Bookkeeping is one of the most essential processes in business accounting because it forms the backbone of how organizations understand, monitor, and manage their financial activities. At its core, bookkeeping involves the systematic recording, organizing, and maintaining of financial data. This information plays a central role in helping companies assess performance and maintain financial stability.

Despite its importance, many people still confuse bookkeeping with accounting. Although the two functions are closely related, bookkeeping meaning refers specifically to the accurate capture of day-to-day financial transactions. Accounting builds on these records to analyze results, ensure compliance, and support strategic decision-making. In other words, bookkeeping in accounting provides the foundation for every financial insight a business relies on.

This guide explains what is bookkeeping, which methods businesses commonly use, why it matters for long-term success, and how professional service providers like BBCIncorp can help companies stay accurate, compliant, and financially confident.

Key Takeaways

- Bookkeeping provides the financial foundation every business relies on, ensuring clarity, accuracy, and reliable reporting.

- Choosing the right bookkeeping method is essential because it must align with a company’s structure, transaction volume, and compliance needs.

- A disciplined bookkeeping process turns everyday transactions into meaningful financial insights that support smarter decisions.

- Most bookkeeping challenges come from inconsistent processes or limited expertise rather than technology alone.

- SMEs and startups can strengthen accuracy, compliance, and efficiency by partnering with professional bookkeeping specialists like BBCIncorp.

What is bookkeeping?

Bookkeeping is the foundation of every financial management system within a business. Before a company can evaluate performance, prepare reports, or meet regulatory requirements, it must first record its daily financial activities in a structured and organized manner.

Understanding what is bookkeeping is essential because it determines how accurately a business can track cash flow, measure profitability, and maintain operational stability.

This section provides a clear explanation of bookkeeping meaning, focusing on how it supports transparency and consistency in financial information. It also highlights the role of bookkeeping in accounting, demonstrating why accurate transaction recording is necessary for preparing reliable financial statements and ensuring long-term financial health.

Bookkeeping meaning and definition

Bookkeeping refers to the structured, consistent, and systematic recording of a company’s financial transactions. It ensures that every financial activity is captured clearly and accurately. A complete bookkeeping system typically records information such as:

- Sales and income

- Operating and administrative expenses

- Asset purchases and adjustments

- Liabilities that arise or are settled

- Capital contributions and withdrawals

The core purpose of bookkeeping is to maintain transparency and integrity in financial data. When records are kept up to date and organized, businesses gain a clear understanding of their financial position. This clarity supports better decision-making, reduces the risk of errors, and provides a reliable basis for compliance, audits, and financial reviews.

Bookkeeping is also the first and most fundamental step of the accounting cycle. Without accurate bookkeeping, financial statements such as the balance sheet, income statement, and cash flow statement cannot be prepared correctly.

What is bookkeeping in accounting?

Bookkeeping in accounting describes how detailed transaction records support broader analytical and reporting functions. Bookkeeping focuses on documenting financial events, while accounting interprets those events to evaluate performance, ensure compliance, and guide future planning. In this relationship, bookkeeping provides the essential foundation for all accounting activities.

Accountants rely on bookkeeping data to:

- Analyze trends and financial ratios

- Conduct reconciliations and internal reviews

- Prepare tax filings

- Produce management and investor reports

Modern businesses often use digital bookkeeping tools to improve accuracy and efficiency. Common systems include cloud-based accounting platforms, automated data extraction, invoicing solutions, and integrated payment tools. These technologies reduce manual work, minimize the risk of human error, and allow companies to maintain real-time insight into their financial health. As a result, bookkeeping becomes not only a documentation task but also a strategic component of strong financial management.

Main types and methods of bookkeeping

Bookkeeping can be categorized using two primary approaches. The first examines how transactions are recorded, which includes single-entry and double-entry bookkeeping. These systems determine the level of detail and accuracy a business can maintain in its financial records. The second approach focuses on recording methods, comparing traditional manual bookkeeping with modern digital systems.

Understanding these types of bookkeeping helps businesses select the structure that best aligns with their scale, operational complexity, and compliance requirements. Each method offers specific strengths and limitations, which are explained below.

Single-entry vs. double-entry bookkeeping

Selecting between single-entry and double-entry bookkeeping is a key decision because it determines how much insight a business can gain from its financial data. The two approaches differ significantly in depth, reliability, and reporting capability.

