Table of Contents

Here may be the most hurtful yet essential to every business owner: how to dissolve a Delaware corporation. No one prays to dissolve their businesses but some time to know the process is essential since even closing your business, this process needs to align with the regulations. In this comprehensive guide, we provide you with a simple, step-by-step approach to dissolving your Delaware corporation.

Whether prompted by a change in direction, market shifts, or financial challenges, winding down a business marks the end of one chapter and the beginning of another.

For Delaware corporations, however, the process doesn’t have to be complicated. Thanks to the Delaware General Corporation Law (DGCL), the state offers a clear and efficient dissolution framework that ensures both compliance and simplicity.

Before diving into the details, here’s what this guide will help you understand:

- What dissolution means under Delaware law and why it’s essential for legally ending your corporation.

- The two types of dissolution – voluntary and involuntary – and how each applies to different circumstances.

- The complete 3-step process to dissolve a Delaware corporation, including tax obligations and document filing.

- What to do after dissolution, such as winding up, tax clearance, and notifying claimants.

- Special scenarios, including how to discontinue corporations with no issued shares or those registered as non-stock or foreign entities.

Even if the process seems detailed at first glance, Delaware’s clear legal structure keeps it straightforward when approached correctly. This guide will walk you through each step and requirement so you can close your Delaware corporation confidently and in full compliance.

What is the dissolution of a Delaware corporation?

Dissolving a corporation means officially closing the corporation with its name removed from the register. It is the end of the legal existence of your corporation. After the dissolution is valid, other groups can make use of the company name.

There are two ways to dissolve your Delaware corporation. You can let your company become void by refusing or neglecting Delaware franchise taxes, then it will be canceled by the state and subject to a tax fine. Another way to close your company is to voluntarily dissolve by holding a vote among shareholders and filing a dissolution certificate to the Secretary of Delaware.

The Court of Chancery is the jurisdiction for the dissolution proceedings and any application during the process. Such proceedings will also include filing the petition for dissolution.

As a business owner, you don’t want to end your company. But when the time has come, you have to make the decision. Below are the main reasons why you should dissolve your Delaware corporation:

- Avoid bankrupt status for private dissolution;

- Don’t need bankruptcy protection;

- Avoid late claims;

- Protect directors from personal liability to claimants;

- Restart the business with another legal entity such as Delaware Limited Liability Company (LLC).

After the dissolution, the Delaware state gives your corporation a period to complete the winding up. You shall handle the final matters after filing the dissolution.

In other words, it is an act of turning assets into money (liquidation process) to pay off creditors and make distributions to shareholders.

What are the two types of dissolution of a corporation?

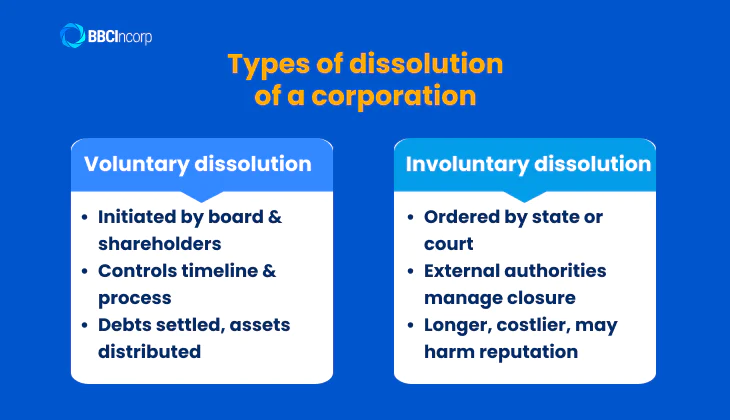

Corporations may reach dissolution for many reasons, completing their business purpose, restructuring operations, or failing to meet regulatory duties. Under the Delaware General Corporation Law (DGCL), corporate dissolution generally falls into two categories: involuntary and voluntary. Each type carries different procedures, levels of control, and legal outcomes that determine how the company ceases to exist.

Voluntary dissolution

A voluntary dissolution occurs when a corporation’s leadership, its board of directors and shareholders, intentionally decides to end the company’s legal existence. This is often the case when a business has fulfilled its objectives, faces reduced profitability, or wishes to reorganize under a new structure.

