- What are accounting records?

- Key types of accounting records businesses must maintain

- Record keeping requirements in Singapore

- How many years to keep accounting records in Singapore

- How to record accounts payable correctly

- Best practices for financial record keeping

- BBCIncorp solutions for smarter record keeping

Effective accounting records form the backbone of a company’s financial management, supporting informed decision-making, accurate reporting, and smooth audits. In Singapore, businesses must pay special attention to this area due to clear regulatory expectations from both ACRA and IRAS, which require companies to maintain documents that reflect genuine business activities and support all tax submissions.

This article outlines the key obligations Singapore companies need to follow, the essential documents involved, and the required retention periods under local regulations. It also explains how to handle accounts payable in a structured way and highlights practical methods to strengthen financial record keeping. By focusing on compliance and efficiency, the guide provides a concise, regulation-centric overview to help businesses build a reliable record keeping system and avoid unnecessary penalties.

Key Takeaways

- Essential documents like invoices, receipts, ledgers, payroll, and bank statements that support transparency, reporting, and compliance.

- Singapore companies must follow IRAS and ACRA rules, keeping records for 5 years (general) or 7 years (GST or specific documents).

- Consistent documentation, digital tools, automated workflows, and periodic reviews improve accuracy and audit readiness.

What are accounting records?

Core definition of accounting records

Accounting records are the complete collection of documents, data entries, and financial evidence a business maintains to capture every transaction it performs. These records encompass all materials that reflect the movement of money, whether incoming or outgoing. This includes invoices, receipts, journals, ledgers, payroll files, inventory reports, bank statements, payment vouchers, and other supporting documents.

Why accounting records matter for businesses

A strong understanding of accounting records helps businesses appreciate their broader value. Well-organized records allow companies to:

- Track cash flow smoothly, offering a clear picture of day-to-day financial activity.

- Manage receivables and payables with greater accuracy, helping maintain healthy financial operations.

- Prepare reliable financial statements, which guide planning, budgeting, and performance analysis.

- Fulfill tax and audit requirements with confidence, thanks to properly supported figures.

- Demonstrate compliance with regulations and reduce the risk of administrative penalties.

- Maintain a trustworthy audit trail, strengthening transparency and reducing the likelihood of disputes or errors.

- Support thoughtful decision-making, giving leaders access to dependable financial insights.

- Build credibility with stakeholders, reassuring investors, lenders, and partners of the company’s financial integrity.

Ultimately, effective record keeping promotes accuracy, clarity, and compliance—helping businesses operate responsibly and make well-informed financial decisions.

Key types of accounting records businesses must maintain

Businesses are required to maintain a wide range of documents to support accurate financial record keeping. These materials form the backbone of a reliable accounting system. Understanding the main types of accounting records helps ensure compliance, transparency, and smooth financial management.

Source documents

Source documents are the original evidence of business transactions and are essential for establishing the authenticity of financial entries. Common accounting records examples include sales invoices, supplier bills, receipts, purchase orders, delivery orders, credit notes, debit notes, and bank deposit slips.

These documents prove that a transaction occurred and provide key details such as dates, amounts, and involved parties. Accurate storage of source documents allows businesses to justify expenses, support tax claims, and respond confidently during audits.

Journals and ledgers

Journals record transactions in chronological order, serving as the first point of entry in the accounting process. Typical journals include the sales journal, purchase journal, and cash book. Entries from journals are then posted to the general ledger, where accounts are grouped and balanced.

Both journals and ledgers rely on the double-entry principle, which requires every transaction to have a corresponding debit and credit. This system ensures internal consistency and makes it easier to track liabilities, assets, equity, income, and expenses. Maintaining updated journals and ledgers is essential for producing accurate financial statements.

Bank and financial statements

Monthly bank statements, bank reconciliation reports, and credit card statements are crucial for verifying cash movements. Reconciliation ensures that the company’s internal cash records match the bank’s records, helping detect discrepancies such as bank errors, unauthorized transactions, or bookkeeping mistakes. These documents strengthen financial accuracy and provide transparency in cash-related activities.

Payroll and employee-related records

Payroll documentation includes payslips, CPF contribution reports (for Singapore businesses), employment contracts, time sheets, and leave records. These materials provide evidence of employee compensation and statutory contributions. Singapore regulations require businesses to keep payroll records for a minimum number of years to meet audit and compliance obligations.

Supporting accounting schedules

Supporting schedules enhance the accuracy of financial reporting. Examples include depreciation schedules, fixed asset registers, inventory records, and loan amortization schedules. These documents explain how financial statement figures are derived and allow auditors and regulators to verify calculations and assumptions.

Record keeping requirements in Singapore

Businesses are legally required to maintain proper record keeping practices to ensure accuracy, transparency, and regulatory compliance. Both ACRA and IRAS place strong emphasis on complete and reliable documentation as part of sound corporate governance and tax administration.

