- What is a balance sheet?

- Key characteristics of a balance sheet

- Common balance sheet formats used globally

- Balance sheet vs income statement

- Key components of a balance sheet explained

- How to read and interpret a balance sheet

- Balance sheet examples and templates for businesses

- Why the balance sheet is vital for business growth and stability

- How to calculate net assets in a balance sheet

- Common challenges and limitations in interpreting balance sheets

- BBCIncorp - Trusted corporate compliance and financial services for your business needs

- Conclusion

In business decision-making, numbers only create value when they are properly understood. Many business owners and investors review financial reports regularly, yet struggle to see how those figures reflect a company’s real financial position. The balance sheet addresses this gap by presenting a clear and structured view of a business’s financial standing at a specific point in time.

As a core financial statement, the balance sheet outlines what a company owns, what it owes, and the equity remaining for shareholders. It plays a critical role in evaluating financial stability, liquidity, and long-term sustainability, making it essential for both operational management and investment analysis.

When assessed together with the income statement and the cash flow statement, the balance sheet completes the financial framework, enabling more informed and confident decisions in business finance.

Key Takeaways

- The balance sheet provides a clear snapshot of a company’s financial position at a specific point in time.

- Understanding assets, liabilities, and shareholders’ equity is essential for interpreting financial strength and risk.

- The balance sheet supports critical decisions in financing, investment, and internal business financial management.

- Net assets and key financial ratios derived from the balance sheet offer deeper insight into long-term financial sustainability.

- Effective balance sheet analysis requires awareness of its limitations and support from professional accounting and compliance expertise.

What is a balance sheet?

At its core, the balance sheet meaning lies in how a business’s financial structure is presented at a given moment. This balance sheet definition focuses not on performance over time, but on capturing a company’s financial position by detailing the resources it controls, the obligations it must meet, and the value remaining for its owners. This snapshot-based perspective makes the balance sheet a fundamental financial statement for evaluating both operational strength and financial resilience.

From a business standpoint, understanding what is a balance sheet goes beyond basic accounting knowledge. It allows stakeholders to assess whether a company is adequately capitalized, overly reliant on debt, or maintaining sufficient liquidity to support day-to-day operations. For investors and lenders, the balance sheet serves as a primary reference point for risk assessment and long-term viability.

The logic of the balance sheet is anchored in the accounting equation:

Assets = Liabilities + Shareholders’ Equity

This equation reflects a simple but powerful principle: everything a business owns is financed either through borrowed funds or through capital contributed by owners and accumulated profits. Assets represent economic resources such as cash, inventory, property, or receivables. Liabilities capture financial obligations, including loans and payables. Shareholders’ equity represents the residual interest after all liabilities are settled.

By maintaining this balance, the statement ensures internal consistency and transparency in financial reporting. Any change on one side of the accounting equation must be reflected on the other, reinforcing the integrity of the company’s financial records.

Beyond structure, the balance sheet reveals critical insights into a company’s financial health. It highlights liquidity through current assets and liabilities, signals solvency through long-term debt levels, and illustrates how effectively capital is deployed. These insights are essential for strategic planning, credit evaluation, and investment decision-making.

In practice, the balance sheet may also be referred to by alternative terms. Under international accounting standards such as IFRS, it is commonly called the statement of financial position, while “balance sheet” remains widely used in business, finance, and regulatory contexts. Despite the variation in terminology, the underlying purpose remains the same: to present a clear and reliable view of a company’s financial position at a specific point in time.

Key characteristics of a balance sheet

Certain features make the balance sheet distinct from other financial statements and explain its enduring relevance in business reporting. Rather than tracking activity over time, this statement focuses on position, structure, and accumulated results. The following characteristics define how the balance sheet should be interpreted in practice:

Snapshot at a specific date

The balance sheet reflects a company’s financial position at a single point in time, such as the end of a fiscal year. This allows stakeholders to evaluate stability and solvency as of a clearly defined reporting date.

