Table of Contents

Understanding the 4 types of financial statements is a key part of running a successful business. These documents are not just about compliance; they provide crucial insights into your company’s financial health. Whether you’re an LLC owner, entrepreneur, or small business owner, mastering these statements will help you track performance, make smarter decisions, and attract investors.

This guide explains the purpose of financial statements, provides an overview of the different forms, and dives into how to read and prepare them accurately.

Overview of 4 major financial statements

Financial statements of accounting are official documents that provide a comprehensive overview of a business’s financial performance. They offer a clear snapshot of financial activities and overall health, serving as an essential tool for evaluating the success and stability of your business.

These financial records of a business allow you to track everything, from profitability and cash flow to asset values and shareholder equity. They are essential for decision-making, helping you spot trends, allocate resources, and attract outside investments.

There are four main types of financial statements, each serving a distinct purpose:

- Balance sheet

- Income statement

- Cash flow statement

- Statement of shareholders’ equity

In the sections ahead, we’ll explore each of these statements in greater detail.

Common uses of financial reports

Why fuss over different financial reports? Because they drive strategy and decision-making across various aspects of your business. They provide a clear and organized snapshot of your company’s financial health, helping you make informed decisions.

Here are some key uses for these financial statements of accounting:

Identify trends

Financial statements help you spot patterns in revenue, expenses, and profits over time. By identifying these business financial information, you can make strategic adjustments to fuel growth, cut unnecessary costs, or prepare for seasonal changes.

Enhance budgeting

Strong financial records allow you to allocate funds efficiently, ensuring you stay within your means while still meeting growth goals. By understanding your cash flow and financial position, you can create more accurate budgets and avoid overspending.

Attract investors

Transparency in your company’s financial health can be a game-changer when attracting investors or securing loans. Detailed and accurate financial statements demonstrate your business’s stability and potential for growth, instilling confidence in stakeholders.

Mitigate risk

Precise and up-to-date financial records can reveal potential risks before they escalate into larger problems. From identifying cash flow shortages to uncovering inefficiencies, these reports help you proactively address issues and safeguard your business from costly mistakes.

In short, financial statements are the blueprint for your business’s success, guiding smarter decisions and sustainable growth.

What are the four financial statements in accounting?

Each of the four financial statements provides distinct but interrelated insights into your company’s financial activities. These detailed types of financial information help build a comprehensive understanding of your business.

Balance Sheet

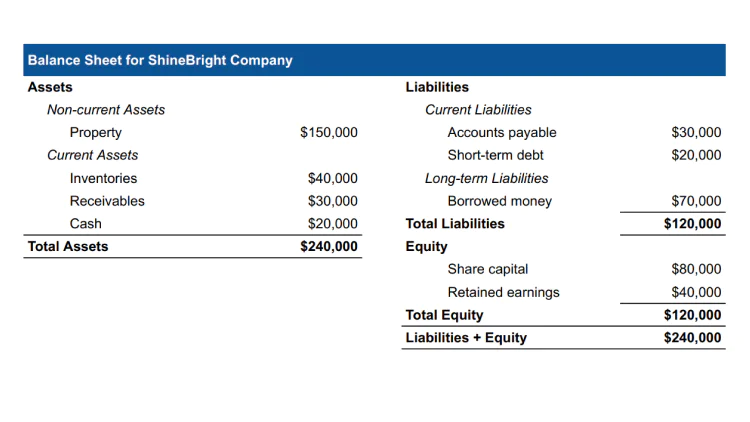

A balance sheet, also known as a “statement of financial position, provides a snapshot of your company’s financial position at a specific point in time.

At the core of the balance sheet is this fundamental equation: Assets = Liabilities + Equity

This equation ensures that everything the business owns (assets) is balanced against what it owes (liabilities) and the owner’s stake (equity). In short, it reflects the financial health of your business.

Key components

To understand a balance sheet, you must be familiar with its three main components:

- Assets: Assets represent everything the company owns or controls that has value. These are categorized as:

- Current assets: Assets that can be converted into cash within one year, such as cash, accounts receivable, and inventory.

- Non-current assets: Long-term assets like property, equipment, and intangible assets (e.g., patents and trademarks).

- Liabilities: Liabilities are the debts or obligations the business owes. These are also divided into:

- Current liabilities: Obligations due within one year, such as accounts payable or short-term loans.

- Non-current liabilities: Long-term obligations, such as long-term loans or bonds payable, due after one year.

- Equity: Equity represents the owner’s claim on the business’s assets after all liabilities are subtracted. It includes:

- Contributed capital: Investments made by shareholders.

- Retained earnings: Profits the business has kept over time, minus any dividends paid out.

