- What is an LLC in Singapore?

- Types of limited liability company in Singapore

- What is the difference between LLC and LLP in Singapore?

- Advantages and disadvantages of a Limited Liability Company in Singapore

- How to set up a limited liability company in Singapore

- Compliance requirements for a limited liability company in Singapore

- Start your business right with BBCIncorp’s incorporation services

- Conclusion

Limited liability company (LLC) in Singapore is the most common type of company, among other types of business entities. This type of company can ensure you a great deal of safety due to its separate legal status and its members’ limited liability.

There’s more! A limited liability company in Singapore can also bring you many tax advantages since it can apply for many special tax-cut schemes. The process of setting up a limited liability is fast and simple. Keep on reading to eventually find out how you can establish an LLC in Singapore!

What is an LLC in Singapore?

Limited liability company in Singapore, or LLC for short, is owned by at least one shareholder (except for public company limited by guarantee) and has the following characteristics:

Legal status

A limited liability company is deemed a separate legal entity, meaning it has a distinctive legal status from its owners. Due to this reason, an LLC is able to:

- Sue or be sued under its own name;

- Acquire, own, hold, develop, and dispose of property under its name.

Limited liability

There is a clear distinctive line between ownership and running an LLC in Singapore. In particular, it is owned by shareholders but managed by a board of directors. Keep in mind that a shareholder can also register as a director.

Due to the separate legal status, the company itself is responsible for the debts and liabilities incurred during its course of operation. Shareholders, on the other hand, are shielded from these problems. Particularly, they have liabilities limited only to their share capital contributions.

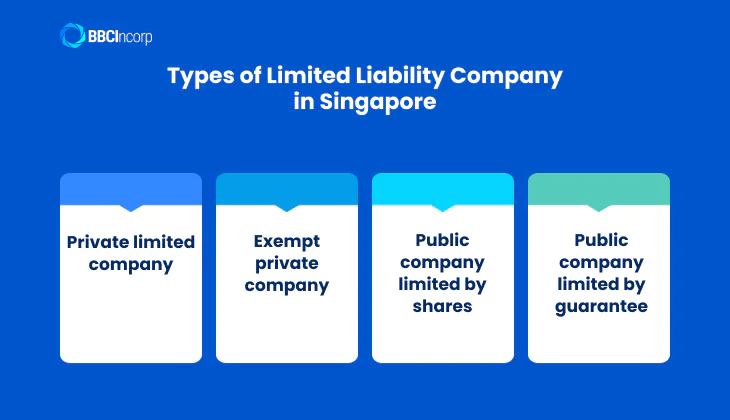

Types of limited liability company in Singapore

Singapore recognises several types of Limited Liability Companies (LLCs), each designed to suit different ownership models, compliance obligations, and long-term objectives. Understanding their distinctions helps entrepreneurs and investors identify the structure that aligns best with their needs.

Private limited company

For entrepreneurs aiming for long-term growth and credibility, the Private Limited Company in Singapore (Pte. Ltd.) is the most widely adopted structure in Singapore. It allows up to 50 shareholders, either individuals or corporate entities, while prohibiting public share offerings.

With its separate legal identity and access to tax incentives, this model dominates new business incorporations. What sets this structure apart is its ability to combine professional credibility with operational flexibility:

- It can own property, sign contracts, and sue or be sued in its own name.

- Shareholders’ liability is capped at their shareholding contribution.

- Eligible for corporate tax benefits, including start-up exemptions.

- Viewed favourably by banks and investors for fundraising.

The Pte. Ltd. in Singapore strikes the best balance between liability protection, tax efficiency, and growth potential.

Exempt private company

Smaller enterprises often turn to the Exempt Private Company in Singapore (EPC) for its simplified compliance framework. Restricted to 20 individual shareholders with no corporate ownership, this entity enjoys greater flexibility in management and lower compliance costs.

Its appeal lies in reduced regulatory obligations that make it more cost-effective to maintain:

- Solvent EPCs with revenue below SG$10 million are exempt from statutory audits.

- Annual filing requirements are simplified compared to larger entities.

- EPCs may grant loans to directors, a privilege not available to other companies.

EPCs provide a practical choice for SMEs seeking flexibility and affordability without sacrificing legal protection.

Public company limited by shares

For business planning to raise significant capital, the Public Company by Shares is the structure of choice. With no restriction on the number of shareholders, this type of company can issue shares to the public and potentially list on the Singapore Exchange (SGX).

