion and liaison office purposes. It has no legal status and is not allowed to engage in profit-generating activities.

How To Open A Branch Office In Hong Kong

Are you a foreign and looking for a branch office presence in Hong Kong market? Read this blog to learn a detailed guide to Hong Kong branch office from A to Z.

What Is a Company Secretary? Role & Duties Explained

Companies Ordinance requires most HK companies to appoint company secretary before registration. What is company secretary in Hong Kong? What are its requirements? Find out!

Hong Kong: The 2018/19 Tax Payment Deadlines Extended For Three Months

IRD announced on the automatic three-month extension for the payment deadline of Salaries Tax, Tax under Personal Assessment and Profits Tax for the YOA 2018/19

BBCIncorp Limited received OCBC Valued Partner Award 2019/2020

BBCIncorp Limited was honored to announce its award “OCBC Valued Partner Award 2019/2020”. It is highlighted that this has been the 5th year that BBCIncorp received this honor.

A Brief Guide To Company Deregistration In Hong Kong

Thanks to its simplicity and inexpensiveness, company deregistration in Hong Kong is a very popular option. Let’s find out!

Delivery Service Temporarily Suspended Due To COVID-19 Pandemic

Due to the severe impact of the coronavirus pandemic (COVID-19), BBCIncorp Limited regrets to announce the temporary suspension of delivery services by courier companies

Which Types Of Business Need Licenses And Permits In Hong Kong?

There are several types of business that requires companies in Hong Kong to apply for business licenses and permits before legally operating. Find out what they are!

Hong Kong’s Significant Controllers Register: How Does It Work?

Hong Kong Significant Controllers Register (SCR) is a requirement critical even in 2023. This blog will tell you the ins and outs of this SCR regime. Find out more!

A Complete Guide To Trademark Registration In Hong Kong

Trademark is a valuable asset to any business. Let’s learn what it is, why should register and how to apply for a trademark registration in Hong Kong.

The 2020/21 Hong Kong Budget: Key Highlights For Business

Financial Secretary Paul Chan Mo-po delivered Hong Kong budget plan for the year 2020/21, which highlights Hong Kong current economy, and a set of proposals for taxation measures.

COVID-19 Outbreak: How To Open A Bank Account For Hong Kong Company

During coronavirus Covid-19 outbreak, OCBC is a good choice to ensure your safety while achieving your goals to open a Hong Kong company and bank account remotely

Double Taxation Agreements In Hong Kong: What You Should Know

Are taxes arisen from cross-border investments a big headache for your business? Let’s find out double taxation agreements for Hong Kong businesses!

Hong Kong Withholding Tax: What You Need To Know

You care about what a withholding tax in Hong Kong is, who need to pay this, and how to reduce it? Keep reading this article and then find out the answer.

An Overview Of Hong Kong Quality Migrant Admission Scheme

In Hong Kong, the Quality Migrant Admission Scheme is tailored for proficient individuals with outstanding achievements to work and live in the country.

What Is An Investment Visa (Entrepreneur Visa) In Hong Kong?

If stashing away as much money as you possibly can is your sole purpose of moving to Hong Kong, an investment visa would be your must-have vehicle.

A Complete Guide To The Hong Kong Employment Visa

An Employment Visa is a must if you intend to relocate to Hong Kong to live and work, bring along your family members, or become a resident in due course.

Hong Kong Dormant Company: What You Should Know

Key features of a Hong Kong dormant company will be explained in this topic to help you stay aware of and keep your business compliant with local law.

BBCIncorp to release the new web interface: What’s new?

A complete website face-lift is our key objective as it represents a step forward from the outmoded page to a better designed and more engaging one, all for better user experience.

BBCIncorp Limited received OCBC Valued Partner Award

The OCBC Valued Partner Award was formally conferred on BBCIncorp, an up-and-coming advisory firm located in Hongkong, for the 4th consecutive year, from 2015 to 2019

BBCIncorp attains Gold Partner status for 2025 with Aspire

BBCIncorp receives Gold Partner recognition from Aspire in 2025, reinforcing our role as a dependable partner for global entrepreneurs.

BBCIncorp Awarded Airwallex Outstanding Partner Award 2025

BBCIncorp Hong Kong team honoured with Airwallex Outstanding Partner Award 2025 for strong partnership and consistent service for international clients.

A Look Back at BBCIncorp’s 2025 Milestones

Mark the milestones and collaborations of BBCIncorp in 2025 thanks to our clients, partners, and BBCIncorp Team. Share in our vision for a promising 2026.

