- What is audit and assurance in Hong Kong?

- Key differences between audit and assurance

- The audit process explained

- Common types of assurance engagements

- Benefits of audit and assurance for businesses

- Common challenges in audit and assurance engagements

- Emerging trends and the future of audit and assurance

- BBCIncorp support for audit and assurance needs

- Conclusion

Hong Kong remains a leading hub for international business and finance, attracting companies from across the globe seeking a transparent and well-regulated environment. In this context, audit and assurance play essential roles in ensuring corporate accountability, building stakeholder trust, and supporting strategic decision-making.

While audits focus on the accuracy and reliability of financial statements, assurance services provide broader insights into business processes, risk management, and compliance. Together, they enable organizations to meet regulatory requirements seamlessly and maintain credibility in the eyes of investors, partners, and regulators.

In this article, let’s explore in detail how audit and assurance differ yet complement each other and why they are essential for sustainable growth in Hong Kong.

Key takeaways on Hong Kong audit and assurance

- Auditing is a regulated process that provides an independent opinion on the accuracy and fairness of a company’s financial statements. It ensures compliance with Hong Kong Financial Reporting Standards and legal obligations.

- Assurance is a broader service that evaluates both financial and non-financial information, including governance, risk management, sustainability reporting, and internal controls. It enhances transparency and reliability beyond traditional audits.

- Key differences include scope, objectives, and flexibility. Audits are mandatory and cover comprehensive financial statements, whereas assurance engagements are often voluntary, focusing on specific areas such as ESG compliance or operational efficiency.

- Together, audit and assurance complement each other to strengthen oversight, risk management, and stakeholder trust.

- Professional support from expert providers like BBCIncorp is efficient and essential to maintain compliance and obligations with ease, especially for global businesses operating in Hong Kong.

What is audit and assurance in Hong Kong?

In Hong Kong’s dynamic business landscape, audit and assurance play a crucial role in maintaining credibility, fostering transparency, and guiding companies through complex regulatory requirements.

Understanding Hong Kong financial audits

A financial audit examines a company’s financial statements, records, and transactions to confirm accuracy, completeness, and compliance with accounting standards. Audits detect errors, irregularities, or potential fraud, which gives stakeholders an ease of mind in reported results.

The types of audits include:

- Internal audits, which evaluate operational processes and controls

- External audits conducted by independent accounting firms

- Statutory audits required under Hong Kong law; and

- Regulatory audits carried out by authorities such as the Inland Revenue Department.

Notably, a professional audit from a reputable firm boosts a company’s reputation with investors, lenders, and regulators while reducing its financial and compliance risks.

Understanding Hong Kong assurance services

Assurance goes beyond reviewing financial statements to assess the reliability of broader business information and processes. Engagements can cover both financial and non-financial areas, including sustainability reporting, corporate governance compliance, and risk management frameworks.

Unlike audits, which focus on historical data, assurance services provide an independent evaluation of systems and controls. Additionally, companies using assurance demonstrate transparency, accountability, and adherence to best practices, which strengthens credibility in Hong Kong’s competitive market.

How audits and assurance work together

Although not the same processes, audits and assurance complement each other to create a complete oversight system. Audits verify the fairness of financial statements. On the other hand, assurance reviews wider operational and strategic processes. Combined, these services improve internal controls, highlight risks, and reinforce stakeholder confidence.

Consequently, foreign-owned businesses in Hong Kong gain a better understanding of their financial health and operational performance. This makes it easier to attract investment, manage growth, and operate in a highly regulated environment.

Key differences between audit and assurance

Knowing the distinctions between audit and assurance is essential for businesses operating in Hong Kong, particularly foreign-owned companies navigating regulatory requirements. Let’s look into the following comparison criteria.

Fundamental nature and objectives

Audits are mandatory, regulated processes that examine financial statements to provide an independent opinion on accuracy and compliance. The primary audit objective is to give stakeholders a credible base that financial reporting adheres to Hong Kong Financial Reporting Standards (HKFRS) and legal obligations under the Companies Ordinance.

Assurance, in contrast, is typically voluntary and flexible, designed to enhance the credibility of a wide range of financial and non-financial information. Assurance objectives go beyond historical financial data, offering insights into processes, controls, and information reliability.

Establishing a clear delineation between audit vs. assurance services is imperative for organizations endeavoring to secure suitable solutions for regulatory adherence.

Scope and coverage

Audit scope is comprehensive, covering the full set of financial statements and related disclosures. Auditors assess transactions, balances, and internal controls to ensure reported results fairly reflect the company’s financial position and performance.

