Table of Contents

What are S corp and LLC?

An LLC, or limited liability company, is a legal entity that can protect owners from personal liability in most instances. Meanwhile, an S corporation is a special type of corporation that meets certain requirements under the Internal Revenue Code. For starters and new business players to the US, you should be aware of this – S corporations are tax statuses that can be elected by limited liability companies (LLCs) or corporations.

An LLC is not a tax designation. Rather, it is a legal structure that can provide limited liability protection for your business. Generally, an LLC tends to be a much simpler business structure than an S corp, but S corps can offer a few key benefits that LLCs do not.

In what follows, we dig into the details of each business structure, the benefits of S corp vs LLC so you can better understand the key differences between the two types and make an informed decision about which one is right for you.

What are the differences between S corp and LLC?

S corp vs LLC tax benefits

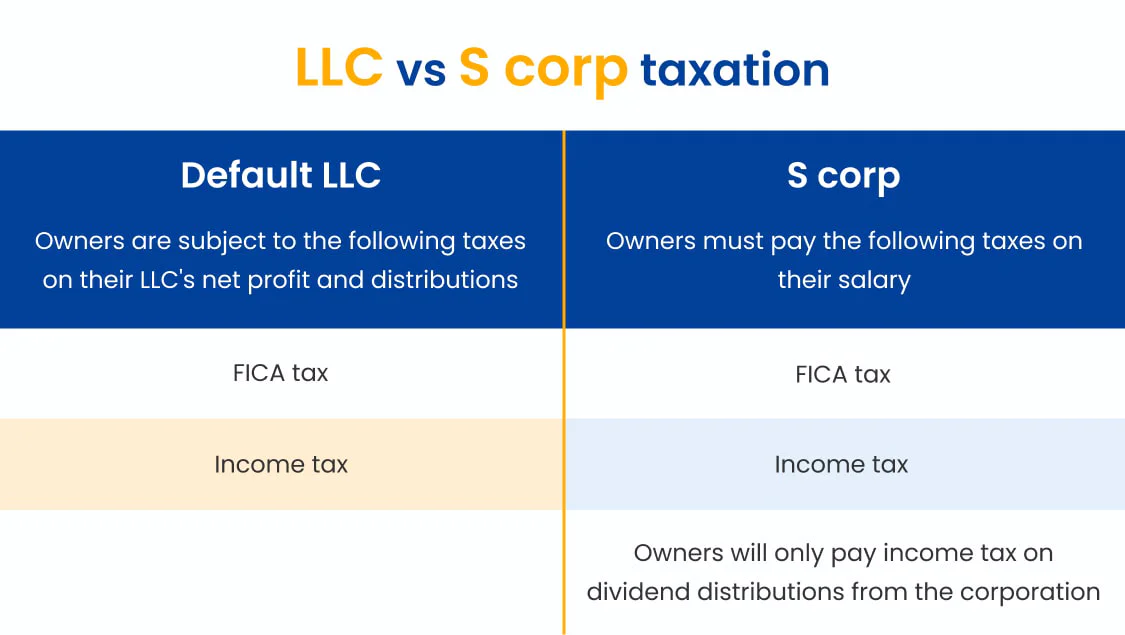

S corps are not subject to self-employment taxes, while LLCs may be.

Self-employment taxes are the Social Security and Medicare taxes that self-employed individuals must pay. S corp owners can be treated as an employee and paid a reasonable salary. This means employers will need to pay income tax and FICA taxes on their salaries. Any income allocated to owners as dividend distributions will not be subject to self-employment taxes – only subject to income tax (without FICA). Check out our blog article on S corp tax benefits and treatment for more interesting facts.

How about LLCs?

LLCs can be taxed as either sole proprietorships or partnerships, depending on how many members the LLC has. LLCs with only one owner are taxed as sole proprietorships, and those with more than one owner are taxed as partnerships.

LLC owners may be subject to self-employment taxes if the entity is taxed as a sole proprietorship or partnership. LLC owners are required to pay income tax along with self-employment taxes on their federal tax returns with respect to their LLC’s net profit and distributions.

It is also worth noting that the IRS views the S corporation as a pass-through entity (similar to LLCs), and this saves you money because you won’t have to pay double taxes on your income. But remember that S corp has to meet certain IRS requirements.

Corporate ownership

S corp corporate ownership is restricted to US citizens and residents. To be taxed as an S corporation, a company must also meet the following requirements:

- Be a domestic corporation

- Have only one class of stock

- Have no more than 100 shareholders

- All shareholders must be individuals, estates, or certain trusts

- May not be partnerships, corporations, or non-resident alien shareholders

On the other hand, LLC ownership can be extended to foreign nationals and have unlimited members. This type of business entity is not subject to some restrictions as S corporations. Despite the fact that an LLC cannot issue stocks like corporations, it can issue different types of membership units.

One striking difference between an LLC and an S corp lies in the transferability of ownership.

In an S corporation, ownership interests are typically freely transferable provided that the transfer complies with S corp regulations. In contrast, LLC ownership interests are not as easy as that of S corp. In order to sell or gift LLC ownership interest to other people, the owner must comply with LLC’s operating agreement, including first getting approval from the other members. This flexibility can be appealing to some business owners, as it provides them with the ability to easily transfer ownership of their business if they ever need or want to.

