Your company must follow corporate tax filing regulations in Singapore, which entail submitting two types of tax returns. In certain situations, your company might be eligible for a simplified return or even an exemption from filing.

It’s important to note that each Singapore tax return has its own specific deadline, which can differ depending on your chosen financial year end and the year of assessment.

This blog provides you with a comprehensive overview of these requirements to help you ensure that your company complies with Singapore’s tax filing obligations accurately.

Time basis for company tax filing in Singapore

When it comes to timing for company tax filing in Singapore, there are several important considerations to keep in mind:

Financial year (FY): The financial year refers to the 12-month period during which your company conducts its financial operations and keeps its financial records.

Year of assessment (YA): The year of assessment is the specific calendar year in which your company’s taxable income is assessed by the Inland Revenue Authority of Singapore (IRAS). In most cases, the YA is the year immediately following the FY.

Financial year-end (FYE): The FYE is the last day of your company’s chosen financial year. It is crucial to note this date as it marks the conclusion of the accounting period for which financial statements must be prepared and corporate income tax must be calculated. The FYE ultimately impacts the deadlines for submitting annual tax returns to the IRAS.

To differentiate these terms, let’s have an example:

ABC Pte. Ltd. chooses its financial year to run from April 1st to March 31st each year.

For the financial year from April 1, 2023, to March 31, 2024, the year of assessment applicable to ABC Pte Ltd is 2024. This is the year in which the company’s taxable income for the FY 2023/2024 will be assessed by the IRAS.

The financial year-end for ABC Pte Ltd, based on their chosen FY, is March 31, 2024. This date signifies the end of the accounting period for which ABC Pte Ltd must prepare its financial statements and calculate its tax liability. Any financial transactions occurring after this date belong to the next FY.

Two types of Singapore tax returns

To fulfill your corporate tax filing obligation in Singapore, you are required to file two types of returns, which are:

- Estimated Chargeable Income (ECI)

- Form C/C-S/C-S Lite

Estimated chargeable income

The Estimated Chargeable Income (ECI) is a mandatory submission required by the IRAS for companies operating in Singapore, which must be submitted in 3 months after a financial year-end.

The purpose of the ECI report is to help the IRAS estimate a company’s tax liability in advance. It provides an approximate figure of the company’s income that will be subject to corporate taxation. This estimated information helps the IRAS streamline the tax assessment and collection processes.

Your company can be exempted from filing ECI with IRAS if it meets the following conditions:

- The revenue in the financial year is no more than 5 million, and

- The ECI is nil in the year of assessment.

Form C/C-S/C-S Lite

Form C/C-S/C-S Lite is a report of your company’s actual income. It provides a much more detailed picture of your company’s finances than the ECI report.

Form C

Form C is a tax form required for corporate income tax filing. It is mainly used by larger companies that do not qualify for alternative filing options such as Form C-S or Form C-S Lite.

Companies filing Form C are required to provide specific financial information, including details about their income, deductions, and computations used to determine their taxable income. This information is essential for calculating the company’s corporate income tax liability accurately.

In addition to completing Form C, companies are also required to submit audited or unaudited financial statements, and other supporting schedules.

Form C-S

Form C-S is a tax form specifically designed for small companies that meet certain eligibility criteria.

The “S” in Form C-S stands for “Simplified,” indicating that this form is a simplified version of the regular Form C, which has twice as fewer fields to fill in.

Your company is qualified for Form C-S when meeting all of the following criteria:

- It is incorporated in Singapore

- Its revenue in the financial year does not exceed SGD 5 million

- All sources of income are subject to the corporate tax of 17%

- The company does not claim any of the following in the year of assessment:

- Carry-back of current-year losses or capital allowances

- Group relief

- Investment allowance

- Foreign tax credit and tax deduction at source

If your company qualifies for tax incentives or preferential tax rates related to specific income types, it is advisable not to use Form C-S for your tax filing, as it may not offer the required flexibility to report such income accurately.

Form C-S Lite

To further relieve the burden of corporate tax filing in Singapore for small companies, the government introduced Form C-S Lite in 2020. Currently, it is the simplest Singapore tax return, consisting of only 6 primary fields.

Your company can qualify for filing Form C-S Lite when the following criteria are met:

- Your company satisfies all the conditions for Form C-S, and

- Its annual revenue does not exceed SGD 200,000.

Deadlines for corporate tax filing in Singapore

The due dates for the two Singapore tax returns are:

- For Estimated chargeable income: in 3 months after a financial year-end

- For form C/C-S/C-S lite: 30th November in the year of assessment

From YA 2020, your company is required to e-file Singapore tax returns with IRAS. Here are some timeline examples for corporate tax filing in Singapore:

Example 1: Your company’s financial year end is 31st December

- The financial year in which income is generated: 1st January 2023 – 31st December 2023

- The year of assessment in which income is assessed and taxed: 2024

- Due date for filing ECI: by 31st March 2024

- Due date for filing Form C/C-S/C-S Lite: by 30th November 2024

Example 2: Your company’s FYE is 30 June

- The financial year in which income is generated: 1st July 2023 – 30 June 2024.

