- What are dividends declared?

- What is a dividend declaration?

- Types of dividends in Singapore

- How to declare dividends in Singapore

- How to calculate dividends declared

- How to find dividends declared

- Dividend tax treatment in Singapore

- Dividend reflection in Singapore company’s account

- How BBCIncorp Supports Your Business

- Conclusion

Understanding how dividend declared works is essential for Singapore companies seeking transparent profit distribution and proper statutory compliance.

In Singapore, dividends can only be declared out of retained earnings, and once the board or shareholders formally approve them, the dividend declared becomes a legal obligation recorded as a liability. This process is governed by the Companies Act 1967 and requires clear documentation, accurate financial reporting, and timely communication with shareholders.

For company owners, CFOs, and investors, knowing the correct procedures for declaring dividends, from resolutions to payment, helps prevent compliance risks and ensures smooth corporate governance.

This guide explores every key aspect of dividend declared in Singapore, including declaration rules, calculation methods, tax treatment, and accounting entries.

What are dividends declared?

Dividends declared refer to the amount of profits that a company has formally approved for distribution but has not yet paid to shareholders. Once approved, these dividends are no longer part of retained earnings. Instead, they are reclassified as a liability because the company becomes legally obligated to settle the amount. Under Section 403 of the Singapore Companies Act 1967, dividends declared must come from accumulated profits, not from share capital.

In Singapore financial reporting, dividends declared are typically presented as a current liability, unless the payment will occur more than twelve months after the reporting date. The amount is usually disclosed in the balance sheet or in the notes to the financial statements as part of the company’s distribution commitments.

What is a dividend declaration?

Generally, a dividend declaration is an event where you announce the dividend payment to shareholders.

While dividends declared refer to the amount already approved for distribution, a dividend declaration describes the process that leads to this approval. It is the formal corporate action through which a company authorizes the payment of dividends.

A dividend declaration requires a resolution, passed by the board of directors for interim dividends, or by shareholders for final dividends, to confirm that the company has sufficient distributable profits. Under Section 403(1) of the Singapore Companies Act 1967, no dividend may be declared unless profits are available, ensuring dividends are not paid out of share capital.

The declaration also establishes key details such as the dividend amount, entitlement date, and payment timeline. Once declared, the company is legally bound to make the payment, and the dividend cannot be revoked without a new resolution, highlighting the importance of careful governance and compliance.

To get a clear insight into dividends in Singapore, simply read our article on the 6 most asked questions about dividends in Singapore.

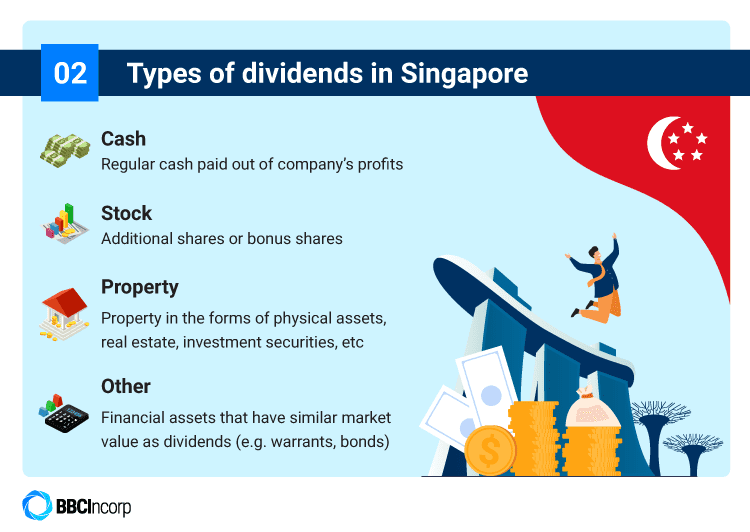

Types of dividends in Singapore

There are several types of dividends you can choose to pay out to your shareholders.

Singapore companies may issue several types of dividends depending on their structure, profits, and shareholder arrangements. While public-listed companies may offer more complex dividend instruments, most private limited companies in Singapore typically use straightforward forms of profit distribution. The common types of dividends include:

Declare cash dividend

A cash dividend is the standard form of distribution where profits are paid directly to shareholders’ bank accounts. It is the simplest and most widely used dividend type among Singapore private limited companies.