Single-entry bookkeeping

Single-entry bookkeeping records each transaction once, usually as income or expense. It functions similarly to tracking a simple cash log.

Pros

- Easy to implement with minimal accounting knowledge

- Low operating cost

- Saves time since each transaction requires only one entry

- Suitable for businesses with simple cash-based activities

- Can be managed without professional bookkeeping support

Cons

- More prone to errors and missing entries

- Does not track assets, liabilities, or equity

- Cannot reflect the true financial standing of the business

- Lacks sufficient detail for budgeting or forecasting

- Difficult to trace income and expenses across accounts

Ideal for: Microbusinesses, freelancers, and sole proprietors with limited transaction volumes.

Double-entry bookkeeping

Double-entry bookkeeping records each transaction twice, once as a debit and once as a credit, ensuring that financial records remain balanced.

Pros

- Provides a comprehensive view of assets, liabilities, equity, income, and expenses

- Produces accurate and meaningful financial statements

- Helps detect errors through trial balance

- Shows the broader financial impact of each transaction

- Creates a clear audit trail and supports compliance

Cons

-

- More complex to maintain than single-entry

- Requires more time or accounting software

- Higher cost when professional support is needed

Ideal for: SMEs, businesses with inventory, and organizations requiring formal reporting.

Manual vs digital bookkeeping

Manual bookkeeping involves recording financial information by hand in physical books, journals, or spreadsheets. This method offers simplicity but is time-consuming and more susceptible to human error.

Digital bookkeeping uses accounting software to record and organize financial data electronically. It increases accuracy, speeds up processing, and provides real-time visibility into financial performance. Common digital bookkeeping platforms include QuickBooks, Xero, and Zoho Books, which offer scalable features for small and medium-sized businesses.

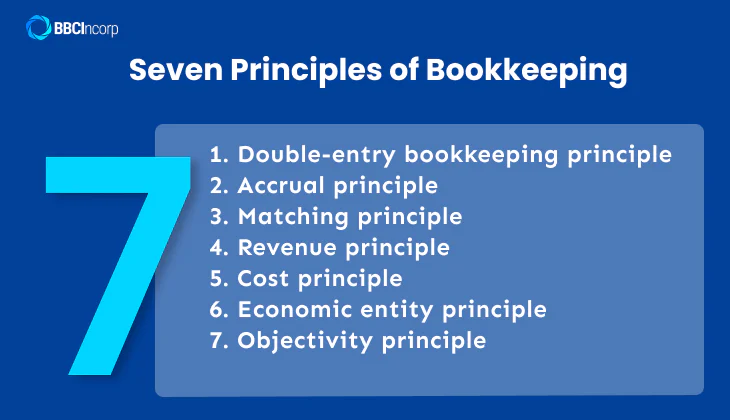

Principles of bookkeeping

The principles of bookkeeping provide the framework that guides how financial information is recorded, classified, and interpreted within a business. These principles ensure that financial records remain consistent, accurate, and free from personal bias.

They also allow companies to produce reliable statements, meet compliance requirements, and maintain transparency with stakeholders. By applying these principles correctly, businesses strengthen the quality of their financial data and create a foundation for sound decision-making and long-term operational stability.

- Double-entry bookkeeping principle

This principle requires that every transaction be recorded in at least two accounts, one as a debit and one as a credit. It ensures that the accounting equation remains balanced and that financial records reflect the full impact of each transaction. This structure improves accuracy and helps detect errors early.

- Accrual principle

Revenue is recognized when earned, and expenses are recognized when incurred, regardless of cash movement. This principle provides a clearer picture of financial performance because it captures the true timing of business activities rather than relying solely on cash receipts or payments.

- Matching principle

Expenses must be recorded in the same accounting period as the revenues they helped generate. This principle ensures accurate profit measurement and prevents overstating or understating financial results.

- Revenue principle

Revenue is recorded when it is earned and the business has delivered goods or services. This prevents premature recognition and ensures that recorded revenue accurately reflects economic activity.

- Cost principle

Assets must be recorded at historical cost rather than their current market value. This creates consistency, avoids subjective valuation, and maintains reliability in financial statements.