On the other hand, assurance services have a more targeted scope and can focus on specific areas such as sustainability reporting, risk management, corporate governance, or cybersecurity. Examples include ESG reporting verification, operational performance reviews, and IT system assurance. By addressing areas beyond traditional audits, assurance engagements provide stakeholders with confidence in selected aspects of a business.

Independence and responsible parties

Auditor independence is fundamental in audits, with external auditors required to remain objective and free from conflicts of interest. Internal auditors, though part of the organization, also operate under governance to maintain impartiality.

Assurance engagements may involve a wider range of specialists, including IT, environmental, and risk management experts, depending on its focus.

Both audit and assurance professionals follow regulatory and professional standards, including HKICPA guidelines and relevant international assurance frameworks, so that outputs remain reliable and consistent.

Recognizing the differences between audit and assurance allows foreign-owned businesses in Hong Kong to align their verification practices with compliance obligations and stakeholder expectations:

- Audits provide a formal, regulated opinion on financial statements.

- Assurance offers broader insights into operational, strategic, and non-financial information.

Employing both strengthens governance, improves credibility, and supports sustainable growth in Hong Kong’s competitive business environment.

The audit process explained

For businesses operating in Hong Kong, knowing how the audit process goes is essential for maintaining compliance, building credibility, and addressing stakeholder expectations.

The audit process involves multiple stages, each designed to provide a thorough evaluation of financial statements and identify potential risks and areas for improvement.

Planning and risk assessment

Audit planning begins with a detailed understanding of the client’s business, industry, and regulatory environment.

First, auditors assess key risks, including financial, operational, and compliance risks, to design an effective audit strategy tailored to the company’s unique circumstances. Evaluating internal controls is a critical part of this stage, as strong controls reduce the likelihood of errors and misstatements in financial reporting. Risk assessment in audit allows auditors to focus resources on high-risk areas, fostering a more efficient and accurate examination of the company’s financial statements.

Keep in mind that proper audit planning also sets the foundation for clear timelines, resource allocation, and communication with management throughout the process.

Fieldwork and evidence gathering

During the fieldwork stage, auditors collect and evaluate evidence to verify the accuracy and completeness of financial information. This involves testing transactions, reconciling account balances, reviewing supporting documents, and assessing the effectiveness of internal controls.

Audiors implement modern audit technology and data analytics tools, such as KPMG Clara and PwC Next Generation audit platforms, to analyze large volumes of data efficiently, identify anomalies, and enhance the overall quality of audit evidence.

Audit fieldwork combines traditional verification methods with technology-driven insights to provide a comprehensive view of a company’s financial health.

Reporting and follow-up

Once fieldwork is complete, auditors prepare a formal audit report containing their audit opinion on the fairness and reliability of financial statements. Audit reporting communicates key findings, highlights areas of concern, and provides recommendations to management and stakeholders. The audit opinion serves as an independent assurance that financial information is accurate and compliant with Hong Kong Financial Reporting Standards (HKFRS).

Audit follow-up lets management address identified issues, optimize internal controls, and implement recommended improvements. Continuous communication during this stage reinforces transparency and accountability.

By understanding each stage of the audit process, foreign-owned companies in Hong Kong can approach audits with security, knowing that audit planning, fieldwork, and reporting are structured to protect their interests and enhance credibility in a highly regulated market.

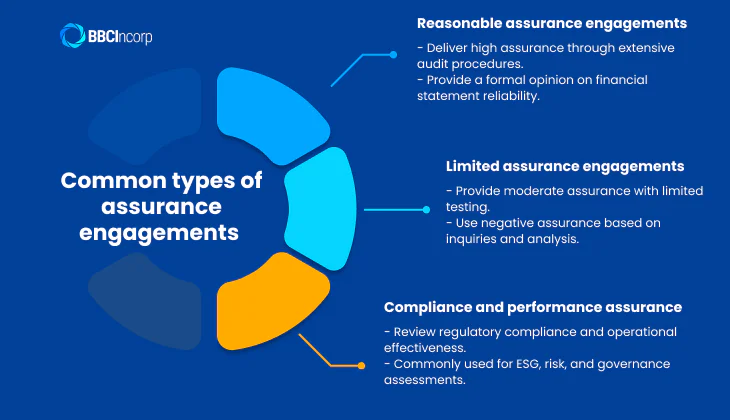

Common types of assurance engagements

Below are the types of assurance engagements you should know to select suitable services for your company:

Reasonable assurance engagements

Reasonable assurance engagements provide a high level of assurance, offering stakeholders credibility in the information reviewed.

