Table of Contents

A 1099 form is a key IRS document used to report income paid to non-employees, helping ensure accuracy and transparency in U.S. tax reporting. Limited Liability Companies (LLCs), one of the most common business structures often face confusion when determining their 1099 responsibilities. And do LLCs get 1099 forms? The answer depends on how the LLC is classified for tax purposes.

In the sections below, we’ll explain how these classifications affect 1099 reporting, outline payer obligations and exemptions, and walk through the filing process while addressing common misconceptions, giving you a clear understanding of your LLC’s tax compliance requirements

Understanding 1099 forms and LLCs

To understand how 1099 rules apply to LLCs, it’s important to first grasp the basics of both. The next section will cover what a 1099 form is, what an LLC represents, and why their connection matters in U.S. tax law.

What is a 1099 form?

A 1099 form is an IRS document used to report income earned outside of traditional employment. It summarizes payments made to individuals such as freelancers, contractors, or service providers throughout the year. Businesses are responsible for issuing these forms to both the recipient and the IRS, ensuring that all income is properly recorded for tax purposes.

Typically, a 1099 is sent by the end of January or early February of the following year. Recipients then use the information on the form to accurately report their income and calculate their total tax liability when filing their tax returns.

IRS Reporting Requirements for Businesses

Businesses operating in the U.S. must follow specific IRS reporting rules to ensure transparency and compliance in tax matters. These rules outline when and how companies must report payments made to non-employees, helping prevent errors and potential penalties. Below are the key IRS reporting requirements every business should be aware of:

- Issue 1099 forms to non-employees, such as freelancers or contractors, who were paid $600 or more during the tax year.

- Send copies of each 1099 form to both the recipient and the IRS — typically by January 31 of the following year.

- Use the correct 1099 form type based on the nature of the payment (e.g., 1099-NEC for non-employee compensation).

- Exclude most corporations from receiving 1099s, except for legal and medical payments.

- Maintain accurate payment records to support timely and compliant reporting.

- File electronically or by mail before IRS deadlines to avoid fines and compliance issues.

Types of LLCs and their tax classifications

LLCs can be classified differently for tax purposes, and each type affects how 1099 reporting applies. Below are the main LLC tax classifications and their impact on reporting requirements:

- Single-Member LLC (SMLLC) is treated by the IRS as a disregarded entity, meaning it’s taxed like a sole proprietorship. The owner reports income on their personal tax return, and payments made to the LLC generally require a 1099 form.

- Multi-Member LLC (MMLLC) is taxed as a partnership, where profits and losses pass through to members. Businesses paying an MMLLC typically must issue a 1099 for eligible payments.

- LLCs taxed as S Corporations (S Corps) elect to be taxed as an S Corp, avoiding double taxation. These entities are usually exempt from receiving 1099s, except in specific cases like legal or medical services.

- LLCs taxed as C Corporations (C Corps) are treated as separate tax entities that pay corporate income tax. C Corps do not receive 1099 forms, as they report income directly to the IRS through corporate filings.

Understanding these classifications helps ensure accurate LLC payment reporting, proper filing, and compliance with IRS rules.

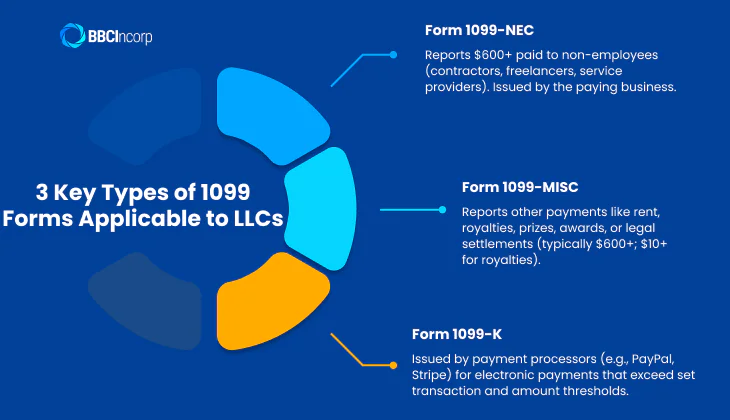

3 Key Types of 1099 Forms Applicable to LLCs

The three most relevant to LLCs are Form 1099-NEC, Form 1099-MISC, and Form 1099-K. Below is a breakdown of how each form works, when it applies, and who is responsible for issuing it.