Why balance sheet is important

The balance sheet is a critical tool for evaluating your company’s financial stability. It helps answer key questions such as:

- Do you have enough assets to cover your liabilities?

- How much of the business is financed by equity versus debt?

For both management and investors, the balance sheet offers essential insights into the company’s liquidity, financial health, and long-term potential.

Balance sheet example

In this example, ShineBright Company maintains an equal balance of liabilities and equity, showing a stable financial foundation.

A strong ratio of current assets to current liabilities indicates the company can easily meet short-term obligations, reflecting strong liquidity.

By investing in property, plant, and equipment (PPE) while retaining earnings, the company demonstrates a focus on long-term growth and operational stability.

Income statement

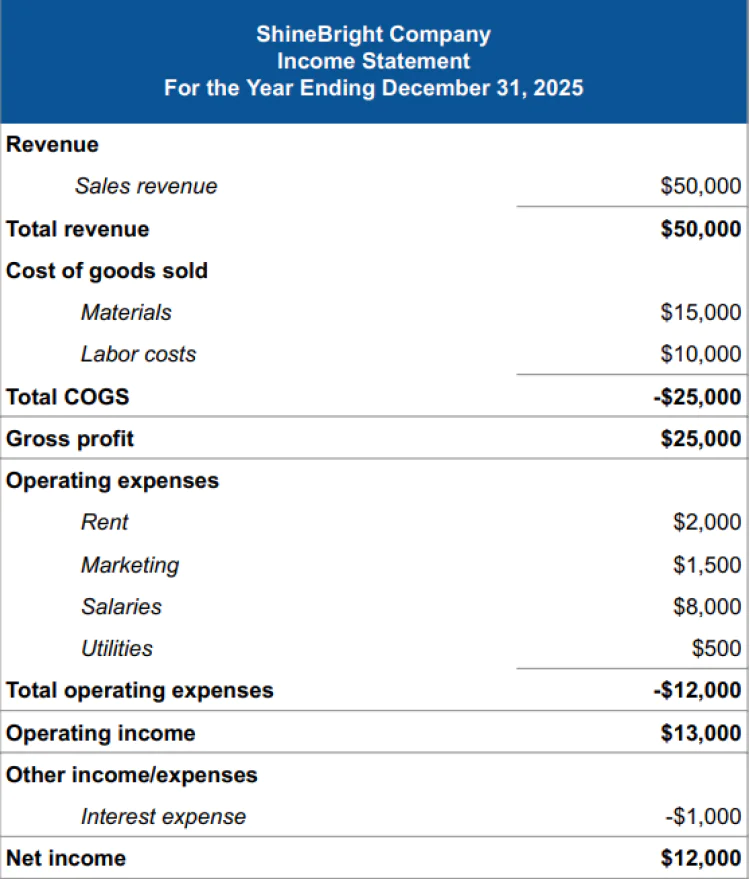

An income statement, sometimes referred to as a profit and loss statement (P&L), shows a company’s revenues, expenses, and profits over a specific period, such as a month, quarter, or year.

It reveals whether the business is earning a profit or incurring a loss by comparing its income (revenue) to its costs (expenses).

Key components

An income statement is broken down into several important sections that provide insights into a company’s operations. These are the most common components:

- Revenue (or Sales): Total income from a company’s core business activities, such as selling products or delivering services. It’s categorized into two types:

- Operating revenue: Earnings from core operations (e.g., a store’s clothing sales).

- Non-operating revenue: Income from non-core activities (e.g., investments).

- Cost of Goods Sold (COGS): These are the direct costs involved in producing goods or delivering services, such as materials, labor, and manufacturing costs.

- Gross profit: Gross profit is calculated as revenue minus COGS. It shows how much money is left from sales after covering the cost of production.

- Operating expenses: These are costs associated with daily operations, such as rent, utilities, marketing, and salaries for administrative staff.

- Net income: Net income, often called the “bottom line,” represents the company’s total profit or loss after accounting for all revenues and expenses, including taxes. A positive net income indicates profitability.

Why income statement is important

The income statement is at the heart of the four primary financial statements as it tracks your ability to generate profit. Entrepreneurs often use it to evaluate efficiency, identify high-performing products, and set growth targets.

Example of income statement

This example illustrates how revenue, expenses, and profit are structured on an income statement, making it easy to see where money is earned and spent.

