- What is tax clearance in Singapore?

- Employer’s tax clearance obligations in Singapore

- How to file IRAS tax clearance in Singapore

- Calculating tax liability for clearance

- Common scenarios requiring tax clearance in Singapore

- Processing time, due dates, and payment

- Penalties for late or failed tax clearance filing

- Special cases and exemptions

- Streamline your IRAS tax clearance with BBCIncorp’s expertise

- Conclusion

Tax clearance in Singapore is a mandatory requirement under the Inland Revenue Authority of Singapore (IRAS) for employers who hire foreign employees or Singapore Permanent Residents. Known as IRAS tax clearance, the process ensures that all outstanding income taxes are fully settled before the employee leaves Singapore, ceases employment, or begins an overseas assignment. Fulfilling this obligation is not only a compliance matter; it protects employers from liabilities arising from unpaid taxes and helps maintain good standing with the tax authority.

Understanding when tax clearance applies, what employers must do, and how to file Form IR21 accurately is essential for avoiding penalties. This guide provides a comprehensive overview of tax clearance Singapore requirements, including eligibility scenarios, calculation of tax liabilities, submission procedures, processing timelines, and potential consequences for non-compliance.

The article also outlines how BBCIncorp supports employers in managing their IRAS tax clearance obligations through proper documentation, timely filing, and ongoing compliance assistance.

Key Takeaways

- Tax clearance Singapore is mandatory for all non-citizen employees who leave employment, change employers, or depart Singapore. Employers must file Form IR21 at least one month before the final working day and withhold all outstanding payments until IRAS issues the clearance directive.

- IRAS assesses all taxable income up to cessation, including salary, bonuses, allowances, benefits-in-kind, and share-based compensation. Accurate documentation and reporting help ensure a smooth assessment and minimise processing delays.

- Tax clearance applies in multiple scenarios such as employee departure, long-term overseas postings, and non-resident directorships, while only limited short-term or low-income engagements may qualify for exemption under IRAS criteria.

- Failure to comply with IRAS tax clearance requirements can result in financial penalties, employer liability for unpaid taxes, administrative delays, and potential travel or re-entry complications for foreign employees.

- BBCIncorp supports employers through accurate Form IR21 preparation, e-filing coordination with IRAS, exemption and obligation advisory, and early tax estimation, helping businesses stay compliant and manage offboarding efficiently.

What is tax clearance in Singapore?

Tax clearance is an important compliance requirement under Singapore’s Income Tax Act, designed to ensure that non-citizen employees settle all outstanding taxes before they cease employment or leave the country.

The system supports tax certainty for both the employee and the employer by allowing the Inland Revenue Authority of Singapore (IRAS) to review the employee’s final tax position and confirm whether additional tax must be paid. Because foreign employees may leave Singapore permanently or for an extended period, IRAS tax clearance serves as a key mechanism to prevent unpaid tax liabilities.

Definition and purpose of tax clearance

Under the Income Tax Act, tax clearance refers to the formal process through which IRAS verifies and collects any taxes owed by a non-citizen employee before their employment officially ends. It applies to all foreign employees, including work pass holders and Singapore Permanent Residents who are leaving their job positions.

The procedure begins when employers file Form IR21, the mandatory notification submitted to IRAS to report that an employee will cease employment or depart from Singapore. After receiving Form IR21, IRAS reviews the individual’s income records, assesses if there are any outstanding taxes, and then issues a tax clearance directive. This directive authorizes the employer either to release final payments or to withhold funds until taxes are fully settled.

The purpose of tax clearance is to prevent tax leakage and ensure that employees with potential liabilities do not exit Singapore without fulfilling their tax obligations.

When tax clearance applies

Tax clearance for foreigners is required in several situations. Employers must file Form IR21 when a non-citizen employee resigns, when their employment contract ends, or when the employee is posted overseas for a long-term assignment. Filing is also mandatory if the employee plans to leave Singapore permanently or for a duration that suggests they will no longer be considered a tax resident.

These requirements apply regardless of job level or sector, as long as the person is a non-citizen earning employment income in Singapore.

Employer’s tax clearance obligations in Singapore

Employers in Singapore are legally required to fulfil specific responsibilities when handling IRAS tax clearance for foreign employees. These obligations ensure that all tax matters are properly reviewed before the employee receives any final payment. Failure to meet these requirements may expose the employer to penalties and increase their compliance risks, making it essential for HR, payroll, and finance teams to coordinate closely.