- Economic entity principle

A business’s financial activities must be kept separate from the personal finances of its owners. This separation ensures clarity and avoids misrepresenting the company’s financial position.

- Objectivity principle

All financial records must be based on objective and verifiable evidence, such as receipts, invoices, and contracts. This principle prevents subjective judgment and supports audit accuracy.

Together, these principles form the foundation of reliable bookkeeping practices. By applying them consistently, businesses ensure that their financial records remain accurate, transparent, and useful for both compliance and strategic decision-making. These principles also support the next step in bookkeeping: managing financial data through structured processes.

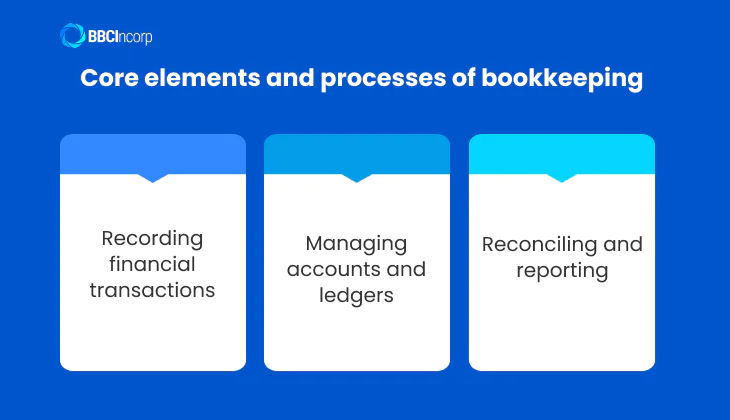

Core elements and processes of bookkeeping

The bookkeeping process involves several structured steps that ensure a business maintains accurate and organized financial information. These steps reflect what bookkeepers do on a daily basis and how they support a company’s financial workflow. From recording transactions to managing ledgers and preparing reports, each task contributes to the integrity of bookkeeping records and the reliability of financial statements.

The following sections outline the core elements of this process and how they work together within a business.

Recording financial transactions

Recording financial transactions is the first step in the bookkeeping process. Bookkeepers document sales, purchases, payments, and receipts as they occur. Several tools are commonly used to capture this activity:

- Cash Registers: Used primarily in retail or point-of-sale environments to record cash and card payments instantly. Cash registers create immediate transaction entries and provide daily summaries that feed into journals.

- General Journals: These are chronological records that capture all financial transactions. Each entry includes the date, description, debit, and credit amount. Journals ensure that transactions are documented systematically.

- Special Journals: Businesses with recurring activities use separate journals such as Sales Journals, Purchases Journals, and Cash Receipts Journals. This improves efficiency and clarity.

Entries must be recorded consistently and in chronological order to provide a complete audit trail. These journals serve as the foundation for transferring information to the general ledger.

Managing accounts and ledgers

After transactions are recorded, bookkeepers post them to the general ledger, the main record that consolidates all accounts. The ledger is organized according to a chart of accounts, typically categorized into assets, liabilities, equity, income, and expenses.

Each ledger account summarizes journal entries related to that category. For example:

- The cash account shows all inflows and outflows

- The accounts receivable account tracks unpaid customer balances

- Expense accounts compile operating costs

The ledger is also used to generate the trial balance, a report that lists all account balances to confirm that total debits equal total credits. A balanced trial balance indicates that financial data is ready for review and reporting.

Reconciling and reporting

Reconciliation involves comparing internal records with external documents such as bank statements or supplier invoices. Bank reconciliation ensures that the cash balance in the general ledger matches the bank’s records, helping identify discrepancies, missing entries, or unauthorized transactions.

Once reconciliation is completed, bookkeepers prepare periodic financial reports. These include the income statement, balance sheet, and cash flow statement. Accurate bookkeeping records are essential for generating these reports, supporting compliance, and providing management with reliable insights into financial performance.

