Offshore Company Registration in Cyprus

Private Limited Company

Private Limited Company

No physical presence required

Company exempted from taxation and exchange control

No hidden fee

All-in-one service

Customized company package

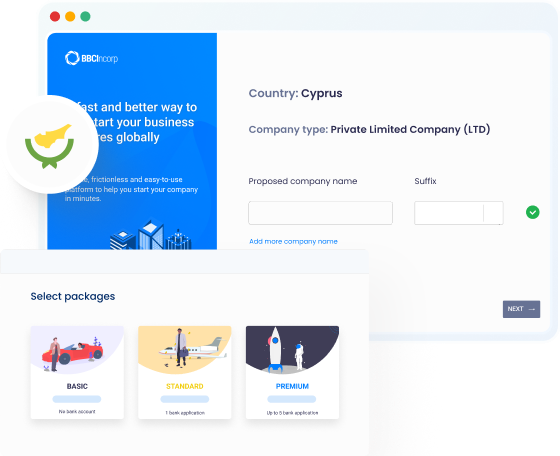

Cyprus Company Formation Packages

Bring your next business venture online

Streamlined process

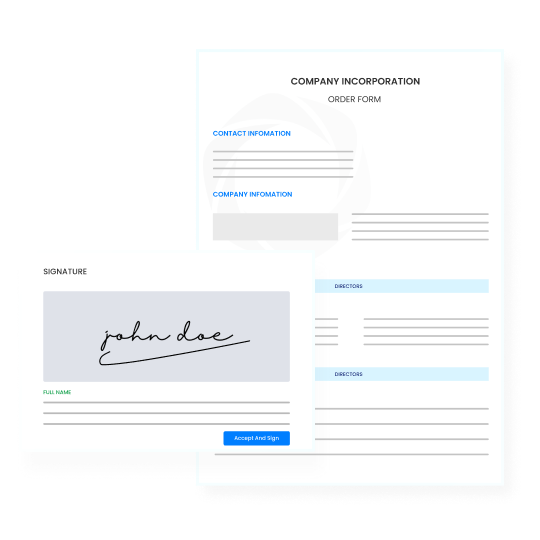

E-signature

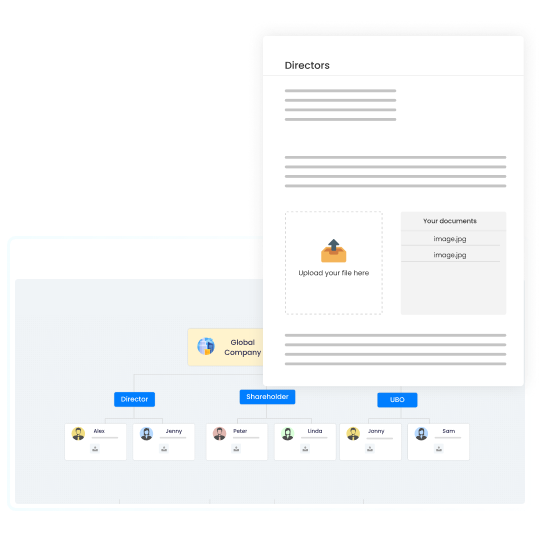

Digitized KYC

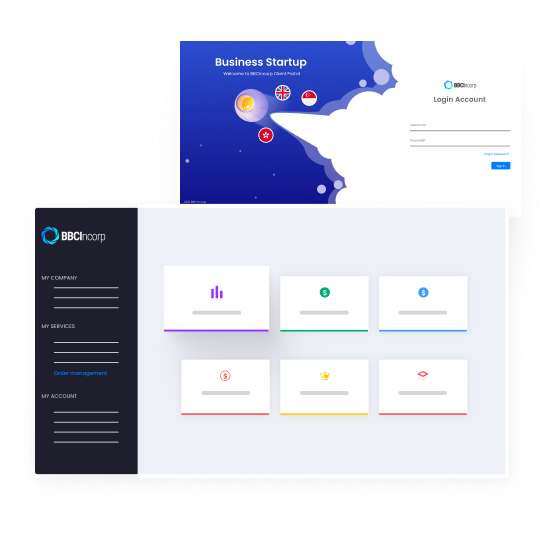

Centralized management portal

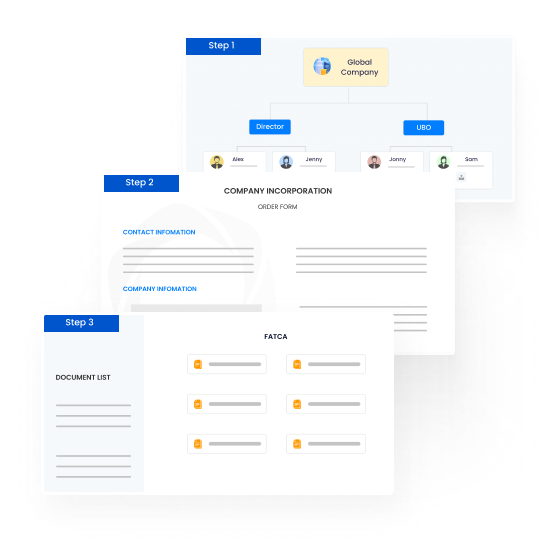

CyprusCompany Incorporation Process

Create your orders

Enter our online order platform for easy onboarding experience and tailor your orders. We have different packages and additional services that suit your goals. All information filled in is secured over 256-bit encrypted line.

Make payment

You can settle payment for services via flexible payment options including debit/credit card of Visa, Master, Amex or Bank Transfer. After you complete payments, we will provide you a checklist of required information for Cyprus company registration.

Collect and verify KYC documents

Once we've received your payment, our customer service will contact you to process the necessary paperwork. We'll guide you to properly prepare documents for incorporation in Cyprus via KYC online form. You can also access our digital Client Portal to proceed with the incorporation steps and keep track of the process anytime, anywhere.

Finish the company registration

The electronic documents are ready after 2 working days of company formation, and it takes 3-7 days for courier the original kit.

KYC Documents Checklist

The following proofs are required for all company members including Directors, Shareholders, Ultimate Beneficial Owners (UBOs), and Contact persons.

To establish the identity of a corporation or entity, it is necessary to provide company documents and evidence of its members.

*Note that the list provided, while comprehensive, may not encompass all requirements.

For further personalized consultations tailored to your specific case, please reach out to our support team anytime