A core obligation is the timely submission of Form IR21. Employers must file Form IR21 at least one month before the employee’s last working day. Early submission allows IRAS to assess the employee’s final tax position and determine whether additional tax is payable. Filing late may delay the issuance of the tax clearance directive and disrupt the employee’s offboarding process.

Another key responsibility is the withholding of funds. Employers are required to withhold all monies due to the employee until IRAS confirms that tax clearance has been completed. This prevents the release of payments that may be needed to settle outstanding taxes.

Employers must withhold the following types of payments:

- Final salary

- Bonuses, commissions, and performance incentives

- Allowances and reimbursements

- Encashment of unused annual leave

- Any lump-sum or contractual termination payments

To comply with employer’s tax clearance obligations, companies must also ensure proper reporting of the employee’s income and taxable benefits. Errors in reporting can delay IRAS tax clearance or result in additional assessments.

Non-compliance may lead to several penalties. These include:

- Fines for late or non-filing of Form IR21

- Penalties for releasing payments before receiving IRAS clearance

- Liability for unpaid tax that should have been withheld

- Increased scrutiny during IRAS audits

To manage tax clearance Singapore requirements effectively, organisations should maintain strong internal coordination. HR should flag upcoming resignations and overseas postings early, payroll should prepare accurate income records, and finance should oversee withholding and filing deadlines. A structured internal workflow significantly reduces administrative risk and supports full compliance with IRAS tax clearance rules.

How to file IRAS tax clearance in Singapore

Filing IRAS tax clearance involves a structured process that employers must complete before releasing any outstanding payments to a foreign employee. The accuracy of documents and information submitted is critical, as IRAS relies on these records to assess the employee’s final tax position.

By preparing thoroughly and following the correct filing steps, employers can avoid delays, penalties, and additional document requests from IRAS.

Documents required for tax clearance

Employers must prepare a set of documents that provide IRAS with a comprehensive view of the employee’s income, benefits, and employment status. These records ensure that the assessment is accurate and that no taxable item is overlooked.

Employee-related documents include:

- FIN or passport details, allowing IRAS to verify the employee’s identity.

- The confirmed last working date, which determines the assessment period.

- The employment contract or appointment letter, showing terms of employment and remuneration structure.

Income and compensation documents include:

- Final month’s salary, reflecting the last payout period.

- Bonuses, commissions, and incentive payments earned but not yet paid.

- Allowances such as subsistence, transport, overseas per diem, or hardship allowances.

- Benefits-in-kind including housing, employer-provided vehicles, digital devices, or reimbursements.

- Share-based compensation such as ESOP, ESPP, or restricted share awards.

Employer-related documents include:

- Employer contact details and payroll records for verification.

- Detailed payroll statements for the final months.

- A full computation of release monies withheld.

- Any additional supporting files requested through myTax Portal.

Collecting all documents in advance ensures that Form IR21 can be filed accurately and without interruption. Once employers have prepared these records, the next step is to understand how to submit Form IR21 through myTax Portal and how IRAS processes the filing.

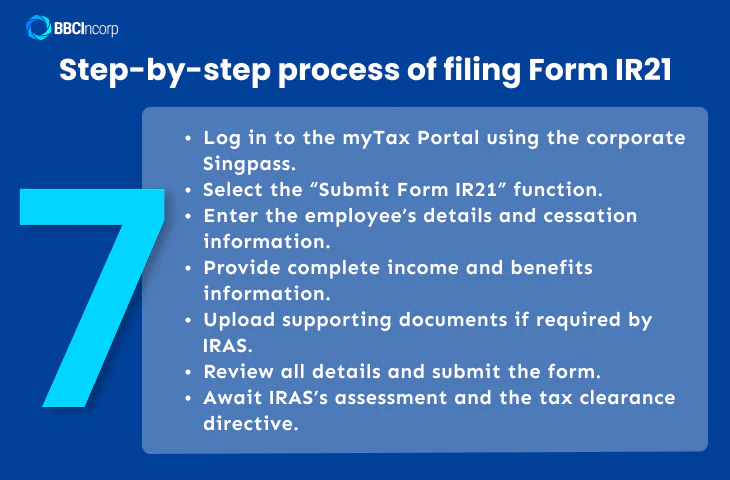

Step-by-step process of filing Form IR21

Filing Form IR21 is a mandatory step in the tax clearance Singapore process and must be completed before any final payments are released to the employee. Employers must ensure the submission is accurate, timely, and supported with the required documentation.

