- Dormant company: meaning and definition

- The advantages of a dormant company in Singapore

- Requirement exemptions for a dormant company in Singapore

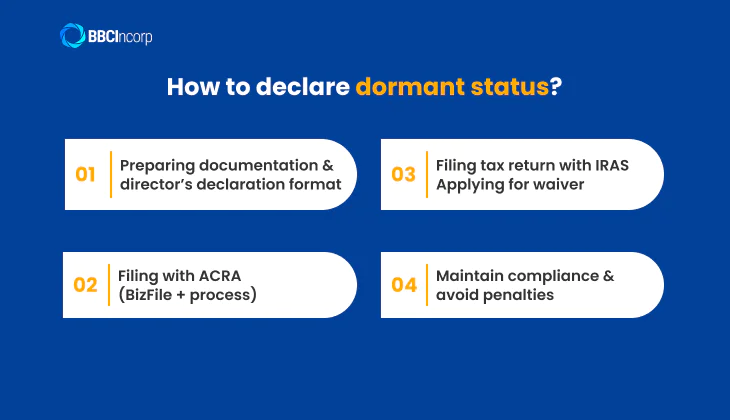

- Step‑by‑Step: How to declare dormant status

- How to recommence Singapore dormant company?

- How to close a dormant company in Singapore?

- Alternatives to dormant status

- How BBCIncorp help for dormant companies

- Conclusion

A dormant company in Singapore refers to a business entity that is not actively conducting business or generating income. However, in Singapore, there is a difference between the criteria set by the Accounting and Corporate Regulatory Authority (ACRA) and the Inland Revenue Authority of Singapore (IRAS) when determining dormancy. ACRA assesses dormancy based on the absence of accounting transactions, while IRAS focuses on whether the company has generated any income.

This article explains how Singapore dormant company status works, the IRAS dormant company definition, and the compliance exemptions available, including key filing obligations and timelines.

Dormant company: meaning and definition

A dormant company is a registered business entity that is not engaged in any active trading or business operations and does not generate income during a specific financial period. This status typically applies to companies that are temporarily inactive, such as those in the process of restructuring, awaiting funding, or holding assets without conducting commercial activities.

While a dormant company remains legally incorporated, it must avoid any business or accounting transactions that would disqualify it from dormant status. In general, a dormant company must not engage in:

- Any accounting transactions

- Payments or receipts exceeding the nominal sum of S$5,000

- Employing staff

- Selling or purchasing goods or services

- Buying or leasing property

- Issuing dividends to shareholders

- Paying directors’ salaries

- Receiving dividend income or managing investments

- Investing in subsidiaries

However, a dormant company may still perform minimal administrative functions such as maintaining a registered office, appointing directors, and paying fees to regulatory authorities, as these are not considered income-generating activities.

In Singapore, the definition of a dormant company can vary depending on which authority’s criteria are being applied. There are two main regulatory bodies involved: the Accounting and Corporate Regulatory Authority (ACRA) and the Inland Revenue Authority of Singapore (IRAS). Each has its own definition of what qualifies as a dormant company.

Under ACRA, a company is considered dormant if there are no accounting transactions during a financial year. Meanwhile, IRAS defines a dormant company based on the absence of income, regardless of whether any transactions have taken place. This distinction is important because the requirements for filing and compliance differ depending on which authority’s definition is being applied.

ACRA’s definition of a dormant company

The Accounting and Corporate Regulatory Authority defines dormant company meaning based on the absence of accounting transactions during a financial period, as stated in the Companies Act. A company is considered dormant if it does not carry out any transactions that affect its financial statements.

Examples of transactions that will cause a company to lose dormant status include:

- Selling goods or providing services

- Purchasing assets or inventory

- Selling company assets (e.g. property or equipment)

- Issuing dividends to shareholders

- Borrowing funds or taking loans

Engaging in any of the above means the company is no longer dormant and will be subject to standard financial reporting requirements.

However, certain activities are excluded from the definition of accounting transactions, meaning they are allowed without affecting dormancy status. These dormant company ACRA requirements include:

- A subscriber taking shares during incorporation

- Appointment of a company secretary or auditor

- Maintenance of a registered office

- Keeping statutory registers and records

- Payment of government fees, penalties, or interest under written law

These actions are considered administrative and do not impact the financial statements.

