- Understanding Hong Kong tax filing deadlines for 2026

- Individual tax filing in Hong Kong

- Corporate profits tax filing requirements

- Penalties and risks of non-compliance

- Tips for efficient tax filing and compliance

- Why choose BBCIncorp for Hong Kong tax filing

- Planning ahead for the 2026 tax season

- Conclusion

Global businesses operating in Hong Kong work in an environment where timing shapes compliance, and missing a Hong Kong tax filing deadline can lead to penalties and closer review. As companies move toward the 2026 cycle, the Inland Revenue Department continues to refine its framework after recent reforms, and this makes it even more important to understand how the Hong Kong tax 2026 obligations apply to both individual tax deadline HK and company tax deadline HK requirements.

At the same time, Hong Kong is strengthening digital administration, and this shift encourages firms to rely more on eTAX for smoother submissions. Because new relief measures also affect the coming year, businesses operating in Hong Kong must connect these updates with their planning process.

With that in mind, what dates matter most, and which deadlines carry the Hong Kong compliance weight for 2026? Let’s walk through the key points.

Understanding Hong Kong tax filing deadlines for 2026

For global businesses and individuals operating in Hong Kong, meeting the Hong Kong tax filing deadline is essential to avoid violations and potential IRD inquiries. Timely submission ensures that income, deductions, and allowances are accurately recorded, reducing the risk of disputes and facilitating smoother financial planning for the 2025/26 assessment year.

Individual tax filing deadlines for 2025/26

The IRD usually issues individual tax returns in early May 2026. Standard filing deadlines require submission within one month, typically early June 2026. Sole proprietors, who manage business income alongside personal earnings, receive an extended period of three months, placing their personal tax filing deadline in early August 2026.

Electronic submissions via eTAX automatically grant a one-month extension, allowing individuals to file without delay. Late filing triggers surcharges ranging from 5% to 100% of the tax due, and interest accrues on unpaid tax. Accurate accounting entries for employment income, business profits, and allowable deductions are crucial to prevent discrepancies that may prompt additional IRD review.

Below is a summary table of the individual tax filing deadlines:

| Taxpayer type | Return issued | Standard deadline | Extended deadline | Notes |

| Salaried individuals | May 2026 | 1 month from issue (early June) | N/A | Filing via paper or eTAX |

| Sole proprietors | May 2026 | 1 month from issue | 3 months from issue (early August) | Applies to self-employed and business owners |

| eTAX filers | May 2026 | Automatic 1-month extension | N/A | Applies to individuals using the IRD eTAX portal |

Thus, accurate accounting entries for employment income, business profits, and allowable deductions are crucial to prevent discrepancies that may prompt additional IRD review.

Corporate profits tax filing deadlines for 2025/26

Corporate profits tax returns are generally issued in bulk from April 2026. The Hong Kong corporate tax filing deadline varies according to a company’s accounting year-end code:

| Accounting year-end code | Standard filing deadline | Extended filing deadline | Notes |

| N code | May 2026 | Up to Feb 2027 for loss cases | Standard corporate filings |

| D code | May 2026 | Up to Feb 2027 for loss cases | Common for companies with non-calendar year accounts |

| M code | May 2026 | Up to Feb 2027 for loss cases | Companies with tax representatives can apply block extension |

As you can see, standard deadlines typically fall in May 2026, but the IRD allows extensions up to February 2027 for companies reporting losses or under special circumstances.

Companies using a tax representative may qualify for the block extension scheme, which simplifies compliance by granting additional time for filings. Electronic filing through eTAX supports faster submission and automatic reminders, but companies with taxable profits must ensure a return is filed even if no notice has been received from the IRD.

The 2026 cycle also reflects ongoing reforms and increased use of digital filing platforms. Companies and individuals who track deadlines carefully, align internal accounting schedules, and utilize eTAX effectively can prevent late submissions while taking advantage of available relief measures.

Individual tax filing in Hong Kong

Foreign business owners and other individuals earning income in Hong Kong must carefully keep track of the personal tax filing deadline. This is because filing an individual tax return in Hong Kong is not optional once the IRD issues a form, even if income falls below the taxable threshold or no income is received during the assessment year.

What is the Individual Tax Return (BIR60)?

The Individual Tax Return, known as the BIR60, is the primary document for reporting personal income and claiming deductions. Issued annually by the IRD, the BIR60 applies to all taxpayers who receive it, including residents and non-residents earning taxable income in Hong Kong.

The BIR60 covers several income types:

- Salaries Tax: Income from employment, pensions, allowances, and bonuses.

