- What are unaudited financial statements?

- Key components of unaudited yearly financial statements

- Who needs to prepare an unaudited financial statement?

- Statutory audit exemptions for private companies

- The preparation process for unaudited financial statements

- Differences between audited and unaudited financial statements

- Importance of accurate unaudited financial statements

- Common mistakes and risks in unaudited financial statements

- Best practices for maintaining reliable unaudited financial statements

- What is the cost of preparing an unaudited financial report?

- BBCIncorp support for unaudited financial reporting

- Future trends in unaudited financial reporting in Singapore

- Conclusion

In Singapore’s highly regulated business environment, financial transparency remains a core requirement even when statutory audits are not mandatory. An unaudited financial report plays a critical role in helping companies present a structured and compliant view of their financial position without undergoing a full audit process.

For business owners, these reports support internal decision-making and annual filing obligations. For investors and lenders, they offer a baseline level of financial insight when evaluating business performance. From a regulatory perspective, unaudited financial statements Singapore must still comply with the Singapore Companies Act and relevant accounting standards, making accuracy essential despite the absence of an independent audit opinion.

Understanding how unaudited financial reports work, how they differ from audited statements, and when they apply is therefore fundamental for companies operating in Singapore.

Key Takeaways

- Unaudited financial statements remain a statutory requirement for many Singapore companies, even when audit exemption applies, and must still comply with the Companies Act and SFRS.

- Accuracy in unaudited financial reporting is not optional. Reliable figures are essential for internal decision-making, investor confidence, and avoiding regulatory or reputational risks.

- Companies qualifying as small companies, small groups, or dormant entities benefit from audit exemption, but management retains full responsibility for the completeness and integrity of financial information.

- A structured preparation process, supported by proper documentation, internal review, and consistent accounting policies, is critical to maintaining credible unaudited financial statements.

- BBCIncorp’s support can significantly reduce compliance risks and administrative burden, helping businesses prepare compliant, unaudited financial statements efficiently while focusing on sustainable growth.

What are unaudited financial statements?

Unaudited financial statements are financial reports prepared by a company’s management without being examined or verified by an independent external auditor. While they do not carry an audit opinion, these statements are still expected to be prepared in accordance with applicable accounting standards and the Singapore Companies Act.

In practice, an unaudited financial report provides a structured snapshot of a company’s financial position and performance for a specific financial year. It reflects management’s representation of the business, based on internal accounting records, reconciliations, and estimates. Although the level of external assurance is lower than that of audited accounts, unaudited statements remain a core compliance and management tool for many Singapore companies that qualify for audit exemption.

The purpose of unaudited financial statements extends beyond regulatory filing. They are commonly used by different stakeholders for distinct objectives, including:

- Business owners and directors, to assess profitability, cash flow, and overall financial health for strategic planning.

- Investors and shareholders, to gain visibility into company performance when audited statements are not legally required.

- Banks and counterparties, to conduct preliminary financial reviews for credit assessments or commercial decisions.

- Regulatory authorities, to ensure companies meet minimum statutory reporting obligations despite audit exemptions.

It is important to note that unaudited financial statements do not imply lower accountability. Management remains fully responsible for the accuracy, completeness, and consistency of the information presented. Any material misstatement or non-compliance may still expose the company and its directors to regulatory or commercial risks.

Key components of unaudited yearly financial statements

A complete set of unaudited financial statements in Singapore is designed to present a coherent and decision-useful view of a company’s financial performance and position, even without external audit assurance. To achieve this, the statements typically consist of several key components, each serving a distinct governance and reporting function.

Directors’ statement

The directors’ statement plays a critical role in reinforcing accountability and corporate governance. It formally confirms that the financial statements have been prepared in accordance with applicable accounting standards and the Singapore Companies Act, and that they have been approved by the board of directors.

In an unaudited context, this statement is particularly important because it represents management’s explicit responsibility for the accuracy and completeness of the financial information. Key elements commonly included are:

- A declaration that the unaudited financial statements give a true and fair view of the company’s financial affairs.

- Confirmation that the company is able to meet its obligations as they fall due.

- Disclosure of directors’ responsibilities in relation to financial reporting and compliance.

Comprehensive income statement

The comprehensive income statement provides an overview of the company’s financial performance over the reporting period. It explains how revenue is generated and how expenses are incurred, ultimately resulting in a profit or loss figure.