Following a clear sequence of steps helps reduce processing delays and prevents unnecessary requests for clarification from IRAS.

The key steps in submitting Form IR21 include:

Step 1: Access myTax Portal using the corporate Singpass.

This grants employers access to IRAS digital services necessary for tax clearance.

Step 2: Select the “Submit Form IR21” function.

The system will open the filing page where employer and employee information must be provided.

Step 3: Enter employee details and cessation information.

This includes personal particulars, type of employment, and the confirmed last working date.

Step 4: Provide full income and benefits data.

Employers must report salary, allowances, bonuses, benefits-in-kind, and any share-based compensation.

Step 5: Upload supporting documents when required by IRAS.

Documents may include payroll reports, benefit statements, or computations of withheld monies.

Step 6: Review all information and submit the form.

Accuracy is essential to avoid resubmission or assessment delays.

Step 7: Await IRAS assessment and the clearance directive.

IRAS typically processes Form IR21 within 7 to 21 working days and will issue either a notice confirming no further tax is due or a directive indicating the amount of tax that must be paid before any withheld payments can be released.

Submitting Form IR21 correctly allows IRAS to assess the employee’s tax position without interruption. Once employers receive the clearance directive, the next consideration is ensuring compliance and avoiding delays through best practices.

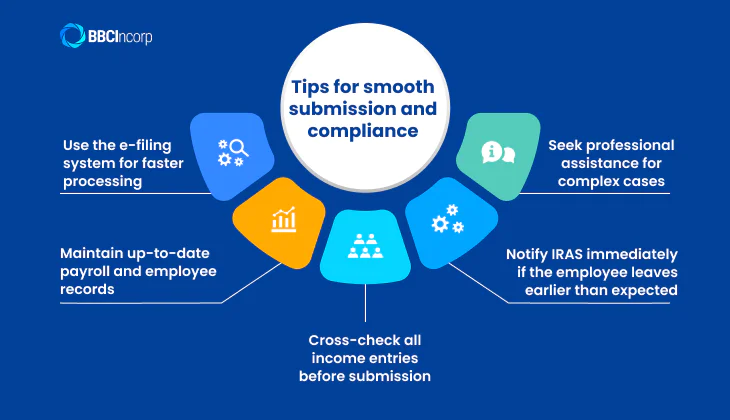

Tips for smooth submission and compliance

Ensuring a seamless filing process requires more than simply completing Form IR21. Employers benefit from adopting structured practices that improve accuracy, reduce administrative workload, and prevent delays caused by missing or inconsistent information. These best practices are especially important for businesses with high employee turnover or foreign staff on short-term assignments.

The practices below can help employers achieve faster, more accurate, and compliant tax clearance submissions:

- Use the e-filing system for faster processing: Electronic submissions reduce errors and shorten IRAS processing times.

- Maintain up-to-date payroll and employee records: Accurate data lowers the risk of discrepancies that may trigger IRAS queries.

- Cross-check all income entries before submission: Verification of salary, bonuses, allowances, and benefits avoids correction requests.

- Notify IRAS immediately if the employee leaves earlier than expected: Prompt communication ensures the cessation date is updated in IRAS records.

- Seek professional assistance for complex cases: Situations involving multi-jurisdiction income or share-based compensation may require support from corporate service providers such as BBCIncorp.

Consistently applying these practices helps employers minimise compliance risks and ensures that tax clearance Singapore submissions are completed accurately and on time.

Calculating tax liability for clearance

Calculating the final tax liability is a key part of the IRAS tax clearance process. Before issuing the tax clearance directive, IRAS assesses all taxable income earned by the employee up to the last day of employment. Employers must understand how these tax components are determined to ensure that Form IR21 is filed accurately and that any outstanding taxes are fully addressed before clearance is granted.

The assessment includes several categories of taxable income that reflect the employee’s total compensation during their period of employment.

The main components typically included are:

- Final salary, representing the last month of employment and any prorated amounts.

- Bonuses, commissions, and incentive payments, whether already paid or still payable.

- Allowances, including subsistence, transport, hardship, overseas per diem, or meal allowances.