Lists balances, not flows

Unlike the income statement or cash flow statement, it records ending balances of assets, liabilities, and equity rather than movements during a period.

Reflects cumulative activity since formation

All figures on the balance sheet represent the cumulative impact of transactions since the company was established, adjusted for accounting entries and reclassifications.

Integral for audits, due diligence, and management reporting

Because it presents a consolidated view of financial structure, the balance sheet is essential for audit verification, investment reviews, and internal decision-making.

Taken together, these characteristics explain why the balance sheet remains a cornerstone financial statement for evaluating financial integrity, risk exposure, and long-term business sustainability.

Common balance sheet formats used globally

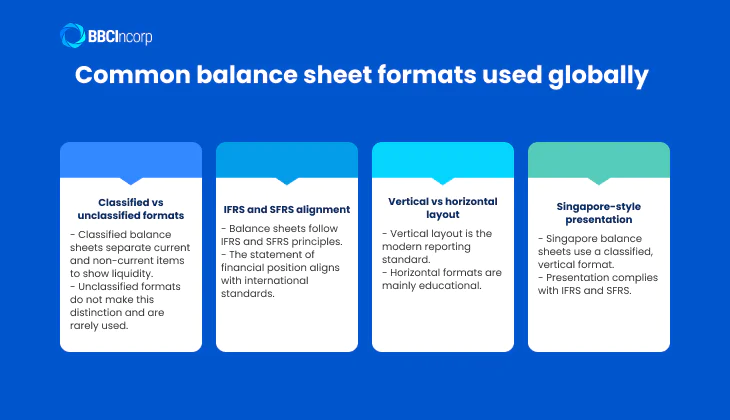

In practice, the presentation of a balance sheet may vary across jurisdictions, while still adhering to consistent accounting principles. Understanding these formats helps businesses interpret reports correctly and meet regulatory expectations, especially in cross-border contexts.

Classified vs unclassified formats

A classified balance sheet separates current and non-current assets and liabilities, offering clearer insights into liquidity. Unclassified formats, though less common, present items without this distinction.

IFRS and SFRS alignment

Under IFRS and Singapore Financial Reporting Standards (SFRS), the balance sheet, often referred to as the statement of financial position, follows a principles-based approach consistent with the balance sheet definition used internationally.

Vertical vs horizontal layout

Modern reporting typically adopts a vertical layout, while the traditional horizontal (T-account) format is mainly used for educational purposes.

Singapore-style presentation

In Singapore, the balance sheet format Singapore commonly follows a classified, vertical structure aligned with IFRS and SFRS requirements.

Overall, regardless of format, the objective of explaining what is balance sheet remains unchanged: to present a clear and comparable view of a company’s financial position.

Balance sheet vs income statement

Financial analysis becomes meaningful only when each financial statement is interpreted in its proper context. Among the core reports, understanding the balance sheet vs income statement relationship is essential, as these two statements serve different but complementary purposes. While one focuses on financial position, the other explains financial performance, together forming a more complete view of a company’s financial reality.

Key differences in measurement and timing

The primary difference between balance sheet and income statement lies in what they measure and when that measurement occurs. The income statement captures financial flows over a defined period, such as revenue earned and expenses incurred during a month, quarter, or year. In contrast, the balance sheet reports balances at a specific point in time, showing accumulated assets, liabilities, and equity as of the reporting date.

Because of this timing distinction, the two statements complement each other. Profitability reflected in the income statement eventually influences retained earnings on the balance sheet, while balance sheet items such as debt and assets directly affect future income and expenses.

When to use each financial statement

The relevance of each statement depends on the decision-making context and the stakeholder involved. Investors often prioritize the income statement to evaluate profitability trends, growth potential, and operating efficiency. At the same time, they rely on the balance sheet to assess capital structure, leverage, and long-term financial stability.

Lenders and creditors place greater emphasis on the balance sheet, as it reveals liquidity, solvency, and the company’s ability to meet obligations. Management teams, however, use both statements together: the income statement to monitor performance and cost control, and the balance sheet to manage resources, funding strategies, and financial risk. In practice, neither statement should be analyzed in isolation.