- The year of assessment in which income is assessed and taxed: 2025

- Due date for filing ECI: by 30 September 2024

- Due date for filing Form C/C-S/C-S Lite: by 30th November 2025

How to file tax returns in Singapore

Below you will find the general process for filing Singapore tax returns:

Step 1: Review IRAS instructions

Before starting the filing process, it’s essential to thoroughly review the instructions provided by the IRAS for either filing Estimated Chargeable Income (ECI) or Form C-S/C. These instructions will help ensure accurate and compliant submissions.

Step 2: Access MyTax Portal

Log in to the MyTax Portal using your company’s CorpPass account.

You can do the filing yourself or entrust this task to any person or tax agent with your company’s CorpPass accounts. With the accounts, they can log in to the portal and e-file your company’s Singapore tax returns.

After logging in, you will need to verify your identity via SMS or OneKey Token, depending on the authentication method you’ve set up.

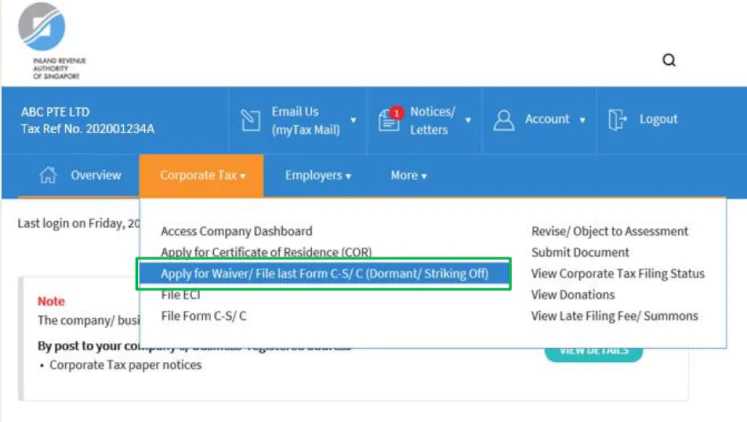

Step 3: Select corporate tax filing

Once you’ve successfully logged in, navigate to the menu bar, where you will find the “Corporate Tax” option. Click on it to access the corporate tax filing section.

Depending on your intention, select either “File ECI” or “File Form C-S/C” from the available options. This choice will depend on whether you are filing the Estimated Chargeable Income or the comprehensive Form C-S/C.

Step 4: Follow IRAS Instructions

Follow the step-by-step instructions provided by IRAS to initiate and complete the filing process. These instructions will guide you through the specific requirements, data entry, and documentation necessary for a successful submission.

By following these steps, you can efficiently and accurately file your corporate tax returns in Singapore through the MyTax Portal, ensuring compliance with IRAS regulations.

Things to note after filing corporate tax filing in Singapore

Once your company’s tax returns have been reviewed, the Singapore IRAS will issue Notices of Assessment by 31st May of the following year. You will have one month from this date to pay the corporate tax amount specified in the notice.

In cases where there is a significant difference between the taxable income reported in Form C-S/C and that reported in the Estimated Chargeable Income (ECI), IRAS may seek an explanation from your company to reconcile the differences.

Be aware that late corporate tax filing in Singapore may result in penalties or even summonses of company directors to address tax liabilities, depending on the decision made by IRAS.

Apart from corporate tax filings, there are other annual compliance requirements that you must meet to stay on the right side of the law. These may include:

- Holding an annual general meeting

- Submitting financial statements

- Auditing accounting records

- Obtaining licenses and permits

COMPLYMATE

Tired of sifting through endless paperwork to understand jurisdictions’ compliance requirements? Our guide can help!

Try Now

Conclusion

For corporate tax filing in Singapore, your company must file ECI and Form C/C-S/C-S (Lite) with IRAS. For the former, the corporate tax filing deadline in Singapore is within 3 months after a financial year end, and for the latter is the last day of November in the year of assessment.

From YA 2020, your company is required to e-file Singapore tax returns. You need to log in to MyTax Portal and start the filing. After the returns are viewed, IRAS will send you Notices of Assessment. You then will need to pay your company’s tax in 1 month according to the amount finalized in such Notices.

Should you have any questions about the Singapore taxes, please contact us via service@bbcincorp.com for answers!

Frequently Asked Questions

How to choose your financial year-end?

By default, your financial year-end (FYE) is automatically set to December 31st. When you submit your annual tax returns to the IRAS, they will assume that December 31st is your FYE unless you have officially requested a different date.

If you ever need to change your FYE for specific reasons, it is important to inform the Accounting and Corporate Regulatory Authority (ACRA) by completing the required forms.

It’s essential to follow the proper procedures for changing your FYE to avoid any compliance issues.

What if your FYE lasts longer than 12 months?

If your company’s FYE lasts longer than 12 months, you must ensure proper documentation and compliance with the Accounting and Corporate Regulatory Authority (ACRA) and the Inland Revenue Authority of Singapore (IRAS).

You may need to provide additional financial statements or disclosures to account for the extended FYE, and it’s advisable to consult with a financial or legal expert to ensure you meet all regulatory requirements.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.