Company Registration in Singapore

Private Limited Company

Private Limited Company

At least one director

Local registered address

Incorporation accomplished within 3 hours

Customized company package

No hidden fee

All-in-one service

Bring Your Next Business Venture Online With BBCIncorp

Say goodbye to traditional paperwork and embrace the convenience of online business incorporation with trusted Singapore company registration services.

Enjoy a hassle-free experience as you bring your business to life.

Say goodbye to traditional paperwork and embrace the convenience of online business incorporation with trusted Singapore company registration services.

Enjoy a hassle-free experience as you bring your business to life.

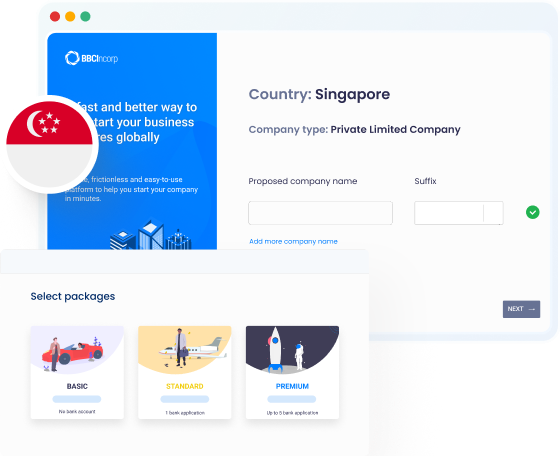

BBCIncorp Client Portal -

Bring your next business venture online

Streamlined process

Experience a streamlined process that puts you in control. Start at your own pace and minimize waiting time for back-and-forth email communication during Singapore company incorporation.

E-signature

Digitally sign and share documents securely, eliminating the need for physical signatures and cumbersome paperwork. So you can collaborate with your partners with ease when incorporating a company in Singapore.

Digitized KYC

Effortlessly declare your information with our standardized forms and organizational charts. Simplify the KYC process and gain peace of mind with our digitized solution.

Centralized management portal

24/7 access to company documents on high-security cloud infrastructure. And no worry about key compliance deadlines with auto reminder.

BBCIncorp Company Incorporation Services For Locals And Foreigners

Singapore's company formation process varies depending on your residency.

Whether you're a local resident or a foreign entrepreneur, trust us to guide you through the complexities of company incorporation with ease.

For Local & Permanent Residents

For Foreigners

Singapore company formation process

KYC Documents Checklist

Below, you'll find a list of the required documents.

The following proofs are required for all company members including Directors, Shareholders, Ultimate Beneficial Owners (UBOs), and Contact persons.

*Note that the list provided, while comprehensive, may not encompass all requirements.

For further personalized consultations tailored to your specific case, please reach out to our support team anytime

Singapore incorporation checklist download

Chart out a clear roadmap towards company formation with our Singapore Incorporation checklist. Start your journey with the following insights on

- Company pre-incorporation requirements

- Compact guideline of application procedures

- Checklist of business licenses

- Post-incorporation and annual compliance keynotes

How we register your companyin 4 easy steps

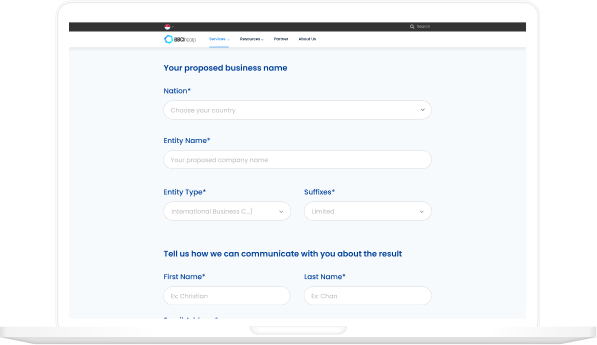

Place your order

Enter our online order platform for easy onboarding experience and tailor your orders. We have different packages and additional services that suit your goals. All information filled in is secured over 256-bit encrypted line.

Make payment

Your settlement can be made online via Credit card, Debit Card. Bank wire transfer is also acceptable.

Collect and verify KYC documents

Once we've received your payment, our customer service team will contact you to process the necessary paperwork. As part of the Singapore company setup, we’ll guide you on how to properly prepare the required documents for incorporation through our online KYC form. You can also access our digital Client Portal to complete the incorporation steps and track the progress anytime, anywhere.

Singapore company registration

As part of our Singapore company incorporation services, your electronic company documents will be ready within 1 working day, and the original documents will be delivered by courier within 3–7 days.

Company Name

Check

Check if your company name is available today with our Entity Name Check Tool.

Wish to get a hassle-free Singapore company incorporation?

Testimonials

Frequently Asked Questions

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.