Table of Contents

In 2024, organizations faced significant financial losses due to fraud, with the Association of Certified Fraud Examiners (ACFE) reporting total losses of $3.1 billion across 1,921 cases, averaging over $1.5 million per case(1).

Additionally, accounting errors and manual financial reporting were estimated to cost U.S. businesses approximately $7.8 billion annually(2). To mitigate such risks, reconciliation in accounting plays a crucial role in ensuring the accuracy and integrity of financial records.

So, what is reconciliation in accounting? This article provides a comprehensive guide to reconciliation in accounting, covering its definition, key types, and step-by-step process. Whether you’re a business owner, accountant, or finance professional, mastering reconciliation techniques is vital for ensuring accurate reporting, regulatory compliance, and financial stability. Read on to learn how effective reconciliation can protect your business from costly errors and fraud risks.

What is reconciliation in accounting?

Reconciliation in accounting is the process of comparing financial records to ensure accuracy and consistency. This involves matching internal records, such as general ledger balances, with external statements like bank records or invoices. The goal is to verify that all transactions are properly recorded, reducing the risk of errors, fraud, or financial misstatements.

The primary objective of reconciliation is to identify and resolve discrepancies. By doing so, businesses can maintain financial integrity, comply with accounting standards, and make informed financial decisions. Regular reconciliation also enhances transparency, supporting audits and regulatory compliance.

For example, during X Corporation’s monthly financial reconciliation, the accounting team notices a discrepancy between the company’s general ledger balance of $25,000 and the bank statement showing $24,700. Upon investigation, they identify:

- A $400 outstanding check has not yet been cleared by the bank

- A $200 automatic bank service charge was deducted but not recorded

- A $100 customer payment was deposited but has not yet been reflected in the ledger

After adjustments, the updated ledger balance aligns with the bank statement:

$25,000 – $400 – $200 + $100 = $24,700

Understanding what it means to reconcile an account goes beyond error correction—it plays a crucial role in internal financial control. The reconciliation meaning in accounting encompasses fraud prevention, accurate financial reporting, and informed decision-making.

Whether performed manually or automated through accounting software, reconciliation is a key component of sound financial management, contributing to business stability and long-term success.

Why is reconciliation in accounting important?

Accounting reconciliation is a critical financial process that ensures accuracy, prevents fraud, and strengthens financial management. For businesses, financial reconciliation plays a key role in maintaining financial integrity and operational stability.

- Ensuring Accuracy

Reconciliation verifies that financial statements accurately reflect a company’s actual transactions. By comparing internal records with external statements, businesses can correct errors and prevent misstatements, leading to reliable financial reporting.

- Detecting and Preventing Fraud

Regular reconciliation helps uncover fraudulent activities such as unauthorized transactions or financial misappropriations. By identifying discrepancies early, businesses can mitigate financial losses and strengthen internal controls.

- Supporting Informed Decisions

Accurate financial records enable businesses to make strategic decisions based on reliable data. Without proper reconciliation, companies may misinterpret cash flow, profitability, or expenses, leading to poor financial planning.

- Maintaining Regulatory Compliance

Financial reconciliation ensures businesses comply with tax laws, financial reporting standards, and regulatory requirements. Accurate records help avoid penalties, audits, or legal issues arising from financial misstatements.

- Managing Financial Risks

By identifying discrepancies in accounts payable, receivables, and inventory, businesses can proactively manage risks such as cash flow shortages, tax miscalculations, or unrecorded liabilities.

- Building Stakeholder Trust

Transparent and accurate financial statements enhance credibility with investors, lenders, and regulators. A well-maintained reconciliation process reassures stakeholders of the company’s financial health.

- Providing a Clear Audit Trail

A consistent reconciliation process creates a reliable audit trail, simplifying audits and financial reviews. This ensures businesses can substantiate transactions and comply with financial reporting obligations.

