Table of Contents

The decision to move LLC to another state across state lines is frequently driven by practical considerations, including more favorable business landscapes, advantageous regulatory frameworks, or personal relocation. For example, Delaware and Wyoming offer attractive options due to reduced tax liabilities and simplified compliance requirements.

However, this transition necessitates a comprehensive assessment of legal, tax, and operational factors. In this article, we will detail the procedures and available methods for the transition and establishment of a new LLC. Our aim is to empower business owners with the information to relocate an LLC and adhere to all pertinent state laws throughout the process.

Can you transfer an LLC to another state?

The prospect of relocating an LLC across state lines is tangible and permissible for business owners seeking more favorable operational landscapes. However, the ability to transfer LLC from one state to another is contingent upon understanding the specific legal requisites dictated by each jurisdiction.

Legal requirements across the states

State Secretary of State offices establish the legal prerequisites for moving a business from one state to another. These requirements encompass filing certificates of domestication, securing a registered agent within the new jurisdiction, and obtaining necessary operational licenses.

The regulatory landscape is not uniform. Certain states may require the establishment of a new LLC, while others facilitate a more streamlined domestication procedure. To illustrate, a California-based LLC moving to Texas would typically file a certificate of domestication with the Texas Secretary of State and appoint a Texas-registered agent.

Conversely, a move to Delaware, renowned for its specialized business court, involves more intricate legal considerations due to its distinct environment. If your LLC is doing business in a state other than Delaware, you will most likely have to register as a “foreign entity” in that other state as well. This adds an extra layer of compliance.

Tax implications of LLC transfers

State tax structures exhibit substantial variation. Some jurisdictions impose franchise taxes, while others maintain a no-state-income-tax policy.

For instance, moving an LLC to another state like New York, a high-tax state, to Florida, a state with no income tax, would result in a substantial alteration in its tax liabilities. Even in Florida, the business would still be subject to federal income taxes and potentially sales tax, depending on its operations.

Furthermore, if the LLC has employees, it would need to register for unemployment taxes and comply with payroll tax regulations in the new state.

Additionally, the concept of “nexus” becomes critical. If the LLC establishes a physical presence, employees, or major sales activity in the new state, it creates a nexus. “Nexus” is the connection that a business has with a state, which then determines whether that state has the authority to impose taxes on the entity.

Essentially, it’s the legal threshold that triggers a business’s tax obligations within a particular state. Therefore, a thorough review of the new state’s Department of Revenue publications, including specific tax forms and filing deadlines, is imperative.

Costs and fees to budget for

Transferring an LLC to another state involves a range of financial considerations. These encompass filing fees for requisite documentation, publication expenses where applicable, and registered agent fees. Furthermore, the amendment of existing contracts and legal documents to reflect the new state of operation will incur additional costs.

First, the planned foreign LLC registration or domestication fees must be factored into the financial plan. Then, the filing fees, for instance, vary greatly, ranging from several hundred to over a thousand dollars. Registered agent fees also vary by state and service provider. Costs associated with a new LLC formation, or if extensive onboarding is required, could be higher.

Reasons to move LLC to a new state

Relocating an LLC is often influenced by a variety of factors, all aimed at increasing business viability and owner satisfaction. Thus, having a clear understanding of these motivations is crucial before moving an LLC from one state to another.

Tax advantages

One of the most compelling reasons to move your LLC to a new state is the benefit of significant tax savings. Different states impose different tax burdens on businesses, so relocating to a state with a more favorable tax climate substantially impacts the entity’s bottom line.

The following are some of the most popular options currently available in the U.S:

- Wyoming and Nevada: Renowned for their lack of corporate income tax and low franchise tax rates, these states are currently preferred options for LLCs seeking to minimize tax liabilities.

- Delaware: While having a franchise tax, it’s often preferred for its specialized business courts and well-established corporate law, providing stable financial savings, particularly for businesses anticipating litigation or complex legal needs. Delaware is also known for its business-friendly legal structure for global incorporations.

- South Dakota: No corporate income tax and very low business taxes.

To determine the most advantageous location for your business, a careful analysis of state tax codes, including income tax, sales tax, and franchise tax, might be beneficial.

Growth opportunities

Along with tax considerations, chances of growth also drive LLC relocation.

Accessing targeted new markets, benefiting from a specialized business environment, or reducing specific operating costs are pivotal factors. In fact, a state with a larger, relevant customer base or industry-specific resources can provide a substantial competitive edge.

Let’s exemplify the following cases for a better understanding:

- Access to specialized talent and capital: Moving to a state like California’s Silicon Valley or Texas’s Austin can provide a tech-focused LLC with access to a concentrated pool of software engineers, data scientists, and venture capital firms.

- Reduced supply chain costs: Consider relocating a manufacturing or distribution LLC to a state with proximity to major transportation hubs, such as a port in Georgia or a logistics center in Tennessee.

