In Singapore, company audits serve as a cornerstone of financial integrity and regulatory compliance. Governed by the Companies Act and monitored by ACRA, audits ensure that a company’s financial statements present a true and fair view in accordance with the Singapore Financial Reporting Standards (SFRS). Understanding audit requirements Singapore is therefore critical, not only to meet legal obligations but also to strengthen transparency and investor confidence.

However, not every business is subject to a statutory audit. The law provides exemptions for small companies and dormant entities, recognizing their lower risk and scale of operations. This article offers a complete overview of Singapore audit requirements, explaining who needs an audit, when exemptions apply, and how businesses can prepare to stay compliant under the latest audit regulations in Singapore.

Overview of audit requirements in Singapore

Singapore’s audit framework reflects its commitment to transparency, integrity, and investor confidence. Every company must prepare financial statements that accurately represent its business performance and comply with the Singapore Financial Reporting Standards (SFRS). Unless exempted, these statements must be reviewed through a statutory audit under the Companies Act (Cap. 50), supervised by the Accounting and Corporate Regulatory Authority (ACRA).

Understanding audit requirements Singapore helps businesses identify when audits are mandatory, how they reinforce accountability, and what exemptions may apply. Audits not only verify compliance with audit regulations in Singapore, but also serve as a vital tool for risk management, detecting irregularities and strengthening financial discipline. The following sections explain what statutory audits involve and which types of entities must undergo them under Singapore’s audit regime.

What is a statutory audit?

A statutory audit is an independent examination of a company’s financial statements conducted by a qualified public accountant to determine whether the reports present a true and fair view of the company’s financial position. In Singapore, statutory audits are mandated under the Companies Act and regulated by ACRA, ensuring that every audit is performed in accordance with SFRS and applicable audit regulations in Singapore.

The audit process involves assessing accounting systems, testing internal controls, verifying material transactions, and reviewing disclosures to ensure accuracy and consistency. Auditors also evaluate compliance with taxation and corporate governance requirements. Their findings culminate in an audit report, which provides assurance to shareholders, investors, and regulators about the reliability of the company’s financial statements.

Beyond legal compliance, a statutory audit reinforces corporate transparency, deters misconduct, and promotes financial integrity, principles that lie at the core of Singapore’s internationally recognized regulatory framework.

Who needs company audits in Singapore?

Under Singapore audit requirements, most incorporated companies must appoint an auditor within three months of incorporation unless they qualify for exemption. The Companies Act and ACRA set out categories of entities that are typically required to undergo an annual audit:

- Private limited companies that exceed the “small company” thresholds under the Companies (Amendment) Act 2014.

- Public companies, including those listed on the Singapore Exchange (SGX), must meet full audit obligations without exception.

- Foreign companies and branch offices operating in Singapore which are required to file audited financial statements with ACRA.

- Charities and non-profit organizations, which must be audited if their annual income or donations exceed statutory thresholds defined under the Charities Act.

Complying with these audit regulations in Singapore ensures that businesses remain in good legal standing, sustain investor confidence, and preserve access to financing. Regularly audited accounts signal robust governance and transparency, qualities that continue to distinguish Singapore as a premier global business hub.

Exemption from audit requirements in Singapore

While statutory audits are a cornerstone of Singapore’s financial reporting regime, not every company is required to undergo one. The Companies (Amendment) Act 2014 introduced specific audit exemption Singapore provisions to reduce administrative burdens on smaller entities while preserving financial accountability. Whether a business qualifies for exemption depends on its size, activity level, and group structure.

These exemptions reflect Singapore’s commitment to fostering a pro-business environment without compromising transparency. Understanding when your company qualifies for exemption is vital for directors and shareholders, as misinterpreting audit requirements in Singapore could result in non-compliance and penalties.

The following sections outline the key categories of audit exemptions available, small companies, dormant companies, and entities not eligible for exemption under Singapore’s current legislation.

Exemption for small companies and small groups

The small company audit exemption was introduced by the Companies (Amendment) Act 2014 and has applied to financial years starting on or after 1 July 2015. Under this framework, a private limited company is exempt from statutory audit if it satisfies at least two out of the following three criteria for the past two consecutive financial years:

- Total annual revenue ≤ SG$10 million

- Total assets ≤ SG$10 million

- Number of employees ≤ 50

To qualify, the company must also be a private limited company, not a public entity.