Form 1099-NEC

The 1099-NEC (Nonemployee Compensation) form is used to report payments of $600 or more made to non-employees, such as independent contractors, freelancers, or service providers. It primarily applies to single-member and multi-member LLCs taxed as disregarded entities or partnerships. Businesses or clients that pay the LLC are responsible for issuing this form.

For example, if a consulting LLC provides $1,200 worth of services to a company, that company must issue a 1099-NEC. Even single-member LLCs must receive this form unless they have elected to be taxed as corporations.

Form 1099-MISC

The 1099-MISC (Miscellaneous Information) form reports various types of payments that don’t fall under nonemployee compensation. This includes rent, royalties, prizes, awards, or legal settlements. Generally, businesses issue this form for payments of $600 or more for rent or services, and $10 or more for royalties.

For instance, if an LLC rents out office space and earns $800 in rent from a business, that business must issue a 1099-MISC. It’s also important to note that even LLCs taxed as corporations may receive this form for certain income types, such as rent or royalties.

Form 1099-K

The 1099-K (Payment Card and Third-Party Network Transactions) form is issued by payment processors such as PayPal, Stripe, or other digital platforms. It reports payments received electronically when specific thresholds are met—traditionally $20,000 in payments and 200 transactions per year, though some states now have lower thresholds.

For example, an e-commerce LLC that processes payments exceeding this limit through PayPal will receive a 1099-K from the platform. This form often complements, but does not replace, the 1099-NEC or 1099-MISC, ensuring that all income from various sources is properly reported to the IRS.

When are LLCs required to receive 1099 forms?

In general, LLCs must receive 1099 forms if they earn $600 or more in a calendar year for services provided to another business. However, there are important nuances based on whether the LLC is a single-member or multi-member entity, and whether it has elected corporate taxation.

Single-member LLCs (disregarded entities)

Single-member LLCs are treated as disregarded entities for federal tax purposes, meaning they are taxed like sole proprietors, including:

- Payments exceeding $600 require a 1099.

- Verification is done via Form W-9; if “individual/sole proprietor or single-member LLC” is checked, a 1099 is needed.

- Use the owner’s Social Security Number (SSN) or Employer Identification Number (EIN) for reporting.

- If the SMLLC has elected to be taxed as an S-Corporation, most 1099 requirements do not apply.

Multi-member LLCs (partnerships)

Multi-member LLCs are treated as partnerships, so their 1099 obligations are similar to SMLLCs:

- Eligible payments over $600 must be reported.

- Applies to professional services like consulting, IT, accounting, or marketing.

- Verification via Form W-9 ensures accurate LLC payment reporting.

- If the LLC elects S-Corp taxation, a typical 1099 filing is generally exempt.

When LLCs are exempt from 1099 reporting

Some types of payment are still reportable even if the LLC is treated as a corporation, including:

- Payments to corporations for goods and services, including payments for merchandise, telecommunication, freight, storage, and similar items.

- Employee-related payments: Wages, business travel allowances, military differential pay, and life insurance benefits paid to employees are reported on Form W-2 instead of a 1099.

- Rent payments through intermediaries: Rent paid to real estate agents or property managers does not require a direct 1099; the agent or manager must report the rent to the property owner on Form 1099-MISC.

- Payments to tax-exempt or government entities include trusts, IRAs, HSAs, Archer MSAs, Coverdell ESAs, ABLE accounts, the United States, a state, the District of Columbia, U.S. territories, or foreign governments.

- Special compensations or awards, such as public safety officer disability or survivor benefits, wrongful incarceration compensation, and fees to informers under certain government or nonprofit programs, are exempt.

- Scholarships, fellowships, canceled debts, employee reimbursements, and canceled debts not under section 6050P.

- Widely held fixed investment trusts (WHFITs) receive appropriate tax statements instead of 1099s.

