Table of Contents

The Beneficial Ownership Information (BOI) report is a new federal requirement introduced under the Corporate Transparency Act, effective January 1, 2024. It requires many companies, especially small businesses and LLCs, to disclose who ultimately owns or controls them.

This move aims to strengthen transparency and prevent illicit financial activity. Failing to comply may result in civil or criminal penalties. This makes timely reporting a legal priority.

So what is a BOI report? How does it affect your business? This article will guide you through the essentials. We break down who must file, what information is required, and how to stay compliant under this evolving regulatory framework.

What is a BOI report?

The Beneficial Ownership Information (BOI) report is a mandatory filing introduced under the Corporate Transparency Act (CTA), which came into effect on January 1, 2024. The purpose of this federal requirement is to help U.S. authorities uncover the individuals who ultimately own or control legal entities operating in the country. By doing so, it aims to combat illicit activities such as money laundering, tax evasion, and terrorism financing.

This reporting requirement affects millions of companies, particularly smaller entities like LLCs and closely held corporations.

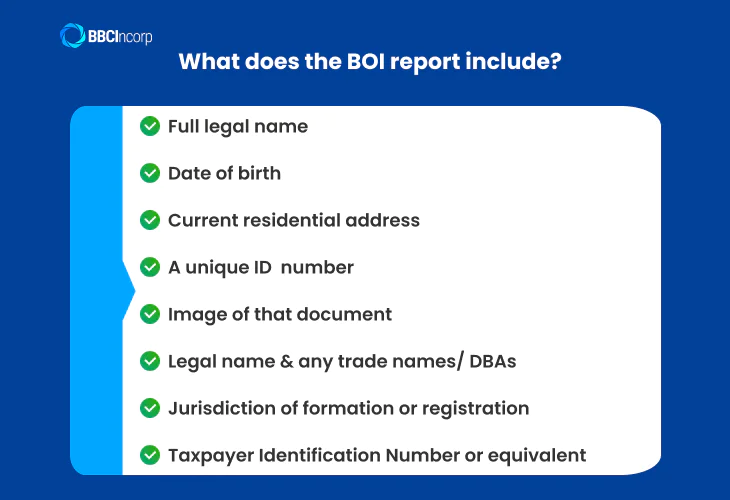

What does the BOI report include?

A BOI report collects specific identifying details about each beneficial owner of a reporting company. According to the Financial Crimes Enforcement Network (FinCEN), a “beneficial owner” is any individual who either directly or indirectly exercises substantial control over the company or owns or controls at least 25 percent of its ownership interests.

Each beneficial owner must provide the following information:

- Full legal name

- Date of birth

- Current residential address (not a business address)

- A unique identifying number from a government-issued document (e.g., passport, driver’s license)

- An image of that document

The report must also include key company details, such as:

- Legal name and any trade names or DBAs

- Jurisdiction of formation or registration

- Taxpayer Identification Number (TIN) or equivalent

Companies formed on or after January 1, 2024, must also report information about their company applicants, the individuals responsible for filing the formation documents.

Who must file a BOI report?

Most domestic and foreign entities registered to do business in the U.S. are required to submit a BOI report. This includes corporations, LLCs, and other entities created through a filing with a secretary of state or similar office.

For instance, companies formed before January 1, 2024, have until January 1, 2025, to file their initial BOI report. Companies formed during 2024 must file within 90 calendar days of receiving notice of their formation. Entities created on or after January 1, 2025, must file within 30 calendar days.

Certain types of entities are exempt from filing. These include:

- Large operating companies with more than 20 full-time U.S. employees, over $5 million in annual U.S. revenue, and a physical office in the U.S.

- SEC-registered companies

- Banks, credit unions, and insurance companies

- Tax-exempt entities

- Subsidiaries wholly owned by exempt entities

For a complete list of exemptions, please refer to Title 31, CFR §1010.380(c)(2).

Why is BOI reporting required?

The meaning of the BOI report in today’s regulatory landscape centers on corporate accountability. Introduced by the Corporate Transparency Act in 2024, this requirement helps identify the individuals who own or control companies.

The policy goals behind BOI reporting

One of the main goals of BOI reporting is to fight money laundering, terrorism financing, and tax evasion. Anonymous shell companies have long been a tool for hiding illicit activities. The BOI framework improves transparency by requiring entities to report personal details of individuals with substantial ownership or control.

This aligns the United States with global standards set by the Financial Action Task Force and with transparency practices already in place in the United Kingdom and European Union.