Special Dividend

A one-off dividend paid outside of the company’s usual distribution schedule, typically arising from exceptional profits, asset disposals, or surplus cash.

Stock Dividend

Instead of cash, shareholders receive additional shares. In Singapore, scrip dividends are primarily used by SGX-listed companies and must comply with MAS and SGX listing rules

Dividend Reinvestment Plans (DRIPs)

A DRIP allows shareholders to reinvest their dividends into newly issued shares. DRIPs are used by listed companies, not by private limited companies.

If you receive property dividends in Singapore, chances are you’ll have to pay property tax. Let’s learn in-depth how Singapore property tax works and how to pay for it.

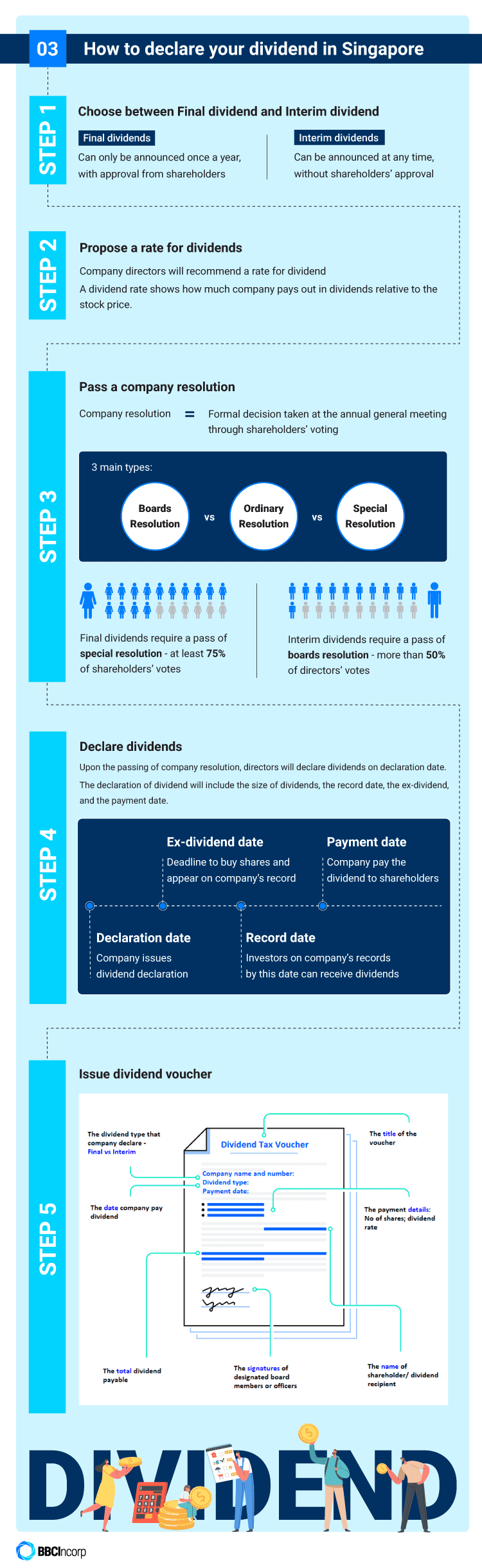

How to declare dividends in Singapore

Normally, declaring final dividends and interim dividends will require different rules.

To summarize, you can wrap up the declaration in five simple steps as follow:

Step 1: Final dividends vs Interim dividends

Declaring your dividend will involve choosing between a final dividend and an interim dividend.

Final dividends can only be announced once a year, with approval from shareholders.

You can pay out final dividends after publishing your company’s financial statement and confirming your profits for the year.

Interim dividends, on the other hand, can be announced at any time, without shareholders’ approval.

You can payout interim dividends before the annual general meeting (AGM) and the confirmation of your annual profits.

Step 2: Propose dividend rate

As a company director, you’ll need to recommend a rate for your dividend.

Generally, a dividend rate shows how much your company pays out in dividends relative to the stock price.

Step 3: Pass special resolutions

Once you propose your dividend rate, you’ll need to pass a company resolution to declare dividends.

Put simply, a company resolution is a formal decision taken at the annual general meeting by voting.

The shareholders can vote on the resolution either by hand or by poll.

There are certain types of resolutions you need to take notice of:

- Board resolutions

This type of resolution requires a simple majority of votes to pass (i.e. more than 50%), or approval by all of the directors of your company.

