Quick Offshore Company Formation With Client Portal

Setting up an international business company can be tough.

You're forced to brave through layers of complex local laws and corporate governance guidelines only to struggle to stay on top of it all in the end.

But what if there's another way to approach this? One that allows you to

- Fast-track your formation process

- Be in control of all compliance related matters

- Stay on top of any law changes

This is where we come in.

Bring your next

business venture online

Company Registration Worldwide

Set up your business in over +15 countries and receive consultations from our local experts.

Typical use of an offshore company

An offshore company can be flexible with various business industries.

Need more resources? This page helps you out.

Wonder how an offshore company fits your plan?

Highly Responsive Reps

Register your offshore company in just 4 steps

Bring your next business venture online

Streamlined process

E-signature

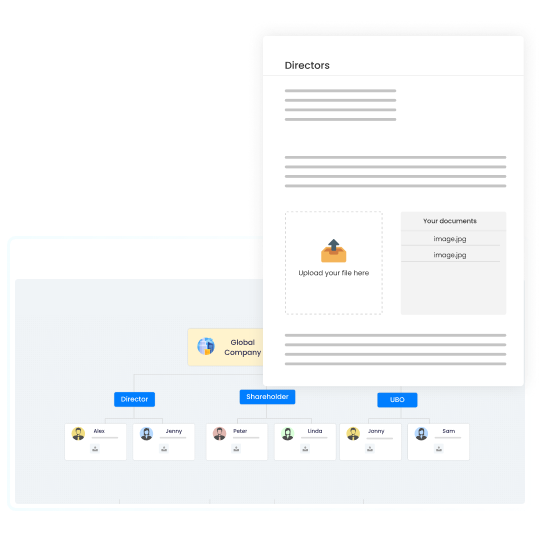

Digitized KYC

Centralized management portal

Offshore Company Formation Services Pricing Package

| Jurisdictions | First year fee | Annual fee * | Package Details | |

|---|---|---|---|---|

| Africa | 2,999 | 2,799 | See more | |

| 999 | 799 | See more | ||

| Americas | 1,299 | 1,099 | See more | |

| 2,699 | 1,999 | See more | ||

| 1,059 | 899 | See more | ||

| 1,799 | 1,799 | See more | ||

| 2,999 | 2,799 | See more | ||

| 499 | 639 | See more | ||

| 1,699 | 1,499 | See more | ||

| 1,699 | 1,499 | See more | ||

| 1,399 | 1,199 | See more | ||

| Asia | 2,999 | 2,999 | See more | |

| Europe | 2,999 | 2,799 | See more | |

| 499 | 499 | See more | ||

| Oceania | 1,299 | 1,099 | See more | |

| 999 | 899 | See more |

How it works with BBCIncorp

From making incorporation decisions, creating order to managing incorporation process, we add value along your incorporation journey.

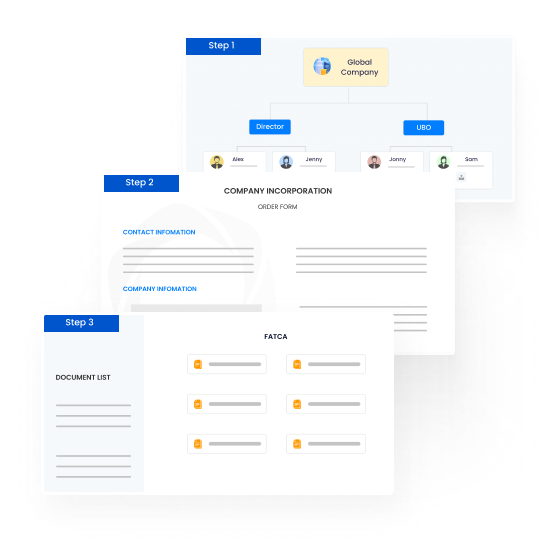

Understanding your case

Our developed in-house consultants with relevant experience in corporate formation will assist you to determine and clearly set out your business goals and conditions. With that information, we help you choose the right plan that could satisfy your needs in an effective manner.