- Profits Tax: Income from business activities for unincorporated businesses, including sole proprietors and partnerships.

- Property Tax: Income generated from renting out property.

Taxpayers who receive a BIR60 must complete and submit it, even if they have no income to report. It’s important to note that filing is required to be eligible for allowances, deductions, and accurate tax assessments.

Who must file an individual tax return

Filing is required for individuals earning income from:

- Salaries, wages, bonuses, and allowances

- Rental properties located in Hong Kong

- Profits from a sole proprietorship

Notably, married couples have the option of a joint assessment, which may reduce the overall tax burden, and spouses can nominate each other to claim specific deductions such as charitable donations or home loan interest. Even if the total income falls below the tax threshold, the IRD expects a return to be filed once issued.

Documents and information required

Preparing an individual tax return involves gathering comprehensive documentation. Key items include:

- Employer-issued IR56B forms detailing salary, bonuses, and allowances

- Records of rental income and related expenses

- Contributions to Mandatory Provident Fund (MPF) schemes

- Charitable donations recognized under Hong Kong tax law

- Home loan interest and self-education expenses, where applicable

- Business profit statements for sole proprietors covering the period from April 2025 to March 2026

Keeping accurate records throughout the year helps prevent errors and reduces the risk of IRD inquiries. For foreign business owners managing multiple income streams, consolidating these documents before filing significantly streamlines the process.

How to file individual tax returns

The IRD provides two main filing methods: paper and electronic.

Paper filing

Paper filing requires submission of the original BIR60 form. Photocopies are not accepted. Individuals can submit the completed form either by post or in person. Returns should be addressed to: the Inland Revenue Department at Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong.

For in-person submission, returns can be delivered to the IRD’s Customer Service Centre at the same address. Working hours are Monday to Friday, 8:30 am to 5:00 pm, excluding public holidays.

Keep in mind to obtain a stamped receipt when handing in the form to confirm submission.

Moreover, accurate completion of all sections is essential, including salary, allowances, rental income, and deductions. In the case of late or incorrect submissions, businesses are likely to be subjected to surcharges ranging from 5% to 100% of the tax due, plus interest on unpaid tax.

Electronic filing

Electronic filing through eTAX is increasingly popular for its convenience, automatic reminders, and extended deadlines. Eligibility requires prior registration with the IRD. Once enrolled in eTAX, individuals can submit the BIR60 along with the following supplementary forms:

- BIRSP1 – Charitable donations

- BIRSP2 – Home loan interest

- BIRSP3 – Self-education expenses

- BIRSP4 – Voluntary contributions to recognized retirement schemes beyond MPF

- BIRSP5 – Dependent allowances and other deductions

Filing via eTAX reduces manual errors, accelerates processing, and automatically grants a one-month extension from the standard Hong Kong income tax filing deadline. This method is especially useful for foreign business owners managing multiple income streams.

Corporate profits tax filing requirements

Foreign business owners and companies operating in Hong Kong must stay informed of the Hong Kong corporate tax filing deadline to maintain compliance, avoid penalties, and manage cash flow effectively.

Who must file profits tax returns

In the case of profit tax Hong Kong, profit tax returns are mandatory for:

- Corporations incorporated in Hong Kong

- Partnerships carrying on business in Hong Kong

- Non-residents deriving profits from Hong Kong sources

On the other hand, profits earned outside Hong Kong are generally exempt from profits tax. However, companies must maintain proper documentation to support offshore claims, as the IRD may request evidence during audits or assessments. Accurate accounting and recordkeeping are particularly critical for foreign owners, as they often manage multiple income streams across jurisdictions.

Types of profits tax returns and supplementary forms

The IRD issues different forms depending on entity type:

In addition to the main return, supplementary forms S1 through S22 must be submitted depending on eligibility for tax incentives or deductions. Notably, new supplementary forms were introduced from the 2024/25 year:

- S19 – Foreign-sourced income reporting

- S21 – Tax certainty scheme

- S22 – Patent box or IP-related income

These forms allow companies to claim reliefs, exemptions, or report special income types accurately, ensuring compliance with the latest IRD requirements. Mandatory electronic filing of these supplementary forms reduces errors, speeds processing, and aligns with the IRD’s ongoing digital transformation.

Filing deadlines and extension schemes

Filing deadlines for the profits tax return 2026 are linked to a company’s accounting year-end code: N, D, or M. Standard deadlines usually fall in May 2026 for profitable companies. Extensions may be granted for loss cases or upon application through the block extension scheme, which is available to companies with tax representatives. In addition, companies must also notify the IRD if taxable profits exist but no return has been issued.

