This is one of the beneficial schemes that might help you, as an employer or business owner, relieve the burden of offering incentives to your local employees (Singapore Citizens). Now, under the Singapore Wage Credit Scheme (WCS), you can increase the salary of your staff to give them motivation, with support from the government.

If you are a new employer, get to know what it is and how it works now. The good news is you do not have to do much application.

What is the wage credit scheme in Singapore?

Under the scheme, the government finds a way to support business owners by co-funding a percentage of the wage increases you, as an employer, pay your local staff in the preceding years. In other words, this is the scheme in which you will receive a partial reimbursement on the increased amount of salary that is paid to employees in the years before.

There is no doubt that WCS brings joy and benefits to everyone. Particularly, employers pay less than what they pay the employees when receiving the reimbursement or claiming back a part of the payment under the Wage Credit Scheme. Also, the scheme can give you advantages to keep and retain talents in your company by offering them higher wages year-by-year.

As for employees, when getting their salary increased, they are highly likely to feel appreciated and have more motivation to work and subsequently perform better at work. Therefore, overall, this may eventually boost the efficiency of employees’ work commitment and the productivity of your business as a whole.

Changes to the wage credit scheme over the years

Let’s have a look at its history. This scheme was first introduced in 2013. Back then, the government offered a quite high co-funding rate at 40% of the wage increases given to local employees who earned a gross monthly wage of up to $4,000, from 2013 to 2015.

Subsequently, due to its effectiveness, the scheme was extended in 2015 with the rate at 20% for 2016 and 2017.

Once again, in 2018, the WCS continued to be prolonged for the next 3 years (2018, 2019, and 2020) with the remaining rate at 20% in 2018 and it was expected to drop down to 15% in 2019 and only 10% in 2020.

In February 2020, the Budget 2020 announced that there would be enhancements to the Singapore Wage Credit Scheme. To be more specific:

- The co-funding percentage will rise from 15% to 20% in 2019, and 10% to 15% in 2020. The incremental co-funding percentage of 5% in 2019 will be paid by the end of June 2020 as expected.

- The maximum qualifying gross monthly wage of an employee will increase from $4,000 to $5,000.

Example

Do you feel confused with all the numbers and percentages? Don’t worry. Let’s have one very simple example:

In 2016, you hired Peter as an employee. Due to his good performance throughout the year 2016, you decided to give him a monthly salary rise of $200 in 2017.

Under the WCS, in 2018, you received back a reimbursement of $480 (20% of $200 monthly is $40, and for the whole year, it is $40 x12 (months) = $480).

Who is eligible for the scheme?

The WCS is only for eligible employers. The qualifying employers are those who give wage increases to employees who meet the following criteria:

- Being Singapore Citizens;

- Having a gross monthly salary of up to $5,000;

- Being on the payroll for at least 3 months in the qualifying year and receiving Central Provident Fund contributions from the same employer for at least 3 months in the qualifying year;

- Receiving at least a $50 monthly wage increase;

- Not being the business owner of the same company.

However, the following entities are excluded from the Wage Credit Scheme:

- Local Government Agencies;

- Government-related schools;

- Grassroots Units and People’s Association Services;

- High Commissions, Embassies, Trade Offices, and Consulates;

- Unregistered Local/Foreign Entities;

- Foreign Military Units;

- Representative offices of Foreign companies, Foreign Government Agencies, Foreign Trade Associations/ Foreign Chambers/ Foreign Non-profit Organisations/Foreign Law Practices;

- Bank Representative Offices/Insurance Representative Officers/Other Financial Representative Offices (registered with MAS); News Bureaus (which are representative offices);

- International Organisations;

- Entities that pay CPF but are not registered in Singapore.

How does the wage credit scheme work?

In this section, there will be more examples to help you understand how the scheme works:

Qualifying wage increase

As aforementioned, the co-funding ratio for 2018 was 20% of qualifying wage increases up to a gross monthly wage level of $4,000. And the co-funding percentages for 2019 and 2020 are respectively 20% and 15% of qualifying wage increases up to a gross monthly wage level of $5,000*.

