Table of Contents

When deciding on the best state to form your LLC, the choice often comes down to Wyoming vs. Delaware LLC. Delaware provides a robust legal framework, sophisticated business courts, and widespread investor recognition, making it ideal for larger companies or those seeking external investment. On the other hand, Wyoming attracts small businesses and startups with its low costs, minimal regulatory requirements, and strong privacy protections.

Both states offer unique advantages, and the best option depends on your company’s priorities, growth plans, and administrative preferences. In this article, we’ll explore the key features of each state and help you determine which is the right fit for your LLC.

Summary:

- Wyoming LLC: Best for small businesses and startups; benefits include lower costs, fewer administrative requirements, and strong privacy protections.

- Delaware LLC: Preferred by larger companies and those seeking investors; advantages include a well-established corporate law system, specialized business courts, and investor familiarity.

What are the common points between Delaware and Wyoming?

Delaware has been known as a promising jurisdiction for a long time, Wyoming began to gain popularity as a convenient option in recent years. This is a reflection of the broader trend of entrepreneurs recognizing why start an LLC in the US as a strategic move for asset protection and operational flexibility.

Business environment

First, both Wyoming and Delaware are highly regarded as business-friendly locations for registering an LLC.

While Delaware has been known as a promising jurisdiction for a long time, Wyoming began to gain popularity as a convenient option in recent years.

Favorable legal procedures

Secondly, you can enjoy pro-business laws and low corporate income taxes in these states. Moreover, there are streamlined filing processes, minimizing the costs and paperwork for your LLC registration.

With their benefits, the two locations have attracted numerous companies operating from all over America.

For instance, in Delaware, over half of the publicly traded companies in the country, and approximately 63% of all Fortune companies, have established their businesses here to flourish.

Meanwhile, Wyoming emerges as an ideal choice for launching small businesses. Its potential has been acknowledged by The Economist Magazine, which refers to the state as the “Switzerland of Rocky Mountain” highlighting its advantageous business climate.

What differences between Delaware and Wyoming LLCs?

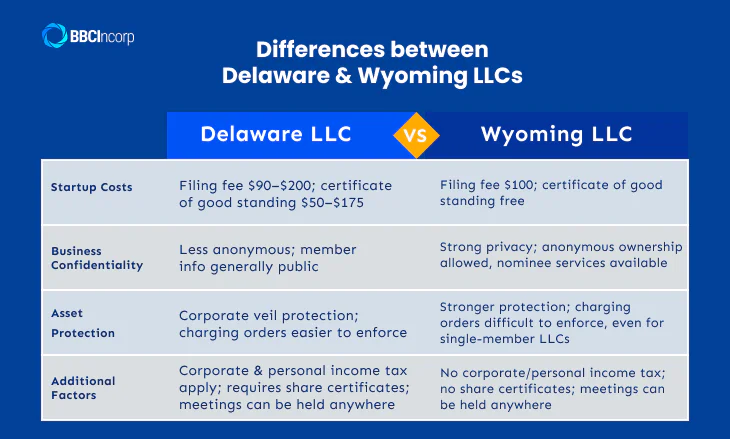

Now that we have explored the shared advantages of between Wyoming LLC vs. Delaware LLC, let’s delve into their differences, which set them apart as distinct options:

Despite liability protection and a balanced regime for business registration, not all companies can operate smoothly in these two states. There are specific differences you must understand.

How much to start an LLC in Delaware and Wyoming?

To start a limited liability company in these states, you must pay a filing fee. For Wyoming, the fee is $100, while in Delaware, it will cost you $90.

If you want to file an annual report in Wyoming, the fee is fixed at $50, depending on the assets of the company. In the case of Delaware, it doesn’t charge fees for annual reports. However, there is an annual tax of $250.

Occasionally, you may need to provide a Delaware certificate of good standing, a requirement by various financial institutions.

Obtaining this certificate in Delaware entails a cost of $175 for a long form and $50 for a short form. In contrast, Wyoming offers this certificate completely free of charge.