Cash flow statement

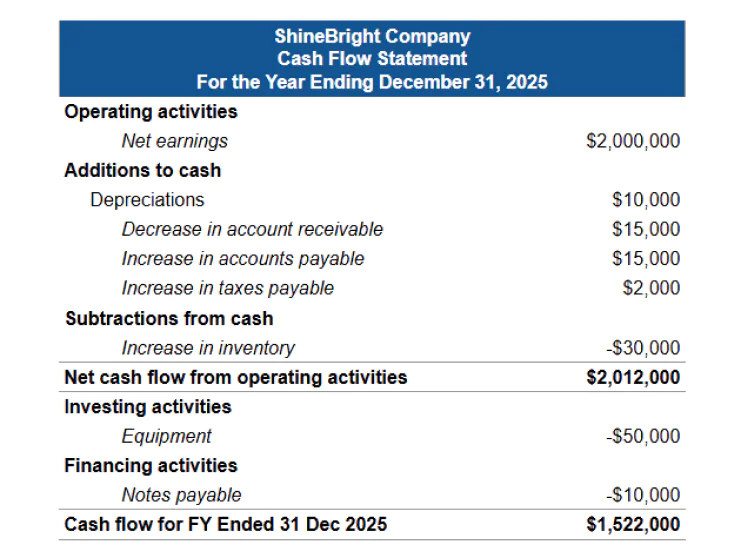

The cash flow statement tracks money flowing in and out of your business during a set period.

Unlike an income statement, which focuses on profits, the cash flow statement emphasizes liquidity, aka the availability of cash to keep your business running smoothly.

Key components

- Operating activities: Cash generated from day-to-day operations like payments for suppliers, salaries, rent, and taxes.

- Investing activities: Cash spent on or earned from investments like equipment or property.

- Cash outflows might include purchasing machinery or software

- Cash inflows could come from selling assets like real estate or receiving returns on investments.

- Financing activities: Cash movement related to funding your business. It includes activities like securing loans, issuing stock, or repaying debts.

Why cash flow statement is important

Among the four basic financial statements, the cash flow statement allows companies to monitor liquidity. It ensures you have enough cash to meet immediate obligations and invest in future opportunities. A healthy cash flow is a key indicator of financial stability, which can reassure investors or lenders about the viability of your business.

Negative cash flow trends can serve as an early warning sign, giving you time to address financial challenges before they spiral out of control.

Example of a cash flow statement

The company ended FY 2025 with a positive cash flow of $1,522,000. This indicates strong liquidity and the ability to fund future operations or investments without external financing. Several key takeaways emerge from this statement:

- Most of the cash inflow came from operations, showing the company’s core activities are generating sufficient revenue.

- The $50,000 spent on equipment suggests the company is taking steps to expand or modernize its operations.

- Minimal dependence on financing activities, only $10,000, reflects a low reliance on debt, which is a good indicator of financial health.

Statement of shareholders’ equity

The Statement of Shareholders’ Equity tracks all changes in a company’s equity over an accounting period, such as a quarter or fiscal year. These changes are influenced by factors like issuing stock, dividend payments, and the company’s profits or losses.

Essentially, it showcases how shareholder value has evolved and provides transparency about equity-related activities.

Key components

- Opening equity balance: The shareholder equity at the start of the period, including retained earnings, common stock, and other equity items.

- Net income or loss: Profits increase equity; losses reduce it, reflecting financial health and efficiency.

- Dividends paid: Payouts to shareholders reduce equity and retained earnings but show a commitment to investors.

- Other changes in equity: Includes share issuances, buybacks, or adjustments from accounting or currency shifts, affecting total equity.

Why it is important

Often overlooked, this document reveals how well a company is distributing profits and whether it’s consistently creating value for shareholders. Of all the forms of financial statements, it is particularly significant to investors.

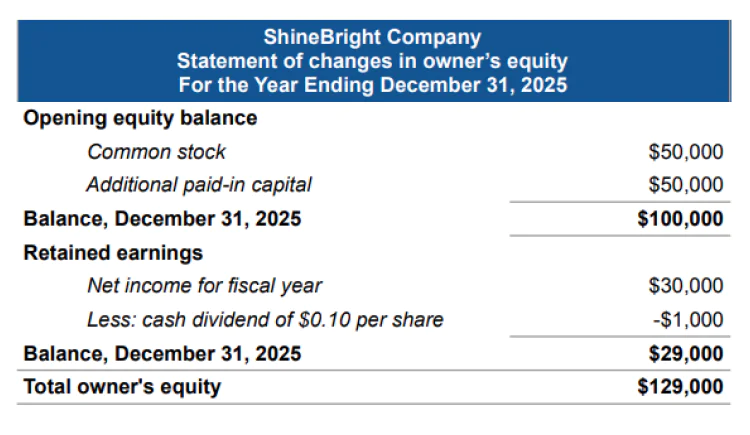

Statement of shareholders’ equity example

The company generated $30,000 in net income, which is a positive indicator of profitability. However, $1,000 was distributed as dividends, leaving $29,000 to reinvest in the business. The common stock and APIC remain unchanged, indicating no new shares were issued during the period.