If the company is part of a corporate group, the entire group must collectively meet at least two of the three thresholds on a consolidated basis to qualify as a small group. This ensures that large corporate structures cannot exploit the exemption through fragmented ownership.

This audit exemption Singapore framework significantly benefits startups and SMEs by allowing them to focus resources on growth and operations rather than compliance costs. However, directors remain responsible for maintaining accurate accounting records and preparing financial statements in compliance with SFRS, even when no audit is required.

Exemptions for Dormant Companies

A company is considered dormant if it has been inactive since its incorporation or since the end of the previous financial year. It remains dormant so long as no accounting transaction occurs; once a transaction is made, the company immediately ceases to be regarded as dormant.

Certain activities, however, are not treated as accounting transactions under Section 205B(3) of the Act. These include:

- The appointment of a company secretary or auditor

- The maintenance of company registers and books

- The payment of statutory fees or charges required by law

Dormant companies are exempt from appointing auditors and preparing audited accounts, but directors must still file annual returns and maintain basic accounting records with ACRA. If the company becomes active again, it must comply with the full audit requirements of Singapore obligations from that financial year onward.

Examples of companies not eligible for exemption

Certain entities are not eligible for any form of audit exemption due to their scale, public accountability, or regulatory oversight. These include:

- Listed companies or those preparing for an initial public offering (IPO)

- Licensed financial institutions, such as banks and insurance firms

- Companies regulated by the Monetary Authority of Singapore (MAS)

- Foreign branches of overseas corporations operating in Singapore

Such organizations handle public funds, complex transactions, or significant stakeholder interests, making independent audits an essential safeguard. For these entities, full compliance with private limited company audit requirements and ongoing external audits remains mandatory under Singapore’s audit regulations.

Audit process and compliance checklist

Audits in Singapore follow a structured process designed to ensure financial transparency, accountability, and compliance with statutory requirements. For many companies, the audit is not merely a regulatory formality, it is a mechanism for building trust with investors, banks, and regulators.

Understanding the full audit process under audit requirements Singapore helps directors and business owners prepare adequately and avoid last-minute compliance issues. From maintaining proper bookkeeping to appointing qualified auditors and preparing financial statements under SFRS and XBRL standards, every step plays a critical role in verifying accuracy and governance quality.

This section outlines each phase of the audit process and provides a practical compliance checklist aligned with audit regulations in Singapore, helping companies stay compliant, audit-ready, and confident in their financial integrity.

Preparation of financial statements

The foundation of every audit lies in proper financial preparation. Under Section 201 of the Companies Act, company directors are responsible for ensuring that financial statements present a “true and fair view” of the company’s financial position. To comply with Singapore audit requirements, businesses must maintain timely and accurate bookkeeping in accordance with the Singapore Financial Reporting Standards.

Since 2018, companies have been required to file their statements in XBRL format via ACRA’s BizFinx system, enhancing transparency and data accuracy. Late or incomplete filings can result in penalties or audit delays.

Good recordkeeping supports the audit process, allowing auditors to verify transactions efficiently. Ultimately, directors, not accountants, bear the legal duty for the accuracy and completeness of financial reports under audit regulations in Singapore.

Appointment of auditors

For companies that do not qualify for audit exemption, appointing an auditor is a key statutory duty under the Companies Act 1967. An auditor must be appointed within three months of incorporation, and the appointment is typically made by the board of directors before the company’s first Annual General Meeting.

If no auditor is appointed within this timeframe, shareholders may do so at a general meeting. Should the company still fail to act, ACRA has the authority to appoint one on its behalf. Once appointed, the auditor remains in office until the conclusion of the next AGM, after which reappointment is generally automatic unless a new auditor is selected.

Timely appointment ensures that companies meet their legal obligations under Singapore audit requirements, avoid administrative penalties, and establish good governance practices from the very start of operations.

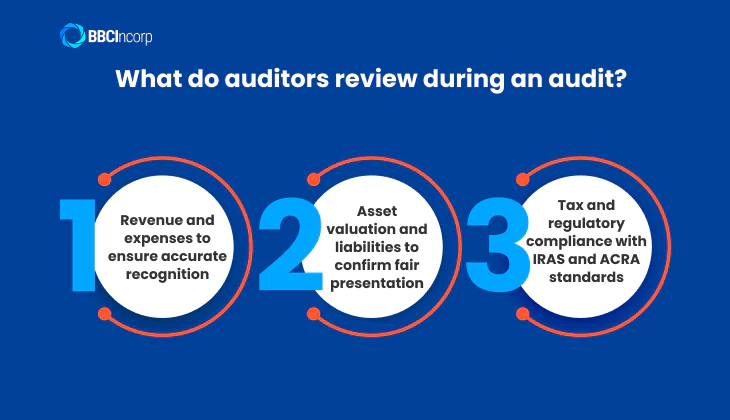

What do auditors review during an audit?