Statutory rules under IRAS and ACRA

ACRA focuses on corporate compliance, ensuring that accounting records support the preparation of true and fair financial statements. IRAS, on the other hand, requires documentation that substantiates income, expenses, and tax declarations. For tax purposes, businesses must generally retain records for at least five years from the relevant Year of Assessment or accounting period. Records may be kept in physical or electronic form, provided they remain accessible, legible, and properly organised throughout the retention period.

What must be included in proper record keeping

IRAS requires businesses to maintain a comprehensive set of documents as part of financial record keeping. These include sales invoices, purchase invoices, receipts, payment vouchers, bank statements, sales listings, purchase listings, asset registers, and credit or debit notes. Together, these records provide a complete audit trail that supports income, expenses, and balance sheet figures.

For GST-registered companies, additional obligations apply. Businesses must keep GST-related documents such as tax invoices, simplified tax invoices, import and export permits, and GST accounting records. These documents are essential for substantiating GST claims and ensuring accurate GST reporting.

Records may be kept in physical or electronic form, provided they are complete, accessible, and readable throughout the retention period.

Common mistakes in business record keeping

Despite clear requirements, many businesses fall short due to avoidable errors, including:

- Failing to retain source documents such as invoices or receipts

- Delayed recording of transactions, leading to gaps or inaccuracies

- Incorrect classification of expenses or income

- Poor storage practices, resulting in lost or corrupted digital files

Addressing these issues early helps businesses maintain compliant record keeping systems and reduces the risk of penalties, audits, or disputes with authorities.

How many years to keep accounting records in Singapore

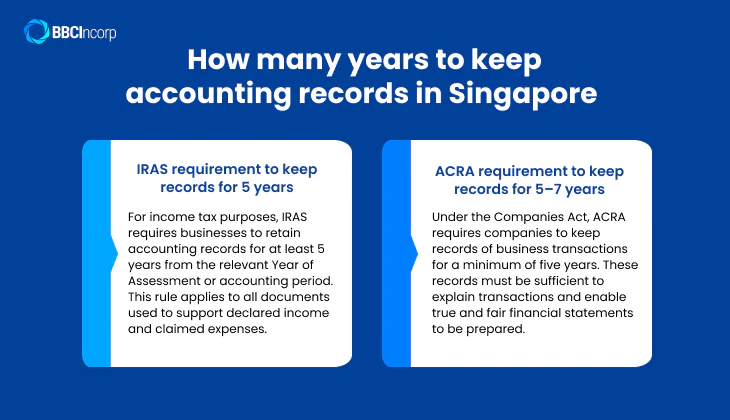

Depending on the applicable regulatory framework and the type of records involved, both IRAS and ACRA impose minimum retention periods to ensure businesses can support their financial and tax positions when required.

IRAS requirement to keep records for 5 years

For income tax purposes, IRAS requires businesses to retain accounting records for at least 5 years from the relevant Year of Assessment or accounting period. This rule applies to all documents used to support declared income and claimed expenses.

Examples of records that must be retained include receipts, sales and purchase invoices, bank statements, payroll records, CPF contribution documents, and other supporting vouchers. These materials allow IRAS to verify tax filings during audits or reviews. Even if a business has ceased operations, it is still required to keep its accounting records for the prescribed five-year period.

This requirement answers both how many years to keep accounting records in Singapore and how long to keep accounting records in Singapore for income tax compliance.

ACRA requirement to keep records for 5–7 years

Under the Companies Act, ACRA requires companies to keep records of business transactions for a minimum of five years. These records must be sufficient to explain transactions and enable true and fair financial statements to be prepared.

However, certain documents may need to be retained for longer periods. In particular, GST-related records, such as tax invoices, import and export permits, and GST accounting schedules, may need to be kept for up to seven years, depending on the nature of the transaction and applicable tax rules. This is where the commonly cited obligation to keep records for 7 years in Singapore applies.

How to record accounts payable correctly

What accounts payable represents

Accounts payable represent a business’s short-term obligations owed to suppliers for goods or services already received but not yet paid. These amounts appear as current liabilities on the balance sheet and play a direct role in cash flow management. So, accurate accounts payable records help businesses track outstanding payments, manage working capital, and avoid late fees or strained supplier relationships.

Steps to record accounts payable

To ensure accuracy and consistency, businesses should follow these key steps when recording accounts payable:

- Record supplier invoices promptly once goods or services have been received. This ensures liabilities are recognised in the correct accounting period.

- Verify invoice details, including amounts, payment terms, tax treatment, and vendor information, to prevent errors or disputes.

- Enter the transaction into the ledger using double-entry bookkeeping, debiting the relevant expense or asset account and crediting accounts payable.

- Update the accounts payable aging schedule to track outstanding balances and prioritise upcoming payments.

- Mark invoices as paid once payment is made and reconcile them with bank statements to confirm accuracy and completeness.

Common mistakes to avoid

Mistakes in how to record accounts payable often arise from poor internal controls. Common issues include duplicate entries, missing invoices, incorrect vendor details, and failure to match invoices with purchase orders or delivery notes. These errors can distort financial data and disrupt cash flow management.