- Benefits-in-kind, such as accommodation, employer-provided vehicles, digital devices, or reimbursed expenses.

- Share-based compensation, including ESOP, ESPP, restricted share awards, and vested options that form part of the employee’s taxable gains.

In addition to taxable income, IRAS may also consider allowable deductions and personal reliefs that the employee is entitled to under tax rules. These deductions can reduce the overall tax payable, though their availability depends on the employee’s residency status and eligibility under Singapore’s income tax framework.

To help employers estimate the employee’s final tax position, IRAS provides a tax clearance calculator that offers a general indication of potential tax liabilities. While it does not replace formal assessment, the calculator helps employers anticipate the likely outcome of the tax clearance Singapore process and prepare for any withholding required.

Understanding how tax liability is calculated allows employers to submit Form IR21 more accurately and ensures smoother processing when IRAS reviews the employee’s final tax position.

Common scenarios requiring tax clearance in Singapore

Tax clearance applies in several employment situations involving foreign employees. Employers must understand when the requirement arises to avoid non-compliance and ensure all tax obligations are fully settled.

While IRAS sets clear triggers for tax clearance, different scenarios may require employers to respond differently depending on whether the employee is leaving Singapore, changing employment status, or taking on short-term roles.

Foreign employees leaving Singapore

Tax clearance for foreigners is required when a non-citizen employee resigns, is terminated, or plans to leave Singapore permanently. Employers must file Form IR21 at least one month before the employee’s last day of work and withhold all final payments until IRAS issues the clearance directive.

In practice, employers need to be aware of the following key considerations:

- If the employee resigns or is terminated, Form IR21 must be filed immediately once the cessation date is confirmed.

- If the employee leaves Singapore before clearance is issued, the employer remains responsible for settling any outstanding taxes.

- Employers must ensure withheld payments are sufficient to cover any tax determined by IRAS.

These steps prevent tax liabilities from remaining unpaid when an employee departs. Once obligations for departing employees are understood, employers must also consider cases involving overseas postings.

Employees assigned overseas or relocating

Foreign employees posted overseas may still require tax clearance depending on the duration and nature of their assignment. IRAS distinguishes between temporary overseas postings and permanent relocations.

Based on IRAS guidance, these situations are typically assessed as follows:

- Temporary overseas assignments do not always require tax clearance if the employee remains employed in Singapore and intends to return.

- Permanent relocations or long-term overseas postings typically require tax clearance because they indicate the employee will no longer be tax resident.

Understanding these distinctions helps employers determine whether Form IR21 is necessary. Another category that often raises questions involves short-term or independent workers.

Directors, consultants, and short-term employees

Certain non-citizen individuals, such as non-resident directors, consultants, and short-term contract workers, may also be subject to IRAS tax clearance.

These scenarios commonly arise in situations where non-citizen individuals perform work in Singapore:

- Tax clearance applies to non-resident directors and independent consultants earning Singapore-sourced income.

- Exemptions may apply for short-term engagements or low-income cases, though detailed conditions will be covered in the Special Cases and Exemptions section.

By understanding these common scenarios, employers can better anticipate when Form IR21 is required and maintain full compliance with tax clearance Singapore requirements.

Processing time, due dates, and payment

Processing timelines and filing deadlines are essential components of the IRAS tax clearance procedure. Employers must understand when Form IR21 should be submitted, how long IRAS typically takes to process the filing, and how tax should be paid once the assessment is issued.

Processing window for Form IR21

IRAS generally requires Form IR21 to be filed at least one month before the employee’s last working day. Once the filing is submitted, IRAS typically takes between 7 and 21 working days to complete its review. During this period, employers must continue withholding all final payments until the clearance directive is issued.

What happens after IRAS completes the review

When IRAS finishes assessing the employee’s final tax position, it will issue a tax clearance directive or a Notice of Assessment (NOA) through myTax Portal. The notice will state whether additional tax is payable and whether the employer may release the withheld funds.

If tax is due, the employer must ensure payment is made promptly in accordance with the instructions provided.

How tax payments should be made

Tax can be paid electronically through myTax Portal using the payment options available, such as electronic bank transfer, internet banking, GIRO (if applicable), or other IRAS-approved methods. Employers should keep proof of payment and verify that the status is updated in myTax Portal.

