Table of Contents

In 2012, the Pebble smartwatch campaign raised over $10 million on Kickstarter, far surpassing its $100,000 goal(1). This landmark success showcased the power of crowdfunding to bring innovative ideas to life.

For many entrepreneurs, securing traditional funding through banks or investors can be a major hurdle. Crowdfunding offers a viable alternative, allowing startups to validate ideas and attract early supporters without giving up equity or taking on debt.

This article provides a comprehensive guide to crowdfunding for business startup ventures. Whether you’re new to the concept or looking to refine your approach, you’ll find key insights, strategies, and best practices to help you launch a successful campaign.

What is crowdfunding?

Crowdfunding has emerged as a modern financing method that enables individuals and businesses to raise capital online from a broad audience. As traditional funding becomes increasingly competitive and selective, crowdfunding offers an accessible alternative for entrepreneurs, creatives, and social causes.

Crowdfunding definition and explanation

Crowdfunding is a financing method where individuals or organizations raise capital from a large number of people, typically through online platforms. Instead of relying on a single investor, entrepreneurs collect smaller contributions from a broad group of supporters.

The crowdfunding meaning goes beyond simple fundraising. It also serves as a tool for building community support, validating business ideas, and gaining early traction. Contributors may receive rewards, equity, or early access to products, depending on the crowdfunding model used.

Popular platforms like Kickstarter, Indiegogo, and GoFundMe have made this model accessible to startups, nonprofits, and creatives seeking alternatives to traditional financing.

How crowdfunding differs from traditional funding methods

Traditional funding methods involve banks, venture capital firms, or angel investors who require detailed business plans, credit histories, or collateral. These methods can be restrictive and time-consuming.

Crowdfunding removes many of these barriers. Campaigns are often built around compelling narratives, prototypes, and direct engagement with potential customers.

This approach democratizes access to capital and gives creators a way to test their products in real time. In the American market, crowdfunding has become an essential pathway for early-stage ventures that want to build visibility, validate demand, and raise funds simultaneously.

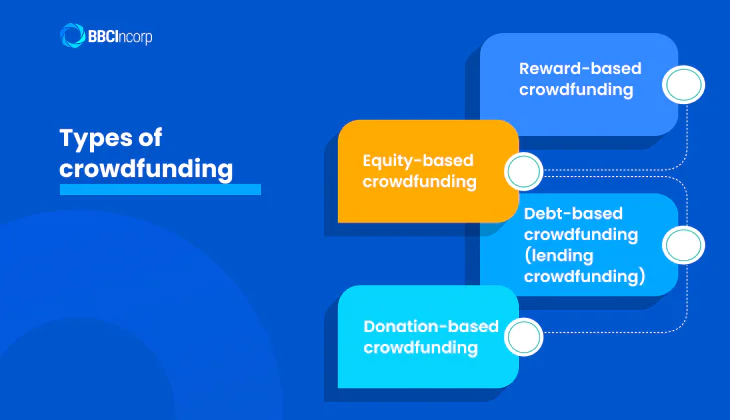

Types of crowdfunding

Crowdfunding offers various models to raise capital, each tailored to specific objectives and contributor incentives. Understanding these crowdfunding types can help startups and small businesses choose the most suitable funding approach.

Reward-based crowdfunding

What is Reward-Based Crowdfunding?

Reward-based crowdfunding involves individuals contributing funds to a project in exchange for non-monetary rewards, such as products or exclusive experiences. This model is popular among startups aiming to validate concepts and generate early interest. It is a practical option when exploring crowdfunding for start-ups or product-based ventures.

How Reward-Based Crowdfunding Works?

Entrepreneurs set a funding goal and offer tiered rewards corresponding to different contribution levels. Supporters pledge amounts aligned with their desired rewards.

If the campaign reaches its target, funds are collected, and rewards are fulfilled. Platforms like Kickstarter and Indiegogo facilitate these campaigns.

Pros and cons of Reward-Based Crowdfunding

Pros:

- Provides early market validation and customer engagement.