During an audit, auditors perform a comprehensive review of financial records to verify their accuracy and compliance with Singapore audit requirements. This includes evaluating:

- Revenue and expenses to ensure accurate recognition

- Asset valuation and liabilities to confirm fair presentation

- Tax and regulatory compliance with IRAS and ACRA standards

Auditors also assess internal controls and identify potential risks of fraud or mismanagement. The findings are documented in an Auditor’s Report, expressing whether the company’s financial statements provide a “true and fair view” under audit regulations in Singapore.

This process not only fulfills statutory obligations but also strengthens the company’s credibility and governance integrity.

Updating audit procedures and requirements from 2024

As Singapore continues to modernize its corporate governance standards, updates to audit regulations in Singapore have focused on digital compliance and audit quality. Since 2024, ACRA has emphasized the use of BizFile+ for electronic submissions and stricter enforcement of SFRS reporting standards, Singapore’s equivalent to IFRS.

Companies must also maintain digital records and implement stronger internal controls to meet audit readiness standards. The ACRA Audit Quality Review Programme (AQR) now conducts more frequent inspections to uphold consistency and accuracy in audit reporting.

For SMEs, the government continues to balance flexibility and compliance: while many remain exempt, maintaining proper records ensures smooth transitions if audit requirements apply in the future.

Penalties and non-compliance risks

Failing to meet audit requirements Singapore can expose companies to both legal and financial consequences. ACRA actively enforces compliance under the Companies Act 1967, and directors are held personally accountable for any oversight.

Penalties range from late filing fines and administrative sanctions to potential disqualification of directors. Beyond immediate fines, non-compliance can erode corporate credibility, affecting access to financing, partnerships, and regulatory renewals.

Understanding the risks of neglecting statutory audits helps companies safeguard their operations and maintain investor trust.

Failure to appoint auditor or file audited accounts

Under the Companies Act, companies that fail to appoint an auditor within three months of incorporation or to file audited accounts within the prescribed period may face significant penalties. According to ACRA’s Late Filing Framework (2023), late submissions of annual returns and financial statements incur penalties ranging from SG$300 to SG$600, depending on delay length.

If the failure is deliberate or repeated, ACRA may impose fines up to SG$5,000 and initiate court prosecution under Section 197(1B). Such breaches are publicly recorded, damaging a company’s reputation and credibility.

Delayed filings can also hinder loan approvals or investor due diligence, as ACRA’s public records form part of financial vetting by banks and partners. Complying with statutory audit obligations ensures legal compliance and sustains corporate transparency.

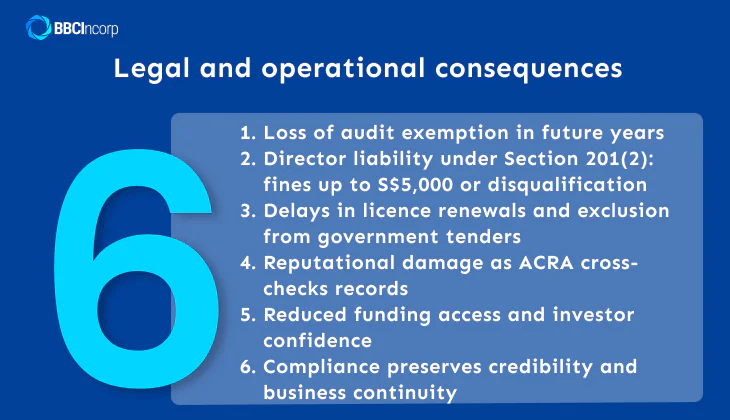

Legal and operational consequences

Ignoring audit requirements in Singapore does not only lead to fines, it can have lasting legal Ignoring audit requirements in Singapore not only results in financial penalties but can also lead to lasting legal and operational setbacks. Continuous non-compliance may cause a company to lose its audit exemption status, requiring full statutory audits in subsequent financial years.

Under Section 201(2) of the Companies Act, directors may be held personally liable for failing to ensure timely financial reporting, facing fines of up to SG$5,000 or potential disqualification from directorships.