Monitoring updates and changes

Employers should regularly check myTax Portal for updated notices, payment confirmations, or additional document requests from IRAS. If the employee’s last working date changes, IRAS must be notified immediately because this may affect the tax assessment period or require resubmission of Form IR21.

By following these timelines and payment procedures, employers can ensure a smooth tax clearance Singapore process and remain fully compliant with IRAS requirements.

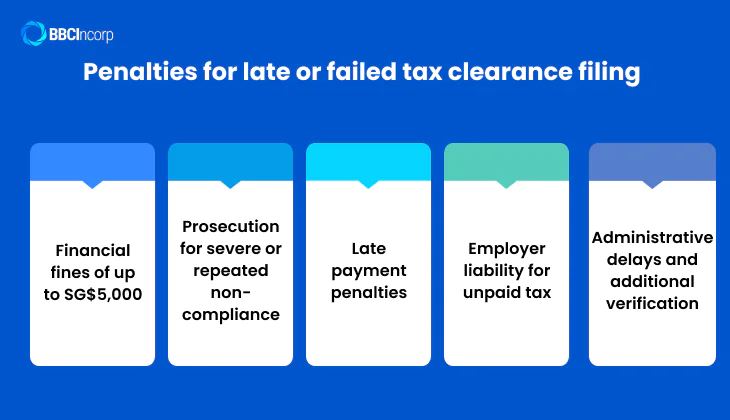

Penalties for late or failed tax clearance filing

Failure to comply with IRAS tax clearance requirements can result in substantial penalties for employers and create significant complications for foreign employees. Because the tax clearance Singapore framework is designed to ensure that outstanding taxes are settled before departure, IRAS enforces strict deadlines and filing obligations for Form IR21.

When Form IR21 is filed late or not submitted, IRAS may impose a range of penalties. These measures reinforce the employer’s responsibility to notify IRAS promptly and prevent outstanding taxes from going uncollected.

Penalties that IRAS may impose include:

- Financial fines of up to SG$5,000 for late filing or non-submission of Form IR21 under the Income Tax Act.

- Prosecution for severe or repeated non-compliance, which may result in heavier penalties upon conviction.

- Late payment penalties of 5 percent of unpaid tax, followed by an additional 1 percent per month (capped at 12 percent), if tax is not paid after IRAS issues the clearance directive or Notice of Assessment.

- Employer liability for unpaid tax, where employers may be required to pay the outstanding amount if final payments were released prematurely.

- Administrative delays and additional verification, including further audits or IRAS withholding the release of monies.

Non-compliance also affects the employee. If IRAS tax clearance is not completed, the employee may experience departure delays, and in more serious cases, travel restrictions or difficulties re-entering Singapore until all taxes are settled.

Preventing tax clearance penalty exposure requires early preparation and disciplined internal coordination. Employers should track cessation dates closely, prepare income data ahead of time, and ensure that Form IR21 is filed at least one month before the employee’s last working day. Establishing a clear workflow between HR, payroll, and finance teams helps reduce errors and ensures timely submissions.

Understanding these penalties underscores the importance of fulfilling IRAS tax clearance obligations and maintaining strong compliance controls during employee offboarding.

Special cases and exemptions

While the tax clearance Singapore framework applies to most foreign employees, several special cases and exemptions may apply depending on the length of employment, income level, or nature of the engagement. These exceptions are narrow, and employers should assess them carefully before assuming that Form IR21 is not required.

Employers may encounter several situations in which tax clearance is not required, depending on IRAS criteria and the employee’s circumstances:

- Short-term or low-income engagements: Foreign individuals who work in Singapore for a brief period and earn minimal employment income may not require tax clearance if they meet IRAS criteria.

- Certain director roles: Some non-resident directors receiving only nominal fees may fall outside the IRAS tax clearance requirement, subject to specific conditions.

- Specific contract arrangements: Cases where the employee is not considered to have “ceased employment” under IRAS rules may qualify for exemption.

However, employers must note that temporary overseas assignments do not automatically constitute an exemption. Even if an employee remains under a Singapore employment contract, IRAS may still require Form IR21 if the assignment affects the employee’s tax residency or indicates that they will not return to Singapore in the foreseeable future.

To avoid missing important notifications or assessment letters, employees should also ensure that their personal information in myTax Portal is accurate. This includes updating their residential address, email, and contact numbers, especially before leaving Singapore or relocating.

By understanding these special cases and exemptions, employers can apply IRAS tax clearance rules correctly and manage edge cases with greater confidence.

