What You Should Know About Banking In Mauritius?

Overview of banking system in Mauritius

Why open offshore bank account in Mauritius?

How to open a Mauritius corporate

bank account online

Choose a bank

Research and choose a bank that meets your business needs, considering factors like minimum deposit, fees, and services.

Check your eligibility

Check bank's eligibility criteria and ensure you meet the minimum requirements to open an account (i.e., residency status, business type, or minimum deposit, etc.)

Submit online application

Upload the necessary documents, provide your personal details, and submit your online application to open a Mauritius corporate bank account.

Wait for account approval

The banks may require additional information to verify your application. The approval timeframe may vary depending on the application complexity and internal processes.

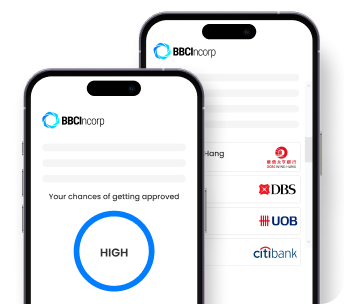

Wonder which can be the best bank for your Mauritius company? Let's find out with our Banking Tool

TRY IT NOW

Required Documents

The specific documents needed will vary depending on the bank you choose. Here are some commonly requested items:

Account application forms

Bank statements

Bank reference letter

Business proofs (e.g., sales/purchase orders, invoices, contracts)

Certified copies of valid passports and recent address proofs (within 3 months) for all directors, shareholders, and account signatories

Business plan

Certified copies of Mauritius GBC company documents (e.g., Certificate of Incorporation, Memorandum & Articles of Association, Registers of directors/shareholders)

Certificate of Good Standing/Certificate of Incumbency

For precise document requirements tailored to your situation, please contact our support team.