To qualify for compliance exemptions, a company must be classified as a dormant relevant company, which means:

- It is not listed, nor a subsidiary of a listed company

- Its total assets do not exceed SGD 500,000

- It has no accounting transactions for the financial year

If these conditions are met, the company may be exempt from preparing financial statements under Section 201A of the Companies Act. However, even dormant companies are still required to file annual returns with ACRA within seven months of the financial year-end. They may be eligible to file a simplified return, but the obligation to report remains in place.

IRAS’s definition of a dormant company

According to the Inland Revenue Authority of Singapore (IRAS), a dormant company is one that has not carried out any business and has not generated any income during the entire basis period (typically a financial year). Unlike ACRA, which defines dormancy based on accounting transactions, IRAS assesses dormancy purely based on the absence of revenue-generating activity.

For example, if your company did not conduct any business and earned no income throughout 2024, it would be regarded as dormant for the Year of Assessment (YA) 2025.

To be eligible for dormant status under IRAS, a company must meet all of the following conditions:

- No business operations conducted for the entire basis period

- No income received, including passive income such as interest or dividends

- Not registered for GST, or has already been de-registered

- No intention to recommence business within the next two years

Although a company may be classified as IRAS dormant company, it is still required to fulfill certain tax-related obligations unless it obtains a waiver of tax filing requirements. In order to apply for this waiver, companies must:

- Satisfy all the dormancy conditions above

- Submit a declaration of dormancy to IRAS

- Continue to meet compliance obligations, such as record-keeping and notifications

If the company resumes any business activity or starts receiving income, it must notify IRAS within one month, and normal tax filing duties will resume accordingly.

IRAS’s approach allows companies that are temporarily inactive to reduce administrative burdens, but only if strict conditions are met and properly maintained.

Key Differences between ACRA and IRAS definitions

Although both ACRA and IRAS classify dormant companies, their definitions serve different regulatory purposes and apply different criteria. The table below highlights the key distinctions:

| Criteria | ACRA | IRAS |

|---|---|---|

| Definition | No accounting transactions during the financial year | No business activity and no income during the basis period |

| Primary Focus | Impact on financial statements | Presence of revenue or income |

| Permitted Activities | Certain administrative actions allowed (e.g., appointing a secretary, paying fees) | No activity allowed — even passive income disqualifies dormancy |

| Purpose of Definition | For exemption from preparing financial statements | For exemption from corporate tax filing |

| Exemption Requirement | Must be a dormant relevant company (e.g., assets ≤ SGD 500,000) | Must apply for a waiver and meet all dormancy conditions |

By understanding these distinctions, companies can navigate compliance more effectively. Even if a company qualifies as dormant under one regulator, it may still be active under the other. Therefore, it’s important to satisfy the definitions and filing requirements of both ACRA and IRAS to benefit from reduced obligations while avoiding penalties.

The advantages of a dormant company in Singapore

Keeping a Singapore company dormant can be a smart and cost-effective business strategy. Whether you’re taking a temporary pause, preserving brand assets, or preparing for future growth, maintaining a dormant company allows you to stay compliant with minimal effort and cost. Below are the key benefits of retaining a dormant company status.

Cost savings

One of the most practical advantages of a dormant company is the reduction in operational costs. Since the company is not actively trading, expenses are limited to basic statutory maintenance, such as annual filing fees, registered office services, and company secretary support.

Dormant companies that meet the Accounting and Corporate Regulatory Authority (ACRA)’s criteria may also qualify for exemption from preparing audited financial statements, which significantly lowers compliance costs.

On the tax front, the Inland Revenue Authority of Singapore (IRAS) may grant filing waivers or allow simplified tax filings for companies that are officially dormant, easing the administrative burden further.

Brand and intellectual property protection

Even while inactive, a dormant company serves as a legal entity that helps safeguard your brand name, trademarks, and intellectual property. By keeping the company registered, you prevent others from using your company name or any associated brand elements. This can be especially valuable for startups or businesses that intend to re-enter the market later or expand when conditions are favorable.

Ease of resuming operations

Reactivating a dormant company is typically faster and simpler than incorporating a new entity. When you’re ready to resume business, the process involves notifying ACRA and IRAS, updating your company’s status, and fulfilling standard compliance obligations again. This flexibility makes dormancy a strategic option for businesses planning a return after restructuring, market testing, or fundraising.

