If you are a property owner in Singapore, you are subject to property tax. Different types of property will be taxed with different tax rates. Let’s learn in-depth how Singapore property tax works, how to calculate it, and eventually how to pay for it.

How is property tax defined in Singapore?

Please do not mistake property tax for rental income tax in Singapore. There are two different kinds of types in the Singapore tax system. Rental income tax is a tax imposed on income from renting out a property (progressive rates for tax residents and 22% for non-residents).

Meanwhile, according to IRAS, property tax is a tax imposed on your property ownership in Singapore, regardless of whether you live in that property or rent it out.

It is stated that the property tax, along with other taxes, will be funneled to the national fund. Particularly, it will be used to invest in infrastructure, defense, education, recreation, healthcare, and services. These will greatly benefit your long-term plan of staying in Singapore.

The properties that are subject to property tax in Singapore are divided into 3 categories:

- Owner-occupied residential properties;

- Non-owner-occupied residential properties; and

- Non-residential properties (Commercial and Industrial properties).

Calculation of property tax in Singapore

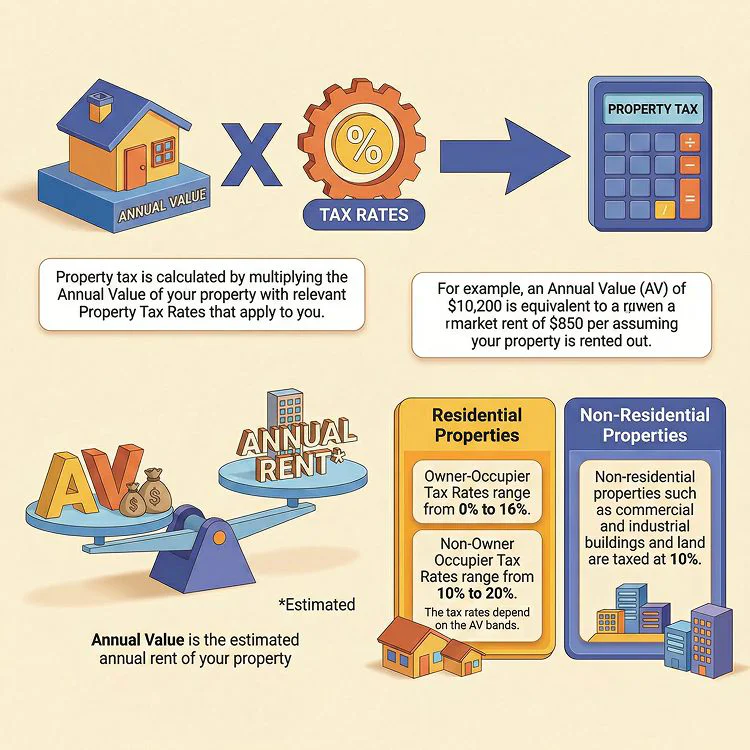

Overall, the annual property tax in Singapore is calculated as follows:

[Annual property tax = Annual Value* x Property tax rates**]

*Annual value (AV) of a property is the estimated gross annual rent of that property if it were to be rented out, not including furniture and maintenance charges. AV is determined based on estimated market rentals of similar or comparable properties.

Normally, IRAS will consider the contracted rentals in the neighborhood to determine the AV of your property. You can also check on the AV of any property in Singapore by using AV checking online service provided by IRAS ($2.5 per search).

**Property tax rates in Singapore vary according to different types of properties.

Tax rates for owner-occupied residential properties in Singapore

Owner-occupied residential property is defined as a property in which the owner lives. This type of property is taxed with concessionary progressive tax rates:

| Annual Value | Tax Rates | Payable Amount |

|---|---|---|

| First $8,000 Next $47,000 | 0% 4% | $0 $1,880 |

| First $55,000 Next $15,000 | – 6% | $1,880 $900 |

| First $70,000 Next $15,000 | – 8% | $2,780 $1,200 |

| First $85,000 Next $15,000 | – 10% | $3,980 $1,500 |

| First $100,000 Next $15,000 | – 12% | $5,480 $1,800 |

| First $115,000 Next $15,000 | – 14% | $7,280 $2,100 |

| First $130,000 Beyond $130,000 | – 16% | $9,380 Depend on AV |

For example, if the AV of your building is $65,000, then you have to pay [(8000 x 0%) + (47,000 x 4%) + (10,000 x 6%)] = $2480 for annual property tax.

Tax rates for non-owner-occupied residential properties in Singapore

A non-owner-occupied residential property is defined as a property that the owner does not live in. These properties may be rented out and they are subject to the following progressive tax rates:

| Annual Value | Tax rates | Payable Amount |

|---|---|---|

| First $30,000 Next $15,000 | 10% 12% | $3,000 $1,800 |

| First $45,000 Next $15,000 | – 14% | $4,800 $2,100 |

| First $60,000 Next $15,000 | – 16% | $6,900 $2,400 |

| First $75,000 Next $15,000 | – 18% | $9,300 $2,700 |

| First $90,000 Above $90,000 | – 20% | $12,000 Depend on AV |

Note: The following residential properties will be taxed at a fixed rate of 10%:

- Accommodation facilities within any sports and recreational club;

- Chalet;

- Child-care center, student-care center, or kindergarten;

- Welfare home;

- Hospital, hospice, rehabilitation place, convalescence place, or place for similar purposes;

- Hotel, backpackers’ hostel, boarding house, or guest house;

- Serviced apartment;

- Staff quarters that are part of any property exempted from tax under s6(6) of the Property Tax Act

- Student’s boarding house or hostel;

- Dormitory for workers.

- The owners of these properties need not apply to IRAS for a 10% tax rate. However, they must achieve approvals for the use of the properties.

Tax rates for non-residential properties in Singapore

Non-residential properties are usually commercial and industrial properties. These properties are taxed at the tax rate of 10%, regardless of whether the owners stay or live in them or not.

Singapore property tax payment

The yearly notice for your property tax in Singapore will be sent to you by IRAS at the end of the previous year. The due date for payment is 31 January.

As for payment methods, the most preferred one is GIRO (General Interbank Recurring Order). GIRO is a convenient method to make payments to billing organizations by directly deducting them from your bank account. With GIRO, you can make a one-time payment or can even have the option of 12 interest-free monthly installments for property tax payments.

Other common payment methods for property tax in Singapore are:

- Internet banking;

- Phone banking;

- ATM;

- AXS Station / AXS e-Station (Internet) / AXS m-Station (Mobile);

Key Takeaways

- Property tax in Singapore is imposed on the ownership of property.

- There are three types of property subject to property tax in Singapore: owner-occupied residential properties, non-owner-occupied residential properties, and non-residential properties. Each type has different tax rates.

- Property tax in Singapore = Annual Value (based on market rentals) x Tax Rates

- Owner-occupied and non-owner-occupied residential properties are taxed with progressive rates, while non-residential properties are taxed at a 10% rate.

- The due date for last year’s property tax payment falls on 31 January each year. The best way to pay this tax is by GIRO since you can go for 12 interest-free monthly installments.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.