The process begins with a formal board resolution and a shareholder vote approving the dissolution. The company must then pay all outstanding debts, taxes, and obligations, notify creditors, and distribute any remaining assets to shareholders according to ownership rights. Once the Certificate of Dissolution is filed with the Delaware Division of Corporations, the entity is officially terminated under state law.

Voluntary dissolution offers greater flexibility and control. Because it’s initiated internally, directors can manage the timeline, minimize risk, and ensure a clean, compliant closure.

Involuntary dissolution

By contrast, involuntary dissolution happens when the state or a court orders the corporation to close. This may result from failure to file annual reports, non-payment of franchise taxes, shareholder disputes, fraud, or gross mismanagement.

In such cases, external authorities intervene to safeguard creditors, shareholders, and public interest. The court may appoint a receiver or trustee to oversee liquidation, handle pending claims, and ensure proper asset distribution. Directors and officers may lose control over the company’s operations and could face personal liability if misconduct is proven.

Compared with voluntary dissolution, this type is lengthier, more costly, and may cause reputational damage, but it ensures that dissolution occurs even when internal governance fails to act.

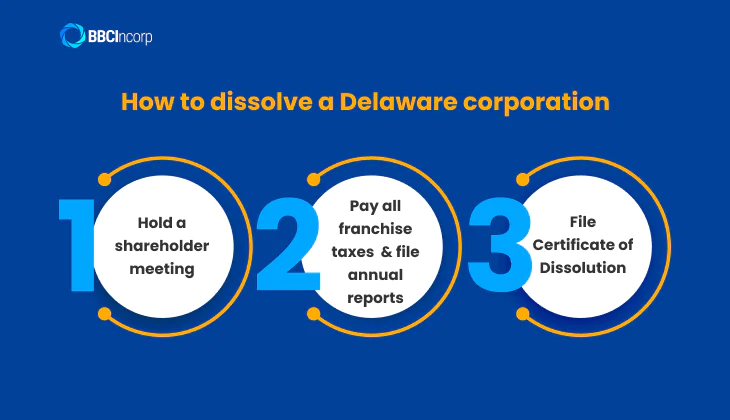

How to dissolve a Delaware corporation

The dissolution of a general Delaware corporation includes three main steps.

Step 1: Hold a shareholder meeting

To start the dissolution process, you will need to hold a meeting to gather all shareholders for a vote. However, under the Delaware General Corporation Law (DGCL 275(a)), the Board of Directors must first adopt a resolution recommending that the corporation be dissolved before the vote takes place. The vote will decide whether or not the corporation will be dissolved. The Board of Directors must adopt the resolution of the corporation dissolution before the vote.

The final result is based on the majority of shareholders’ written opinions. In Delaware, shareholders can either vote at a formal meeting or provide written consent representing a majority of the outstanding shares, as permitted under DGCL 228.

If a majority of shareholders agree to dissolve the corporation by their written consent, the dissolution decision is approved. Then, we move on to the next steps of the dissolution process.

Step 2: Pay all franchise taxes and file annual reports

Under the Delaware Code, all corporations must complete filings and payments for Delaware Franchise Tax and Annual Report, following the calendar year. You must submit the related fees and filing documents to the Delaware Division of Corporations, which administers the Delaware franchise tax process, not to the Secretary of State.

For companies owing Delaware franchise taxes for one year or more, it will get voided and lose its good standing status in Delaware. An amount of penalty will be applied to the corporation depending on the amount of tax owed by the corporation.

However, the company does not get “automatically canceled” – instead, it is classified as void under DGCL 510.

Once void, the state will no longer issue any official certificates (such as a Certificate of Good Standing), and the corporation cannot legally conduct business, sign contracts, or file for dissolution until reinstated through a Certificate of Renewal and Revival under DGCL 312.

Step 3: File Certificate of Dissolution

Filing a dissolution certificate is the final step to completing the dissolution process. There are two forms of dissolution certificates in Delaware. You can choose to file a long form, known as a standard form, or a short form depending on your company situation. Each form has its conditions and requirements.

Filing for short forms is much cheaper than the long form, but only qualified corporations can use the short form for filing dissolution certificates. Below are conditions that a corporation must meet to use the short form for the dissolution, according to section 391 of the Delaware Code:

- The corporation has no assets and has stopped all business transactions;

- The corporation is required to pay a minimum amount of franchise taxes annually since the first year of its incorporation;

- The corporation paid franchise taxes and fee dues until the end of the year when the Delaware certificate of dissolution is filed.