Requirement exemptions for a dormant company in Singapore

Your dormant company could apply for a waiver from filing an annual tax return or preparing financial statements when it fulfilled certain criteria as laid down by ACRA or IRAS.

Exemption from filing annual tax returns

While all companies in Singapore are generally required to file corporate tax returns with the Inland Revenue Authority of Singapore (IRAS), a dormant company may apply for an exemption from this obligation. This exemption is not automatic—it must be formally requested through the myTax Portal, and approval is subject to meeting specific conditions.

To obtain a waiver from filing tax returns, the company must satisfy all of the following conditions:

- It has submitted past tax returns (Form C-S or Form C), including full financial statements and tax computations up to the date it ceased business.

- It does not own any investments, such as property or fixed deposits, and does not earn income from such assets.

- It has been de-registered for Goods and Services Tax (GST) if it was previously GST-registered.

- It has no intention to resume business activities within the next two years.

Applications can be submitted online via myTax Portal by a director, company secretary, or authorized CorpPass Approver.

Once approved, IRAS will no longer issue Form C/C-S annually, and the company will not need to reapply unless it resumes business, in which case the waiver becomes void.

Exemption from preparing financial statements

Under the Accounting and Corporate Regulatory Authority (ACRA), a dormant company is automatically exempted from statutory audit requirements. Additionally, certain dormant companies may also be exempt from preparing financial statements, provided that specific conditions are met.

To qualify for this exemption, the dormant company must:

- Be unlisted and not a subsidiary of a listed company

- Have remained dormant since incorporation or since the end of the previous financial year

- Fulfil the substantial assets test, meaning its total assets (or the consolidated assets of the group, if it is a parent company) do not exceed S$500,000 at any time during the previous financial year

- Have its directors lodge a declaration with ACRA confirming its dormant status

The directors’ declaration must confirm that:

- The company has been dormant throughout the relevant period

- No notice was received under Section 201A(3) of the Companies Act during the financial year

- All accounting and related records have been properly maintained as required under Section 199 of the Companies Act

Companies that are listed, subsidiaries of listed companies, or fail the substantial assets test must still prepare full financial statements, even if dormant.

Do you feel the need to put your company in a dormant status? Contact us now!

Step‑by‑Step: How to declare dormant status

Declaring dormant status in Singapore involves compliance with both the ACRA and IRAS. Each authority has different criteria and processes, and meeting them properly helps reduce unnecessary compliance work and penalties. Below is a step‑by‑step guide to ensure your company meets the necessary requirements.

Preparing documentation & director’s declaration format

Before any filing begins, directors must ensure that the necessary documentation is in order. A key requirement is the director’s declaration confirming the company’s dormant status throughout the financial year.

- Prepare a written declaration by the director under Section 201A or 205B of the Companies Act stating that the company had no accounting transactions during the financial year.

- Ensure that all statutory registers and records (e.g. register of members, directors, and secretaries) have been maintained in compliance with Section 199.

- While there’s no prescribed format from ACRA, the declaration must cover these core legal statements.

- Supporting internal documentation should also be kept, including meeting resolutions and updated registers, even if no filing is required for those.

Filing with ACRA (BizFile + process)

Once the documentation is ready, the company must update its status with ACRA through the BizFile+ platform. This ensures recognition of the dormant status under the Companies Act.

- Log in to BizFile+ using CorpPass or SingPass and select the appropriate filing form depending on the company’s obligations.

- Submit the director’s declaration through the annual return or relevant compliance form to indicate dormancy.

- Dormant companies that meet certain criteria (e.g. private companies with no public interest) may qualify to file a simplified annual return without attaching full financial statements.

- This filing should be completed within 7 months from the end of the company’s financial year.

Filing tax return with IRAS / applying for waiver

Even when a company is dormant, IRAS still requires a tax return unless a formal waiver has been granted. Companies must either file a return or apply for exemption through the myTax Portal.

- The default expectation is that all companies file Form C‑S or Form C‑S Lite via IRAS myTax Portal by 30 November of the Year of Assessment.

- To apply for a tax filing waiver, companies must:

- Have submitted previous Form C-S/C and final tax computations up to the cessation of business.

- Not hold any investments (e.g. properties, fixed deposits) or derive any income.

- Be deregistered for GST (if applicable).

- Not intend to resume business within the next two years.

- Applications are made online and outcomes are issued within two months.

- If approved, IRAS will no longer send Form C or C‑S annually, and no further tax returns are required unless the company resumes activity.