Viewed together, the balance sheet vs income statement comparison highlights how financial position and financial performance are interconnected. Understanding their differences and how they reinforce one another is fundamental to sound financial analysis and informed business decisions.

Key components of a balance sheet explained

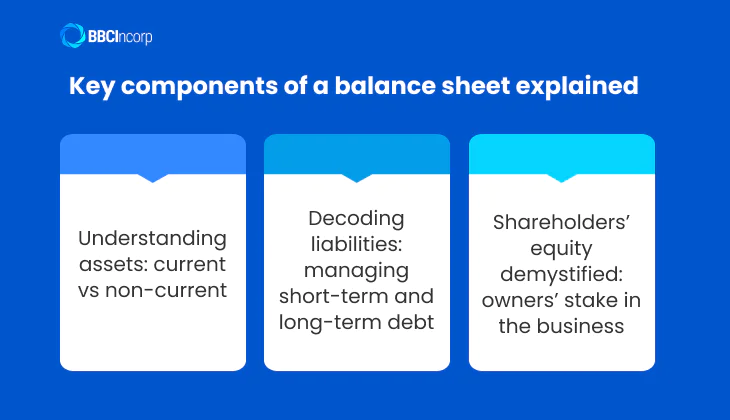

To understand a company’s financial position in depth, it is essential to examine the core components of the balance sheet. Each section – assets, liabilities, and shareholders’ equity – serves a distinct purpose while remaining closely interconnected. Together, they explain not only what a business owns and owes, but also how its operations are financed and sustained over time.

Understanding assets: current vs non-current

Assets represent economic resources controlled by a business and are fundamental to its ability to operate and grow. They are typically classified into current assets and non-current assets based on how quickly they can be converted into cash.

Current assets include cash, trade receivables, inventory, and other resources expected to be realized within one year. These items are closely tied to liquidity, reflecting a company’s capacity to meet short-term obligations without financial strain.

In contrast, non-current assets support long-term operations and value creation. Examples include property, plant, and equipment, as well as intangible assets such as patents and goodwill. While these assets are not easily liquidated, they contribute to long-term profitability and competitive advantage. Over time, depreciation and amortization systematically allocate the cost of these assets, ensuring a more accurate representation of asset value.

Decoding liabilities: managing short-term and long-term debt

Liabilities represent a company’s financial obligations arising from past transactions. Similar to assets, they are classified based on timing into current liabilities and long-term liabilities, a distinction critical for effective debt management.

Current liabilities include accounts payable, accrued wages, taxes payable, and short-term borrowings due within one year. These obligations directly affect cash flow planning and working capital management.

Long-term liabilities, such as bonds, mortgages, and deferred tax liabilities, extend beyond one year and reflect longer-term financing strategies. Understanding the composition and maturity of liabilities helps businesses assess solvency risk, negotiate financing terms, and maintain financial stability over time.

Shareholders’ equity demystified: owners’ stake in the business

Shareholders’ equity represents the residual interest in a company after all liabilities have been deducted from assets. It reflects the owners’ stake and is a key indicator of long-term financial strength.

Equity typically comprises common stock, retained earnings, and treasury stock. While common stock shows capital contributed by shareholders, retained earnings capture cumulative profits reinvested in the business. It is important to distinguish book value, reported on the balance sheet, from market value, which fluctuates based on investor expectations and external factors.

When analyzed together, assets, liabilities, and shareholders’ equity provide a comprehensive framework for evaluating financial health. Understanding how these components interact allows business leaders and investors to interpret balance sheet data with greater clarity and confidence.

How to read and interpret a balance sheet

Understanding the numbers on a balance sheet requires more than recognizing individual line items. Effective interpretation depends on knowing how the statement is structured and how its figures interact. When read correctly, the balance sheet becomes a practical tool for evaluating financial stability, risk exposure, and overall business strength.

