Individuals are generally required to stay compliant with personal tax returns in Hong Kong, known as the Salaries Tax and Personal Assessment, to report income and calculate their tax liability. However, there are other types of tax returns that individuals must also stay compliant with and report to the Inland Revenue Department (IRD), depending on specific circumstances.

In this article, we will outline the various tax return obligations that individuals in Hong Kong may need to fulfill.

What type of personal tax returns are required in Hong Kong?

In Hong Kong, a tax return is a financial document you submit to the government, reporting your income, deductions, and other financial details for a specific tax year. The government uses this information to accurately calculate the amount of tax you are required to pay.

Filing tax returns is one of the most crucial annual requirements to ensure that your tax liabilities are accurately determined and that you pay the correct amount of taxes owed under Hong Kong’s tax laws.

Income tax return for individuals come in various types, and the specific one you need to file depends on the sources of your income and your financial activities.:

- Salary tax returns (BIR60): For individuals in Hong Kong who earn income from employment, including salaries, wages, bonuses, and other employment-related income.

- Property tax returns (BIR57): If you own property in Hong Kong and earn rental income from it, you may be required to file a property tax return.

- Profits tax returns (BIR52/BIR54): For sole proprietorship and partnerships, or who have income from a trade, profession, or business conducted within Hong Kong.

- Other returns: There are various other returns, such as tax returns for income from interest (IRD61A) or tax returns for income from director’s fees (IRD61E), which may apply to individuals with specific income sources.

It’s important to note that Hong Kong follows a territorial-based tax system, which means that individuals are only required to file a tax report for income that arises in or is derived from Hong Kong. Any income earned outside the country is not subject to Hong Kong taxation, and there’s no need to include it in tax returns.

The filing deadline for personal tax returns in Hong Kong is usually in May each year, and you may be required to provide supporting documents and details of your income and deductions.

In the following section, we will focus on the 3 most common tax returns for individuals, which are: salary tax returns, property tax returns, and profits tax returns.

Salary tax return for individuals

This return helps the government accurately assess and collect salary tax, which is Hong Kong’s version of income tax.

By submitting this tax return, individuals ensure that they are transparent and compliant with the city’s tax laws, allowing the government to calculate the right amount of tax based on their total taxable income.

Eligibility

Individuals in Hong Kong must file a salary tax return if they earn income from employment, like salaries, bonuses, or wages. If your income arises in Hong Kong, you likely need to file this return.

It’s important that you complete, sign, and file the salary tax return on time even if you do not have any income to report.

Tax rate

The tax rate for salaries in Hong Kong is progressive, ranging from 2% to 17%, depending on your income level. Lower-income earners pay lower rates, while higher-income earners pay higher rates.

Tax return forms

The main form required for individual tax filing is known as the Tax Return – Individuals (BIR60) Form.

The Inland Revenue Department (IRD) automatically issues this form to individuals on the first working day of May each year. Upon receiving the tax return, individuals have two filing options:

- Manually fill out the form and submit it by mail; or

- Complete and submit the form electronically via the IRD’s e-Tax service.

The due date for filing a return

The standard deadline for submitting a salary tax return is usually within 1 month from the date of issue.

However, if you opt for electronic filing via the e-Tax service, there might be an extended deadline. This extension is aimed at encouraging electronic filing, which is more efficient and convenient for both taxpayers and the tax administration.

Profits tax return Hong Kong for individuals

Eligibility

Individuals who have income from a trade, profession, or business conducted within Hong Kong must file a Profit Tax Return.

- Self-employed individuals: If you are running a business as a sole proprietor or in partnership with others, and the business operates in Hong Kong, you are eligible to file this return.

- Partnerships: Partnerships conducting business activities in Hong Kong are required to file a profit tax return. Each partner’s share of the partnership’s profit is subject to taxation.

Tax rate

In Hong Kong, the profit tax rate for unincorporated businesses, which includes partnerships and sole proprietorships, is structured as follows:

- The first HK$2 million of assessable profits are taxed at a rate of 7.5%.