This statement typically presents:

- Revenue from core and non-core business activities.

- Operating and administrative expenses.

- Net profit or loss for the financial year.

For stakeholders, it offers insight into profitability trends, cost control, and operational efficiency.

Financial position statement (balance sheet)

The statement of financial position outlines what the company owns and owes at the end of the financial year. It summarises assets, liabilities, and equity, enabling users to assess liquidity, solvency, and capital structure.

Together, these components form the foundation of reliable unaudited financial reporting.

Who needs to prepare an unaudited financial statement?

In Singapore, the requirement to prepare financial statements applies broadly to companies, even when statutory audits are not mandatory. Under the Companies Act, certain entities may qualify for audit exemption but are still expected to maintain and submit unaudited financial statements singapore that accurately reflect their financial position.

Small company

A private company may be classified as a small company if it meets at least two of the following criteria for the past two financial years:

- Total annual revenue does not exceed SGD 10 million.

- Total assets do not exceed SGD 10 million.

- The number of employees does not exceed 50.

For these companies, preparing unaudited financial statements helps reduce compliance costs while still supporting internal management, investor communication, and statutory filings.

Small group

A small group consists of a holding company and its subsidiaries that collectively meet the small company thresholds on a consolidated basis. While audit exemption may apply, the group must still ensure that consolidated financial information is properly prepared, consistent, and supported by reliable underlying records across all entities.

Dormant company

Dormant companies, defined as entities with no significant accounting transactions during the financial year, may qualify for further compliance relief. In many cases, they are exempt from audit and simplified financial reporting may apply, provided statutory conditions are met and proper records are maintained.

Understanding which category a company falls into is essential for determining reporting obligations. Even when audit exemptions apply, proper preparation of unaudited financial statements remains a statutory and governance responsibility.

Statutory audit exemptions for private companies

Under Singapore law, statutory audits are not mandatory for all companies. Certain private companies may qualify for audit exemption, provided they meet specific criteria set out in the Companies Act. In such cases, companies are still required to prepare and maintain unaudited financial statements in Singapore in compliance with statutory and accounting requirements.

Companies exempted from statutory audits

Audit exemption generally applies to private companies that fall within the “small company” regime. This framework is intended to reduce regulatory burden for smaller businesses while preserving financial accountability.

A private company may be exempt from statutory audit if it qualifies as:

- A small company for the relevant financial year, or

- Part of a small group, where both the holding company and its subsidiaries meet the prescribed thresholds on a consolidated basis.

- Audit exemption under the ‘small company’ regime applies only where the company is a private company and meets the qualifying criteria.

Conditions for audit exemption

To qualify for audit exemption, a private company must meet at least two of the following conditions for the past two consecutive financial years:

- Total annual revenue does not exceed SGD 10 million.

- Total assets do not exceed SGD 10 million.

- The average number of employees does not exceed 50.

Failure to meet these conditions in any financial year will result in the company being subject to statutory audit requirements. Importantly, audit exemption does not remove the obligation to prepare accurate financial statements. Directors remain responsible for ensuring compliance, transparency, and proper record keeping, even in the absence of an external audit.

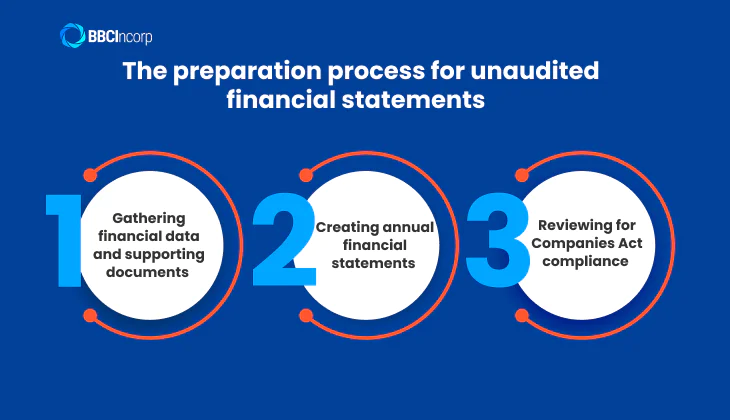

The preparation process for unaudited financial statements

Preparing unaudited financial statements Singapore requires a structured and disciplined approach, even without the involvement of an external auditor. A well-defined preparation process helps ensure accuracy, consistency, and compliance with statutory requirements, while also supporting effective financial management.