Notably, electronic filing through eTAX provides automatic reminders and may grant additional time compared with traditional paper filing. Hence, this method is usually preferred.

If your company is qualified for the block extension scheme, you can also submit returns later without incurring penalties, but timely and accurate preparation remains essential.

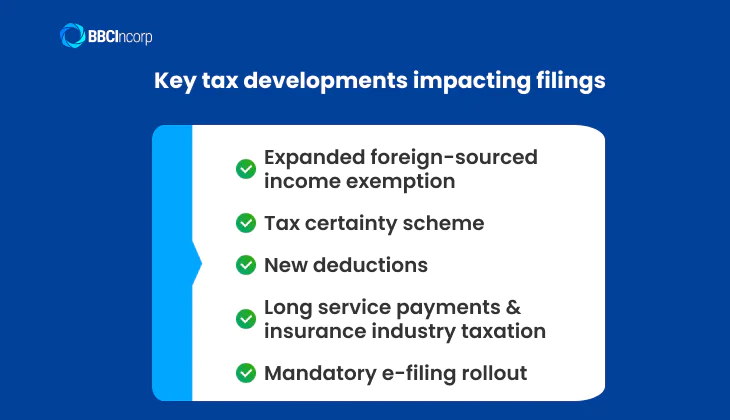

Key tax developments impacting 2026 filings

Several developments are particularly relevant for the 2026 assessment year:

- Expanded foreign-sourced income exemption (FSIE) – Companies claiming FSIE must report relevant income and maintain documentation to qualify for exemptions.

- Tax certainty scheme – New rules provide clarity on non-taxation of onshore equity disposal gains under specified conditions.

- New deductions – Companies can claim lease reinstatement costs and annual allowances on buildings in accordance with updated depreciation rules.

- Long service payments and insurance industry taxation – Revised rules affect the treatment of severance payments and certain insurance sector profits.

- Mandatory e-filing rollout – Starting from 2025/26, all companies are expected to submit profits tax returns electronically.

Foreign owners must align internal accounting processes with these changes, ensuring all relevant income, deductions, and incentives are captured. Proper integration of digital filing, accurate bookkeeping, and awareness of extended or conditional deadlines can prevent unnecessary surcharges and streamline interactions with the IRD.

Staying informed of the corporate tax deadline HK and planning ahead allows companies to manage cash flow, leverage reliefs, and comply with evolving regulations effectively.

Penalties and risks of non-compliance

Foreign business owners in Hong Kong face significant consequences for missing the tax filing deadline. The Inland Revenue Department applies Hong Kong tax penalties rigorously, and late or non-filing can create financial, legal, and operational challenges.

Penalties for late filing and non-filing

- A 5% surcharge applies immediately to returns filed after the due date. For instance, a company with a profits tax liability of HK$100,000 that files one week late would incur a surcharge of HK$5,000.

- Additionally, if the delay extends beyond six months, an additional 10% surcharge may be applied, raising the total penalty in this example to HK$15,000.

- Repeated or deliberate non-compliance may lead to prosecution, with company directors or officers potentially facing fines or criminal liability.

Impact on assessments and audits

- Hong Kong follows an “assess first, audit later” approach. When a return is not submitted, the IRD may issue an estimated assessment based on previous years or industry averages, which can result in higher tax liabilities than expected.

- Companies must retain records for at least seven years, including invoices, payroll, bank statements, and financial statements.

- Entities with complex structures, high income, or foreign ownership face higher audit scrutiny. A multinational company with multiple Hong Kong branches, for example, may undergo a more detailed review than a small local business.

- Filing errors or omissions, even if unintentional, can trigger follow-up inquiries, revised assessments, and additional interest charges.

Let’s look at the following example. A foreign-owned trading company missed the May 2026 BIR51 filing deadline. The IRD issued an estimated assessment based on the previous year, resulting in a tax bill HK$50,000 higher than the actual liability. Surcharges totaling HK$7,500 were added. Because the company had incomplete records, it spent weeks compiling additional documentation to correct the assessment.

Observing Hong Kong tax filing deadlines protects cash flow, reduces IRD penalties, and strengthens credibility with regulators. Companies that keep accurate records, monitor deadlines, and submit returns on time can limit exposure to unnecessary costs and administrative delays.