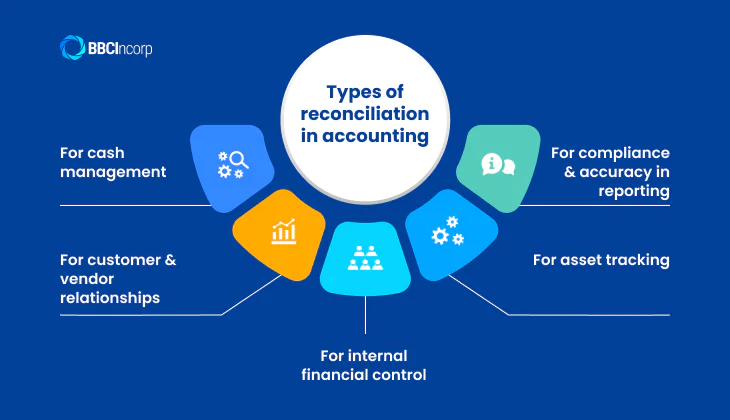

Types of reconciliation in accounting

Account reconciliation is essential for maintaining accurate financial records, ensuring compliance, and preventing discrepancies. Below are the types of financial reconciliation that depend on the nature of transactions and the accounts involved.

For cash management

- Bank Reconciliation: This process compares a company’s cash records with bank statements to identify outstanding checks, deposits in transit, and unauthorized transactions, ensuring cash flow accuracy.

- Digital Wallet Reconciliation: Businesses that accept digital payments must match wallet transactions with financial records to ensure all payments and withdrawals are accounted for correctly.

For customer and vendor relationships

- Accounts Receivable Reconciliation: Ensures that customer payments match invoices, preventing revenue misstatements and detecting uncollected balances.

- Accounts Payable Reconciliation: Confirms that supplier invoices align with payments made, preventing duplicate payments and disputes.

For internal financial control

- Intercompany Reconciliation: Large businesses with multiple subsidiaries reconcile transactions between divisions to eliminate discrepancies and ensure accurate financial reporting.

- General Ledger Reconciliation: Compares general ledger balances with sub-ledger entries to confirm financial data integrity and prevent errors in financial statements.

For asset tracking

- Inventory Reconciliation: Compares recorded inventory levels with physical counts to identify theft, shrinkage, or recording errors.

- Fixed Assets Reconciliation: Ensures asset records align with depreciation schedules and purchase documentation, preventing overstatement or understatement of asset values.

For compliance and accuracy in reporting

- Tax Reconciliation: Matches financial records with tax filings to confirm that tax liabilities are accurately reported and regulatory requirements are met.

- Credit/Debit Card Reconciliation: Ensures that recorded card transactions match bank and merchant processor statements, preventing fraud and unauthorized expenses.

- Global Currencies Reconciliation: Businesses handling international transactions verify foreign exchange rates and currency conversions to maintain accurate financial records.

- Real-Time Automatic Payment Reconciliation: Automates the matching of payments with invoices and transaction records, improving efficiency and reducing reconciliation errors.

By implementing structured reconciliation processes, businesses can ensure financial accuracy, mitigate risks, and maintain compliance, ultimately strengthening stakeholder confidence.

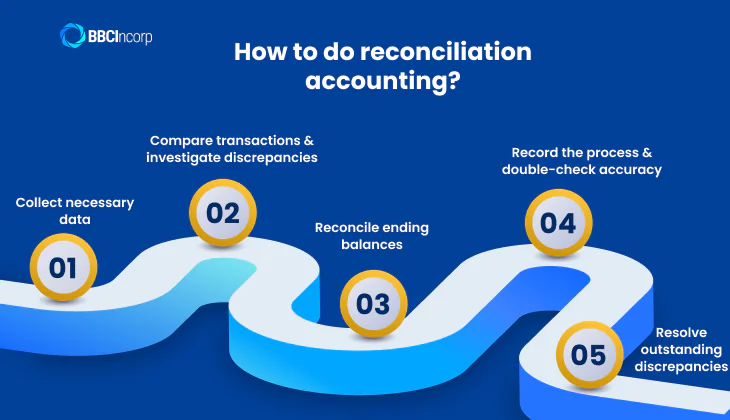

How to do reconciliation accounting?

The account reconciliation is essential for ensuring financial accuracy, detecting discrepancies, and maintaining compliance with accounting standards. By reconciling accounts regularly, businesses can prevent errors, uncover fraud, and keep financial records aligned with actual transactions.