Gathering financial data and supporting documents

The process begins with collecting complete and reliable financial records for the financial year. These documents form the foundation of the financial statements and must be properly maintained.

Common supporting documents include:

- Sales and purchase invoices.

- Receipts and expense claims.

- Bank statements and reconciliation reports.

- Loan agreements, payroll records, and tax filings.

Ensuring that all transactions are recorded accurately at this stage reduces the risk of misstatements later in the process.

Creating annual financial statements

Once the financial data is consolidated, the next step is to prepare the annual financial statements in accordance with the Singapore Financial Reporting Standards (SFRS). This ensures consistency with local accounting requirements.

Key reports typically assembled include:

- The directors’ statement, confirming management responsibility.

- The comprehensive income statement, outlining revenue and expenses.

- The statement of financial position, detailing assets, liabilities, and equity.

Careful application of accounting policies and proper classification of items are essential to present a true and fair view.

Reviewing for Companies Act compliance

Before finalisation, the financial statements should be reviewed against the Singapore Companies Act to ensure all statutory disclosures and formatting requirements are met. This review helps identify gaps, inconsistencies, or non-compliance issues that may affect filings with ACRA or stakeholder confidence.

By following a systematic preparation process, companies can ensure their unaudited financial statements are reliable, compliant, and fit for both regulatory and business purposes.

Differences between audited and unaudited financial statements

Understanding the differences between audited vs unaudited financial statements is essential for companies when deciding the appropriate level of financial reporting. While both serve to present a company’s financial position and performance, they differ significantly in terms of verification, credibility, scope, and regulatory purpose.

| Aspect | Audited financial statements | Unaudited financial statements |

| Verification | Reviewed and verified by an independent external auditor | Prepared by management without external audit verification |

| Credibility | High level of assurance, supported by an audit opinion | Lower assurance, based on management representation |

| Purpose | Primarily statutory compliance and external reliance | Internal management, filing, or limited external use |

| Detail and scope | Extensive testing, disclosures, and audit procedures | Limited review, based on internal records |

| Cost and time | Higher cost and longer preparation timeline | More cost efficient and faster to prepare |

| Regulatory requirements | Mandatory for companies not qualifying for audit exemption | Permitted for companies qualifying for statutory audit exemption |

For stakeholders such as investors, lenders, and regulators, audited financial statements provide greater confidence due to independent verification. In contrast, unaudited statements are typically sufficient for smaller companies that meet exemption criteria and require financial reporting mainly for internal or compliance purposes.

Selecting between audited and unaudited financial statements depends on regulatory obligations, business size, and stakeholder expectations. Understanding these differences allows companies to balance compliance, credibility, and operational efficiency.

Importance of accurate unaudited financial statements

Accuracy determines whether an unaudited financial report can truly support business decisions or merely fulfill a formal requirement. In Singapore, where many private companies qualify for audit exemption, the reliability of unaudited financial statements becomes even more critical for both management and external stakeholders.

From an internal management perspective, accurate unaudited financial statements serve as a practical decision-making tool. They enable directors and senior managers to evaluate financial performance with confidence, manage cash flow effectively, and identify potential risks at an early stage. Strategic decisions related to budgeting, expansion, financing, or cost control rely heavily on financial data that is consistent and free from material errors.

For investors and shareholders, unaudited financial statements often represent the primary source of financial insight, particularly in privately held companies. When prepared accurately, these reports provide transparency into profitability, financial position, and business sustainability. This clarity supports informed discussions around valuation, capital contributions, dividend planning, and long-term growth expectations.

Equally important is the role accuracy plays in avoiding financial and regulatory risks. Inaccurate or poorly prepared unaudited financial statements may lead to:

- Misleading assessments of business performance.

- Non-compliance issues during statutory filings with ACRA.

- Erosion of trust with banks, business partners, or potential investors.

Ultimately, accurate unaudited financial statements are not a lesser alternative to audited accounts. They are a fundamental management and governance tool that supports informed decision-making, stakeholder confidence, and sustainable business operations.

Common mistakes and risks in unaudited financial statements

Despite being exempt from audit, unaudited financial statements still involve substantial responsibility and potential risk if they are not prepared with sufficient care. In practice, issues often arise when companies rely solely on internal records without adequate review or professional oversight.