Recommended roles: company secretary and tax agent

While a dormant company has fewer compliance duties, it is still essential to engage qualified professionals to ensure accuracy and avoid penalties.

- A company secretary ensures that statutory documents are correctly prepared and filed with ACRA. Their oversight is crucial even for dormant entities.

- For IRAS-related matters, engaging a tax agent helps streamline waiver applications and confirms that the company meets eligibility criteria.

- While directors are ultimately responsible for declarations, professional assistance reduces compliance risk and ensures the company remains in good legal standing.

By carefully managing both ACRA and IRAS processes, businesses can successfully maintain dormant status while staying compliant with current Singapore regulations.

How to recommence Singapore dormant company?

If your company has been inactive but plans to resume operations or receive income, certain obligations must be fulfilled to ensure compliance with the Inland Revenue Authority of Singapore (IRAS). Restarting a dormant company involves timely notifications and updated tax procedures.

Notification to IRAS

You must inform IRAS within 1 month of recommencing business or receiving income. This is done by sending an email to IRAS with the following details:

- Subject: “Recommencement of business and request for Corporate Income Tax Return”

- Company Name and Unique Entity Number (UEN)

- Date of recommencement of business (in dd/mm/yyyy format)

- Date of receiving other sources of income such as interest, dividends, or rent (if any)

- New principal activity and its effective date, accompanied by a copy of the latest business profile

Additional requirements

To resume full operations, companies should also:

- Meet the shareholding test to qualify for certain tax exemptions or carry-forward losses

- Appoint an ‘Approver’ via CorpPass for managing corporate tax matters

- File via IRAS digital services, keeping in mind the 15-minute timeout for inactivity

- Declare any eligible donations to approved bodies or government entities

Reactivating a dormant company is straightforward, but timely action is crucial to maintain tax compliance and avoid penalties.

How to close a dormant company in Singapore?

If your company is dormant and you’ve decided not to resume business activities, you can formally close it to avoid future compliance obligations. There are two main ways to close a dormant company in Singapore: winding up or striking off. The appropriate method depends on your company’s financial status and future plans.

Option 1: Winding up

Winding up involves appointing a liquidator to settle the company’s affairs and distribute any remaining assets. This method is required if the company is insolvent (unable to pay its debts) and is generally more costly due to professional fees. It’s a court or members’ voluntary procedure under the Companies Act and is rarely used for dormant entities unless liabilities are involved.

Option 2: Striking off the company

For most dormant companies with no debts or liabilities, striking off is a simpler and more cost-effective process. Before applying for striking off with ACRA, directors should ensure:

- All income tax returns have been filed up to the cessation of business.

- Outstanding tax matters with IRAS are resolved, including assessments and queries.

- GST registration is cancelled, with no unpaid GST or related issues.

Eligibility criteria for striking off

You may apply for striking off via ACRA’s BizFile+ if your dormant company:

- Has ceased business operations or never commenced since incorporation

- Has no outstanding debts to IRAS or other government agencies

- Has no legal proceedings, charges, or regulatory actions pending

- Has no assets or liabilities, present or future

- Has received authorization from all or a majority of directors to file the application

The striking off process is free of charge and typically takes around 4 months to complete, including the public objection period.

Alternatives to dormant status

Dormant status is not the only option for a company that is no longer active. Depending on your long-term plans and financial situation, other alternatives may be more suitable. Below are three common approaches to consider: striking off, liquidation, and maintaining active status with minimal operations.

Striking off a company

Striking off is a common and cost-effective way to close a company that has ceased business and has no outstanding obligations. The application is submitted through ACRA’s BizFile+ system and is free of charge. If approved, the company’s name is removed from the register, usually within 4 to 6 months.

This process is suitable for companies that are solvent, not involved in legal proceedings, and have settled all tax matters with IRAS. However, once a company is struck off, it cannot be reinstated unless ordered by a court.

Why choose striking off?

- Simple and low-cost closure method

- Faster than formal winding up

- Appropriate for dormant or inactive companies with no debts

Limitations:

- Cannot be reversed easily

- Requires full clearance of all tax, legal, and regulatory matters

Liquidation

Liquidation, or winding up, is more formal and typically used when a company has liabilities or is insolvent. A licensed liquidator is appointed to manage the process, distribute assets, and settle debts before officially closing the business.