- Enables pre-selling of products, aiding in production financing.

- Does not require relinquishing equity.

Cons:

- Obligates creators to deliver promised rewards, which can be challenging.

- Success is not guaranteed; many campaigns fail to meet funding goals.

- Public exposure of ideas may risk imitation by competitors.

Equity-based crowdfunding

What is Equity-Based Crowdfunding?

Equity-based crowdfunding allows investors to fund a business in exchange for ownership shares or equity. This approach suits crowdfunding for investment projects or startups seeking substantial capital and willing to share future profits.

How Equity-Based Crowdfunding Works?

Businesses present their ventures on equity crowdfunding platforms, detailing their business plans and valuation. Investors evaluate these opportunities and invest in exchange for equity stakes.

Successful funding results in investors becoming partial owners, sharing in profits and potential appreciation.

Pros and Cons of Equity-Based Crowdfunding

Pros:

- Access to significant capital without the burden of loan repayments.

- Investors may offer valuable expertise and networks.

- Aligns investor and entrepreneur interests toward business success.

Cons:

- Requires sharing ownership and potential dilution of control.

- Involves complex legal and regulatory compliance.

- Success depends on convincing investors of the business’s potential.

Debt-based crowdfunding (lending crowdfunding)

What is Debt-Based Crowdfunding?

Debt-based crowdfunding, or peer-to-peer (P2P) lending, entails individuals lending money to businesses or individuals with the expectation of repayment plus interest.

This model suits crowdfunding for small business owners seeking loans without traditional financial intermediaries.

How Debt-Based Crowdfunding Works?

Borrowers apply for loans on P2P platforms, providing financial details and loan purposes. Lenders assess these applications and fund loans that match their risk preferences. Borrowers repay the principal with interest over agreed terms.

Pros and Cons of Debt-Based Crowdfunding

Pros:

- Offers access to capital for those who may not qualify for traditional loans.

- Potentially lower interest rates due to reduced overhead.

- Streamlined application and funding processes.

Cons:

- Obligates timely repayments, impacting cash flow.

- Interest rates may be higher for borrowers with lower creditworthiness.

- Lenders assume the risk of borrower default.

Donation-based crowdfunding

What is Donation-Based Crowdfunding?

Donation-based crowdfunding involves individuals donating money to support a cause, project, or individual without expecting financial returns. This model is common for charitable initiatives, community projects, or personal emergencies.

How Donation-Based Crowdfunding Works?

Organizers create campaigns detailing their cause and funding needs. Supporters contribute voluntarily, motivated by altruism or belief in the cause. Platforms like GoFundMe facilitate these campaigns.

Pros and Cons of Donation-Based Crowdfunding

Pros:

- Provides funding without the obligation of repayment or equity loss.

- Engages communities and raises awareness for causes.

- Simplified setup and minimal regulatory requirements.

Cons:

- Relies heavily on the emotional appeal and network reach.

- Competitive space with numerous campaigns vying for attention.

- No guarantee of meeting funding goals.

Pros and cons you should know about crowdfunding

Crowdfunding has become an increasingly popular way for startups and small businesses in the U.S. to secure financing outside of traditional channels. While it offers numerous benefits, there are also significant challenges entrepreneurs must consider.

Pros of crowdfunding for startups

Crowdfunding opens several doors for early-stage businesses, beyond just raising money.

- Access to capital: Helps overcome traditional funding barriers such as bank loan rejections or investor disinterest.

- Market validation: A successful campaign proves public demand before product launch.

- Audience building: Creates a base of early adopters who often become loyal customers.

- Feedback and insights: Supporters provide constructive input during the development phase.

- Less risk: Unlike loans, you aren’t burdened with debt or required to give up equity (depending on the model).

- Publicity and marketing: A well-executed campaign can attract media attention and organic promotion.

- Partnership and networking opportunities: Exposure can lead to collaboration with investors, suppliers, or mentors.

Cons of crowdfunding for business

Despite its benefits, crowdfunding poses some risks and challenges.