Income Tax in Cyprus: Resident and Non-Resident Guide

Cyprus continues to attract global investors, entrepreneurs, and professionals with one of Europe’s most favorable tax systems. Its low tax rates, broad treaty network, and transparent regulations make it a preferred destination for both residents and non-residents. However, navigating income tax in Cyprus requires more than surface knowledge. Understanding who qualifies as a tax resident,…

Everything You Need to Know About Corporate Tax Cyprus

Cyprus has steadily built a reputation as one of Europe’s most business-friendly jurisdictions. With a corporate tax rate of 12.5%, it stands among the lowest in the European Union, reflecting a long-term commitment to attracting capital and rewarding enterprise. Investors value not just the numbers but the principles behind them: clarity, consistency, and credibility. Yet,…

Cyprus Companies Law: A Comprehensive Guide for Businesses

Cyprus has emerged as one of Europe’s most dynamic corporate centers, attracting entrepreneurs who value a stable business climate, a favorable tax environment, and access to European markets. Beyond its strategic advantages, the island’s appeal lies in its clear and comprehensive legal system. The Cyprus Companies Law Cap 113 forms the backbone of this framework,…

What Is an Account Number in Banks for Businesses

Many people still ask, What is an account number? and why every bank requires it. The confusion is common because a bank account number looks simple, yet it performs one of the most important functions in modern finance. It identifies your financial account with precision, so that every payment you send or receive reaches the…

S-Corporation vs. Sole Proprietorship: Choosing The Best Structure

Choosing the right structure shapes every part of a small business, from taxes to personal liability. For many entrepreneurs, the decision often comes down to two common options: an S Corp or a sole proprietorship. Both support small business ownership, yet they operate very differently in terms of legal protection, tax treatment, and growth potential….

Everything About the State of Delaware Registered Agent

Delaware is one of the most popular states for business incorporation in the United States, attracting companies with its flexible corporate laws, strong legal protections, and business-friendly environment. Notably, a central requirement for operating in Delaware is appointing a state of Delaware-registered agent. This entity is the official contact for government notices, legal documents, and…

Essential Guide to Shareholder Agreements for Business Owners

What happens when business partners disagree on decisions, profit distribution, or the future of the company? In the U.S., a shareholder agreements provides a formal framework to manage these situations. This legally binding contract defines the rights and responsibilities of shareholders, establishes internal procedures, and offers mechanisms for resolving disputes. Regardless of whether a company…

Why Compliance Advisory in the US Drives Sustainable Growth

Discover how compliance advisory in the US helps global entrepreneurs manage obligations, stay organized, and drive sustainable growth with confidence.

Navigating Compliance and Tax Complexity in the U.S. Market

Navigate U.S. taxes and compliance confidently with BBCIncorp expert tips and services, from incorporation to filings and strategic growth guidance.

Foreign Investment in the U.S.: Opportunities and Insights for 2026

Tips on foreign investment in America. Streamline your U.S. expansion with BBCIncorp. Get Delaware company formation services, compliance, banking account, and more.

Explaining the Major Types of Corporations With Examples

Every successful business starts with a vision, but turning that vision into a lasting enterprise depends on choosing the right structure. The type of corporation a founder selects shapes how the company operates, raises capital, and protects its owners. Some structures prioritize control and simplicity, while others focus on scalability, investment, or tax efficiency. Across…

What Is a Single-Member LLC (SMLLC)? How to Form It?

Starting a business today is easier than ever, but choosing the right structure can shape everything from how you pay taxes to how investors see you. One option that’s quietly redefining entrepreneurship is the single-member limited liability company. It gives one owner the freedom of running a sole business with the protection usually reserved for…

What Is The Articles of Organization for An LLC? How to Find It?

Establishing a limited liability company (LLC) begins with a fundamental step: filing the Articles of Organization for LLC, which serves as the official record that brings an LLC into legal existence. Many states require filing to define an LLC’s name, address, ownership, and management structure. The terminology, however, varies across jurisdictions, where some refer to…

Do LLCs get 1099 forms? Key information you need

A 1099 form is a key IRS document used to report income paid to non-employees, helping ensure accuracy and transparency in U.S. tax reporting. Limited Liability Companies (LLCs), one of the most common business structures often face confusion when determining their 1099 responsibilities. And do LLCs get 1099 forms? The answer depends on how the…

Enterprise Accounting: Mastering Complexity at Scale

In offshore environments, this challenge multiplies. Each jurisdiction imposes different reporting rules, timelines, and compliance standards, making group-level transparency increasingly difficult to sustain. As a result, even well-structured enterprises face inconsistencies, reporting delays, and rising governance risks. Enterprise accounting restores order to this complexity. By standardizing data, automating reconciliation, and integrating accounting with ERP and…

EU Maintains Blacklist, Updates Grey List Commitments in October 2025 Review

EU’s October 2025 update keeps the non-cooperative tax jurisdiction list unchanged while revising the grey list, removing Vietnam and adding new cooperative countries.