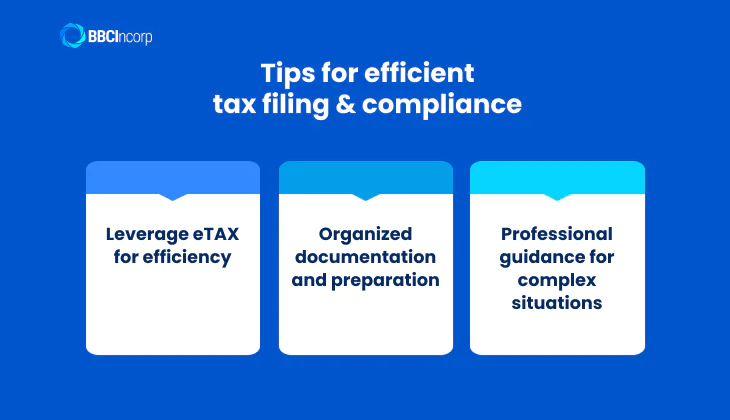

Tips for efficient tax filing and compliance

Managing tax obligations in Hong Kong becomes simpler when businesses and individuals adopt the right strategies. Applying these Hong Kong tax filing tips will ensure timely submissions while taking advantage of available tools and extensions.

Leverage eTAX for efficiency

- Filing electronically grants a one-month extension for individuals and sole proprietors.

- Supporting documents can be uploaded in XML or iXBRL formats, reducing errors and accelerating processing.

- The Individual Tax Portal, Business Tax Portal, and Tax Representative Portal, launching mid-2026, centralize filings, track deadlines, and provide official updates.

Organized documentation and preparation

- Collect IR56B forms, salary statements, rental income details, and other records early to prevent last-minute delays.

- Keep clear and structured records of deductible expenses, including MPF contributions, charitable donations, self-education costs, and home loan interest. Proper documentation streamlines reporting and audit readiness.

- Notify the IRD promptly if taxable income exists but no return has been received.

Professional guidance for complex situations

Tax advisors can help with cross-border operations, corporate structures, or specialized deductions. Expert guidance is crucial for accurate filings, the correct application of exemptions, and compliance with evolving regulations.

Navigating Hong Kong’s tax requirements can be complex, especially for companies and individuals with multiple income streams or international operations, but working with BBCIncorp lets you simplify this process.

Why choose BBCIncorp for Hong Kong tax filing

Managing tax obligations in Hong Kong requires accuracy, local insight, and consistent execution. That’s why international businesses often work with a partner that understands both the Inland Revenue Department practice and global compliance expectations. And BBCIncorp delivers Hong Kong tax filing services built around integrity, accountability, and results.

Comprehensive tax and compliance support

We provide end-to-end assistance for corporate tax filings in Hong Kong and individual filings:

- Assistance with the preparation and filing of profits tax returns, salaries tax returns, and personal filings

- Completion and electronic submission of required supplementary forms, including incentive and exemption-related schedules

- Structured review of income, expenses, and deductions to reduce filing errors

- Direct liaison with the IRD for follow-ups and clarification requests

- Support with eTAX submissions to meet the Hong Kong tax filing deadline

Integrated business services under one platform

The most effective way to manage tax compliance is to integrate it with broader business operations.

Our comprehensive corporate services in Hong Kong include:

- Hong Kong company incorporation

- Opening a business account

- Business accounting services covering accounting, auditing, tax filings, and other financial reporting

- Payroll processing and employer reporting obligations

- Support for company secretarial services

- Ongoing compliance with Hong Kong requirements

- E-commerce solutions for global expansion

We provide the service you need through a single coordinated framework via our Client Portal platform. This centralized online system allows you to order services, track progress in real time, communicate directly with our team, upload, and store documents securely in one place.

With practical execution and a dedicated focus on compliance outcomes, BBCIncorp tax services support businesses operating in Hong Kong with stability and confidence. Visit our website today to learn more.

Planning ahead for the 2026 tax season

Timely preparation remains one of the most effective ways to manage the Hong Kong tax filing deadline. Starting early reduces last-minute pressure, lowers the risk of errors, and allows businesses to respond calmly to Inland Revenue Department queries. Both individuals and companies benefit from planning, especially when income sources span multiple jurisdictions or involve related entities.

Taking early action also improves compliance with statutory timelines. Particularly, individuals gain flexibility ahead of the personal tax filing deadline, while companies place themselves in a stronger position to meet the Hong Kong corporate tax filing deadline without relying on reactive extensions.