In accordance with section 275 of the Delaware Code, the required information for both long form and short form are as follows:

- Corporate name;

- Formation date said on the certificate of incorporation;

- Names and addresses of all directors and officers;

- The authorized date of dissolution;

- A statement of the final result authorized by all shareholders with their written consent and the Board of Directors.

The filing fee will be different depending on the dissolution form and its length. Look at this table to see the Delaware pricing system for filing the dissolution:

| Short form | Long form | |

| First document | US$10 | US$204 |

| One additional page | US$9 | US$9 |

A certified copy of each form costs $50. The filing process usually lasts from 2-3 weeks. The State, however, offers expedited services for different needs:

- 1-hour fee: US$1000;

- 2-hour fee: US$500.

- Same-day fee: US$200;

- 24-hour fee: US$100.

A cover letter is required to be included in the filing with your contact information including name, address, and telephone or fax number.

What should be done after obtaining the dissolution certificate?

After the dissolution, a corporation has 3 years in existence under Delaware law. During this period, the corporation can publish notices to claimants, do the winding up, and tax clearance.

Winding up

As mentioned earlier in this blog, winding up is considered the settlement stage with creditors in the dissolution process of a Delaware corporation.

The act of winding up can be voluntary, also known as a court-supervised process, or compulsory depending on the financial situation of the corporation.

A company is forced to be wound up by the Court of Chancery when it is not able to pay debts to its creditors. The situation is considered as ending like bankruptcy. In this case, creditors may not receive enough money owed by the company.

The voluntary winding up, on the other hand, is when the corporation can establish and comply with a plan. It actively sells assets for distribution to creditors. In this way, the company can avoid bankruptcy and in some cases, discharge shareholder liability from the company’s debts. The remaining assets, then, can be distributed to shareholders.

Tax clearance

All state taxes do not need to be submitted for dissolution filing, but the taxes are required to be paid before franchise tax dues. If your corporation conducts any business in Delaware, remember to check the “Out of Business” box and indicate the last day of your business operation.

An S corporation passes income, losses, deductions, and other credits through to shareholders for federal tax purposes.

Notices to claimants

One important thing that needs to be done is to publish notices to claimants, persons, or organizations who claim against your corporation.

Delaware Law sets some specific rules for statements of such notices as follows:

- The statement must be in written form, a document or public notice in a newspaper, with all reasonable information addressed to the claimant;

- The statement must include the mailing address to which the claim must be sent;

- The deadline for receiving the claim from the claimant must be included in the notice and no earlier than 60 days from the date the notice is sent;

- If the claim is not received by the deadline, the claim will be barred;

- The notice must list the total amount of all distributions to shareholders for every 3 years up to the date of corporate dissolution.

There are some cases in which the receivers of the notice forget about the deadline to submit their claims. In some other cases, your corporation can reject claims from the claimants.

In some ways, sending notices to claimants helps limit your company’s liability and protect the assets for distributions to shareholders.

How to discontinue a corporation that hasn’t issued any shares or conducted business

The corporation which hasn’t issued any shares or hasn’t started a business will be dissolved by the state of Delaware with a certificate acknowledged by a majority of important members. The certificate was filed by a majority of the incorporators or directors, who are listed in the certificate of incorporation, to the Secretary of Delaware.

Below is the required information for the certificate:

- Either of the following statement:

- A statement that the corporation hasn’t issued any shares and hasn’t done any business activities;

- A statement that the corporation has started a business but hasn’t issued any share, and all debts have been settled; or

- A statement that the corporation hasn’t conducted business but has issued stock with stock certificates included.

- The date of incorporation that is listed in the certificate of incorporation;

- A statement that no capital has been paid;

- A statement that all rights and franchises are surrendered.

How to dissolve other types of corporations

2-Stockholder Corporation

For a corporation with only 2 stockholders, if each stockholder holds 50% of the stocks, one stockholder can file the petition for the dissolution to the Court of Chancery without written agreement from the other stockholder.

In such cases, the Court gives the corporation 2 periods of time for decisions about the dissolution:

- Within 3 months from the filing date, the Court will produce a certificate stating all stockholders’ agreement on the discontinuance of the corporation;

- Within 1 year from the filing date, the Court will produce a certificate stating the completion of all distributions to stockholders.