- Any portion of assessable profits exceeding HK$2 million is taxed at a rate of 15%.

Tax return forms

The specific form you need to use depends on your specific situation:

- For persons other than corporations (sole proprietors or partnerships): you should file Profit Tax Return – Form BIR52 to report income and expenses as an individual taxpayer

- For non-resident persons: you should file Profit Tax Return – Form BIR54

The IRD issues these forms to individuals and partnerships on a specific date, normally the first working day of April each year.

Upon receipt, the taxpayer has two primary options for filing their profit tax returns:

- Electronic filing through the IRD’s e-Tax service, along with any required supplementary forms, other forms, or documents that may be needed; or

- Manually filling out the physical forms and mailing them to the IRD, along with any necessary supplementary documents.

The due date for filing a return

Individuals must fill in the provided form and submit it back to IRD within 1 month from the issuance date, typically around April or May each year.

Property tax return for individuals

Eligibility

You need to file a property tax return if you meet any of the following conditions:

- You own a property in Hong Kong by yourself;

- You jointly own or co-own a property in Hong Kong with other individuals, corporations, or bodies of persons; or

- You earn rental income from a property in Hong Kong, regardless of whether you own it by yourself or with others.

Tax rate

The property tax rate is set at a standard rate of 15% on the net assessable value of the rental income. This means that the tax payable is calculated as 15% of the rental income after allowable deductions for expenses have been made.

Allowable deductions can include rates paid to the government, repairs, and maintenance expenses among others.

Tax return forms

To report income from property that is jointly owned or co-owned by yourself with other person(s), including corporations and bodies of persons, you are required to complete and submit Property Tax Return – Form BIR57.

The due date for filing a return

The deadline for submitting your property tax return is usually one month from the date IRD sends the form to you, which is on the first working day of April each year.

How to file a personal tax return Hong Kong?

Filing a tax return for individuals in Hong Kong is straightforward. Below is a step-by-step guide to help you navigate through the electronic filing process.

Step 1: Determine tax liability

Before starting the filing tax return process, you need to have a clear understanding of your tax liability. This means you should carefully evaluate all the different kinds of income you’ve received.

- Does the income come from your salary for a business?

- Does it come from the rental you receive every month?

- Is it the profit you gain from your sole proprietorship?

- Are you a director of one business?

Answer these questions to know which type of tax return you need to prepare for filing and duly complete. But remember, thanks to the territorial-based tax system, you typically only have to declare and pay taxes on the income that originated within Hong Kong.

Step 2: Prepare supporting documents

Gathering all crucial supporting documents and records is a fundamental step in your tax preparation, as they provide evidence for the information reported on your tax return and are particularly valuable in case the Inland Revenue Department (IRD) requests additional proof of your income.

Step 3: Complete the tax return Form

You will receive the tax return form from the IRD tailored to your specific income situation. Once received, it’s your responsibility to accurately complete and submit it back to the IRD within the stipulated one-month timeframe. Ensure that you fill in the details thoroughly, reflecting all your income sources as required. This prompt and accurate completion is crucial for staying compliant with tax regulations.

Step 4: File tax return online

You can report your income tax with e-filing, or in other words, use the e-Tax service. This serves as the portal to the electronic services offered by the Hong Kong IRD. It provides a convenient, secure, and eco-friendly way for individuals to fulfill their tax-related obligations. Here are the details you can follow to file your tax return online.