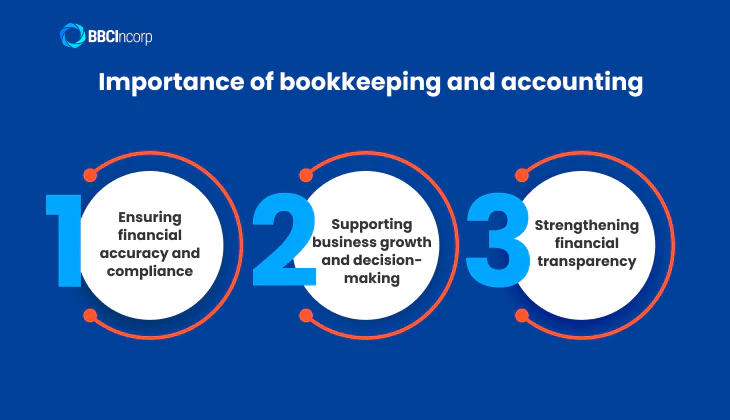

Importance of bookkeeping and accounting

Accurate bookkeeping and accounting are essential components of effective business financial management. They provide the structure that enables companies to track performance, maintain compliance, and make informed decisions. Without reliable records, businesses face significant risks, including cash flow gaps, tax penalties, operational inefficiencies, and reputational damage.

Understanding the importance of bookkeeping and accounting allows organizations to appreciate how financial clarity supports stability, growth, and long-term success. The following sections outline the key benefits of bookkeeping and why bookkeeping is important for every business, regardless of size or industry.

Ensuring financial accuracy and compliance

Bookkeeping plays a critical role in maintaining accurate financial records, which are required for tax filings, audits, and compliance with regulatory standards. Properly recorded transactions ensure that businesses report their income and expenses correctly, reducing the risk of errors that could trigger penalties or tax audits.

Accurate bookkeeping records also support compliance with corporate law, employment regulations, and jurisdiction-specific requirements. When financial information is well documented, companies can respond quickly to audit requests and provide verifiable evidence for every transaction. This reduces operational disruption and prevents financial misstatements that could damage credibility with regulators or stakeholders.

Supporting business growth and decision-making

Organized books allow business owners and managers to understand financial performance in real time. This enables more accurate budgeting, trend analysis, and forecasting. With clear financial data, companies can evaluate profitability, identify areas for cost control, and allocate resources more effectively.

Bookkeeping also plays a vital role in supporting growth scenarios. For example:

- Loan applications: Banks require detailed financial statements before approving business loans or credit facilities.

- Investor reporting: Investors rely on accurate records to assess risk, evaluate return potential, and monitor ongoing performance.

- Expansion planning: Reliable data helps businesses determine whether they have the financial capacity to scale operations or enter new markets.

These scenarios demonstrate how the benefits of bookkeeping extend beyond compliance into strategic decision-making and long-term development.

Strengthening financial transparency

Consistent bookkeeping enhances transparency by providing a clear, verifiable record of financial activities. This builds trust with business partners, suppliers, lenders, and stakeholders who rely on accurate information to assess the health of the business.

Financial transparency also supports sustainability and long-term planning. When records are updated regularly, businesses can anticipate risks, plan for future investments, and demonstrate accountability to internal and external parties. Transparent bookkeeping and accounting ultimately create a culture of responsibility, which strengthens the company’s reputation and its ability to maintain long-term relationships.

Common bookkeeping challenges businesses face

Many businesses, particularly small and medium enterprises, encounter recurring bookkeeping challenges that disrupt financial accuracy and daily operations. These issues often arise from limited resources, insufficient training, or the reliance on outdated systems. Understanding these bookkeeping mistakes is essential for identifying risks early and improving business financial management.

One of the most common challenges is the lack of time dedicated to maintaining proper records. Business owners often prioritize operations, sales, or customer service, leaving bookkeeping tasks incomplete or postponed. As a result, transactions may be recorded late, inconsistently, or inaccurately, leading to gaps in financial data. Poor recordkeeping also increases the likelihood of compliance issues, especially during tax filing or financial reviews.

Another major challenge is the absence of skilled personnel. Bookkeeping requires knowledge of financial transactions, classification, and the use of journals and ledgers. When handled by untrained staff, businesses frequently face problems such as:

- Misclassified expenses

- Missing receipts

- Duplicate entries

- Inaccurate account balances

These mistakes do not only distort financial health but also hinder management’s ability to make informed decisions.

Outdated or manual bookkeeping systems create additional obstacles. Businesses that still rely on spreadsheets or paper-based processes struggle with version control, error tracking, and data loss. Manual processes slow down month-end closing, increase the risk of inconsistencies, and make reconciliation more difficult. Without regular reconciliation, discrepancies between internal records and bank statements may go unnoticed, creating cash flow problems or exposing the company to fraud.