For legitimate companies, compliance provides more than legal safety. It builds trust with banks, investors, and regulators. It signals that the business is serious about transparency and long-term growth. Entities that meet BOI filing requirements often find smoother onboarding processes and fewer questions during audits or due diligence reviews.

Legal consequences of non-compliance

The law also outlines clear consequences for non-compliance. As enforcement increases, businesses cannot afford to ignore BOI compliance. FinCEN has the authority to impose civil penalties of up to $500 per day for ongoing violations and criminal fines of up to $10,000 and two years in prison.

Notably, these consequences apply even if the company did not intend to mislead but still failed to act.

Revised scope as of 2025

A major shift occurred on March 21, 2025, when FinCEN issued an interim final rule narrowing the CTA’s scope. Under this rule, domestic reporting companies, entities formed in the United States, are exempt from BOI reporting.

Only foreign reporting companies (entities formed abroad and registered to do business in the U.S.) remain subject to filing requirements. U.S. beneficial owners of foreign entities are also exempt.

These foreign reporting companies must file by April 25, 2025, if they were registered before March 26. New foreign companies have 30 calendar days after registration to file.

So what are BOI reports in practical terms? They are detailed disclosures that promote responsible business activity and protect the financial system. Many companies have asked, is the BOI report legit?

The answer is yes. It is an enforceable federal requirement that reflects the broader shift toward corporate transparency. Entities that understand the BOI report meaning and comply on time will reduce risk and meet evolving expectations in global business.

When and how to file a BOI report

Once you understand what a BOI report is, the next step is knowing when and how to file. BOI filing requirements vary depending on when the company was created and any changes to its ownership or control structure.

Filing deadlines and frequency

For reporting companies created or registered before January 1, 2024, the deadline to submit their initial BOI report is January 1, 2025. Companies formed on or after January 1, 2024, currently have 90 calendar days from the date of their formation or registration to file.

This window was extended from 30 days for new companies formed in 2024, but starting January 1, 2025, the timeline will revert to 30 days.

In addition to the initial report, any company that undergoes a change in its beneficial ownership or applicant information must file an updated report within 30 days of the change. This includes changes such as a new beneficial owner, a change in a reporting person’s address, or a new identification document.

There is no requirement to file annually or periodically if no changes occur. However, the report must remain accurate. This answers a common question: how often do you file BOI reports? Only when changes occur.

Where and how to file

All BOI reports must be submitted through the official filing portal maintained by FinCEN, the Financial Crimes Enforcement Network. There is no filing fee. The secure online system is designed to collect and protect sensitive data under the agency’s strict confidentiality rules.

Companies must prepare accurate information for both the entity and its beneficial owners. This includes consistent names, addresses, and identifying numbers, ideally matching other official filings to avoid delays or compliance issues.

All identification documents must be current and clearly legible. Expired IDs or inconsistent data may lead to a rejected filing or legal punishments.

When asking what the BOI filing process involves or what a federal BOI report includes, the answer is clarity, timeliness, and accuracy. Submitting your report correctly protects your business from punishments and demonstrates responsible corporate governance in today’s transparent regulatory environment.

BOI reporting for LLCs and small businesses

Limited liability companies and small businesses now fall under tighter federal scrutiny, particularly when it comes to ownership disclosure. With the Corporate Transparency Act in full effect, comprehending what is a BOI for LLCs is essential for legal compliance and business continuity.

Why LLCs must comply

Unlike corporations, LLCs generally are not required to disclose ownership details to the public. This privacy has made them an appealing vehicle for small business owners, but it also attracted misuse. The BOI report for LLCs aims to balance that privacy with greater transparency, letting U.S. regulators identify who truly controls or benefits from a business.

Both single-member and multi-member LLCs must comply with BOI reporting requirements if they are formed or registered to do business in the U.S., unless exempt. This means that even small one-person entities must file, along with more complex partnerships. You can learn more about the differences between these two structures in our guide to multi member LLC vs single member LLC.

Each beneficial owner must be identified in the BOI report for an LLC. A beneficial owner is anyone who exercises substantial control or owns at least 25 percent of the company. The information required includes their full legal name, date of birth, residential address, and a valid government-issued ID number.

Special cases and challenges

LLCs and small businesses may face unique challenges when ownership or company details change. For example, adding or removing a member triggers the need to file an updated BOI report within 30 days.

Changes in business address, tax identification number, or even the reclassification of the entity (such as a partnership converting to a corporation) also require timely updates.

These nuances highlight the importance of understanding the answer to the question: what is a BOI report for LLC? and how it may evolve throughout the business lifecycle. For small businesses, staying compliant means monitoring internal changes just as closely as external filings.