- Risk of failure: Not all campaigns meet their funding goals.

- Idea theft: Public exposure makes your concept vulnerable to copycats.

- Platform fees: Sites often charge between 5%–10% of total funds raised.

- Time and effort: Planning, promoting, and managing the campaign requires significant resources.

5 best crowdfunding sites for startups

Crowdfunding platforms have revolutionized how startups raise capital by connecting entrepreneurs directly with potential backers. These platforms not only provide access to funds but also serve as a means for market validation and community building.

Choosing the right platform is crucial and should be based on several factors:

- Nature of your business or project

- Financial needs and objectives

- Market validation

- Ownership and control

- Ability to fulfill obligations

- Legal and regulatory considerations

Here are five prominent crowdfunding platforms suitable for startups:

Kickstarter

- Pricing and fees: Kickstarter charges a 5% platform fee on the total funds raised, in addition to payment processing fees of 3% + $0.20 per pledge.

- Target audience: Primarily caters to creative projects, including art, music, film, and technology innovations.

- Pros and cons: High visibility and credibility, but it’s all-or-nothing—if you don’t hit your goal, you receive no funds.

Indiegogo

- Pricing and fees: Indiegogo imposes a 5% platform fee on funds raised, with payment processing fees varying by currency (e.g., 3% + $0.20 for USD transactions).

- Target audience: Supports a wide array of projects, notably in technology and innovation sectors.

- Pros and cons: Offers flexible funding (keep what you raise), but lower visibility than Kickstarter.

GoFundMe

- Pricing and fees: Charges a transaction fee of 2.9% + $0.30 per donation.

- Target audience: Ideal for personal causes, charitable events, and community projects.

- Pros and cons: Best for donation-based needs, but not ideal for crowdfunding for investment projects or product launches.

Patreon

- Pricing and fees: Patreon offers tiered plans: Lite at 5%, Pro at 8%, and Premium at 12% of monthly income, plus payment processing fees.

- Target audience: Content creators such as artists, podcasters, and educators seeking recurring support.

- Pros and cons: Strong for community building and recurring revenue, but not suited for one-time startup funding.

StartEngine

- Pricing and fees: StartEngine charges companies a fee upon successful fundraising; specifics can vary based on the offering.

- Target audience: Entrepreneurs and startups seeking equity crowdfunding from both accredited and non-accredited investors.

- Pros and cons: One of the top equity crowdfunding platforms in the U.S.; supports Reg A+ and Reg CF, but requires significant documentation and legal readiness.

Alternatives to crowdfunding

While crowdfunding has gained popularity as a means of raising capital, startups have several other funding avenues to consider:

- Angel investors: Affluent individuals who provide capital for startups in exchange for equity or convertible debt. They often offer mentorship alongside funding. For example, Jeff Bezos invested $250,000 in Google during its early stages.

- Venture capital: Professional investment firms that manage pooled funds to invest in startups with high growth potential. They typically invest larger sums than angel investors and may require significant equity. Notable firms include Sequoia Capital and Andreessen Horowitz.

- Small business loans: Traditional bank loans or those backed by the Small Business Administration (SBA) provide startups with debt financing. These require repayment with interest but allow founders to retain full ownership. The SBA’s 7(a) loan program is a common choice for small businesses.

- Grants: Non-repayable funds offered by government agencies, corporations, or foundations to support specific industries or initiatives. For instance, the National Science Foundation provides grants for technological innovations.

- Self-financing: Also known as bootstrapping, this involves using personal savings or revenue to fund the business. While it avoids debt and dilution of ownership, it places financial risk on the founder. Many entrepreneurs start this way to maintain control.

- Friends and family: Securing funds from personal connections can be a quick way to raise capital. However, it’s essential to formalize agreements to prevent misunderstandings. Open communication about risks is crucial.

- Business accelerators and incubators: Programs that provide startups with mentorship, resources, and sometimes capital in exchange for equity. Y Combinator and Techstars are prominent examples, offering intensive support to early-stage companies.