Typically, you’ll need to pass a board resolution to declare interim dividends.

You can find an example of board resolutions for dividend declaration in Singapore here.

- Shareholder’s resolution

The shareholder’s resolution can take the form of an ordinary resolution or a special resolution.

An ordinary resolution needs a simple majority at a meeting to pass whereas a special resolution requires at least a 75% majority of votes.

To declare final dividends, you’ll need a pass of special resolution.

For your reference, a special resolution in Singapore will look like this.

Step 4: Declare dividend singapore company

Upon the passing of the company resolution, you can officially declare your dividend on declaration date.

Specifically, your declaration will include the size of dividends and dividend dates such as the record date, the ex-dividend, and the payment date.

List of dividend dates

- Record date is the date by which the investor must be on the company’s records in order to receive a dividend.

- Ex-dividend date is the deadline by which investors must buy shares to qualify for the dividend payment, usually 1-2 days before the record date.

- Payment date is the date on which company pay the dividend to shareholders

For example, your company declared a dividend on November 10th, 2021 (declaration date) of US$0.40 per share (size of dividend) payable on December 20, 2021 (payment date) to shareholders of record as of November 30, 2020 (record date).

If you choose to declare final dividends, you cannot revoke or cancel them in any way. But if you declare interim dividends, you can cancel or modify them without legal entanglement.

However, it is always recommended that you stick to the approved declaration to not upset your shareholders.

Step 5: Issue dividend voucher

After the declaration of the dividend, make sure you issue dividend vouchers to your shareholders.

Essentially, it is a dividend receipt that records all details of dividend payment, including the name of shareholders, date of issue, number of shares, total dividend paid, and more.

Your company’s dividend voucher will look something like this.

How to calculate dividends declared

Calculating dividends declared starts with determining the amount of distributable profits available. Under Section 403 of the Singapore Companies Act 1967, a company may only declare dividends out of profits, meaning retained earnings form the legal basis for the calculation. The standard formula is:

Dividends Declared = Retained Earnings Available × Dividend Rate

For per-share analysis, companies may also calculate dividends on a per-share basis. This mirrors the method used in global accounting and investment standards, including IFRS-aligned frameworks and investor guides:

Dividend per Share (DPS) = Total Dividends Declared ÷ Number of Outstanding Shares

This dual approach allows companies to calculate both the total dividend amount and the per-share allocation, ensuring transparency and proportional distribution for all shareholders.

How to find dividends declared

Dividends declared can be identified by reviewing a combination of a company’s financial statements and its statutory corporate records. Once dividends are formally approved, they reduce retained earnings and create a liability that remains outstanding until the payment is made.

Several documents together provide a complete and reliable picture of dividends declared:

Statement of Changes in Equity

This statement captures movements within the equity accounts. A deduction in retained earnings recorded here is one of the clearest financial indicators that dividends have been declared for the period.

Balance Sheet

Declared but unpaid dividends appear as a current liability under “Dividends Payable.” This reflects the company’s legal obligation to distribute the approved amount to shareholders.

Statement of Cash Flows

Although this statement does not record dividends declared, it reports dividends paid under financing activities. Reviewing this section helps distinguish between what has merely been declared and what has already been disbursed.

Corporate Resolutions

A directors’ resolution (for interim dividends) or a shareholders’ resolution (for final dividends) serves as the formal authorisation for the declaration. These documents specify the amount approved, the declaration date, and the intended payment timeline.

Accounting Ledger

The ledger entry to “Dividends Payable” provides transactional evidence of the liability created at the point of declaration, supporting both internal reporting and external audit requirements.

Taken together, these records form a coherent and auditable trail of dividends declared within any Singapore private limited company.

Dividend tax treatment in Singapore

Overall, the dividend distributions by a Singapore resident company are tax-free. This means that neither your company nor the shareholders will have to pay tax on the dividend payments.

However, there are some cases where special tax treatments are applied.

Typically, non-taxable dividends include:

- Dividends paid by Singapore resident companies under the one-tier tax system

- Foreign dividends received by Singapore resident individuals

- Income distributed from Real Estate Investment Trusts (REITs)

On the flip note, taxable Singapore dividends include:

- Dividends paid by co-operatives

- Foreign dividends received by residents through Singapore-based partnerships. Nevertheless, there is tax exemption available for these dividends if certain conditions are met. More details are here.