The most common example is a financial statement audit, where auditors conduct detailed testing of transactions, account balances, and internal controls. These require comprehensive procedures to verify accuracy, completeness, and compliance with Hong Kong Financial Reporting Standards (HKFRS) and relevant regulations.

Through a formal opinion, reasonable assurance makes sure that financial statements fairly represent the company’s financial position and performance.

Limited assurance engagements

Limited assurance engagements provide a moderate level of assurance, without the complexity or depth of a full audit.

A typical example is a system review, which involves analytical procedures and inquiries rather than extensive testing of each transaction. Auditors provide a negative assurance conclusion, stating that nothing has come to their attention to indicate material misstatements.

Limited assurance is suitable for companies seeking a cost-effective way to confirm information reliability.

Compliance and performance assurance

Businesses can also benefit from compliance assurance and performance assurance, which focus on adherence to regulatory requirements, internal policies, and operational efficiency.

To exemplify, multinational corporations apply ESG assurance, evaluating environmental, social, and governance reporting, as well as assessments of risk management frameworks and internal audit processes. They provide stakeholders with confidence that the company operates responsibly, follows best practices, and manages risks effectively.

Benefits of audit and assurance for businesses

Whether through reasonable assurance, limited assurance, or compliance and performance assurance, these services foster organized governance, reinforce transparency, and sustainable growth in Hong Kong.

Enhancing credibility and trust

A key audit benefit lies in enhancing business credibility and reinforcing stakeholder trust. Independent audit and assurance give investors, banks, and regulators confidence that financial and non-financial information is reliable and fairly presented.

This level of confidence matters for public companies seeking market recognition, private firms negotiating financing, and non-profits accountable to donors and oversight bodies. Verified information enables smoother access to capital, stronger banking relationships, and constructive engagement with regulators.

Improving internal controls and risk management

Audit and assurance play crucial roles in evaluating internal controls and implementing risk management practices. Through systematic review, auditors identify control weaknesses, fraud risks, and operational inefficiencies that may remain unnoticed in daily operations.

Assurance engagements extend this value through assessing entity structures and operational processes. These findings will be useful to nurture continuous improvement and promote disciplined management practices.

Regulatory compliance and risk mitigation

Businesses in Hong Kong must comply with extensive legal and reporting obligations, including IFRS and other applicable standards. Audit and assurance support regulatory compliance by confirming that financial reporting aligns with statutory and professional requirements. This proactive approach reduces the likelihood of penalties, disputes, and reputational harm, providing long-term protection in a closely monitored business environment.

Common challenges in audit and assurance engagements

Audit and assurance engagements carry inherent challenges, including audit risks, potential misstatements, limits in fraud detection, and issues arising from incomplete client cooperation. These factors can affect audit assurance quality, timelines, and the reliability of conclusions. Recognizing these challenges early allows organizations to approach audit and assurance with clearer expectations and proper preparation.

Mitigating audit risks

Managing audit risk remains a core challenge within audit and assurance work. Complex transactions, group structures, and evolving reporting requirements increase exposure to error. Risk-based planning helps auditors focus on areas with a higher likelihood of misstatement, improving efficiency and audit quality.

Proper documentation supports transparency and provides a clear trail of audit judgments. Professional skepticism also plays a vital role, requiring auditors to critically assess evidence rather than rely solely on explanations from management. Within advanced audit and assurance, cross-border operations add further complexity, particularly when accounting practices differ across jurisdictions.

Ensuring effective assurance engagements

Challenges in assurance engagements often stem from unclear scope and misaligned expectations. Defining objectives at the outset allows audit assurance activities to concentrate on relevant financial or non-financial information. Clear communication between management and assurance providers reduces delays and improves the usefulness of findings.

Technology adoption increasingly shapes effective assurance outcomes. Data analytics tools support deeper analysis of large datasets, improve anomaly detection, and enhance efficiency. At the same time, data quality issues or limited system access can restrict their impact. Thus, the teams must deliver CPA audit and assurance, combine technical expertise, professional judgment, and technology to address these limitations.

Emerging trends and the future of audit and assurance

Audit and assurance in Hong Kong continue to evolve as technology, sustainability expectations, and regulatory standards reshape how assurance work is delivered. These changes influence not only audit methodology but also how foreign-owned companies present information to investors, regulators, and global stakeholders.

Digital transformation in audit and assurance

Digital tools now play a central role in modern audit and assurance. Digital audit platforms integrate AI in audit, advanced data analytics, and automated testing to analyse large datasets with greater speed and accuracy. These technologies improve risk identification, enhance anomaly detection, and reduce reliance on manual sampling.