Seychelles Annual Renewal Requirements for Dormant IBCs: Essential Compliance Checklist

Seychelles has long been a preferred jurisdiction for International Business Companies (IBCs) seeking a favourable offshore environment. It is renowned for its tax efficiency, confidentiality, and swift incorporation process, which can often be completed within 24 to 48 hours. Seychelles offers a compelling proposition for global entrepreneurs and investors. In 2025, Seychelles continues to uphold…

Annual Compliance Insights for Seychelles Holding Company

Seychelles has become one of the most attractive destinations for setting up a Seychelles holding company. Its favorable tax regime, reliable privacy framework, and efficient incorporation process make it a preferred choice for investors seeking a secure and flexible structure. Recent regulatory updates, particularly the International Business Companies Amendment Act 2025, highlight the growing importance…

BBCIncorp Unveils Compliance 4.0 – A Smarter Way to Manage Offshore Obligations

We are excited to announce the launch of Compliance 4.0, a major upgrade to the BBCIncorp Client Portal that redefines how clients handle offshore annual compliance. Building on the foundation of Compliance 3.0, this release moves beyond simple reminders to deliver a seamless, guided, and interactive compliance experience. The first rollout focuses on Seychelles, setting…

Key Accounting Strategies for Enterprises Amidst New Compliance Demands

Discover key accounting strategies from BBCIncorp that turn compliance into opportunity, building resilience, transparency, and growth for global enterprises.

Countries Without a U.S. Trade Deal in 2025: Tariff Rates and Economic Effects

In 2025, U.S. trade policy took a dramatic turn. The April 2 Liberation Day tariffs marked the start of sweeping measures against countries without bilateral trade agreements, followed by further escalations in July and August. These shifts disrupted long-standing trade flows, drove up costs, and forced companies to rethink sourcing, pricing, and investment strategies almost…

Do I Have to Renew My LLC Annually? How to Renew an LLC?

Forming a limited liability company is only the first step. Business owners must also renew LLC status each year to maintain compliance and avoid disruptions. Renewal ensures your business remains in good standing with the state, keeps liability protections active, and supports uninterrupted operations. Whether you are managing a single-member entity or a growing company,…

What Is the BOI Report? A Complete Guide for LLCs

The Beneficial Ownership Information (BOI) report is a new federal requirement introduced under the Corporate Transparency Act, effective January 1, 2024. It requires many companies, especially small businesses and LLCs, to disclose who ultimately owns or controls them. This move aims to strengthen transparency and prevent illicit financial activity. Failing to comply may result in…

How to Add a DBA to an LLC: Complete Guide

Forming a Limited Liability Company (LLC) is a smart move for protecting your personal assets and establishing a legal business structure. However, your official LLC name might not always align with your branding or the specific services you offer. That’s where an LLC doing business as DBA (Doing Business As) becomes useful. By registering a…

What Is an Incumbency Certificate? How to Get One

Understanding the certificate of incumbency (also called an incumbency certificate) is essential for anyone needing proof of who legally represents a company. This document confirms the identity and authority of corporate officers—such as directors, secretaries, and authorized signatories. Whether opening a bank account, completing legal transactions, launching business expansions, or entering international deals, banks, law firms,…

Implementation of the Virtual Asset Business Act 2022 in Saint Vincent and the Grenadines

The Virtual Asset Business (VAB) Act 2022 officially came into effect in Saint Vincent and the Grenadines (SVG) on 31 May 2025. This legislation sets out the legal and supervisory framework for regulating Virtual Asset Businesses operating within or from SVG. Through this enactment, SVG reinforces its commitment to building a transparent, compliant, and forward-thinking…

LLC Membership Certificate: Info important and Template PDF

An LLC membership certificate, though seemingly a simple document, is vital for formally documenting ownership within a limited liability company. For the LLC structure, this certificate serves as official proof of each member’s interest in the business. It details names, ownership percentages, and issuance dates, clarifying the company’s internal structure. While state statutes do not…

12 Must-Have LLC Organizational Documents for Business in the USA

A Limited Liability Company (LLC) is a business structure in the U.S. that combines the liability protection of a corporation with the flexibility of a partnership. When forming and running an LLC, having the right LLC documents is crucial. These documents outline ownership, management, and operational procedures, making them vital for both legal compliance and…

Business Certificates for LLC: Types and How to Obtain Them

An LLC certificate is a vital document confirming the legal existence or specific status of a Limited Liability Company. From opening a business bank account to signing crucial contracts, possessing the correct certificate is essential. While many inquire, “What is an LLC certificate?”, the answer varies by type. LLCs can hold several distinct certificates, including…

What Are Bylaws for Corporation? How to Write Them?