The stockholders can extend either period by making an agreement and filing it to the Court of Chancery before these two periods end.

Non-stock corporation

The dissolution process of a non-stock corporation will be similar to a general corporation. A vote will be held among all members of the governing body of the corporation. If the corporation hasn’t started its business, it can be dissolved by the state in the same way as mentioned in the previous paragraph.

Foreign corporation

If your corporation is doing business in Delaware but is registered outside the state, you must file a separate form to withdraw your right to do business in Delaware, along with the provision of filing fees. The corporation will be liable to annual report fees and minimum business taxes if it fails to withdraw.

Conclusion

For any business operator, it is crucial to understand the company situation and make the appropriate decisions about the corporation dissolution. Depending on your corporation type, the process of dissolution will be different.

This blog has provided you with detailed guidance on how to dissolve a Delaware corporation. In case you have more questions, feel free to get in touch with us to discuss your business!

Frequently Asked Questions

What is the difference between dissolution and cancellation in Delaware?

Many business owners often use the terms “dissolution” and “cancellation” interchangeably when referring to closing a company in Delaware.

Although both processes ultimately end the entity’s legal existence, they are distinct procedures under Delaware law:

- Corporations are dissolved by filing a Certificate of Dissolution under the Delaware General Corporation Law (DGCL 275).

- Limited Liability Companies (LLCs) are canceled by filing a Certificate of Cancellation under the Delaware Limited Liability Company Act (18-203).

While the outcome appears similar, each entity type has different filing forms, statutory references, and closing requirements that must be completed correctly with the Delaware Division of Corporations.

How much does it cost to dissolve a company in Delaware?

The total cost of dissolving a company in Delaware depends on its business type and the form used for filing.

For corporations, the filing fee for a Certificate of Dissolution is:

- US$10 for the short form (for companies with no assets and no ongoing business), or US$204 for the long form (for all other corporations).

- Each additional page costs US$9, and certified copies are available for US$50.

In addition, Delaware offers optional expedited processing services, with fees ranging from approximately US$100 to US$1,000, depending on the desired turnaround time.

For Limited Liability Companies (LLCs), the fee to file a Certificate of Cancellation under Section 18-203 of the Delaware LLC Act is US$220, which includes a stamped “Filed” copy issued by the Division of Corporations.

What is needed to dissolve a corporation?

To properly dissolve a Delaware corporation, several legal and administrative requirements must be completed before the state recognizes the company’s closure.

- Board Resolution and Shareholder Approval: The Board of Directors must adopt a resolution recommending dissolution, followed by majority shareholder approval.

- Settlement of Taxes and Reports: All Delaware franchise taxes and annual reports must be filed and paid in full before submission of the dissolution documents.

- Filing of Certificate of Dissolution: The corporation must submit a Certificate of Dissolution (short or long form) to the Delaware Division of Corporations, together with the required filing fees.

- Winding Up and Recordkeeping: After approval, the corporation must wind up its affairs, settling debts, notifying claimants, and retaining records for at least three years as required by DGCL 278.

Completing these steps ensures the corporation is formally dissolved, avoiding future liabilities and maintaining compliance with Delaware law.

Who manages the dissolution process?

In Delaware, the responsibility for managing a corporation’s dissolution depends on whether the process is voluntary or court-ordered.

- Board of Directors: Oversees the voluntary dissolution process by passing a resolution, obtaining shareholder approval, and supervising the filing of the Certificate of Dissolution with the Delaware Division of Corporations.

- Delaware Court of Chancery: Handles involuntary or court-supervised dissolutions, appointing a receiver or trustee when the corporation becomes insolvent or fails to complete its obligations.

In both cases, directors or court-appointed officers are responsible for winding up affairs, settling debts, and ensuring compliance with Delaware law throughout the process.

Is it mandatory in Delaware to publish a notice when dissolving a company?

Publishing a notice is not mandatory in all cases, but it is strongly recommended under DGCL 280. Doing so helps limit the corporation’s future liability by informing creditors and claimants of the dissolution and setting a deadline for submitting claims.

If a company chooses not to publish, it may still face claims within the statutory three-year winding-up period.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.