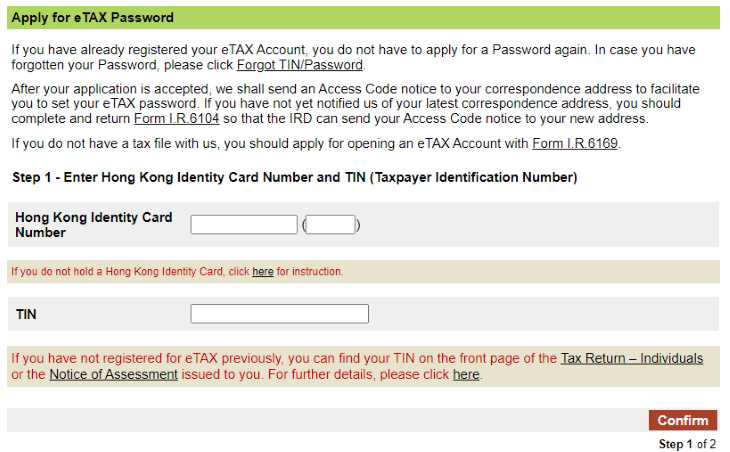

First, log in to the eTax Portal. The information you need to fill in to log in requires you to have your Taxpayer identification number (TIN) which will show in your tax return on receiving from the IRD and your eTAX password.

If you are a new user, you must apply for the eTax password. Click the button “Apply for eTAX Password” on the bottom right of the screen.

Fill in the necessary information and the IRD system will send you the access code within 2 working days to fill in.

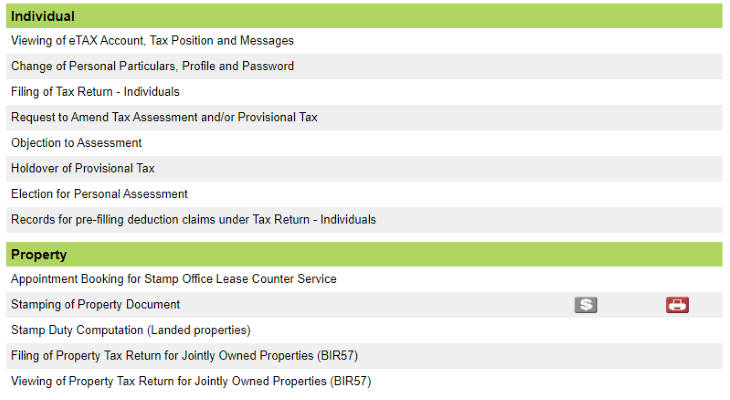

Once log in, click the “View services” button to choose the service you want to use on the portal. For each type of tax return filing, there may be some differences in the sequences of steps.

However, the logic behind it remains the same. You are required to complete all relevant sections with your income details and, if necessary, upload supporting documents. Ensure to adhere to the provided guidelines to input the correct information accurately.

After completing all the required fields, you can choose “Compute Estimated Salaries Tax/Property Tax/ Profit Tax Before Submission” to see the estimated tax payable.

Sign and submit the return using your eTax password, MyGovHK password, a digital certificate, or the iAM Smart platform.

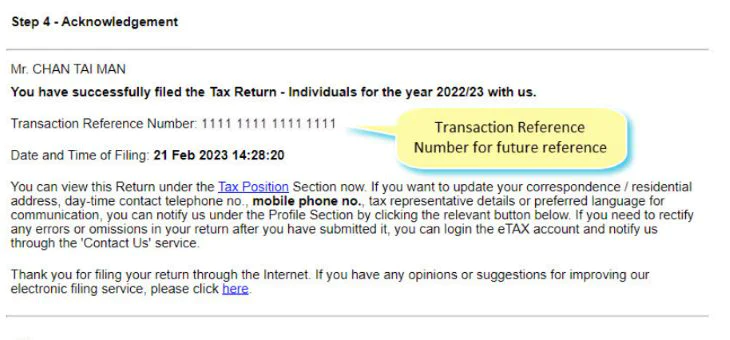

Once the return is submitted, the acknowledgment screen will be shown. Your return data will be kept for 3 years for viewing, printing, and saving through services under the Tax Position Section of your eTAX Account.

Conclusion

Grasping the essentials of personal tax returns Hong Kong is crucial for every individual earning within the region. Staying compliant not only keeps you on the right side of the law but also ensures that you avoid unnecessary fines and complications.

It’s also important to manage your finances and uphold credibility in a vibrant financial hub like Hong Kong.

For further information relating to business formation in Hong Kong, feel free to contact us at service@bbcincorp.com.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.