From an operational perspective, businesses risk delays in licence renewals, rejection of government tenders, and reputational harm as ACRA and other agencies cross-reference compliance records. For startups and SMEs, these issues can also undermine funding opportunities and investor confidence.

Meeting statutory audit obligations is therefore essential to maintain regulatory credibility and business continuity.

Audit compliance made easy with BBCIncorp experts

In Singapore’s fast-evolving regulatory landscape, compliance is no longer a routine task, it is the foundation of business credibility. Yet, meeting audit requirements Singapore obligations can be challenging, especially for companies expanding across borders or managing complex financial structures.

At BBCIncorp, we bridge the gap between compliance and strategy. Our specialists translate statutory obligations into clear, actionable processes, from determining audit eligibility to preparing compliant financial statements and coordinating with auditors. With our expert guidance, businesses gain not only peace of mind but also a transparent framework for sustainable growth.

Professional audit and compliance support

At BBCIncorp, audit and compliance are more than procedural checkboxes, they are the backbone of business integrity. Our experts provide end-to-end support to help companies navigate Singapore’s evolving regulatory environment with confidence.

From assessing your financial reporting obligations under audit requirements Singapore standards to preparing compliant statements and managing XBRL submissions, we ensure accuracy, timeliness, and transparency at every step. For entities requiring statutory audits, our team coordinates seamlessly with independent auditors to simplify reviews and minimize disruption.

Through our integrated approach, compliance becomes an enabler of growth, not a burden. Discover how our professional accounting services in Singapore can streamline your reporting and strengthen your corporate governance.

Audit exemption advisory

Gaining and maintaining audit exemption in Singapore requires more than meeting compliance thresholds, it demands strategic foresight and disciplined reporting. BBCIncorp’s advisory team works with businesses to evaluate their exemption eligibility, optimise structures, and plan ahead for sustainable compliance.

We assist clients in understanding how Singapore’s audit framework applies to different business entities, including those governed by Private Limited Company audit requirements, ensuring governance efficiency and transparency as they scale. Through ongoing compliance monitoring and forward-planning support, complemented by our accounting services in Singapore, we help businesses stay adaptive, compliant, and positioned for growth in the long term.

Conclusion

In Singapore’s competitive and highly regulated market, compliance is not a formality, it is the foundation of corporate integrity. Understanding and meeting audit requirements Singapore empowers businesses to build credibility, reduce risks, and earn the confidence of investors and regulators alike.

Whether a company qualifies for exemption or requires a full statutory audit, disciplined governance ensures long-term sustainability. With BBCIncorp’s expert guidance, businesses can transform compliance from a burden into a strategic advantage, one that drives growth through transparency and trust.

For tailored guidance on your audit and compliance needs, reach out to BBCIncorp’s specialists at service@bbcincorp.com!

Frequently Asked Questions

Do all companies in Singapore need to be audited?

Not all businesses are required to undergo statutory audits in Singapore. While the Companies Act mandates audits for most entities, exemptions are available under certain conditions, particularly for “small companies” that meet specific financial and employee thresholds.

Can a dormant company be exempt from audit?

Yes. A dormant company in Singapore, which does not carry out any accounting transactions during a financial year, may qualify for audit exemption in Singapore under Section 205B of the Companies Act. However, it must still maintain proper accounting records and file annual returns with ACRA.

How do I know if I qualify as a small company?

A company may qualify as a small company if it meets at least two of the following criteria for the past two financial years:

- Total annual revenue ≤ SG$10 million

- Total assets ≤ SG$10 million

- Number of employees ≤ 50

Meeting these benchmarks determines eligibility for audit exemption Singapore, as outlined by ACRA under the Companies (Amendment) Act 2014.

What is the deadline for audit submission?

For companies that require audits, the first auditor must be appointed within three months of incorporation, unless exempt. Audited financial statements must then be filed with ACRA within seven months after the financial year-end. Staying compliant with Singapore audit requirements helps avoid late filing penalties and potential disqualification of directors.

Do foreign-owned companies qualify for exemption?

Foreign-owned entities operating in Singapore may qualify for audit exemption in Singapore only if they meet the same small-company thresholds and are not regulated by MAS or other authorities. However, most foreign branches are still required to prepare audited financial statements in their home jurisdictions. It’s best to seek professional advice to ensure alignment with audit regulations in Singapore and cross-border reporting obligations.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.