- Industry-specific regulatory advantages: A financial tech company might find advantages in states like Wyoming, with progressive fintech laws.

- Market saturation and niche opportunities: If a local service-based LLC finds its current market saturated, moving to a neighboring state with less competition but a similar demographic profile can open up new customer bases.

- Government incentives and grants: Some states offer specific incentives, grants, or tax breaks to attract businesses in particular sectors, such as renewable energy or advanced manufacturing.

There is more to the question ”Can I transfer my llc to another state?”, because you can, and you should if the conditions are right

Personal relocation

When personal circumstances shift, relocating becomes a consideration. And for an LLC owner, aligning your business location with your residence often makes a lot of practical sense.

The same state lets you manage the day-to-day and compliance with state regulations, like maintaining a registered agent and filing reports. Having your business and home in the same place fosters stronger local connections. You can more readily engage with your community, build relationships with customers, and participate in local business networks.

Additionally, there can be tax efficiencies. Some states offer deductions or credits for businesses operating within their borders.

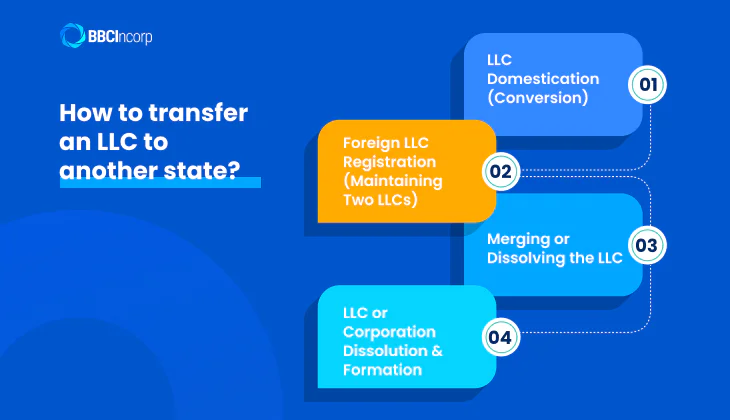

How to transfer an LLC to another state?

When relocating, procedural options are crucial as well, as there are several methods to transfer LLC to new state, each with its own requirements.

Below is a breakdown of the most commonly applied approaches.

Option 1: LLC Domestication (Conversion)

Domestication, also known as conversion, involves changing your LLC’s state of formation without dissolving the original entity. This is often the most seamless method, as it allows you to maintain your business’s history, Employer Identification Number (EIN), and contracts. States like Arizona, Texas, Nevada, and Wyoming implement this process, but not all states recognize domestication.

Steps to implement

- Verify that both your current and target states permit domestication.

- Draft the Articles of Domestication.

- Submit the Articles of Domestication to the Secretary of State in your target state, along with the required fees.

- Obtain a Certificate of Domestication.

- Amend your operating agreement, contracts, and other business documents to reflect the new state.

- Notify the original state of the domestication. This step is critical in the process of transferring an LLC to another state.

Option 2: Foreign LLC Registration (Maintaining Two LLCs)

Foreign LLC registration involves keeping your existing LLC in its current state and registering it as a “foreign LLC” in the new state where you intend to operate.

This is the most common answer to the question, “Can my LLC operate in another state and the current one at the same time?”

Steps to implement

- Secure a registered agent in the new state.

- Submit an application for foreign registration with the Secretary of State in the new state.

- Obtain a Certificate of Authority.

- Stay compliant in both your original and new states.

Option 3: Merging or Dissolving the LLC

This method involves merging your existing LLC into a newly formed LLC in the target state. It is less common but may be possible if domestication is not an option and maintaining two LLCs is undesirable.

Steps to implement

- Establish a new LLC in the target state.

- Create a merger agreement outlining the terms of the merger.

- Submit the merger agreement to the Secretary of State in both states.

- Dissolve the original LLC.

Option 4: LLC or Corporation Dissolution and Formation

How to transfer an LLC from one state to another in this way involves voluntarily dissolving your current LLC and forming an entirely new LLC in the target state. While more complex, it offers a clean break and allows you to establish a fresh start in the new location. This is the most complete method to move LLC to new state.

Steps to implement

- Dissolve the existing LLC, following the procedures in your current state.

- Form a new LLC in the target state.

- Transfer assets and contracts to the new LLC.

- Secure required licenses and permits in the new state.

- Notify stakeholders of the transition.

Each of these methods has its own set of advantages and disadvantages. Hence, you need to evaluate your business needs and consult with experienced legal and tax professionals.

Other compliance obligations when moving LLC to another state

Successfully navigating the process of moving LLC from one state to another necessitates diligent attention to ongoing compliance, ensuring seamless business operations.