The defining characteristics of this structure focus on capital raising on governance:

- Unlimited number of shareholders permitted.

- Shares may be offered to the public to raise funds.

- Subject to higher disclosure and compliance standards.

- Mandatory annual audits regardless of company size.

Though more complex and costly to manage, this structure offers unparalleled opportunities for expansion through access to public markets.

Public company limited by guarantee

When the mission is social or charitable rather than profit-oriented, the Public Company Limited by Guarantee (CLG) provides the right framework. Instead of shareholders, members agree to contribute a nominal amount in the event of winding up.

Its unique value lies in supporting organisations that reinvest resources into their objectives rather than distributing profits:

- Operates without share capital; members act as guarantors.

- Commonly used by charities, professional bodies, and non-profits.

- Requires at least three members and one resident director.

- Eligible for charity registration with the Commissioner of Charities.

CLGs ensure accountability and provide legal personality to mission-driven organisations, strengthening their credibility with donors and regulators.

From Private and Exempt Private Companies to Public Company Limited by Shares or by Guarantee, Singapore’s LLC framework accommodates enterprises of every size and purpose.

Whether the goal is cost-efficient operation, credibility in financial markets, or a formal identity for non-profits, there is a company type designed to match those needs.

What is the difference between LLC and LLP in Singapore?

When choosing a business structure, it’s crucial to understand how a Limited Liability Partnership (LLP) diverges from a Limited Liability Company (LLC) in Singapore. Each offers limited liability protection, but they differ significantly in ownership, management, tax treatment, and regulatory obligations.

Understanding these differences helps business owners pick the entity that best suits their long-term goals.

| Aspect | Limited Liability Company (LLC) | Limited Liability Partnership (LLP) |

| Definition | A separate legal entity incorporated under the Companies Act, typically as a Private Limited Company (Pte Ltd). | A business structure combining partnership flexibility with limited liability, registered under the LLP Act. |

| Owned By | Shareholders (individuals or corporate entities). | Partners (minimum 2, can be individuals or corporate bodies). |

| Legal Status | Separate legal entity distinct from its shareholders; can own assets, sue or be sued in its own name. | Separate legal entity distinct from its partners; can own assets, sue or be sued in its own name. |

| Yearly Statutory Obligations | Must file annual returns with ACRA, maintain statutory registers, hold AGMs (if required), and file corporate tax with IRAS. | Must file annual declaration of solvency / insolvency with ACRA, and partners file personal / corporate taxes on income derived. |

| Registration Requirements | At least 1 local resident director, 1 company secretary (within 6 months), and a registered office address. | At least 2 partners, 1 manager who is a local resident, and a registered office address. |

| Set-up Fee | SG$315 payable to ACRA:

| SG$115 payable to ACRA:

|

| Taxes | Taxed as a company at a flat corporate rate of 17%, with exemptions and rebates available for start-ups. | Profits taxed at the partner level; individual partners pay personal income tax, corporate partners pay corporate tax. |

| Continuity in Law | Perpetual succession; unaffected by changes in shareholders or directors. | Continuity depends on partners; LLP continues as long as there are at least 2 partners, but may be dissolved more easily. |

| Closing the Business | Requires formal winding up or striking off under the Companies Act, including settlement of debts and filing with ACRA. | Can be wound up voluntarily by partners or compulsorily by the court if insolvent. |

While both LLCs and LLPs provide protection from personal liability, LLCs generally offer stronger separation between ownership and management, higher regulatory and compliance obligations, and more suitable tax treatment for growth-oriented enterprises.

On the other hand, LLPs present a simpler structure, lower setup and ongoing costs, and flexibility in management, making them a good fit for smaller professional firms or partnerships where partners are comfortable sharing both ownership and management roles.

