Offshore Company Registration in Panama

Registering a Panama offshore company offers several advantages:

Panamanian Exempt Corporation

Panamanian Exempt Corporation

Company formation in 3 to 4 business day

No tax imposed on foreign-source profits

No minimum paid up capital

Company packages tailored to your needs

No hidden charge, all fees included

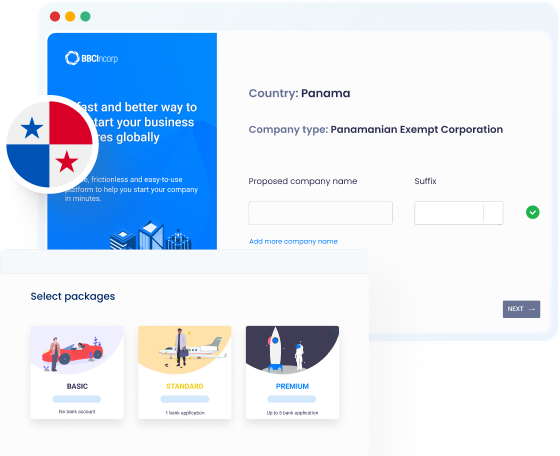

Panama Company Registration Packages

Bring your next business venture online

Streamlined process

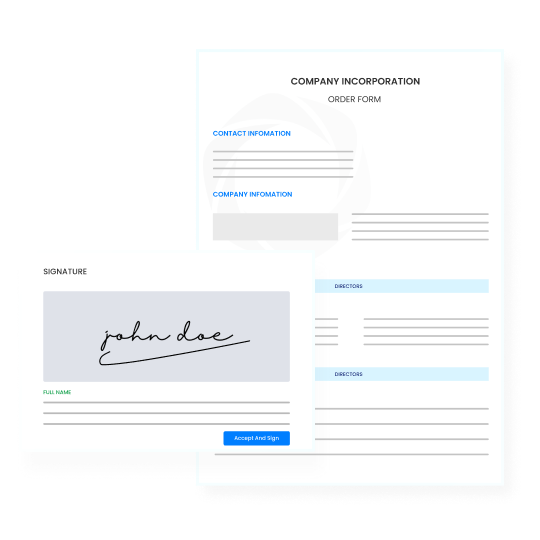

E-signature

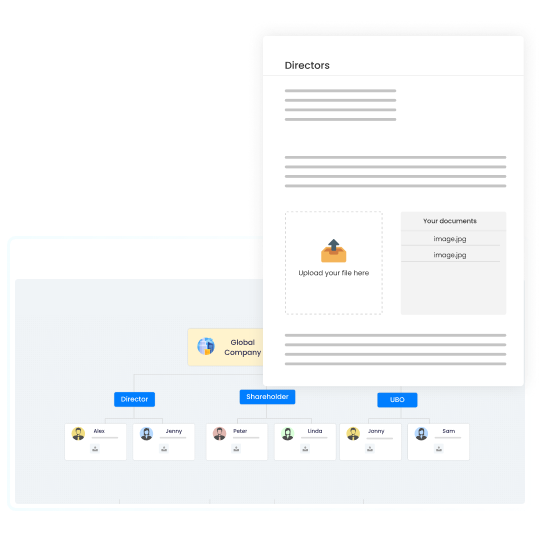

Digitized KYC

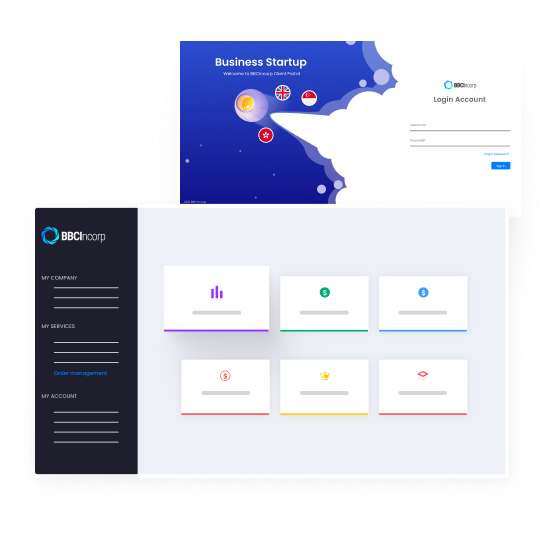

Centralized management portal

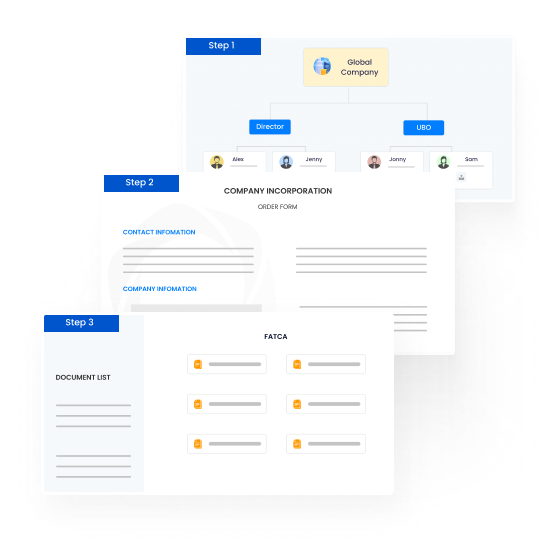

PanamaCompany Incorporation Process

Create your orders

Enter our online order platform for an easy onboarding experience and tailor your orders. We offer different packages and additional services that suit your goals. All information entered is secured over a 256-bit encrypted line.

Make payment

You can settle payments for services via flexible options including Visa, Master, Amex debit/credit cards, or bank transfer. Once your payment is complete, we will provide you a checklist of required information for Panama company registration.

Collect and verify KYC documents

After receiving your payment, our customer service will contact you to process the necessary paperwork. We'll guide you in properly preparing the documents for incorporation in Panama via KYC online form. You can also access our digital Client Portal to proceed with the incorporation steps and keep track of the process anytime, anywhere.

Finish the company registration

The electronic documents will be ready within 2 working days after Panamanian company formation, and the original kit will be delivered by courier within 3–7 days.

KYC Documents Checklist

The following proofs are required for all company members including Directors, Shareholders, Ultimate Beneficial Owners (UBOs), and Contact persons.

To establish the identity of a corporation or entity, it is necessary to provide, company documents and proofs of its members.

*Note that the list provided, while comprehensive, may not encompass all requirements.

For further personalized consultations tailored to your specific case, please reach out to our support team anytime