Navigating the balance sheet layout and structure

The first step in reading a balance sheet is understanding how assets, liabilities, and equity are arranged. Assets are typically listed at the top, followed by liabilities and then shareholders’ equity. This structure reflects the core accounting equation and helps users trace how resources are financed.

Within each category, items are ordered by liquidity and maturity. More liquid assets such as cash and receivables appear before inventory and long-term assets. Similarly, liabilities are presented based on due dates, with short-term obligations listed ahead of long-term commitments. This ordering allows readers to quickly assess a company’s short-term financial flexibility.

Another critical check is ensuring the statement balances perfectly. Total assets must always equal the combined total of liabilities and equity. Any imbalance may indicate reporting errors or incomplete records. A clear grasp of the balance sheet structure enables users to move beyond surface-level figures and identify potential financial strengths or red flags.

Essential financial ratios derived from the balance sheet

Beyond structure, meaningful interpretation comes from analyzing financial ratios derived from balance sheet data. These ratios translate raw figures into insights that guide decision-making.

Liquidity indicators measure short-term financial resilience. The current ratio compares current assets to current liabilities, indicating whether a business can meet near-term obligations. The quick ratio refines this view by excluding inventory, focusing on the most liquid resources.

Leverage and risk ratios evaluate financial dependence on debt. The debt-to-equity ratio shows how much financing comes from creditors relative to shareholders, while the debt-to-assets ratio highlights the portion of assets funded by liabilities. Higher ratios generally signal increased financial risk.

Efficiency and profitability metrics link the balance sheet to performance outcomes. Asset turnover measures how effectively assets generate revenue, while return on equity assesses how efficiently shareholders’ capital is employed. Together, these ratios help investors and business leaders assess operational efficiency, financial risk, and long-term value creation.

By combining structural understanding with ratio analysis, the balance sheet becomes a powerful analytical framework. This approach enables stakeholders to interpret financial data with clarity and make informed strategic decisions.

Balance sheet examples and templates for businesses

Balance sheets are not presented in a single, universal format. The way a balance sheet is structured often reflects a company’s size, operational complexity, and industry characteristics.

While the core principles remain consistent, a balance sheet example for a small business looks very different from that of a large corporation. Service-based firms, retail businesses, and technology companies also emphasize different line items depending on how they generate revenue and manage resources. Understanding these variations helps businesses choose reporting formats that align with both operational needs and compliance requirements.

Simple balance sheet sample for small businesses

A balance sheet sample designed for small businesses is typically straightforward and highly focused. On the asset side, it usually includes cash, trade receivables, and occasionally basic fixed assets. Liabilities tend to be limited to accounts payable, short-term loans, or accrued expenses. Shareholders’ equity generally consists of initial capital contributions and retained earnings.

This simplified structure supports minimalistic reporting, allowing owners to track liquidity, obligations, and net asset position without unnecessary complexity. Such formats are commonly used by service providers, freelancers, and early-stage companies, where financial activities are relatively simple and transparency is prioritized over detailed disclosures.

Advanced sample for larger companies

In contrast, a balance sheet for larger organizations presents a more comprehensive and detailed financial picture. Assets may include intangible assets, long-term investments, and deferred tax assets. On the liabilities side, advanced formats often feature deferred revenue, complex reserves, long-term borrowings, and pension obligations.

These balance sheets are typically accompanied by additional disclosures and notes to explain accounting policies, valuation methods, and risk exposures. Such detail is essential for meeting regulatory standards, supporting audits, and providing investors with sufficient insight into financial structure and long-term commitments.

Whether simplified or advanced, each balance sheet format serves the same fundamental purpose. Selecting the appropriate template ensures that financial information remains relevant, compliant, and useful for decision-making at every stage of business growth.

Why the balance sheet is vital for business growth and stability

Beyond its technical role in financial reporting, the balance sheet plays a strategic role in shaping long-term business decisions. For business owners, investors, and financial institutions, understanding the importance of balance sheet analysis is essential to evaluating resilience, scalability, and sustainability. By presenting a clear view of financial structure, the balance sheet supports informed decision-making across multiple stages of business growth.