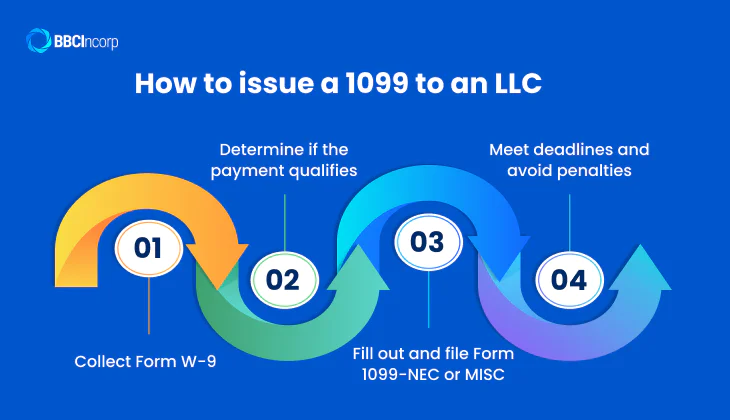

How to issue a 1099 to an LLC

Step-by-step explanation to help payers correctly handle the 1099 process.

Step 1: Collect Form W-9

Before making any payments, always request a completed Form W-9 from the LLC. This form provides key information such as the company’s name, address, and taxpayer identification number (EIN or SSN). More importantly, it helps determine the LLC’s tax classification — whether it is taxed as a sole proprietorship, partnership, or corporation. If the “C Corporation” or “S Corporation” box is checked, a 1099 is typically not required, except for payments related to legal or medical services.

Step 2: Determine if the payment qualifies

The IRS requires a 1099 form for payments totaling $600 or more in a calendar year for most business-related services. This includes professional services such as accounting, consulting, maintenance, rent, and royalties. However, not all payments qualify, you do not need to issue a 1099 in these cases listed above.

Step 3: Fill out and file Form 1099-NEC or MISC

Once you’ve confirmed that the payment qualifies, choose the correct form:

- Form 1099-NEC for non-employee compensation (e.g., service fees paid to contractors).

- Form 1099-MISC for other types of payments such as rent, royalties, or legal settlements.

You’ll need to file the form with the IRS and provide a copy to the LLC. Always double-check the information for accuracy to prevent errors that could trigger IRS notices.

Step 4: Meet deadlines and avoid penalties

Copies must be sent to recipients by January 31, and the same deadline applies for filing electronically or by mail with the IRS. Late or incorrect filings can result in penalties ranging from $60 to $310 per form, depending on how late the submission is.

Common misconceptions about 1099 and LLCs

Many business owners misunderstand how 1099 reporting applies to LLCs, leading to costly IRS mistakes. These misconceptions often stem from confusion about how LLCs are taxed and when reporting is actually required.

All LLCs are treated the same

This is one of the most widespread myths. The truth is that not all LLCs are subject to the same 1099 requirements. The IRS determines reporting obligations based on an LLC’s tax classification, not its legal structure.

No need to issue 1099s for small payments

The IRS requires a 1099 form if total annual payments reach $600 or more, even if they are spread across multiple transactions. It’s the cumulative total, not the individual payment, that matters. Businesses should keep accurate records throughout the year to track thresholds and avoid missing filings.

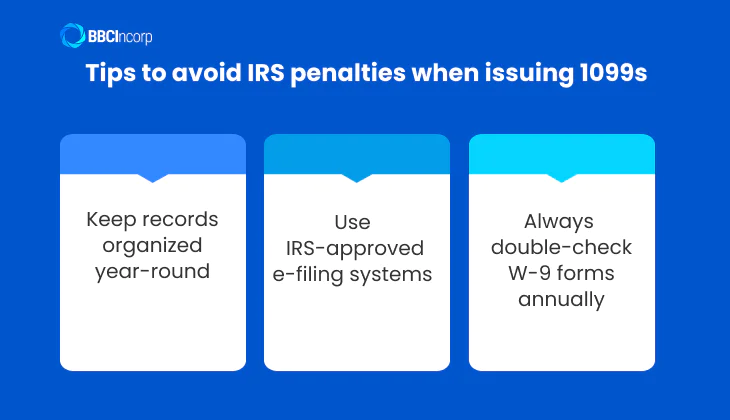

Tips to avoid IRS penalties when issuing 1099s

Keep records organized year-round

Every business should maintain clear and accurate records throughout the year. Tracking payments, vendor information, and cumulative totals from the start helps prevent confusion during tax season.

Businesses that rely on a 1099 compliance checklist can easily identify vendors who meet the $600 reporting threshold and confirm which payments qualify for reporting. By staying organized, businesses reduce the risk of missing forms or submitting incorrect details that could trigger IRS penalties.