By applying consistent processes and regularly reviewing accounts payable records, businesses can improve financial accuracy, strengthen controls, and maintain reliable accounting records.

Best practices for financial record keeping

Effective financial record keeping goes beyond meeting minimum compliance requirements. By applying structured and consistent practices, businesses can improve accuracy, reduce risk, and maintain reliable financial visibility. The following accounting records best practices are widely recommended across regulatory and professional reference sources.

Maintain a consistent documentation process

Businesses should establish a clear documentation process that defines how transactions are recorded, reviewed, and stored. A formal document retention policy helps determine which records must be kept, in what format, and for how long.

Regularly updating journals and ledgers ensures transactions are captured in the correct accounting period, reducing errors and adjustments later. Using standardized naming conventions for files, such as including dates, vendor names, and reference numbers also improves retrieval efficiency and reduces the risk of misplaced documents, especially in digital environments.

Adopt reliable digital accounting systems

Modern accounting systems play a key role in improving financial record keeping quality. Cloud-based accounting software allows real-time access to records, automated postings, and secure storage. Automation tools can streamline repetitive tasks such as invoice entry, payment tracking, and bank reconciliations.

Technologies like optical character recognition (OCR) for receipts further reduce manual data entry and minimize human error. These systems also make it easier to maintain complete audit trails, supporting compliance reviews and audits. Overall, digital solutions enhance accuracy, speed up reconciliation processes, and simplify long-term record management.

Conduct periodic reviews and internal audits

Regular reviews are essential for maintaining reliable accounting records. Monthly reconciliations, such as matching bank statements with cash records help identify discrepancies early. Annual preparation of financial statements provides a structured opportunity to assess the completeness and accuracy of recorded data.

Internal audits, whether formal or informal, help detect irregularities, control weaknesses, or documentation gaps before they become compliance issues. Early detection allows businesses to correct errors promptly and maintain confidence in their financial reporting.

BBCIncorp solutions for smarter record keeping

Managing accounting records accurately can be time-consuming, especially as regulatory requirements in Singapore continue to evolve. BBCIncorp provides comprehensive accounting services Singapore businesses rely on to maintain structured, compliant, and efficient financial systems.

Professional bookkeeping and accounting support

Managing accounting records accurately can be time-consuming, especially as regulatory requirements in Singapore continue to evolve. BBCIncorp provides comprehensive accounting services Singapore businesses rely on to maintain structured, compliant, and efficient financial systems.

Digital tools and automated workflows

To enhance efficiency, BBCIncorp helps businesses adopt modern, cloud-based accounting solutions tailored to their operational needs. Automated workflows reduce manual data entry, minimise errors, and enable faster reconciliation.

System integrations support smoother reporting, while secure digital document management ensures records are properly stored, accessible, and retained in accordance with regulatory requirements. These financial record keeping solutions improve accuracy while simplifying long-term record management.

Compliance-focused advisory

Beyond daily bookkeeping, BBCIncorp offers advisory support to help businesses stay compliant. This includes guidance on statutory retention periods, maintaining audit-ready documentation, and meeting financial reporting and tax filing obligations. By combining technical expertise with regulatory insight, BBCIncorp helps businesses strengthen compliance and reduce financial risk.

Maintaining proper accounting records is essential for compliance, transparency, and accurate financial reporting in Singapore. From understanding retention requirements to applying structured record keeping practices, businesses need reliable systems to stay audit-ready and compliant with IRAS and ACRA guidelines.

For businesses seeking a more efficient approach to financial record keeping, BBCIncorp offers professional accounting and bookkeeping solutions tailored to Singapore’s regulatory environment. Contact BBCIncorp today to build a compliant, scalable record-keeping system that supports long-term business growth.

Frequently Asked Questions

How long must a company keep its accounting records in Singapore for tax and compliance purposes?

Companies in Singapore are generally required to retain their accounting records for at least five years from the end of the relevant accounting period. This requirement applies to both tax compliance under IRAS and statutory obligations under ACRA.

What software tools can help Singapore businesses manage their accounting records more efficiently?

Many Singapore businesses use cloud-based accounting software such as Xero, QuickBooks Online, and SAP Business One. These platforms are often integrated with invoicing, payroll, and document management tools to streamline workflows, improve accuracy, and support efficient accounting record management.

Can Singapore companies store their accounting records overseas or in cloud systems?

Yes. Companies may store their accounting records overseas or in cloud-based systems, provided the records are readily accessible in Singapore upon request by IRAS or ACRA. The records must also remain complete, accurate, secure, and retained for the required statutory period.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What are accounting records?

- Key types of accounting records businesses must maintain

- Record keeping requirements in Singapore

- How many years to keep accounting records in Singapore

- How to record accounts payable correctly

- Best practices for financial record keeping

- BBCIncorp solutions for smarter record keeping

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.