Streamline your IRAS tax clearance with BBCIncorp’s expertise

Managing tax clearance Singapore requirements can be challenging for businesses, especially when handling multiple foreign employees or tight departure timelines.

BBCIncorp supports companies with structured and compliant solutions that simplify the IRAS tax clearance process and reduce administrative burden. Our team ensures accuracy at every stage, helping employers meet statutory obligations while avoiding errors and penalties.

BBCIncorp provides a comprehensive range of tax clearance services tailored to the needs of employers. These include:

- Preparing and reviewing Form IR21 to ensure that all income, benefits, and cessation details are correctly reported.

- Liaising with IRAS through e-filing, tracking submission status, and managing follow-up queries until the directive is issued.

- Advising on IRAS tax clearance exemptions, employer obligations, and edge cases requiring careful assessment.

- Assisting businesses in using tax clearance calculators and payroll systems to estimate potential tax liabilities accurately.

Engaging BBCIncorp brings several operational and compliance benefits to employers:

- Greater filing accuracy through professional document review and verification.

- Full compliance with IRAS requirements and reduced risk of penalties for late or incorrect submissions.

- Lower administrative workload for HR, payroll, and finance teams during employee offboarding.

- Improved planning certainty by understanding tax liabilities before releasing final payments.

With structured processes and clear communication, BBCIncorp ensures that the IRAS tax clearance workflow is smooth and fully compliant from start to finish. Our specialists guide employers through each step, ensuring that deadlines are met and obligations are fulfilled.

Conclusion

Timely compliance with tax clearance Singapore requirements is essential for both employers and foreign employees. Ensuring that Form IR21 is filed accurately and within the deadlines set by IRAS helps prevent unnecessary complications such as financial penalties, administrative delays, or restrictions on an employee’s departure from Singapore. Adhering to these rules is not only a statutory obligation but also an important part of responsible offboarding and corporate governance.

Given the complexity of IRAS tax clearance procedures, many businesses benefit from professional support to manage filings with confidence. BBCIncorp provides structured assistance throughout the process, from preparing Form IR21 to advising on exemptions and liaising with IRAS. Our involvement helps employers reduce errors, meet deadlines, and maintain full compliance with IRAS requirements.

For tailored assistance with tax clearance Singapore filings or to learn more about our corporate compliance services, contact BBCIncorp at service@bbcincorp.com. Our team is ready to support you through every stage of the IRAS tax clearance process.

Frequently Asked Questions

How long does IRAS take to process Form IR21?

IRAS typically processes Form IR21 within 7 to 21 working days, provided that all submitted information is complete and accurate.

Where can I find a tax clearance calculator?

Employers can use estimation tools available on IRAS’s website or third-party payroll systems to approximate the employee’s final tax payable. These calculators provide general guidance only and do not replace formal assessment.

Do S Pass holders need to complete income tax clearance?

Yes. All non-citizen employees, including S Pass, Employment Pass, and Work Permit holders, must complete IRAS tax clearance when they cease employment, change employer, or leave Singapore.

Which types of income does IRAS assess during tax clearance?

IRAS reviews all taxable income up to the last day of employment. This includes salary, bonuses, allowances, benefits-in-kind, reimbursements, and share-based compensation such as ESOP or stock awards.

Can my employer withhold my salary for tax clearance purposes?

Yes. Employers are required to withhold all monies due to the employee from the date they become aware of the cessation. Withholding continues until IRAS issues the tax clearance directive.

Am I allowed to leave Singapore before my income tax is cleared?

Employees may face departure delays if tax clearance is not completed. In some cases, unresolved tax matters may result in travel restrictions or complications when re-entering Singapore.

What is an Income Tax Clearance Certificate (ITCC)?

An ITCC is the confirmation issued by IRAS indicating that a foreign employee has no outstanding tax liabilities. It authorises employers to release withheld salary and confirms the individual has met all tax obligations under the tax clearance Singapore framework.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is tax clearance in Singapore?

- Employer’s tax clearance obligations in Singapore

- How to file IRAS tax clearance in Singapore

- Calculating tax liability for clearance

- Common scenarios requiring tax clearance in Singapore

- Processing time, due dates, and payment

- Penalties for late or failed tax clearance filing

- Special cases and exemptions

- Streamline your IRAS tax clearance with BBCIncorp’s expertise

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.