While both states offer a supportive environment for entrepreneurs, the overall expenses from initial setup to annual maintenance can differ notably.

| Types | Wyoming LLC | Delaware LLC |

| Initial Formation Fee | $100 | $90–$200, depending on expedited filing. |

| Annual Fees / Taxes |

|

|

| Registered Agent Fee | $50–$300/year | $50–$300/year |

| Reporting Requirement | Simple annual report filing | Annual franchise tax filing required |

| Estimated Total Annual Cost | $110–$360/year | $350–$600/year |

Level of business confidentiality

When it comes to confidentiality, Wyoming stands out for its strong privacy protections. The state allows anonymous ownership of LLCs, meaning members’ or managers’ names do not need to be publicly disclosed. Business owners can also use nominee services or special provisions to keep their identities confidential, ensuring a higher level of privacy.

In contrast, Delaware offers less anonymity. While it remains a reputable and secure jurisdiction, information about LLC members is generally more accessible through public records due to its stricter disclosure requirements.

In summary, both states maintain privacy safeguards, but Wyoming provides stronger confidentiality, making it ideal for those prioritizing anonymity. However, Delaware’s transparent framework, supported by its specialized Court of Chancery may appeal more to businesses seeking legal certainty and investor trust.

Asset protection

When it comes to safeguarding your assets, Wyoming LLCs are widely recognized for offering some of the best protection in the U.S. The state provides charging order protection, even for single-member LLCs, meaning creditors can only access a member’s distributions rather than ownership rights. It’s also extremely difficult to pierce the corporate veil in Wyoming, except in rare cases like fraud.

By comparison, Delaware LLCs also protect owners through the corporate veil, but their laws are generally seen as less restrictive for creditors. Charging orders may be easier to enforce, offering slightly weaker protection for individuals. However, Delaware still provides a stable legal environment and remains a preferred choice for many companies. For those prioritizing asset security and privacy, Wyoming often stands out as the stronger option.

Annual report fees

Filing annual reports is an essential part of keeping your LLC in good standing, and the costs vary significantly between Wyoming and Delaware. In Wyoming, maintaining compliance is relatively affordable. The state charges a minimum annual report fee of $50, plus a small $2 processing fee. The amount may increase depending on the total value of your company’s assets located within the state..

In Delaware, annual maintenance costs are higher. Every LLC must pay a flat $300 franchise tax each year, regardless of income or asset value. This payment, along with the annual report filing, can be easily handled online via Delaware’s official business services portal. Although Delaware’s fees are more expensive, many larger corporations consider them worthwhile for the state’s strong legal framework and investor-friendly reputation.

Additional factors to consider

In addition to the fees and business confidentiality, don’t forget to carefully evaluate the following factors:

| Requirements | Delaware | Wyoming |

| Corporate income tax | Yes | No |

| Personal income tax | Yes | No |

| Corporate shares tax | No | No |

| Franchise tax | Yes | No |

| Minimal annual tax | No | Yes |

| Requires shares certificate | Yes | No |

| Requires minimal capital | No | No |

| Meetings can be held anywhere | Yes | Yes |

taxes to pay ?

forms to file ?

Find the answers you need in this guide.

Ultimately, the choice between a Delaware LLC and a Wyoming LLC will depend on your unique circumstances. Make sure to consult a legal professional for advice on the right jurisdiction.

Should I create an LLC in Wyoming or Delaware?

Once you are familiar with the factors differentiating Delaware LLC from Wyoming LLC, let’s decide which state is beneficial for your business!

Why should you choose Delaware LLC?

When considering the best state for incorporation, Delaware consistently stands out thanks to its well-established legal system and business-friendly regulations. One of the key benefits of Delaware LLC is the presence of the Court of Chancery, a specialized court dedicated to handling corporate and commercial disputes. Unlike traditional courts, the Court of Chancery does not use juries; instead, cases are decided by experienced judges with strong business and legal backgrounds, ensuring faster and more reliable resolutions.

In addition, Delaware’s corporate lawyers are highly skilled in business law, allowing companies greater flexibility in governance and management structures. Upon registering an LLC in Delaware, the state also offers favorable tax policies, helping reduce overall tax burdens for both businesses and individuals. For entrepreneurs aiming to build scalable companies that benefit from long-term legal stability and tax efficiency, Delaware remains one of the most strategic choices in the U.S.