Update business information

A crucial step involves promptly updating your business address with the IRS. While your EIN typically remains constant, please confirm if any tax-related details require modification. Similarly, you should engage with the new state’s Department of Revenue to ascertain any necessary tax registrations or revisions.

Appoint a Registered Agent in the new state

Appointing a compliant registered agent within the new jurisdiction is essential for receiving legal and official correspondence. This is the time to secure all requisite business licenses and permits for the new operational location while concurrently addressing the cancellation or transfer of existing licenses from the original state.

Transparent and timely communication of these changes to customers, vendors, and partners is paramount for maintaining business relationships.

Update business licenses and permits

Develop a comprehensive transition plan aimed at minimizing operational disruptions. In this case, proactive communication of the moving LLC to new state timeline and any potential changes to your team and clients is vital. This approach ensures a smooth transition and reinforces stakeholder confidence.

Start your new LLC in Delaware with BBCIncorp

Instead of transferring LLC to another state where they allow domestication, forming a new LLC in Delaware presents compelling advantages for businesses seeking strategic growth and long-term stability.

Why Delaware?

- Predictable legal environment: Delaware’s Court of Chancery specializes in corporate law, offering a well-established body of case law, particularly valuable for companies anticipating complex litigation, mergers, or acquisitions.

- Flexible and business-friendly regulations: Delaware’s General Corporation Law is renowned for its flexibility. They allow for tailored operating agreements and simplified corporate governance.

- Tax optimization for out-of-state operations: While Delaware imposes a franchise tax, it offers significant tax benefits for LLCs operating primarily outside of the state. There is no Delaware income tax on income generated outside of Delaware.

- Business credibility and investor confidence: A Delaware LLC often carries more prestige and strong credibility with investors, partners, and financial institutions.

- Specialized financial and legal services: Delaware’s status as a hub for business incorporation has led to a concentration of expert legal and financial services.

- Access to capital markets: Delaware facilitates LLCs formed in the region to delve into capital markets, including venture capital and private equity.

Choose Delaware LLC Formation with BBCIncorp

BBCIncorp offers streamlined Delaware LLC incorporation services, providing:

- Full LLC formation packages in Delaware, including filing and registered agent services.

- Registered agent services with active mail forwarding and compliance deadline alerts.

- Ongoing compliance support, including annual report filing assistance.

- Expedited processing options for urgent incorporations.

- Real-time tracking and processing of orders on our online portal platform

- Opening of business banking accounts, accounting, bookkeeping, and company secretary services as needed

Explore our pricing plans and take the first step toward establishing your LLC in Delaware for your journey today.

Conclusion

“Can I move my LLC to another state?” Moving your LLC to a new state is a significant undertaking, demanding careful consideration of legal, tax, and operational nuances. And there are many methods: from domestication to forming a new entity, each method presents unique features. Therefore, researching and planning for your operational continuity are must-do steps.

Tax incentives in Wyoming and Nevada are compelling, yet Delaware offers a unique blend of legal strength and business prestige. With its renowned legal framework and prominent business environment, a Delaware LLC can become a powerful catalyst for growth.

Contact our experts today at service@bbcincorp.com to explore your options and discover how we can streamline your transition to Delaware.

Frequently Asked Questions

Do I need to move my LLC to another state if I relocate personally?

No, you don’t have to move the entity. However, it is an option you should keep in mind.

While not legally mandated, relocating your LLC when you personally move is often highly advisable. It streamlines compliance with registered agent requirements and state tax obligations, simplifies day-to-day operations, facilitates local networking, and simplifies your personal tax filings.

What happens to my EIN when I move an LLC?

Your EIN typically stays the same.

The Employer Identification Number (EIN) assigned by the IRS to your LLC generally remains unchanged when you move your business to a new state. The EIN is tied to your business entity, not its physical location. However, it’s essential to update your business address with the IRS using Form 8822-B, “Change of Address or Responsible Party – Business.”

What are the typical costs of transferring an LLC?

Transferring LLC to another state involves a range of potential expenses, which can vary significantly depending on the chosen method and the specific states involved.

These costs typically include:

- Filing fees for domestication or foreign registration with the Secretary of State

- Annual fees for a registered agent in the new state, and

- Expenses associated with obtaining necessary business licenses and permits (if any).

Additionally, businesses should budget for potential legal and accounting fees for professional guidance, costs to update contracts and other legal documents to reflect the new state, and possible dissolution fees if the original LLC is being dissolved.

What is the best state to register an LLC in?

While the ideal state varies, Delaware consistently ranks highly. Its specialized Court of Chancery offers predictable legal outcomes, and its flexible General Corporation Law allows for customizable agreements. Delaware’s prestige enhances credibility, and it provides tax advantages for out-of-state/ global operations.

Wyoming and Nevada may also offer tax benefits, and your home state simplifies logistics, but Delaware’s prominent business environment is often optimal for long-term stability and growth.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.