- Income distribution from REITs derived by individuals through partnerships in Singapore

If you want to see how taxes could potentially affect your business in Singapore, simply check out our overview of taxation in Singapore.

Dividend reflection in Singapore company’s account

Once you declare your dividend payment, it will appear on your liability account. In other words, you are owning debt to your shareholders until the payment.

The amount of your liability will depend mostly on the value of declared dividends.

After you pay out dividends to shareholders, your liability account will disappear, and the cash account will be credited by a similar amount.

How BBCIncorp Supports Your Business

Singapore’s regulatory environment demands accuracy, timely filings, and proper documentation, especially when it comes to dividends, corporate governance, and annual compliance. BBCIncorp combines deep cross-border expertise, technology-driven processes, and a multidisciplinary professional team to support businesses throughout their entire corporate journey.

What Makes BBCIncorp Different:

End-to-end compliance management with a technology-first model

Our Client Portal, digital onboarding workflows, automated reminders, and secure document management ensure that compliance is seamless, transparent, and always up to date. Businesses stay compliant without administrative burdens or missed deadlines.

Expertise in foreign-owned and cross-border businesses

For international founders and multi-entity groups, BBCIncorp provides clear guidance on Singapore structuring, tax residency, cross-border reporting, and regulatory filings—making expansion and long-term operation smoother and more predictable.

Professional accounting and tax execution

Our accounting and tax specialists deliver accurate bookkeeping, management reports, tax computation, and IRAS submissions. This ensures your financial data is reliable, audit-ready, and aligned with both Singapore FRS and your group-level consolidation requirements.

Scalable corporate secretarial support

Whether you are running a lean startup or a multi-entity Singapore structure, our corporate secretarial service covers resolutions, AGM filings, share allotments, officer updates, constitution amendments, and all statutory records required by ACRA.

Dividend and capital structure documentation done right

BBCIncorp prepares directors’ and shareholders’ resolutions, dividend vouchers, share registers, and related documents with precision, ensuring that every dividend declaration complies with the Companies Act and is fully audit-ready.

By combining regulatory expertise, technology-enabled processes, and practical, execution-driven support, BBCIncorp helps businesses operate with clarity and confidence in Singapore. From dividend declarations to ongoing compliance and governance, our team ensures your company remains compliant, well-structured, and ready for sustainable growth.

Conclusion

Understanding how dividends declared, recorded, and managed is essential for maintaining strong governance and financial clarity within a Singapore company. From determining available profits to approving resolutions, issuing vouchers, and reflecting dividends accurately in financial statements, each step carries legal and accounting implications under the Companies Act and Singapore’s one-tier corporate tax system.

With clear processes, proper documentation, and timely compliance, dividend distribution becomes a strategic tool rather than an administrative burden, supporting shareholder confidence and long-term corporate stability.

If you want to learn more about running a business in Singapore, get in touch with one of our friendly consultants via service@bbcincorp.com and we’ll help you with any concerns you may have.

Frequently Asked Questions

Do dividends create a tax shield for my company?

No, a dividend is not an expense for tax purposes, but a distribution of your company’s retained earnings.

As such, your company does not receive a tax deduction or tax shield from the dividend payment.

Can I pay myself dividends instead of salary and save on taxes?

If you are a director or an employee of the company, you should always receive your salary.

If you depend on dividend payment, you may not receive a sufficient source of income if the company has made no profits or suffered a loss.

What additional documents do I need to declare dividends in Singapore?

Apart from a dividend voucher, you will need the following documents to declare dividends in Singapore:

- Dividend register

- Resolution to pay dividends

- Shareholders’ approval

- Warrants to shareholders

- A meeting minutes including the location, date, detail on the declared dividends, etc.

If I reinvest my dividends, are they taxable?

Reinvested dividends are subject to the same tax rules that apply to dividends you receive, so they are taxable.

How often should I pay dividends?

The normal frequency is four times per year on a quarterly basis. However, you can pay dividends twice a year, once a year, or even monthly.

There is no specific in this matter. In fact, you can set your own policies regarding dividend payments.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What are dividends declared?

- What is a dividend declaration?

- Types of dividends in Singapore

- How to declare dividends in Singapore

- How to calculate dividends declared

- How to find dividends declared

- Dividend tax treatment in Singapore

- Dividend reflection in Singapore company’s account

- How BBCIncorp Supports Your Business

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.