Automation also supports continuous auditing models, where selected data can be reviewed in near real time rather than only at year’s end. As systems mature, audit teams gain deeper insight into business activity while maintaining audit quality and consistency across complex group structures.

Growing importance of ESG and sustainability assurance

Demand for ESG assurance continues to rise as stakeholders place greater emphasis on environmental, social, and governance performance. Investors and regulators increasingly expect credible sustainability reporting, supported by independent assurance over non-financial metrics.

Auditors and assurance providers now play a broader role in evaluating data accuracy, reporting frameworks, and governance processes behind sustainability disclosures. This shift reflects a wider expectation that corporate reporting extends beyond financial results to include long-term impact and risk exposure.

Regulatory changes and evolving standards

Global developments in audit regulation and audit standards also shape the future of audit and assurance. Updates to IFRS and International Standards on Auditing influence how audits are planned, executed, and reviewed, with stronger emphasis on audit quality, professional judgment, and ethical conduct.

For the coming years, regulators continue to focus on transparency, independence, and accountability, reinforcing expectations for consistent application of standards across jurisdictions.

Together, digital innovation, sustainability assurance, and regulatory evolution signal a future where audit and assurance deliver broader insight, higher confidence, and greater relevance for companies operating in Hong Kong.

BBCIncorp support for audit and assurance needs

At BBCIncorp, we provide structured support for companies seeking reliable audit and assurance in Hong Kong, with a focus on foreign-owned businesses. Our solutions align statutory obligations with your commercial needs.

We deliver comprehensive Hong Kong audit services tailored to different industries and business structures:

- Preparing audits in compliance with Hong Kong Financial Reporting Standards and regulatory requirements

- Ongoing compliance services, covering financial reporting reviews, compliance assessments, and risk advisory support

- An integrated approach for foreign owners, simplifying both local and global reporting standards

We also leverage modern audit technology and data analytics to enhance efficiency, consistency, and accuracy. Our services are delivered and managed through the BBCIncorp Client Portal, an integrated online platform where you can:

- Upload and securely store documents for legal and audit procedures

- Order corporate services directly on the platform

- Monitor the progress of multiple companies across jurisdictions

- Communicate directly with our dedicated team for timely assistance and answers to any questions you might have

Visit our website or chat with our team to explore how our auditing services streamline compliance in Hong Kong.

Conclusion

Audit and assurance are essential components of modern business governance. While audits provide a regulated, independent opinion on financial statements, assurance engagements offer a broader evaluation of financial and non-financial information, enhancing credibility and stakeholder confidence. Understanding the key differences and synergies between these services enables companies to leverage both for more comprehensive oversight, risk management, and informed decision-making.

Integrating audit and assurance into business strategy strengthens internal controls, improves compliance, and supports transparent reporting, which is particularly important for foreign-owned companies operating in Hong Kong’s complex regulatory environment. The combination of statutory audits and targeted assurance engagements ensures that both financial accuracy and operational reliability are maintained.

For timely assistance and more details on our Hong Kong services, don’t hesitate to send a message to BBCIncorp at service@bbcincorp.com for professional support today.

Frequently Asked Questions

Are dormant or inactive Hong Kong companies exempt from audit and assurance requirements?

Legally dormant companies that have completed the proper filing procedures with the Companies Registry can be exempt from annual audit and financial reporting. This means no statutory audit is required, provided the company has not carried out any business, received income, or incurred significant transactions during the financial year.

Inactive companies that are not formally declared dormant must still comply with standard audit and reporting obligations. They are required to prepare financial statements, maintain proper accounting records, and undergo an annual statutory audit to meet Hong Kong regulatory requirements.

How often does my Hong Kong company need to undergo audit and assurance procedures?

Most Hong Kong companies are required to undergo audit and assurance procedures at least once every financial year. A statutory financial audit is legally mandated for each financial year unless the company is officially dormant.

Additional assurance services, such as compliance reviews, risk assessments, or non-financial reporting verification, are optional. Companies can schedule these services annually or based on a risk-focused approach, depending on internal policies, investor expectations, or regulatory obligations. Regular audits and assurance foster accurate reporting, support governance, and provide stakeholders with confidence in the company’s financial and operational integrity.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is audit and assurance in Hong Kong?

- Key differences between audit and assurance

- The audit process explained

- Common types of assurance engagements

- Benefits of audit and assurance for businesses

- Common challenges in audit and assurance engagements

- Emerging trends and the future of audit and assurance

- BBCIncorp support for audit and assurance needs

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.