Free ebook

Key matters for doing business in Singapore

Get all the details for doing business in Singapore with our guide

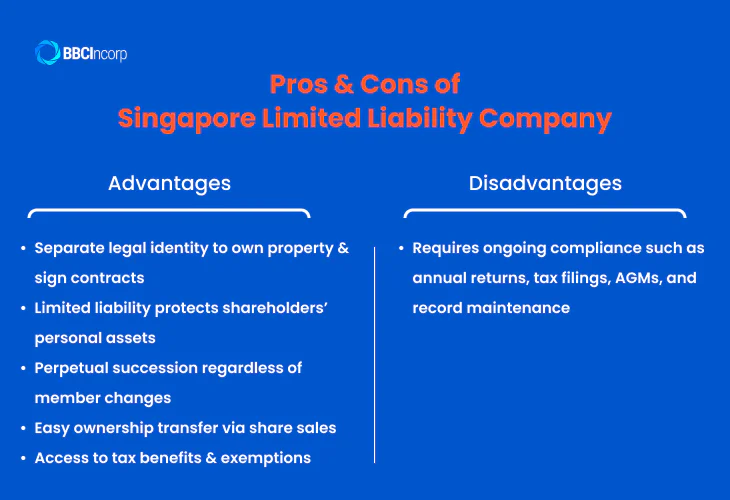

Advantages and disadvantages of a Limited Liability Company in Singapore

Based on the nature of LLC in Singapore, here are the benefits and drawbacks of such a business type:

Advantages

- Separate legal status: an LLC can own property and enter a contract with its owned name and identity.

- Limited liability: shareholders have liabilities limited only to their shares and they are not personally responsible for the business’s debts.

- Perpetual succession: changes of members do not affect the existing rights and liabilities of an LLC. A company has perpetual succession until wound up or struck off.

- Ownership transfer: ownership of an LLC can be transferred partly or wholly by transferring shares from one to another.

- Tax benefits: an LLC can enjoy many beneficial tax schemes and have many legal ways to reduce its income tax, such as the partial tax exemption scheme for companies.

Disadvantage

The main drawback of an LLC is a considerably large number of compliance requirements. Some examples are filing annual returns with ACRA, filing tax returns with IRAS, holding Annual General Meeting, maintaining accounting, and other related documents.

How to set up a limited liability company in Singapore

ACRA is the government agency responsible for company registration in Singapore. The first thing you need to do is to finalize what type of limited liability company to incorporate. Then, you have some preparation to do:

Requirements to register a Singapore LLC

You need to prepare some documents containing the following information:

- A proposed business name for your company

- A brief description of the business activities

- Details of the company’s registered address in Singapore

- Particulars of shareholders and other related papers

- Particulars of directors*

- Company’s constitution, which can be an available model or a customized one.

It is regulated in Section 145 of the Companies Act that every company must have at least one director who is:

- An ordinary resident in Singapore

- 18 years old or above

- Of full legal capacity.

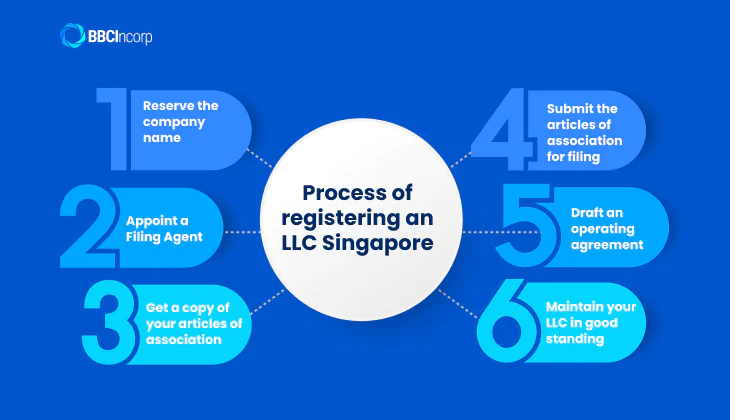

The process of registering an LLC Singapore

Incorporating a limited liability company (LLC) in Singapore is not simply a filing exercise, it is a structured procedure overseen by the Accounting and Corporate Regulatory Authority (ACRA). Each stage requires accuracy and compliance with statutory obligations.

The process can be broken down into six main steps:

Step 1: Reserve the company name

The registration journey begins with reserving a company name through ACRA’s BizFile+ portal.

The name must be unique and must not conflict with existing entities, trademarks, or contain prohibited expressions. If the proposed name relates to a regulated industry, such as banking, finance, or education, it will require additional approval from the relevant authority.

Once approved, the name is reserved for 120 days, allowing sufficient time for the incorporation to proceed.

Step 2: Appoint a Filing Agent

Foreign entrepreneurs cannot directly file incorporation documents on BizFile+ as the system requires a SingPass login.

For this reason, appointing a licensed Corporate Service Provider (CSP), commonly referred to as a filing agent, is a mandatory step. The filing agent will prepare statutory declarations, verify documents, and ensure that the submission to ACRA complies with all legal requirements.