Use IRS-approved e-filing systems

Businesses should use IRS-authorized e-filing systems to submit 1099 forms efficiently. E-filing provides instant confirmation of receipt, reduces human error, and aligns with current IRS standards. This system allows faster, more accurate submissions compared to paper filing and helps businesses avoid late or incorrect forms.

Always double-check W-9 forms annually

Each payer must verify that all contractor and vendor details are up to date. Requesting an updated Form W-9 every year ensures that key information such as the EIN or SSN, legal business name, and tax classification remains accurate.

Since LLCs can change their tax status over time, updating W-9s helps determine whether the entity should receive a 1099. Businesses that regularly review W-9 forms can avoid rejected filings, reporting mismatches, and unnecessary fines.

How BBCIncorp can help your LLC stay compliant

Staying compliant with IRS and state regulations is a critical part of managing any LLC. BBCIncorp offers comprehensive LLC compliance services designed to simplify this process, ensuring accuracy, timeliness, and peace of mind for business owners.

BBCIncorp provides an integrated suite of services to help businesses establish and maintain compliance:

- LLC Formation: Assistance with entity setup, name registration, and filing formation documents.

- EIN Application: Support in obtaining an Employer Identification Number for tax and banking purposes.

- Tax Registration: Guidance in registering your business for federal and state tax obligations.

Understanding how your LLC is classified for tax purposes is essential to accurate reporting. BBCIncorp helps you determine whether LLCs receive 1099 forms, including LLC partnerships, LLC corporations, or single-member LLCs. We also provide assistance to:

- Determine the correct tax classification for disregarded entities, partnership, or corporation.

- Identify applicable 1099 forms based on your business activities.

- Manage W-9 collection, payment tracking, and timely filing to meet IRS requirements.

BBCIncorp’s business tax filing services go beyond annual returns to ensure year-round accuracy:

- Conducting annual compliance reviews to prevent costly errors.

- Providing tax filing and documentation support tailored to LLCs of all sizes.

- Offering strategic recordkeeping guidance to maintain transparency during IRS audits.

Reach out to BBCIncorp today for fast, affordable LLC and tax compliance support. Their team of experts ensures your filings are handled correctly, so you can focus on growing your business with confidence.

This article provides you with all the essential information regarding do LLCs get 1099, covering key topics such as the different 1099 forms applicable to LLCs and how to issue a 1099 correctly. It also highlights common misconceptions, practical tips to avoid mistake. Understanding these basics ensures your LLC remains compliant and avoids costly filing errors.

For seamless management, BBCIncorp offers professional LLC compliance services, including 1099 reporting help and business tax filing support. With expert guidance, you can navigate complex IRS rules, meet every deadline, and maintain flawless LLC 1099 compliance. Reach out to BBCIncorp today for fast, affordable, and reliable LLC compliance services, including full support for 1099 reporting for LLCs of all types.

Frequently Asked Questions

What happens if I issue a 1099 to a corporation by mistake?

There’s no specific IRS regulation addressing penalties for issuing a 1099 to a corporation by mistake. However, doing so may cause discrepancies in the recipient’s tax records or confusion during filing.

To prevent such issues, businesses should always verify a vendor’s tax classification with Form W-9 before issuing any 1099 form or partner with professional compliance services like BBCIncorp to avoid unnecessary administrative errors.

Should I issue a 1099 for product purchases?

No. Payments made strictly for goods, inventory, or tangible merchandise are not subject to 1099 reporting. The rule applies primarily to services such as consulting, accounting, or design work. Always distinguish between goods and services in your records to stay compliant.

Are attorney payments to LLCs exempt from 1099 reporting?

No. Payments for legal services must always be reported on Form 1099-NEC, even if the law firm is an LLC or corporation. The IRS requires this to ensure all legal fees are properly tracked for income reporting.

What is the minimum payment threshold for issuing a 1099 to an LLC?

Typically, a 1099 is required when payments for services reach $600 or more in a calendar year.

Can an LLC be exempt from receiving a 1099?

Yes. An LLC that elects to be taxed as an S-Corporation or C-Corporation is generally exempt from 1099 reporting. However, payments for legal or medical services must still be reported, regardless of corporate status. When in doubt, verify the entity’s classification using Form W-9 or consult BBCIncorp’s LLC compliance specialists for tailored guidance.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.