Cannot do business without banking?

In today's world, having a corporate bank account is not just a convenience, it's a necessity for running a successful business. However, navigating the banking landscape can be challenging, you may need to spend months trying to open an account, potentially missing out on business opportunities in the meantime.

We can help you reduce this waiting time dramatically, often down to just a few weeks or less. Our expertise and relationships with banks worldwide allow us to streamline the account opening process, saving you time and money.

Offshore banking benefits

- Provide access to global markets for trading and investment purposes

- Facilitate global transactions easily without currency control

- Support for multi-currency accounts (USD, EUR, GBP, SGD, HKD, AUD, etc.)

- Safeguard your wealth and assets from potential financial instability in home country

- Ensure a high level of data confidentiality

- Offer specialized or customized banking products and services

- Simplify transactions with 24/7 internet banking and debit/credit cards

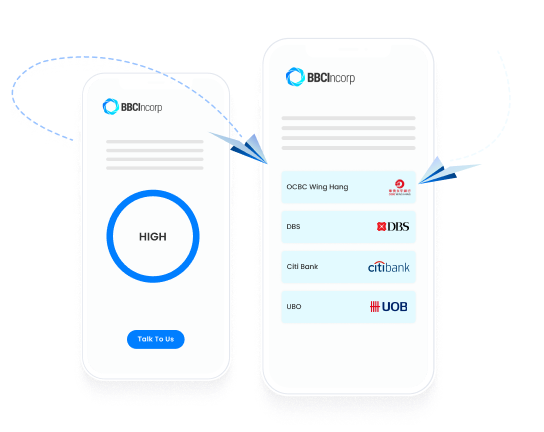

Why choose us for banking introduction

Extensive banking network

We have cultivated long-term relationships with banks in numerous jurisdictions, allowing us to provide solutions that are tailored to your unique business needs and circumstances.

Local expertise

Our deep experience working closely with banks ensures you're well-prepared for the due diligence process, enhancing your chances of securing bank account approval.

Transparent pricing

Rest easy knowing there are no hidden fees. Regardless of the bank you choose from our selection, we charge just one straightforward, flat fee – making sure you understand exactly what you're paying for.

HowIt Works

Understand the case

Our banking consultants will work with you to strive to make clear your business conditions and expectations before giving you advice on available banks with whom you should open your corporate bank account.

Collect and Verify document

Based on the agreement, we will proceed to help you prepare for required documents in the best way that could increase your success rate.

Schedule bank meeting

Depending on each bank’s obligation, we will arrange a bank meeting with your selected bank representative to set up your bank accounts. Before the meeting, we will give you samples of interview question for preparation.

Bank Account approval

We do not guarantee to successfully open your bank account. It totally depends on the bank’s decision to approve your account or not. The process could take a week or more.

Required Documents

The specific documents needed will vary depending on the bank you choose. Here are some commonly requested items:

KYC form

Bank statements

Bank reference letter

CV of shareholder(s) and director(s)

Business plan

Trading proofs

Information of some major clients, suppliers or partners

For precise document requirements tailored to your situation, please contact our support team.

Frequently Asked Questions

How to open offshore business bank account online?

Typically, you'll need to find an offshore bank that might best suit your business needs. The required documentation to open your offshore business account may vary from bank to bank; in most cases, you will need to submit your identity proof, your overseas address, the source of deposits, etc.

How much does it cost to open an offshore bank account?

It depends on your selected offshore bank, the jurisdiction in which you want to open your corporate account, the application fee, the notarized document fee to set up the account (if any), etc. It is recommended that trusted Offshore Banking Services instead of opening account by yourself would help avoid waste of time and money caused by the requirement and related costs during your account opening process.

Which country is best for offshore account?

Some popular choices for offshore banking include Switzerland, Belize, British Virgin Islands, Singapore, Hong Kong, Mauritius. Each country has its own advantages and disadvantages, so it's important to pick one that's right for your business.

For further information, you can check this blog out: Top 9 Countries With Best Offshore Bank Accounts

Feel free to contact our dedicated Relationship Managers via service@bbcincorp.com for detailed instructions on how to open offshore business account online.