Many of the risks stem from gaps in recording, classification, or disclosure. These weaknesses may not be immediately visible but can significantly affect how financial information is interpreted. Typical problem areas include:

- Omissions, such as failing to record certain expenses, liabilities, or related party transactions.

- Misclassification of income, expenses, assets, or liabilities, which distorts reported performance.

- Incomplete disclosures, particularly in the notes to the financial statements, limit transparency for users.

When such issues occur, the consequences extend beyond accounting accuracy. Management may draw misleading conclusions when planning budgets, managing cash flow, or assessing business performance. For investors and lenders, unreliable unaudited financial statements can weaken confidence and raise concerns about the company’s governance standards.

From a regulatory standpoint, inaccurate financial reporting may also result in compliance issues during statutory filings with ACRA. Directors remain accountable under the Companies Act, and material misstatements can expose the company to penalties, enforcement actions, or reputational harm.

In essence, poorly prepared unaudited financial statements carry risks that go far beyond technical errors. They can undermine decision-making, damage stakeholder trust, and create avoidable regulatory exposure.

Best practices for maintaining reliable unaudited financial statements

Maintaining reliable unaudited financial statements requires more than basic compliance. Without external audit verification, companies must rely on strong internal practices to ensure financial information remains accurate, consistent, and credible for decision-making.

One of the most important practices is transparency in financial recording and presentation. Transactions should be recorded promptly, supported by clear documentation, and classified consistently across reporting periods. This transparency strengthens the reliability of the unaudited financial report and reduces the risk of misunderstandings by stakeholders.

Internal review is another critical safeguard. Companies should establish a structured review process where financial statements are checked by management or finance personnel independent from day-to-day bookkeeping. Regular reconciliations of bank balances, receivables, payables, and tax records help identify discrepancies early.

Proper documentation also plays a central role in maintaining reliability. Best practices include:

- Retaining invoices, receipts, contracts, and bank statements in an organised manner.

- Documenting accounting judgments, estimates, and assumptions.

- Maintaining clear audit trails for significant transactions.

By prioritising transparency, internal review, and proper documentation, companies can ensure their unaudited financial statements remain dependable, compliant, and suitable for both regulatory and business purposes.

What is the cost of preparing an unaudited financial report?

Cost is often a key consideration when companies evaluate whether an audit is necessary. Preparing an unaudited financial report generally involves significantly lower costs, as it does not require independent audit procedures or external verification.

What is the cost of an audit?

The cost of a statutory audit can vary widely depending on company size, transaction volume, and business complexity. Audit fees typically reflect:

- The extent of audit testing and verification required.

- Time spent reviewing internal controls and accounting systems.

- Additional work for complex transactions or group structures.

For small and medium-sized companies, these costs may represent a substantial compliance burden, especially when an audit is not legally required.

How can you reduce audit costs?

For companies that qualify for audit exemption, preparing unaudited financial statements offers a more cost-efficient alternative. Beyond audit exemption, businesses can further control costs by:

- Maintaining organised accounting records throughout the year.

- Applying consistent accounting policies and documentation.

- Engaging professional accounting support early to avoid rework or corrections.

Understanding the cost implications of audited versus unaudited reporting allows companies to balance compliance, financial transparency, and operational efficiency more effectively.

BBCIncorp support for unaudited financial reporting

For companies that qualify for audit exemption, preparing unaudited financial statements Singapore still requires a high level of technical accuracy and regulatory awareness. BBCIncorp supports businesses by combining accounting expertise with a deep understanding of Singapore’s compliance framework, helping companies meet their reporting obligations with confidence.

Tailored solutions for Singapore companies

BBCIncorp provides customised unaudited financial reporting services designed to reflect each company’s operational scale and structure. Our team prepares accurate and compliant unaudited financial statements based on properly maintained accounting records and consistent application of accounting policies.

In practice, our unaudited financial reporting services are most relevant for:

- Startups seeking structured financial reporting from an early stage.

- Small and medium-sized enterprises are managing ongoing compliance efficiently.

- Foreign-owned companies require local expertise to navigate Singapore regulations.