Corporation bylaws play a central role in shaping how a business operates and makes decisions. Whether you are launching a startup, managing a small business, or leading an established corporation, having clear and well-drafted business bylaws is essential. But what are corporate bylaws, and why do they matter? At their core, bylaws are internal rules…

What Does DBA Stand for in Business? How to Register it Legally

If you’re starting a business, you may have come across the term DBA, short for “Doing Business As.” But what is a DBA, exactly? In simple terms, a DBA allows a business to operate under a name different from its legal, registered name. This is especially helpful for sole proprietors or LLCs that want to…

How to Start a Medical Business: Ideas & Guide for Startups

The healthcare industry is experiencing significant growth, fueled by technological advancements and an increasing demand for accessible, personalized care. This expansion presents a wealth of opportunities for entrepreneurs eager to make a meaningful impact. However, understanding how to start a healthcare business involves more than just a great idea; it requires meticulous planning, thorough market…

Foreign vs. Domestic LLC: What’s the Difference You Must Know?

Ever wondered why a business operating legally in one U.S. state might be considered “foreign” just a few miles away, within the same country? The answer lies in the classification of a Limited Liability Company (LLC) at the state level. When an LLC is initially formed in a particular U.S. state, it is designated as…

Professional Limited Liability Company: Definition, How to Form

What is a PLLC, and why does it matter if you’re a licensed professional? A PLLC, or professional limited liability company, is a legal structure created for individuals in regulated fields, namely doctors, lawyers, accountants, and architects. These professions face stricter state requirements and liability risks, which a standard LLC may not fully address. That’s…

Obtaining a Certificate of Good Standing in the Cayman Islands

A Cayman Islands Certificate of Good Standing is an official document issued by the Registrar of Companies that confirms a company’s legal status and compliance with local laws. This certificate is especially important for businesses engaged in international transactions, banking, or regulatory procedures, as it provides proof of the company’s good legal standing. Whether opening a…

Can I Be My Own Registered Agent for My LLC? Key Factors

A registered agent is a designated person or service responsible for receiving legal documents, government notices, and compliance-related correspondence on behalf of a limited liability company. This role is required in all US states for LLC formation and ongoing operations. Many entrepreneurs ask, “Should I be my own registered agent for an LLC or appoint someone…

Should I Use My Home Address for My LLC? Pros, Cons & Tips

Starting a new business often involves navigating a maze of crucial decisions, and one of the earliest dilemmas many new limited liability company owners face is: Can I use my home address for my LLC? While seemingly straightforward, this choice carries significant implications for your personal privacy, business professionalism, and even legal compliance. Your LLC’s…

How to Start a Technology Business: Step-by-Step Guide for Founders

The tech industry continues to captivate entrepreneurs, offering vast opportunities for innovation and growth. With the U.S. tech sector contributing around 8.9%(1) to the national GDP in 2024, the allure of launching a tech startup remains strong. However, transforming a technology business startup idea into a registered, funded, and scalable company requires strategic planning and…

How to Start a Tax Service Business: A Comprehensive Guide

A tax service business provides professional help with preparing, filing, and advising on tax matters for individuals and businesses. Services can range from basic tax returns to strategic tax planning and IRS representation, depending on the preparer’s credentials. In the U.S., demand for tax preparation remains high, with the market expected to grow from $32.33…

Tips On Managing Global Company Operations While Ensuring Data Security

Discover practical strategies for managing global company operations while ensuring data security and compliance with BBCIncorp’s powerful Connective Hub.

Asia Pacific: An Industrial Hub with Rapid Adoption of Robotics and Automation

Asia Pacific drives automation technology with faster production, lower costs, and strong supply chains. Explore how APAC business expansion fosters business success.

The Rise of APAC Regional Trade Powerhouses: What are RCEP and CPTPP?

APAC trade agreements: RCEP & CPTPP. How they facilitate market access, tariff cuts, and Singapore & Hong Kong as your prime entry points to Asia Pacific.

Trade Tensions Rising: Why Shifting to APAC Business Formation

Rising trade tensions push businesses to APAC business formation. Discover why incorporating in Singapore and Hong Kong offers growth, stability, and resilience.

What Is a Business Startup? Funding, and How to Launch

The driving force behind groundbreaking inventions and burgeoning industries often lies within the dynamic realm of startups, young companies founded for selling a unique offering. These ventures, numbering over 150 million globally with over 82,000 launching in the US(1), serve as crucial catalysts for innovation and job creation, contributing significantly to economic advancement. Nevertheless, the…

Types of Limited Liability Companies: What Are the Differences?

Globally recognized for its blend of corporate liability protection and partnership-like flexibility and tax advantages, the limited liability company (LLC) is a popular business structure for aspiring entrepreneurs worldwide. However, “LLC” is an umbrella term for diverse entity types, each tailored to particular ownership arrangements, governance styles, and business aims. Choosing the right types of…