- Strategic partnerships: Collaborating with established companies can offer financial support, resources, and market access. For example, a tech startup might partner with a larger firm to co-develop a product, sharing both costs and revenues.

Exploring these funding avenues allows startups to assess the full spectrum of financial strategies, from crowdfunding sources to equity investment and beyond, ensuring a well-informed growth path.

How to run a successful crowdfunding campaign?

Launching a successful crowdfunding campaign requires careful planning, compliance, and engagement. While platforms provide the infrastructure, the responsibility lies with founders to attract and retain the trust of crowdfunding investors. Below are key steps to maximize your campaign’s impact.

Step 1: Understanding legal and regulatory

Before starting a campaign, familiarize yourself with federal and state laws governing crowdfunding. In the U.S., the Securities and Exchange Commission (SEC) regulates equity crowdfunding under the JOBS Act.

Businesses must comply with disclosure rules, especially regarding financial statements, use of proceeds, and business risks. Additionally, there are investment limits for non-accredited investors based on income and net worth. Working with legal counsel is strongly recommended to ensure full compliance.

Step 2: Creating a compelling campaign

A successful campaign begins with a clear and concise message that tells your story, explains your value proposition, and outlines how funds will be used.

Your campaign page should be visually compelling, using high-quality images and videos to enhance credibility. Setting realistic funding goals increases your chances of success. For reward-based campaigns, offer incentives that are desirable, feasible, and aligned with your brand.

Step 3: Marketing your campaign

Strategic marketing is essential. Leverage social media, email lists, and online communities to build momentum before and during the campaign.

Outreach to media outlets, bloggers, and influencers can amplify visibility. Engaging directly with potential crowdfunding investors fosters trust and builds early traction.

Step 4: Managing your campaign

Transparency is critical once the campaign is live. Provide regular updates about progress, milestones, and any changes. This maintains interest and builds accountability.

Respond promptly to questions and concerns to demonstrate reliability. After the campaign ends, fulfilling promised rewards or equity commitments on time strengthens your brand’s reputation and encourages long-term support.

Conclusion

Crowdfunding has emerged as a transformative tool in today’s entrepreneurial landscape, offering startups a dynamic way to secure capital, validate ideas, and build a community of early supporters. As a non-traditional financing option, it levels the playing field for new founders across industries.

BBCIncorp supports entrepreneurs in laying a strong legal foundation, guiding them through compliance and structuring for long-term success. Whether you’re considering crowdfunding for business startup growth or exploring offshore company formation, our expertise can help streamline your journey.

Explore this innovative funding path with confidence, knowing you’re backed by a team committed to your business’s development from day one.

Reference Source:

(1): https://edition.cnn.com/2012/05/14/tech/gaming-gadgets/pebble-smartwatch-kickstarter-project/index.html

Frequently Asked Questions

Should you consider crowdfunding for your small business startup?

Yes, crowdfunding can be a viable option for small business startups. It allows entrepreneurs to raise capital without relying on traditional loans or investors, providing an alternative means to fund their ventures.

Can you actually make money from crowdfunding?

Yes, businesses can generate revenue through crowdfunding. By presenting a compelling project or product, companies can attract backers who contribute funds in exchange for rewards, equity, or other benefits, depending on the type of crowdfunding utilized.

What are the rules of crowdfunding?

Crowdfunding is subject to various regulations, particularly in the United States under the Jumpstart Our Business Startups (JOBS) Act.

These rules include compliance with Securities and Exchange Commission (SEC) regulations, investment limits for non-accredited investors, and specific disclosure requirements for companies seeking to raise funds through crowdfunding platforms.

Do you pay crowdfunding back?

The obligation to repay funds raised through crowdfunding depends on the type of crowdfunding employed. In debt-based crowdfunding, businesses are required to repay the borrowed funds with interest.

However, in reward-based or donation-based crowdfunding, there is typically no obligation to repay the funds, though businesses may need to fulfill promised rewards or acknowledgments to backers.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.