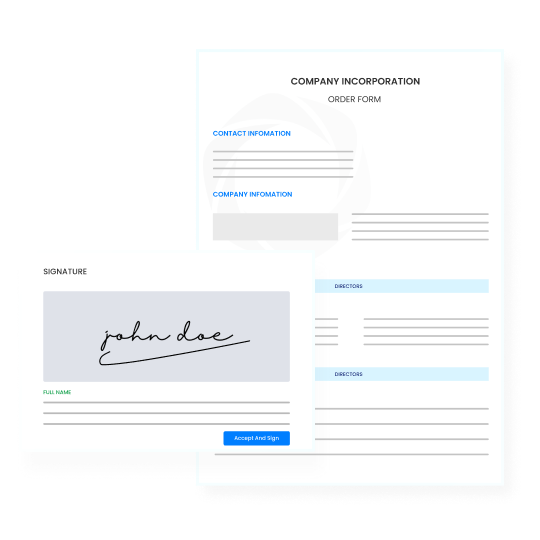

Knowing your client (KYC)

Based on a unified agreement, we will collect the required customer's documents and verify them with signed order and due diligence forms. Our digital Client Portal is tailor-made for client's enhanced experience while using our services. You'll log in and can proceed with the incorporation steps and keep track of the process anytime, anywhere.

Incorporation process

The order form will be passed through the compliance department and the company registrar for incorporation. Depending on each country, the time needed to obtain the hard copies of company documents could be as short as 1 hour to a couple of working days.

Post-registration services

Registering an offshore company is only the first step. To operate effectively, you will also need a company formation bank account to support trading with partners. Depending on your chosen package, our team assists with essential post-registration services to prepare your business for operations.

KYC Documents Checklist

KYC documents are essential to verify the identity of individuals and corporations while setting up offshore companies.

Below, you'll find a list of the required documents.

The following proofs are required for all company members including Directors (or Managers for LLCs), Shareholders (or Members for LLCs), Ultimate Beneficial Owners (UBOs), and Contact persons.

To establish the identity of a corporation or entity, it is necessary to provide company documents and proofs of its members.

*Note that the list provided, while comprehensive, may not encompass all requirements.

For further personalized consultations tailored to your specific case, please reach out to our support team anytime

Frequently Asked Questions

What is an offshore company?

In business context, "offshore" is associated with a jurisdiction out of the home land where has more beneficial conditions. An offshore company is often attached to many advantages such as favorable tax, asset protection, business privacy, etc. Moreover, some jurisdictions will have special programs and laws to encourage the growth of certain business sectors.

Starting or moving your business offshore will require you to register the business in the country of registration, which is called "offshore company formation". The regulations and requirements will vary by the jurisdiction. However, most offshore countries have relaxing laws to welcome entrepreneurs around the world to land their businesses within the borders. Each country will have various business structures you can choose from. Common structures are International Business Company (IBC), Corporation, Business Company (BC), Limited Liability Company (LLC).

Who should use an offshore company?

Businessmen/ Digital entrepreneurs:

With an offshore company, you can begin an activity without the need to deal with the setup of complicated infrastructure and reap tons of benefits from offshore jurisdictions.

Digital entrepreneurs are one of the main groups to fit in an offshore company. This group don't have a fixed addresses or business offices. They facilitate the digital platforms to start and grow their businesses. They prefer the simple online incorporation, minimal tax reporting requirements that can save their budget. And offshore companies meet their criteria.

Ecommerce business:

One of offshore company's key features is flexibility and simple setup, which is a good facilitator of those whose business is on the Internet, maintain domain and manage sites. Another advantage is tax optimization for online businesses. Sales tax is the top concerning issue when operating an online business. Typically, some offshore jurisdictions don't collect sales tax for the purchasing whithin the borders.

Consultants / Counsellors:

Simple administration and high level of privacy make offshore company incorporation a great choice for consulting businesses.

Trading business:

International trading companies are often connected with offshore company structure thanks to its versatile nature.

Holding business:

Holding company does not engage in any trading activities but is established to hold shares or assets of other companies. An offshore company has various uses, for example reducing withholding tax, increasing asset protection, and enhancing privacy, so it is considered preferred choice for holding or IP holding company.

Forex/crypto based business:

Another group that suits to start a company offshore is stockbroker or forex service provider. Most offshore jurisdictions have great asset protection laws and corporate anonymity. Besides, some offshore jurisdictions have friendly environment and strong financial services that are ideal starting the related businesses.