The balance sheet supports business growth and stability in several critical ways.

Assessing solvency and liquidity

By comparing assets with liabilities, the balance sheet reveals whether a business can meet short-term obligations while remaining financially stable in the long term. Liquidity indicators derived from current assets and liabilities help identify early signs of cash pressure, while solvency measures highlight capital adequacy and long-term risk exposure.

Supporting loans and investment decisions

Financial institutions rely heavily on balance sheet data when evaluating loan applications. Asset quality, leverage levels, and equity strength influence credit decisions and borrowing terms. From an investor perspective, the balance sheet provides insight into capital structure and downside risk, making it a core reference for assessing overall financial health before committing capital.

Enabling internal decision-making in business finance

Within the organization, the balance sheet informs key business finance decisions such as budgeting, expansion planning, and risk management. Decisions related to acquiring assets, restructuring debt, or distributing profits are grounded in balance sheet capacity rather than short-term performance alone.

Tracking performance through comparative analysis

Reviewing balance sheets across multiple reporting periods allows businesses to identify trends in asset growth, debt accumulation, and equity changes. This comparative approach helps management evaluate whether growth is supported by sustainable financing or driven by increasing financial risk.

Recognizing important limitations

Despite its value, the balance sheet reflects historical accounting values and may not capture intangible drivers such as brand strength or future market opportunities. For this reason, balance sheet analysis should always be complemented with income and cash flow statements.

When interpreted in context, the balance sheet becomes a cornerstone for maintaining stability, supporting growth, and protecting long-term enterprise value.

How to calculate net assets in a balance sheet

Understanding how to calculate net assets in balance sheet analysis is essential for evaluating a company’s underlying financial strength. Net assets provide a simplified but powerful measure of what remains after all obligations are settled, making them highly relevant for financial assessment, valuation, and regulatory reporting.

Net assets are calculated using a straightforward formula:

Net Assets = Total Assets – Total Liabilities

This calculation shows the residual value attributable to the business after deducting all financial obligations from total resources. When derived from the balance sheet, net assets serve as an important indicator of overall financial health and capital adequacy.

From an analytical perspective, net assets matter because they help investors and stakeholders assess whether a company is solvent and financially sustainable. A positive net asset position suggests that the business owns more resources than it owes, while a negative figure may signal financial distress or excessive leverage. In valuation contexts, net assets are often used as a baseline reference, particularly for asset-heavy businesses or during restructuring and liquidation assessments.

It is important to note that net assets and shareholders’ equity are closely related but not always identical in certain accounting contexts. While shareholders’ equity represents owners’ residual interest, net assets may be adjusted for specific accounting treatments, such as minority interests or revaluation reserves, depending on reporting standards.

For example:

If a company reports total assets of SG$1,200,000 and total liabilities of SG$750,000, its net assets amount to SG$450,000. This figure reflects the underlying value available to shareholders before considering market-based factors.

In Singapore, net asset calculations are commonly referenced in statutory filings, compliance assessments, and financial reviews prepared under IFRS and SFRS. Accurate calculation supports transparency and consistency in regulatory and investor reporting.

When applied correctly, net assets offer a clear and practical lens for interpreting balance sheet strength and long-term financial positioning.

Common challenges and limitations in interpreting balance sheets

Despite its importance in financial analysis, the balance sheet is not without limitations. Understanding common balance sheet limitations helps investors, lenders, and management avoid overreliance on static figures and interpret financial information more accurately within a broader business context.

Interpreting a balance sheet requires careful consideration of several structural and accounting-related challenges.

Snapshot timing and decision impact

The balance sheet reflects a company’s financial position at a single reporting date. It does not capture seasonal patterns, short-term cash fluctuations, or events occurring after the reporting period. As a result, decisions based on one balance sheet may miss emerging trends or temporary risks.