Why should you choose Wyoming?

Business owners are drawn to Wyoming due to lower administrative and annual operating costs. Additionally, there is the exemption from income, franchise, and corporate taxes, which substantially reduces their tax burdens.

Operating in this state involves adhering to the Corporation Act. This enables companies to be swiftly established. Notably, even non-American entrepreneurs can establish an LLC here.

If you’re looking for somewhere to run a small online shop or an e-commerce business without raising venture capital, Wyoming holds great potential.

Form your LLC in minutes with BBCIncorp

Setting up your business in Delaware has never been easier with BBCIncorp, a trusted global service provider specializing in company formation, banking support, and corporate compliance. With over a decade of experience serving thousands of entrepreneurs worldwide, BBCIncorp ensures that every step of your Delaware LLC formation service is fast, transparent, and fully compliant with U.S. regulations.

Whether you’re a startup founder or an international investor, BBCIncorp simplifies the entire incorporation process. Our all-in-one platform provides a seamless digital onboarding experience, helping you establish your Delaware company with minimal paperwork and maximum efficiency.

Why choose BBCIncorp for your Delaware LLC formation?

- Fast incorporation – Get your LLC formed within just 1–2 business days.

- Comprehensive support – Dedicated experts guide you through every stage of formation.

- Transparent pricing – All Delaware state fees included, with no hidden costs.

- Banking assistance – Support for opening U.S. or multi-currency business accounts.

- Digital convenience – Secure online KYC, e-signature, and centralized document management.

- Tax consultation – Free 30-minute session with CPA and exclusive 10% TaxHub discount.

BBCIncorp empowers entrepreneurs to launch, manage, and scale their Delaware LLCs with confidence, turning complex compliance into a streamlined, growth-ready experience.

To wrap up

When comparing Wyoming vs. Delaware LLC, it’s clear that each state offers unique advantages and regulations tailored to different types of businesses. Whether you value stronger privacy protections in Wyoming or the legal sophistication of Delaware, you should carefully evaluate each factor to find the best fit for your goals.

Consulting with professionals can provide valuable guidance during this decision-making process. Feel free to contact us via service@bbcincorp.com for expert support on setting up your LLC in the U.S. and exploring which state aligns best with your business strategy.

Frequently Asked Questions

Why is it better to form an LLC in Delaware?

- Delaware has no corporate income tax

- Delaware has very favorable tax laws for LLCs

- This state has a well-developed court system that is specifically designed to deal with business disputes.

So forming an LLC there can give your business some added credibility.

Why should you form an LLC in Wyoming?

- Wyoming has no personal income tax and no corporate income tax

- Wyoming has very favorable laws for LLCs

What is the Delaware tax loophole?

Delaware allows corporations and wealthy individuals to avoid paying some taxes in other states. So there’s something called the Delaware Loophole, which allows businesses to avoid paying state corporate income tax where the money is generated.

Should you incorporate a company in Nevada instead of Delaware or Wyoming?

When comparing Wyoming vs. Nevada vs. Delaware LLC, each state offers distinct advantages depending on your business goals and structure. However, Nevada often stands out as the ultimate choice for small businesses seeking easy registration, low corporate taxes, and no state income tax.

Learn more in our article comparing Delaware vs. Nevada LLCs.

What is the best state to form an LLC for an online business?

For online businesses, Delaware is often the best choice thanks to its flexible laws, strong legal protection, and credibility with investors. Its benefits of Delaware LLC also include no state income tax on out-of-state income and an efficient incorporation process.

Which state should I choose when forming my business to save on taxes?

If your goal is tax savings, states like Wyoming, Nevada, and South Dakota have no state income or franchise taxes. Still, Delaware offers a balance of tax efficiency and legal advantages, especially for growing or investor-backed businesses.

Can a non-resident (foreigner) form an LLC in Wyoming or Delaware?

Yes. Both states allow non-U.S. residents to form LLCs without requiring citizenship or residency. Foreign owners must comply with IRS filing rules, and may benefit from pass-through tax for foreigners to avoid double taxation.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.