When to consider liquidation:

- The company has unpaid debts

- You need legal protection for creditors

- You want a formal process for closing financial matters

Liquidation is more expensive than striking off but may be necessary if obligations remain.

Keeping company active: minimal operations

If you expect to resume business later or want to retain the corporate structure, keeping the company active is an option. By limiting operations, you can reduce expenses while maintaining flexibility.

Pros:

- Keeps the company ready for future activity

- Retains assets like brand names or licenses

- Avoids the need for re-incorporation

Cons:

- Must still file annual returns and tax documents

- Ongoing costs for secretarial and compliance services

This option is best when a business pause is temporary or when maintaining the legal entity serves strategic purposes.

How BBCIncorp help for dormant companies

Maintaining a dormant company in Singapore still involves key compliance obligations. BBCIncorp offers dedicated support to ensure your company remains fully compliant with local regulations, even during periods of inactivity. Our solutions are designed to reduce administrative burden and help you avoid costly penalties.

Even when inactive, a company must fulfill certain requirements with ACRA and IRAS. BBCIncorp provides comprehensive services tailored to dormant companies, including:

- Corporate secretarial services: We manage all statutory filings such as annual returns and director declarations, ensuring your business meets its legal obligations without unnecessary effort.

- Compliance monitoring: From maintaining registers to managing deadlines, our experienced team helps you keep your company in good standing—without you having to track every rule.

- Accounting for dormant entities: Even dormant companies may need to file tax returns or keep proper accounting records. Our Dormant Company Accounting services simplify these tasks while keeping costs predictable.

Why Choose BBCIncorp?

Choosing the right partner can make a significant difference in maintaining your dormant status efficiently. BBCIncorp combines industry expertise with a streamlined service experience, making it easy to manage dormant companies while preparing for future reactivation if needed. Clients benefit from:

- Transparent, flat-rate pricing

- Timely reminders and ongoing support

- Full-service offerings in tax, secretarial, and accounting matters

Whether you’re maintaining a dormant company or incorporating a company in Singapore, BBCIncorp ensures every step is managed with care, compliance, and convenience.

Conclusion

In conclusion, understanding the concept of dormant companies in Singapore is crucial for any business considering this status. By opting for dormancy, companies can enjoy certain exemptions from compliance obligations, making it a strategic choice for businesses not currently active.

If you need help with staying compliant with the accounting compliance requirements for your dormant company, feel free to contact us at service@bbcincorp.com or view our dormant accounting package.

Frequently Asked Questions

What are the costs of maintaining a dormant company?

Although a dormant company is not actively trading or generating income, it still incurs some maintenance costs. These typically include annual filing fees, corporate secretarial services, and accounting or tax submissions where applicable. You may also need to maintain a registered office address and renew any business licenses if required.

Does a dormant company still need a company secretary?

Yes, under Singapore law, every private limited company must have at least one company secretary, even if it is dormant. The company secretary is responsible for ensuring the company continues to meet statutory obligations, such as maintaining registers, preparing board resolutions, and filing annual returns.

Failure to appoint a qualified secretary can lead to non-compliance, which may result in penalties or even enforcement action by the authorities. Appointing a professional corporate secretary is a cost-effective way to fulfill this legal requirement while maintaining good corporate governance.

Am I eligible for tax deductions while my business is dormant?

No, tax deductions generally do not apply to companies during periods of dormancy. Since a dormant company is not generating income or incurring business expenses in the course of trade, there are no deductible expenses. Attempting to claim deductions may result in the company being deemed active, triggering additional compliance requirements such as the filing of full tax returns and possibly financial statements. To preserve dormant status, it’s essential to avoid transactions that could be classified as business activity.

How long can a company remain dormant?

There is no legal time limit for how long a company can remain dormant in Singapore. As long as the company fulfills its compliance requirements—such as maintaining a company secretary, filing annual returns, and keeping proper records—it can continue to hold its dormant status indefinitely.

However, business owners should regularly assess whether keeping the company dormant remains necessary or whether it is more practical to strike it off to reduce ongoing administrative costs.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- Dormant company: meaning and definition

- The advantages of a dormant company in Singapore

- Requirement exemptions for a dormant company in Singapore

- Step‑by‑Step: How to declare dormant status

- How to recommence Singapore dormant company?

- How to close a dormant company in Singapore?

- Alternatives to dormant status

- How BBCIncorp help for dormant companies

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.