Valuation constraints from historical cost

Most balance sheet items are recorded at historical cost rather than current market value. This can create gaps between reported figures and economic reality, particularly for long-held assets such as property or strategic investments.

Reliance on accounting estimates

Many figures depend on accounting estimates, including depreciation, impairment, provisions, and allowances. These estimates involve management judgment and assumptions, which can materially affect reported assets, liabilities, and equity.

Industry-specific comparability issues

Different industries operate with distinct asset structures and financing models. These differences create financial statement challenges when comparing balance sheets across sectors without adjusting for industry norms.

Risk of misinterpretation or manipulation

Aggressive accounting policies, transaction timing, or balance sheet restructuring may temporarily improve reported positions without improving underlying performance.

Recognizing these limitations helps ensure that balance sheet analysis remains balanced, contextual, and supported by complementary financial information.

BBCIncorp – Trusted corporate compliance and financial services for your business needs

As businesses grow and expand across jurisdictions, maintaining accurate financial records and meeting regulatory obligations becomes increasingly complex. Reliable professional support plays a critical role in safeguarding compliance, financial transparency, and long-term operational stability. This is where experienced service providers such as BBCIncorp add strategic value.

Accurate financial records form the foundation of sustainable business operations. Without proper oversight, errors in reporting or missed compliance requirements can expose companies to regulatory penalties, reputational risks, and operational disruptions. Professional support in corporate compliance and financial management helps ensure that statutory obligations are met consistently and accurately.

Expert registered agent and corporate secretarial support

Qualified registered agent services and corporate secretarial teams help companies maintain good standing with local authorities. These services support timely filings, statutory record maintenance, and ongoing compliance with jurisdiction-specific regulations, reducing administrative burden on internal teams.

Outsourcing accounting and auditing functions

Engaging external specialists for accounting and auditing allows businesses to access technical expertise without building extensive in-house teams. This approach improves reporting accuracy, ensures alignment with applicable accounting standards, and supports audit readiness while allowing management to focus on strategic priorities.

Protecting privacy and legal standing

Outsourcing compliance and administrative tasks also helps protect shareholder and director privacy, particularly in jurisdictions where public disclosures are required. Professional service providers act as an interface with regulators, helping companies meet legal obligations while maintaining confidentiality and structural integrity.

Multi-jurisdictional business support

For companies operating across multiple regions, coordinated business support is essential. BBCIncorp offers multi-jurisdictional solutions that align compliance, accounting, and corporate governance requirements across different regulatory environments, ensuring consistency and operational continuity.

Partnering with a trusted service provider enables businesses to manage compliance and financial responsibilities with confidence. With the right support structure in place, companies can focus on growth, expansion, and value creation while maintaining strong regulatory and financial foundations.

Conclusion

A solid understanding of the balance sheet is essential for effective business financial management. More than a static report, the balance sheet provides critical insight into a company’s financial position, liquidity, and long-term stability, enabling better strategic and operational decisions. When reviewed regularly and analyzed alongside income and cash flow statements, it becomes a practical tool for monitoring financial health and managing risk.

However, accuracy and compliance are just as important as interpretation. Regulatory requirements, accounting standards, and cross-border obligations can significantly affect how balance sheets are prepared and assessed. Professional support plays a key role in ensuring reliable reporting and ongoing corporate compliance.

For businesses seeking clarity, consistency, and confidence in financial reporting, partnering with experienced advisors can make a meaningful difference.

To learn how BBCIncorp can support your compliance and accounting needs, please contact our team at service@bbcincorp.com for tailored guidance.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is a balance sheet?

- Key characteristics of a balance sheet

- Common balance sheet formats used globally

- Balance sheet vs income statement

- Key components of a balance sheet explained

- How to read and interpret a balance sheet

- Balance sheet examples and templates for businesses

- Why the balance sheet is vital for business growth and stability

- How to calculate net assets in a balance sheet

- Common challenges and limitations in interpreting balance sheets

- BBCIncorp - Trusted corporate compliance and financial services for your business needs

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.