*Please take note that any portion of a wage increase that brings an employee’s gross monthly wage above that amount is not eligible for co-funding.

Moreover, if an employer sustains the wage increases given in 2017, 2018, and 2019 in the following years (in 2018, 2019, 2020), that increased amount will also be co-funded at the respective levels by the government.

Note

The first thing we need to know is how to calculate the gross monthly wage of one employee:

[Gross monthly wage = Total wages**/ The number of months that CPF contributions were made]

**The total wages include basic salary, overtime, and bonuses paid in one calendar year.

Computation of wage credit

Wage Credit can be understood as the amount you, as an eligible employer, will receive in the qualifying year, and it is calculated according to the following formula:

[Wage Credit = Co-funding Ratio x Gross Monthly Wage Increase x The number of months that CPF contributions were made]

For a better understanding, let’s look at these examples:

Example 1:

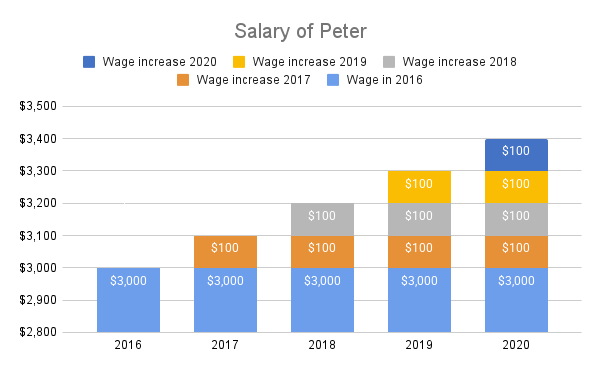

In 2016, you hired Peter as an employee, paying him $3,000/month. Due to his good performances throughout the years, you decided to increase his salary each year by $100/month from 2017-2020. Eventually, his salary goes up to $3400/month (still below the eligible ceiling gross wage of $4,000 in 2018 and $5,000 in 2019 and 2020). The amount of Wage Credit is described in the table:

The amount of Wage Credit is described in the table:

| Year | 2019 | 2020 |

|---|---|---|

| Gross Monthly Ceiling | $5,000 | $5,000 |

| Qualifying Wage Increase | $300 | $400 |

| Co-funding from the government (monthly) | 20% x $300 = $60 | 15% x$400 = $60 |

| Amount of Wage Credit | $720 | $720 |

Example 2:

In 2016, you hired Peter as an employee, paying him $4,700/month. Due to his good performances throughout the years, you decided to increase his salary each year by $100/month from 2017-2020. Eventually, his salary goes up to $5,100/month. The amount of Wage Credit is described in the table:

| Year | 2019 | 2020 |

|---|---|---|

| Gross Monthly Ceiling | $5,000 | $5,000 |

| Qualifying Wage Increase | $300 | $300* |

| Co-funding from the government (monthly) | 20% x $300 = $60 | 15% x $300 = $45 |

| Amount of Wage Credit | $60 x 12 (months)= $720 | $540 |

*You are wondering why it is not $400? The answer is that the $100 increase in 2020 makes Peter’s salary more than the ceiling ($5,100 > $5,000). Therefore that $100 is not eligible for co-funding.

Receiving wage credit

Here is the good news: you do not have to apply for anything. The IRAS will send a notification to you by post if you are eligible.

The payout or reimbursement will be sent to you by 31 March in the year immediately following the qualifying year through the GIRO bank account or the bank account registered with PayNow Corporate. If you do not have any of these accounts, please register one now to receive the payout.

And please also remember:

- The raised co-funding percentage of 5% in 2019 will be paid by the end of June 2020

- The Wage Credit payout or reimbursement is taxable.

Conclusion

Although you do not have to apply for the Wage Credit Scheme in Singapore, you still should know how it works to plan your budget. Since some enhancements have been made to the scheme, these upgrades should give you some advantages to start the year 2020.

In the Singapore Budget 2020, the Job Support Scheme has also been introduced to benefit employers in Singapore. If you have any questions or concerns about this matter, don’t hesitate to drop us a message at service@bbcincorp.com!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.