Compliance and regulatory guidance

Beyond preparation, BBCIncorp offers ongoing guidance to ensure financial statements comply with ACRA filing requirements and Singapore Financial Reporting Standards. This includes reviewing disclosures, verifying classifications, and aligning reports with statutory expectations, reducing the risk of non-compliance or follow-up queries from regulators.

Benefits of engaging BBCIncorp

Engaging BBCIncorp allows companies to streamline financial reporting while maintaining reliability and control. Key benefits include:

- Time-efficient processes that reduce internal workload.

- Cost-effective solutions aligned with audit exemption status.

- Risk mitigation through professional oversight and advisory support.

With structured processes and expert guidance, BBCIncorp enables companies to maintain reliable unaudited financial reporting while focusing on business growth.

Future trends in unaudited financial reporting in Singapore

The landscape of financial reporting in Singapore continues to evolve, even for companies that qualify for audit exemption. As regulatory expectations and business practices mature, the preparation of unaudited financial statements Singapore is increasingly shaped by technology, efficiency, and higher compliance standards.

Digitalisation is playing a central role in this shift. Automated data capture, real-time transaction recording, and integrated accounting systems are reducing manual errors and improving the accuracy of financial information. These developments enable companies to maintain more consistent and timely unaudited financial reporting throughout the financial year.

Cloud accounting adoption is another defining trend. Cloud-based platforms allow businesses to centralise financial data, support remote collaboration, and maintain stronger audit trails, even without a formal audit. For startups and SMEs in particular, cloud accounting improves visibility and control while supporting scalable growth.

At the same time, regulatory standards continue to evolve. While audit exemption frameworks remain in place, authorities increasingly expect unaudited financial statements to demonstrate higher levels of transparency, consistency, and documentation. This reflects a broader emphasis on governance and accountability, regardless of company size.

Looking ahead, companies that invest in digital tools and robust financial processes will be better positioned to meet rising expectations for unaudited financial reporting in Singapore.

Conclusion

An unaudited financial report remains a core reporting tool for many Singapore companies that qualify for audit exemption. When prepared correctly, it supports statutory compliance, informed decision-making, and transparent communication with stakeholders. Throughout this guide, we have explored how unaudited financial statements are structured, who must prepare them, and why accuracy is critical despite the absence of external audit assurance.

For businesses, reliable unaudited financial statements Singapore helps mitigate regulatory and operational risks while providing meaningful insights for management and investors. Engaging experienced professional support further strengthens this process by ensuring compliance with ACRA and SFRS requirements, reducing errors, and allowing companies to focus on sustainable growth with confidence.

If you would like tailored guidance on unaudited financial reporting and filing requirements, feel free to reach out to our team at service@bbcincorp.com.

Frequently Asked Questions

Can an unaudited financial report be used when applying for a business loan?

Yes. An unaudited financial report can be used when applying for a business loan in Singapore, especially for small loan amounts, early-stage assessments, or non-bank financing. In practice, most lenders do not rely on the audit status alone. Instead, they evaluate overall repayment capacity using supporting evidence such as bank statements, tax filings, and cash flow records. For larger or long-term facilities, banks may still request audited financial statements before final approval.

Is an unaudited financial report sufficient for company valuation when selling a business?

No. An unaudited financial report is not sufficient on its own for company valuation in a business sale. While it can provide background information on performance and financial position, buyers typically require higher assurance. In most transactions, valuation is supported by audited financial statements or confirmed through due diligence before pricing is finalised.

If a company issues an unaudited financial report but falsely claims it is audited financial statements, what are the consequences under Singapore law?

No. This is not allowed. Falsely representing unaudited financial statements as audited is a serious offence under the Singapore Companies Act. Such misrepresentation may result in regulatory enforcement by ACRA, including fines, legal sanctions, and potential director disqualification. Directors and officers involved may also face personal liability.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What are unaudited financial statements?

- Key components of unaudited yearly financial statements

- Who needs to prepare an unaudited financial statement?

- Statutory audit exemptions for private companies

- The preparation process for unaudited financial statements

- Differences between audited and unaudited financial statements

- Importance of accurate unaudited financial statements

- Common mistakes and risks in unaudited financial statements

- Best practices for maintaining reliable unaudited financial statements

- What is the cost of preparing an unaudited financial report?

- BBCIncorp support for unaudited financial reporting

- Future trends in unaudited financial reporting in Singapore

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.