Many local entrepreneurs also prefer engaging a CSP for accuracy and efficiency.

Step 3: Get a copy of your articles of association

Every LLC must be governed by a constitution, previously known as the Articles of Association. This document sets out the rules on how the company is managed, the responsibilities of directors, and the rights of shareholders.

It typically includes clauses on the company’s name, registered office, liability of members, share capital, and subscriber details. Business owners can adopt ACRA’s Model Constitution or draft a customized version tailored to their operations.

Step 4: Submit the articles of association for filing

Once the constitution and supporting documents are ready, they must be filed with ACRA via BizFile+, usually through the appointed filing agent. This stage is commonly associated with the submission of the Memorandum and Articles of Association Singapore, which formalises the governance framework of the company.

The filing package includes shareholder and director details, particulars of the company secretary, and the registered office address. A filing fee of SG$300 applies, and if all information is accurate, approval is typically granted within 1 to 3 business days.

For companies in regulated industries, processing may take longer due to the need for additional authority reviews. Upon approval, ACRA issues an electronic Certificate of Incorporation, confirming that the company has been legally established.

Step 5: Draft an operating agreement

Although not legally required, drafting an operating agreement is strongly encouraged. This document complements the constitution by detailing how shareholders intend to run the business in practice. It clarifies matters such as voting rights, dividend distribution, decision-making processes, and dispute resolution.

Having an operating agreement in place minimises misunderstandings and is especially valuable when there are multiple shareholders or external investors.

Step 6: Maintain your LLC in good standing

The next step is to fill in and submit other information about your company to ACRA, mainly about shared details and other members. The processing time for company registration may take a few days, sometimes only a few hours after the application is successfully submitted.

The outcome will be informed to you via email. If the registration is approved, there will be an attached Unique Entity Number (UEN) and a URL to download your business profile. The email, in this case, can act as an official certificate of incorporation in Singapore. Congratulations on your new company!

The process of registering an LLC in Singapore is designed to be straightforward yet comprehensive, ensuring that every company begins its journey on a sound legal and governance foundation.

By reserving a compliant name, engaging a filing agent, preparing the constitution, submitting incorporation documents, establishing an operating agreement, and fulfilling post-incorporation requirements, entrepreneurs can build a business that not only meets regulatory standards but is also structured for long-term growth.

Singapore LLC cost

Singapore has long been regarded as a premier destination for global investors thanks to its pro-business policies, political stability, and competitive tax regime. While these advantages make the city-state attractive for incorporating a limited liability company (LLC), entrepreneurs must also understand the costs involved.

From statutory filing fees to ongoing compliance expenses, a clear picture of the financial requirements is essential for effective planning.

Statutory ACRA Fees

Statutory fees are the official charges payable to ACRA at different stages of incorporation and company administration. They are fixed, transparent, and apply to all companies regardless of size or structure. The table below summarises the most relevant ACRA fees:

| Transaction | Fee (SG$) |

| Name application | 15 |

| Company incorporation (registration) | 300 |

| Annual return filing | 60 |

| Conversion within company types | 40 |

| Lodgment of Notice of Error (NOE) | 60 |

| Registration of particulars relating to charges | 60 |

| Registration for amalgamation | 400 (plus SG$300 if a new company is created) |

| Application for extension of time to file accounts or hold AGM | 200 |

Additional Setup and Compliance Costs

In practice, companies also incur expenses outside of statutory fees to remain compliant and operational:

- Registered office address: SG$250 – 500 per year if using a service provider.

- Company secretary: SG$300 – 1,500 annually for professional secretarial services, mandatory within six months of incorporation.

- Nominee director: Often required by foreign-owned companies, with costs ranging from SG$1,500 – 5,000 per year.

- Corporate bank account: No direct government charge, but banks usually require a minimum deposit of around SG$1,000.

- Corporate Service Provider (CSP) packages: Incorporation and compliance support from SG$500 upwards depending on scope of services.

Estimated First-Year Costs

When statutory fees and compliance expenses are combined, the total cost of incorporation is higher than the SG$315 minimum government charge.

- Local founders: Around SG$1,500 – 2,500 in the first year.

- Foreign founders: Around SG$3,000 – 5,000, accounting for nominee director and full-service support.