The total owner’s equity of $129,000 reflects a strong financial position, with a significant portion ($29,000) coming from retained earnings, which shows the company is reinvesting its profits effectively.

How the financial statements work together

The 4 types of financial statements are deeply interrelated and work together to paint a complete picture of your business.

Income to cash flow

Revenue and expenses reported on the income statement don’t just show profitability, they also flow directly into the operating section of the cash flow statement.

For example, net income serves as a starting point to calculate cash generated or used in operating activities, providing clarity on how much cash the business is truly generating.

Balance sheet to equity statement

The equity section of the balance sheet at the end of a period is not an isolated number. It ties directly to changes reflected in the statement of shareholders’ equity, such as profits retained, dividends paid, or additional capital raised.

This connection highlights how profits or losses and shareholder activities impact the company’s overall value over time.

Holistic perspective

By combining these different perspectives, these financial reports for business allow management, investors, and other stakeholders to assess key factors such as performance, liquidity, cash flow, and growth potential.

For example, while the income statement shows profitability, the cash flow statement reveals whether that profit translates to actual cash, and the balance sheet shows the overall financial position.

Together, the different financial statements don’t just report numbers, they create a detailed financial story that offers insights into where the business stands, how it has performed, and where it is headed. Understanding these connections is critical for making informed business decisions and demonstrating financial transparency.

How to read financial statements

Analyzing financial documents doesn’t have to be overwhelming. These steps can help you get started:

- Prioritize key metrics: Pay attention to figures like net income, profit margins, and cash flow.

- Evaluate trends: Analyze financial data over time (e.g., quarterly or yearly) to identify patterns of growth or potential concerns.

- Use ratios for clarity: Financial ratios, such as liquidity or debt-to-equity, can provide a deeper understanding of the company’s performance.

- Consider the bigger picture: Go beyond the numbers. Think about the company’s industry and how it compares to competitors.

- Seek clarification: When in doubt, reach out to your financial advisor or accountant for answers to your questions.

With practice, spotting trends and key insights becomes easier, helping you make informed decisions. Preparing and reviewing these financial statements not only equips you to present essential information to investors or creditors but also allows you to uncover performance trends that can strengthen your business and drive future growth.

Tips for preparing accurate financial statements

Accuracy is crucial when preparing important financial reports for business. These tips will help maintain reliable records and avoid costly mistakes:

Maintain organized records

The foundation of accurate financial statements lies in well-kept records. Keep track of every financial transaction, from revenue and expenses to loans and payments. Organize these records systematically, using clear categories for income, assets, liabilities, and other key items.

Use cloud-based tools to store and back up documents securely, allowing easy access whenever needed.

Use reliable accounting software

Manual accounting is not only time-consuming but prone to human error. Investing in reliable accounting software can streamline the process and reduce mistakes. These tools can automate calculations, generate reports, and flag inconsistencies, making it easier to produce accurate statements.

Choose software tailored to your business size and needs, and ensure it’s updated regularly to meet evolving accounting standards.

Reconcile accounts regularly

Reconciling your accounts means comparing your internal records with bank statements and other external records to ensure consistency. This practice prevents discrepancies and allows you to identify and fix errors before they escalate.

Schedule regular reconciliation (e.g., monthly), especially for bank accounts, credit cards, and invoice systems.

Seek professional help

Managing financial statements can be complex, especially when operating in jurisdictions like Hong Kong and Singapore, where regulatory compliance is crucial.

Opt for services like BBCIncorp’s Accounting, Auditing & Tax Filing services to ensure your financial statements are accurate, comply with all legal and regulatory standards, and are prepared efficiently.

Professional help not only saves time but also reduces the risk of errors that could lead to costly penalties.

Conclusion

Understanding the 4 types of financial statements is more than just a bookkeeping task. These important financial reports for business are powerful tools that provide transparency, foster trust with stakeholders, and support smart decision-making.

Want to take the guesswork out of preparing your financial statements? Explore professional offshore accounting services like BBCIncorp. Be confident in your numbers, so you can focus on growing your business.

Frequently Asked Questions

How often should financial statements be prepared?

Many businesses create financial statements on a quarterly and annual basis, though some choose to prepare them monthly. The frequency typically depends on factors like legal requirements, the expectations of investors, or the conditions of loans.

How are financial statements connected?

Financial statements provide insights into a company’s financial position from various angles. For example, the net income from the income statement influences the equity statement, which then affects the balance sheet. Similarly, the cash flow statement shows how income translates into actual cash movements.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.