Company management structure

LLCs and S corporations have different management structures. LLCs can have either a member-managed or manager-managed structure. S corps, on the other hand, must have a board of directors made up of shareholders. This board elects officers who are responsible for running the company on a day-to-day basis.

Incorporation fees and procedure

The fees for forming an LLC are typically lower than those for incorporating an S corporation. In addition, it may be easier to form an LLC than to form an S corporation.

The LLC formation fees can vary depending on the state in which you form your LLC, typically ranging in price from US$40 to US$500. The amount mainly covers the cost of filing the Articles of Incorporation with your state, as well as any annual fees that may be required.

In order to form your LLC, you’ll need to file the Articles of Incorporation with your state. This is typically a simple form that you can fill out and file online. You will also need to pay a filing fee, which varies from state to state. Before starting your procedure, make sure to decide on which should be the best state to start your LLC in the US based on the taxes, fees in that state, and your business needs.

S corporations tend to be subject to more regulations than LLCs, and their shareholders must meet certain requirements. In most cases, there’s a filing fee to submit your articles of incorporation with the secretary of state. The average cost can range from $100 to $250, depending on the state.

In order to elect S corporation status, you must then file form 2553 with the federal government IRS once your certificate of incorporation has been filed. The form is filed by the corporation, not by individual shareholders.

Note

Be advised that the above incorporation fees (for your reference) don’t include the cost of an attorney or accountant – those who will support the document preparation in case your LLC or Corporation is more complex. Additional costs might also be incurred if you request yearly reporting fees, financial reporting, tax filing services, and so on.

You are highly recommended to carefully consult professional service providers or legal experts when forming either an LLC or corporation. It may cost more but you will save a lot of time and resources, especially if you avoid mistakes.

Compliance and corporate formalities

One of the key differences between LLCs and S Corps is the corporate maintenance and filing requirements. An LLC is a relatively simple business structure to maintain. In most cases, all you need to do is file an annual report with your state and pay your taxes. An S Corporation, on the other hand, is a bit more complicated. In addition to filing an annual report and paying taxes, S Corps must also file an annual tax return with the IRS.

LLCs are not required to hold regular meetings, but S corps are. S corps must also keep minutes of these meetings, make them available to shareholders upon request, and keep detailed records of their shareholders, directors, and officers.

Distribution of profits and losses

Both LLCs and S corporations are pass-through entities, but the way that profits and losses are distributed to the owners between those two are different.

In an LLC, the owners can choose how to distribute the profits and losses among themselves. For example, an LLC member who holds a 50% ownership interest can receive 80% of profits and losses.

In the case of an S corporation, the profits and losses must be distributed in proportion to each owner’s share of the corporation. This means 50% of profits and losses would go to a 50% shareholder.

Still uncertain about your intended business structure in the USA? How about giving our US Business Entity Selection Tool a try to make an informed decision for your venture?

What are the similarities between LLCs and S Corps?

Separate legal entity

Both LLCs and S corps are separate legal entities from their owners. This means that the business can own assets, enter into contracts, and be sued in its own right.

Limited liability protection

An LLC and an S corp are both business entities that offer limited liability protection to their owners. This means that the owners are not personally liable for the debts and liabilities of the business.

Pass-through taxation

Both LLCs and S corps are also eligible for pass-through taxation, which means that the business itself is not taxed on its income. Instead, the profits and losses are “passed through” to the owners and reported on their individual tax returns.

Can an LLC be an S corp?

An LLC is a state-chartered business entity that offers limited liability protection to its owners, while an S corp is a federally chartered legal form and tax status that can be elected by LLCs or corporations. Note that S corp is a tax status business owners can elect for their business. So, you as a business owner can incorporate an LLC and elect to be taxed as an S corp.

Keep in mind, there are certain requirements that must be met in order for the IRS to consider the LLC an S corp. Let’s check whether or not the LLC has only one class of stock and has less than 100 members, all of whom are US citizens or resident aliens, and other requirements.

If your LLC meets these requirements (and other qualifying requirements to become an S corp as prescribed by the IRS), it can elect to be taxed as an S corp by filing Form 2553 with the IRS.

S corporation vs LLC: Which is the right for your business?

There are several key differences between LLCs and S corps that business owners should be aware of. LLCs are more likely to offer flexibility when it comes to taxation, as they can choose to be taxed as either a partnership or a corporation. LLCs also offer flexibility and simplicity when requiring less paperwork to start up, and are less expensive to maintain.

Corporations, including S corp with its ability to issue stock, give it a big advantage when it comes to raising capital. An S corporation allows for easier transfer of ownership than an LLC, not to mention S corps are not subject to self-employment taxes. Yet, forming S corps means you are subject to more stringent eligibility requirements.

The business structure you decide on can have a profound effect on the future of your company. If you’re not sure which structure is right for you, feel free to chat with our consultants who can help you weigh the pros and cons of each option.

Want more information on other US business structures for your reference? You may feel interested in What is a C corporation? And how it works

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.