If you’re wondering what a BOI report is for a business in broader terms, it’s a shift toward greater accountability. And for LLCs, it’s a compliance step that cannot be overlooked in 2025.

BBCIncorp’s corporate secretary services help simplify BOI compliance

BOI compliance presents ongoing challenges for small businesses and LLCs, especially those unfamiliar with U.S. reporting rules. Understanding what is a BOI report and managing the filing process requires close attention to federal regulations, ownership structures, and deadlines.

BBCIncorp provides the support needed to meet these requirements accurately and efficiently.

Why corporate secretary support is crucial for BOI filing

BOI reporting introduces complex obligations that many business owners have not faced before. It is not just a matter of submitting a form. Companies must provide detailed, accurate information about their beneficial owners, track changes promptly, and stay aligned with FinCEN’s filing standards.

This process requires a consistent and knowledgeable approach. A corporate secretary handles the preparation of key documents, applies the right criteria to identify reporting obligations, and tracks regulatory changes. For U.S. and foreign-owned entities alike, this role reduces mistakes and keeps reporting in line with current legal requirements.

With BBCIncorp corporate secretary services, business owners gain clarity and control over their BOI reporting obligations, supported by expert review and timely action.

How BBCIncorp supports BOI reporting in the U.S.

BBCIncorp offers end-to-end assistance tailored to small businesses and LLCs. This includes:

- Entity assessment: Analysts determine whether the company qualifies as a reporting company or falls under one of the 23 exemptions under the Corporate Transparency Act.

- Document preparation: Beneficial ownership information is collected and reviewed, including full legal names, residential addresses, dates of birth, and acceptable identification numbers.

- Filing and monitoring: BOI reports are submitted to FinCEN through the official filing system. Any required updates or corrections are tracked and managed according to the 30-day update rule.

- Ongoing compliance: Calendar-based alerts and structured monitoring help businesses stay current with filing obligations, even as ownership or entity classification evolves.

At BBCIncorp, our expert team collaborates with professional partners to establish the framework and procedures necessary to address these emerging requirements. Thereby, we provide the solutions businesses need to remain current and progress confidently with ease.

For further details, please visit our website or reach out to BBCIncorp to discuss your BOI reporting requirements with our support team.

Conclusion

In short, the BOI report for an LLC is a key federal requirement that promotes corporate transparency and strengthens the United States framework against illicit financial activity. It applies to a wide range of companies, particularly LLCs and corporations that previously operated with minimal ownership disclosure.

What is a BOI report and how BOI compliance works is now a core part of responsible business management. Filing early facilitates businesses to avoid costly mistakes and stay ahead of regulatory obligations. It also supports broader goals of financial accountability and trust in the corporate environment.

Given the legal and procedural demands, many businesses turn to experienced professionals for reliable reporting and timely updates. Among them, BBCIncorp provides optimal systems to assist companies in effectively managing their BOI obligations, providing dedicated assistance from the incorporation stage onward.

Kindly contact service@bbcincorp.com for timely support with your BOI report and ongoing filings today.

Frequently Asked Questions

What does BOI stand for in business?

BOI meaning in business stands for Beneficial Ownership Information. It refers to the personal details of individuals who directly or indirectly own or control a company. The full form of BOI is central to new compliance requirements under the Corporate Transparency Act in the U.S., which came into effect on January 1, 2024.

Reporting companies, especially small businesses and LLCs, must report this information to the Financial Crimes Enforcement Network (FinCEN). The goal is to strengthen corporate transparency and prevent misuse of anonymous entities for financial crimes. Failure to submit an accurate BOI may lead to civil or criminal penalties.

What is the difference between a BOI report and tax filings?

A BOI report, or Beneficial Ownership Information report, focuses on identifying the individuals who ultimately own or control a company. Filed with FinCEN, this report supports anti-money laundering efforts by promoting transparency in business ownership. It does not involve financial data or tax assessment.

On the other hand, tax filings are submitted to the IRS and include financial details like income, expenses, and deductions used to calculate taxes owed.

In short, the BOI report reveals ownership for regulatory oversight, while tax filings report financials for tax compliance. They serve different legal and administrative functions.

Do I need to refile if nothing changes?

If there are no changes to your company’s beneficial ownership or key identifying details, you do not need to refile your BOI report. The purpose of BOI reporting is to maintain accurate and current records with FinCEN. However, if any information changes, such as ownership structure, address, or legal name, you must file an updated report within 30 days.

Staying alert to changes is essential to remain compliant with the Corporate Transparency Act. Regular reviews can help confirm whether your current filing still meets the reporting requirements set by FinCEN.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.