Best practices to stay on track

Consistent record management throughout the year is essential:

- Maintain complete records of income, expenses, and supporting documents as transactions occur

- Track income sources separately, particularly where offshore activities or intercompany arrangements exist

- Organize deduction records such as payroll costs, rental expenses, professional fees, and statutory contributions

- Review accounting year-end dates early to anticipate the applicable HK tax filing deadline and extension framework

Engage professional services

Early engagement with professional advisors provides time to review reporting positions, confirm compliance under updated rules, and identify applicable reliefs or incentives. This proactive approach allows issues to be addressed before returns are due, reducing disruption and avoiding unnecessary assessments.

Planning ahead transforms tax filing into a structured process. With records prepared and advice secured in advance, businesses operating in Hong Kong approach the 2026 tax season with clarity, control, and confidence.

Conclusion

Meeting the Hong Kong tax filing deadline remains a core responsibility for businesses operating in the city, particularly those with international ownership and cross-border activities. Clear knowledge of filing timelines, accurate preparation of records, and timely submission help reduce exposure to penalties, estimated assessments, and unnecessary follow-up from the Inland Revenue Department.

A structured approach to tax compliance supports better financial visibility and long-term stability. A well-organized filing system aligns with IRD requirements, giving businesses greater confidence in their reporting position and reducing operational disruption. Thus, professional help from BBCIncorp further strengthens this process with practical guidance at each stage.

For timely assistance and details on our Hong Kong tax filing services, don’t hesitate to send a message to BBCIncorp at service@bbcincorp.com.

Frequently Asked Questions

Which tax incentives does Hong Kong offer?

Hong Kong provides several key tax incentives to attract investment and support business growth. The two-tier profits tax system taxes the first HK$2 million of profits at 8.25 percent and the remainder at 16.5 percent. Certain industries, such as corporate treasury centers, aircraft leasing, and reinsurance businesses, enjoy concessionary tax rates.

Profits derived from outside Hong Kong are generally exempt from local taxation under the territorial tax principle. The Inland Revenue Department also allows deductions for expenses directly related to generating assessable profits and for approved research and development activities.

Additionally, charitable donations up to 35 percent of assessable income are deductible. These incentives make Hong Kong a competitive tax jurisdiction with low rates and transparent rules.

Can I claim relief from double taxation in Hong Kong?

Yes. Hong Kong has signed double taxation agreements (DTAs) with over 40 jurisdictions to prevent the same income from being taxed twice. These agreements determine how income is taxed between Hong Kong and its treaty partners, helping residents and businesses avoid double taxation on cross-border income.

Relief is generally available through exemptions or foreign tax credits, depending on the terms of each DTA. To claim the benefit, taxpayers must prove Hong Kong tax residency and submit the required documentation to the Inland Revenue Department.

Are foreigners required to file taxes in Hong Kong?

Tax filing obligations in Hong Kong depend on income source rather than residency or nationality. Foreigners must file a tax return if they earn Hong Kong-sourced income from employment, rental properties, or a sole proprietorship. Filing is also required once the Inland Revenue Department issues a return, even when income falls below the taxable threshold or no tax is ultimately payable.

Hong Kong operates a territorial tax system, so income sourced outside Hong Kong is generally not taxable. However, businesses must submit a return when requested, and incorrect assumptions about source rules will lead to compliance issues.

Is it possible to get more time to file?

Additional filing time may be granted under specific conditions.

Individuals and sole proprietors who submit returns electronically through eTAX receive an automatic one-month extension beyond the standard deadline stated on the return. Sole proprietors also benefit from a longer base filing period than salaried individuals.

Companies may obtain extended deadlines by appointing a tax representative and joining the IRD block extension scheme, which aligns filing dates with accounting year end categories. These extensions apply only to filing deadlines, and payment dates shown on tax assessments remain unchanged and must be observed.

Are the filing deadlines different for paper filing and e-filling/ iTR filing?

Yes. The filing method directly affects deadlines for individuals and sole proprietors. Paper submissions must follow the standard due date printed on the tax return, usually one month from the issue date. Electronic filing through eTAX or iTR systems provides an automatic one month extension, offering additional time without a separate application. This benefit applies only when the return is submitted online.

In addition, corporate profits tax deadlines are not determined by paper or electronic format alone, but by accounting year end codes and approved extension arrangements with the IRD.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- Understanding Hong Kong tax filing deadlines for 2026

- Individual tax filing in Hong Kong

- Corporate profits tax filing requirements

- Penalties and risks of non-compliance

- Tips for efficient tax filing and compliance

- Why choose BBCIncorp for Hong Kong tax filing

- Planning ahead for the 2026 tax season

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.