The statutory fees imposed by ACRA form the foundation of Singapore’s transparent and low-cost incorporation regime. However, real operating expenses also include professional and compliance costs that vary depending on whether the founders are local or foreign. By budgeting for both categories, entrepreneurs can ensure that their Singapore LLC is not only incorporated smoothly but also maintained in good standing for the long term.

Compliance requirements for a limited liability company in Singapore

After the registration, your company will need to appoint the following officers:

- Company secretary: a secretary must be appointed within 6 months from the incorporation date and this position must not be left vacant for more than 6 months.

- Auditors: every company must appoint an auditor within 3 months from the incorporation date unless it is exempted from audit requirements.

Furthermore, Singapore LLC must comply with other requirements regulated by different government agencies, such as:

- Choosing financial year-end

- Maintaining statutory registers

- Holding Annual General Meetings for companies limited by shares

- Filing annual returns with ACRA annually

- Filing tax returns with IRAS annually

Start your business right with BBCIncorp’s incorporation services

Launching a business in Singapore requires more than just meeting statutory requirements, it calls for accuracy, efficiency, and reliable local expertise. This is where BBCIncorp’s incorporation services provide a significant advantage. By partnering with a trusted service provider, entrepreneurs can streamline the entire process, reduce risks of non-compliance, and focus on building their core business.

At BBCIncorp, our company incorporation services in Singapore are designed to support both local and foreign founders at every stage:

- Company name selection: Guidance to ensure your desired name meets ACRA’s regulations and is reserved without delay.

- Document preparation: Assistance in compiling the constitution, shareholder and director details, and other statutory records.

- Application submission: Filing through BizFile+ on your behalf to guarantee accuracy and timely approval.

- Post-incorporation compliance: Ongoing support with annual returns, corporate secretarial services, and tax filing to maintain good standing.

- Bank account opening support: Connections with leading financial institutions to simplify the setup of your corporate banking.

By choosing BBCIncorp, you ensure that your Singapore LLC is not only incorporated correctly but also positioned for long-term success in one of the world’s most competitive business environments.

Conclusion

Limited Liability Company, especially Private Limited Company, is the most chosen registration option among the most common types of companies and businesses in Singapore. The main reasons are mainly due to the business’s separate legal status, members’ limited liabilities, and eligibility to many beneficial tax schemes.

The process of setting a limited liability in Singapore comprises reserving the business name and registering the company. After incorporation, an LLC in Singapore needs to comply with a considerable number of different requirements.

Should you have any further questions on this topic or how to start your own business in Singapore, please contact BBCIncorp via service@bbcincorp.com for timely support!

Frequently Asked Questions

What is the difference between LLC vs Pte LTD Singapore?

In Singapore, the term limited liability company (LLC) broadly refers to a business structure that provides its owners with limited liability protection.

The most common type of LLC in Singapore is the Private Limited Company (Pte. Ltd.), which is a specific form of LLC incorporated under the Companies Act. In practice, when people refer to an “LLC” in Singapore, they usually mean a Pte Ltd.

The distinction is mainly in terminology, LLC describes the legal concept, while Pte Ltd is the standard registration form under ACRA.

What are the characteristics of an LLC in Singapore?

A Singapore LLC is recognised as a separate legal entity, meaning it can own assets, incur liabilities, and enter into contracts in its own name. Shareholders enjoy limited liability, restricted to the amount they have invested in shares. The company enjoys perpetual succession, meaning its existence is not affected by changes in ownership or management.

Furthermore, profits are taxed at the corporate rate rather than at the shareholder level, and companies must comply with statutory obligations such as filing annual returns and appointing at least one local resident director.

Why should you set up a company in Singapore?

Singapore is consistently ranked as one of the most business-friendly jurisdictions in the world. Entrepreneurs benefit from a competitive flat corporate tax rate of 17%, extensive double taxation treaties, and exemptions on certain types of foreign-sourced income.

The country also offers a transparent regulatory framework, political stability, and world-class infrastructure.

These factors make Singapore not only an attractive destination for regional headquarters but also a strategic hub for expanding into Asia and beyond.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is an LLC in Singapore?

- Types of limited liability company in Singapore

- What is the difference between LLC and LLP in Singapore?

- Advantages and disadvantages of a Limited Liability Company in Singapore

- How to set up a limited liability company in Singapore

- Compliance requirements for a limited liability company in Singapore

- Start your business right with BBCIncorp’s incorporation services

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.