These bookkeeping challenges have a direct impact on business performance. Inaccurate numbers affect budgeting, tax filings, investor communication, and overall decision-making. They weaken financial credibility and create operational inefficiencies.

To address these problems, many companies turn to automation or outsourcing. Automated bookkeeping solutions reduce manual data entry, improve accuracy, and ensure that information is updated in real time. Outsourced bookkeeping services provide professional oversight, structured processes, and reliable bookkeeping solutions that help businesses remain compliant and focus on growth.

BBCIncorp bookkeeping services: helping businesses stay accurate and compliant

BBCIncorp is a global corporate services provider supporting companies across multiple jurisdictions with structured, reliable, and professional bookkeeping support. With years of expertise in corporate administration and compliance, BBCIncorp delivers accounting and bookkeeping services that help businesses stay accurate, compliant, and operationally efficient.

BBCIncorp bookkeeping services span the full financial management process, starting with system setup and structure design. The team assists businesses in:

- Setting up new bookkeeping systems

- Migrating from outdated or manual processes to digital platforms

- Standardizing account structures across different jurisdictions

Ongoing accounting and bookkeeping services include:

- Monthly and annual transaction recording

- Ledger management and account reconciliation

- Preparation of financial statements

- Software integration using tools such as Xero, QuickBooks, and Zoho Books

BBCIncorp also supports tax compliance through timely submissions, regulatory checks, and advisory services tailored to each jurisdiction. This is especially valuable for companies operating in competitive markets such as bookkeeping Singapore, where meeting deadlines and maintaining accurate records are essential for staying compliant.

SMEs and startups benefit significantly from these solutions because they gain:

- Improved accuracy and financial clarity

- Reduced administrative workload and operational risk

- A cost-efficient alternative to hiring in-house staff

- Access to ongoing professional bookkeeping support and guidance

For businesses seeking a dependable and scalable approach to financial management, BBCIncorp provides the expertise and systems necessary to maintain stability and support growth. Contact our team today to learn how our professional bookkeeping support can help streamline your financial operations.

Conclusion

Bookkeeping is a core component of strong financial management, providing businesses with accurate records, clear insights, and reliable data for long-term planning. This guide has explained what is bookkeeping, the bookkeeping meaning, and the key methods used to maintain structured financial information. From recording transactions to managing ledgers and reconciling accounts, each step contributes to compliance, transparency, and operational stability.

The importance of bookkeeping lies in its ability to support decision-making, ensure regulatory compliance, and help businesses understand their financial health with confidence. As companies grow, maintaining proper bookkeeping practices becomes essential for avoiding errors, improving efficiency, and sustaining performance.

If your business needs tailored bookkeeping or compliance assistance, our team is ready to help at service@bbcincorp.com.

Frequently Asked Questions

Is double-entry bookkeeping mandatory for all businesses?

No. Double-entry bookkeeping is not legally required for every business, but it is strongly recommended. Companies that manage inventory, handle loans, process payroll, or plan to raise investment benefit greatly from its accuracy and reliability. It is also the standard method for GAAP compliance and is preferred for audit readiness.

Do I need accounting software to manage double-entry bookkeeping?

Not necessarily. Double-entry can be maintained manually using spreadsheets, but software significantly reduces errors, improves efficiency, and provides better scalability as your business grows. Tools like Xero, QuickBooks, and Zoho Books automate posting, reconciliation, and reporting, making the process easier for both beginners and experienced users.

What’s the most beginner-friendly bookkeeping setup?

Manual single-entry bookkeeping is the simplest to understand, especially for very small or home-based businesses. However, many new entrepreneurs prefer a basic double-entry software setup, such as Wave or Zoho Books, because it offers more structure, automated calculations, and built-in safeguards, without requiring advanced accounting knowledge.

Can I outsource bookkeeping instead of doing it myself?

Absolutely. Outsourcing bookkeeping is a common solution for founders, SMEs, and startups that want to save time and ensure accuracy. Professional providers like BBCIncorp offer end-to-end bookkeeping, financial reporting, software setup, and tax compliance support. This allows businesses to focus on growth while maintaining precise, compliant financial records across multiple jurisdictions.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.