Is it actually legal to own an offshore company?

Yes. It is legal for you to own an offshore company. The problem is that you just need to follow the regulations set out by the country of company registration. Such regulations can be tax filing, annual reports and other ongoing obligations.

Are offshore companies safe?

Tax is the most concerning matter when it comes to starting an offshore company. Most countries will try to optimize the taxable amount for foreign businesses to encourage the company registration. The downside is that some countries have excessively favorable regulations that potentially lead to tax evasion, or illegal tax avoidance.

Thus, offshore businesses usually must comply with additional tax reports following Foreign Account Tax Compliance Act (FATCA), or requirements set out by the Organization for Economic Cooperation and Development (OECD) and the World Trade Organization (WTO). European Union (EU) also has a list of non-cooperative tax jurisdictions for tax purposes. The countries that are in the scope must apply regulations on businesses to ensure the tax transparency.

If you register your offshore company with a jurisdiction, your business has legal protection. So the answer is "Offshore companies are safe" as soon as you comply with the related requirements, especially tax reporting regulations. So do reasearch carefully the applicable requirements of your business to make sure your company stay compliant.

What are the purposes of the offshore company?

The main reason for starting an offshore company is to enjoy more favorable conditions. Such conditions can be tax advantages, simple incorporation, beneficial environment for specific types of businesses.

Some business owners, especially owners of big firms, want to have an offshore company to hold their intangible assets such as intellectual property for tax purposes. They can cut down the amount of business taxes by using transfer pricing for their offshore company.

What are the advantages of using an offshore company?

There is no limits to the benefits of an offshore company. Governments of offshore countries constantly update business trends and keep their laws and supportive programs up-to-date. Below are advantages you can find in many offshore countries:

- High level of corporate privacy and assest protection

- Easy and simple incorporation process

- Favorable tax conditions

- Minimal reporting requirements

Which is the best country for offshore company registration?

Best offshore company jurisdiction is the one that fits your business needs. Over 40 countries encourages overseas investors to start offshore company within the borders. Each of them has distinct and competitive features to magnitize entrepreneurs around the world. Thus, considering the following impactful factors for choosing the best one:

- How you want your company is taxed;

- Where your customers are located;

- What type of products and services you are planning to sell; and

- How your prefer cost, service speed and range of related services of the incorporation to be.

There are still other considerations for the offshore country selection depending on your specific situation.

What are tips for choosing an ideal incorporation jurisdiction?

Below are some tips to help you determine an offshore jurisdiction that excellently fits your business needs:

- The country profile: The stability of economy and politics from high-profile countries provides the potential for your business growth.

- Country of residency: Where you live will affect to the eligibility of offshore company registration.

- Tax regime: Take time to examine tax rates that may apply to your business and exemption cases (if any). Chances are business owners could save money by operating in a low-tax or even no income tax jurisdictions.

- High-risk or low-risk list: Be aware if your chosen offshore jurisdiction is in the "red" list namely EU list of non-cooperative tax countries, US sanctioned countries. This will affect to your business trading or expanding plan.

What is the difference between an international business company (IBC) and LLC?

An international business company (IBC) is a type of legal entity that is often used for international business transactions. IBCs are typically incorporated in offshore jurisdictions and offer various benefits, such as low taxation and limited regulation.

An LLC, on the other hand, is a type of legal entity that is typically used for domestic businesses. LLCs are typically incorporated in the United States and offer various benefits, such as pass-through taxation and limited liability.

So, what is the difference between an IBC and LLC? Well, the main difference is that an IBC is typically used for international business transactions while an LLC is typically used for domestic businesses. Additionally, IBCs are typically incorporated in offshore jurisdictions while LLCs are typically incorporated in the United States. Finally, IBCs offer various benefits, such as low taxation and limited regulation, while LLCs offer different benefits, such as pass-through taxation and limited liability.

How do I register for international business?

To register your business for international trade, you will need to follow a few simple steps. First, you will need to choose a business structure that is right for your company. You will then need to obtain the necessary licenses and permits from the government. Finally, you will need to have your company's financial information in order. Once you have all of this information, you will be ready to begin the registration process yourself or use a company formation service to expedite it.