Below is a step-by-step guide on “what is reconcile accounts” and how to carry out the process effectively.

Step 1: Collect necessary data

The first step in the account reconciliation process is gathering all relevant financial records. This ensures that you have accurate and complete data before starting the reconciliation. Essential documents include:

- Bank statements – to verify cash transactions

- General ledger records – to cross-check accounting entries

- Invoices and receipts – to confirm payments and revenues

- Credit card statements – to reconcile business expenses

- Accounts payable and receivable reports – to validate outstanding balances

Ensuring all records are updated and available is crucial to conducting a smooth reconciliation process.

Step 2: Compare transactions and investigate discrepancies

After collecting the necessary documents, the next step is to compare the recorded transactions in the company’s financial system with external records. Key elements to check include:

- Transaction amounts: Ensure they match across different records.

- Date of transactions: Verify that transactions are recorded in the correct period.

- Missing entries: Identify any unrecorded deposits, payments, or withdrawals.

- Bank fees: Check for any deductions not recorded in the books.

- Duplicate entries: Ensure that transactions are not recorded more than once.

If any discrepancies are found, investigate the cause by reviewing supporting documents. The differences could be due to timing issues, accounting errors, or bank adjustments.

Step 3: Reconcile ending balances

To ensure accuracy, adjust the recorded balances to reflect actual financial activities. The steps include:

- Adjusting for outstanding checks: Subtract checks issued but not yet cleared.

- Accounting for deposits in transit: Add deposits made but not yet reflected in the bank statement.

- Recording unposted fees or interest: Add or subtract bank charges and interest payments.

- Verifying adjustments in the ledger: Ensure all necessary corrections are recorded.

After these adjustments, the final balance in your books should match the external records.

Step 4: Record the process and double-check accuracy

Once all adjustments are made, it is important to document the reconciliation process. This includes:

- Making journal entries to correct any discrepancies.

- Recording adjustments in financial reports.

- Saving all supporting documents for audits and future reference.

- Reviewing the reconciliation process to confirm no errors were overlooked.

An adequately recorded reconciliation ensures financial transparency and simplifies audits.

Step 5: Resolve outstanding discrepancies

If there are still differences after reconciliation, take corrective actions:

- Contact the bank or vendor: Clarify unknown charges or missing payments.

- Review past transactions: Check for prior errors that may have caused inconsistencies.

- Adjust financial records: Update incorrect entries in the books.

- Strengthen internal controls: Implement measures to prevent future discrepancies.

Regular reconciliation—typically done monthly or quarterly—ensures that financial statements remain accurate, reducing risks and improving financial decision-making.

Common reconciliation discrepancies and how to resolve them

When performing reconcile accounts, businesses often encounter discrepancies that can affect financial accuracy. Understanding these common issues and knowing how to address them is essential for maintaining reliable records. Below are the most frequent discrepancies and their resolutions.

1. Timing Differences

Timing discrepancies occur when transactions are recorded in one period but reflected in external statements in another. Common examples include:

- Outstanding checks – Issued payments not yet cleared by the bank.

- Deposits in transit – Funds recorded in company books but not yet processed.

How to resolve:

- Identify pending transactions by comparing the general ledger with the bank statement.

- Adjust records to reflect outstanding items while ensuring they clear in the next period.

- Maintain clear documentation to differentiate genuine timing issues from errors.

2. Missing Transactions

Missing transactions occur when payments, deposits, or fees fail to appear in financial statements. Causes include:

- Overlooked expenses such as bank charges or interest fees.

- Failed bank feeds leading to unrecorded transactions.

- Manual entry errors or forgotten invoices.

How to resolve:

- Review bank statements and financial software to identify unrecorded transactions.

- Enter missing transactions promptly to maintain data consistency.

- Implement automated reconciliation tools to minimize oversight.

3. Transaction Errors

Errors in transaction recording can distort financial statements. Common mistakes include:

- Transposition errors – Recording incorrect numbers (e.g., $1,500 as $1,050).

- Duplicate entries – Logging the same transaction more than once.

- Misclassified transactions – Assigning expenses or income to the wrong accounts.

How to resolve:

- Cross-check original receipts and invoices against ledger entries.

- Adjust errors using correcting journal entries.

- Strengthen internal controls with periodic audits and employee training.

By proactively identifying and resolving these reconcile accounts discrepancies, businesses can ensure accurate financial reporting and minimize risks.

Best practices for accounting reconciliation

Accurate financial reconciliation is essential for maintaining a company’s financial health, ensuring compliance, and preventing errors or fraud. Implementing best practices can enhance efficiency and reliability in this critical process.

- Establish a Reconciliation Schedule

Regular reconciliation—preferably monthly—prevents discrepancies from accumulating and helps businesses detect issues before they escalate. - Embrace Automation

Leveraging accounting software minimizes human errors, speeds up matching transactions, and enhances accuracy through AI-driven processes. - Segregate Duties

Assign different individuals to recording, reconciling, and approving financial transactions to maintain checks and balances and prevent fraud. - Gather Necessary Documents

Ensure access to bank statements, invoices, receipts, and other financial records. A well-organized documentation system streamlines reconciliation and audit readiness. - Match Transactions Carefully

Compare financial records against supporting documents to verify accuracy. Even minor mismatches should be addressed promptly to prevent reporting errors. - Investigate Discrepancies Promptly

If inconsistencies arise, trace the root cause immediately. Delayed resolution can lead to larger financial misstatements. - Document Everything

Maintain detailed reconciliation records, including adjustments and resolutions. This ensures compliance and aids in future audits. - Implement Strong Internal Controls

Define clear reconciliation procedures, approval processes, and periodic reviews to minimize risks and improve accuracy. - Stay Up-to-Date on Accounting Standards

Ensure compliance with evolving regulations, such as GAAP or IFRS, to maintain consistency in financial reporting.

By adopting these best practices, businesses can strengthen financial oversight, reduce errors, and support long-term financial stability.

Conclusion

Reconciliation in accounting is more than just a routine task—it’s a fundamental pillar of financial integrity. By embracing it as a strategic tool, businesses can enhance transparency, mitigate risks, and make informed decisions with confidence.

As Warren Buffett once said, “Accounting is the language of business.” Ensuring accuracy in financial records is not just about compliance; it’s about building a solid foundation for sustainable growth.

Let us help you simplify the reconciliation process with expert guidance and seamless solutions. Contact us today at service@bbcincorp.com and take control of your financial future with precision and confidence.

References:

(1): https://www.acfe.com/about-the-acfe/newsroom-for-media/press-releases/press-release-detail

(2): https://www.brex.com/spend-trends/accounting/how-to-fix-accounting-errors-and-mistakes

Frequently Asked Questions

What are the risks of not performing bank reconciliation?

Failing to perform bank reconciliation introduces critical risks that can undermine a business’s financial health:

- Inaccurate Financial Reporting: Errors and fraud may go unnoticed, leading to misleading internal reports and non-compliance with external reporting standards.

- Cash Flow Mismanagement: Incorrect ledger balances can distort cash projections, impacting daily operations and financial planning.

- Manual Input Errors: High transaction volumes increase the risk of human errors when using spreadsheets or outdated methods.

- Data Fragmentation: Decentralized spreadsheets across departments lead to version confusion, data loss, and inconsistent records.

- Lack of Standardization: Non-uniform reconciliation formats delay financial close and increase the chance of mistakes.

- Limited Visibility: Without real-time tracking, managers struggle to monitor progress or detect bottlenecks in the close process.

- Regulatory Non-Compliance: Evolving standards require accurate, timely reporting—something manual methods often fail to support.

In short, reconciliation in accounting is not just about checking boxes—it’s about ensuring accuracy, trust, and compliance at every level of your organization.

What is 3-way reconciliation in accounting?

Three-way reconciliation in accounting is a vital process, especially for law firms, to ensure trust account accuracy, compliance, and client fund transparency. It involves comparing three records:

- Trust bank statements (from the bank)

- Firm’s internal trust ledgers (overall account activity)

- Individual client trust ledgers (specific client balances)

The goal is to confirm that all three balances match exactly. This helps detect errors, prevent misuse of client funds, and meet ethical and legal obligations. Typically required monthly, this reconciliation is essential for maintaining financial integrity and regulatory compliance in legal accounting practices.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.