Procedure for filing Belize Annual Tax Return

Filing an Annual Tax Return in Belize involves three main steps:

Step 1

Apply for a Tax Identification Number (TIN) from the Registry. This number is essential for tax authorities to effectively monitor the status of your International Business Company (IBC). Typically, it takes around 7 working days to receive an approved TIN.

Step 2

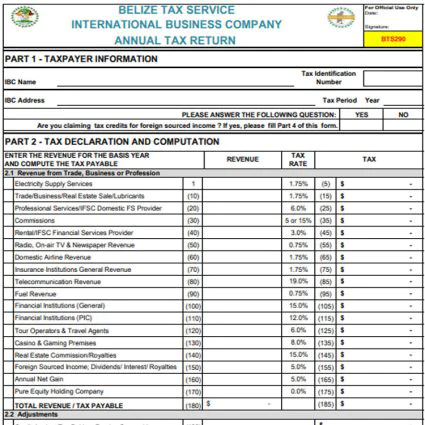

Complete the IBC Annual Business Tax Form (BTS290) for your annual tax return. The form is divided into five sections:

- Part 1 – Taxpayer information: You must provide all required details, including your TIN, company address, and filing date.

- Part 2 – Tax declaration & computation: You need to declare your business’s annual revenue, and the form will calculate the corresponding tax based on the applicable rates.

- Part 3 – Declaration: Certify the completeness and accuracy of your tax return by confirming your name, position in the company, and signing and dating the form.

- Part 4 – Tax paid on income from foreign sources: You need to provide a summary of the revenue amount, types of revenue, and taxes paid in foreign jurisdictions.

- Part 5 – Annual net gain computation: Calculate your net annual gain using the formula provided in the form.

BTS290 sample form

Reminder:

Companies must ensure timely tax payments. Additionally, certain companies may be required to submit audited financial statements in compliance with IFRS alongside their tax forms. The companies obligated to provide audited financial statements include:

- International Business Companies (IBCs) with minimum receipts of $6,000,000 (U.S. dollars); or

- Any other companies that meet at least two of the following criteria:

- Listed on an approved stock exchange;

- Regulated by the IFSC;

- Undergoing a restructuring process or planning to sell all their assets through an auction;

- Required to prepare consolidated financial statements.

Step 3

Submit all required documents and proofs to your registered agent via email.

Deadline for annual tax return

In 2021, the Belize Tax Service Department announced the initial deadlines for filing annual tax returns for International Business Companies (IBCs) during the grandfathered period and for non-exempt IBCs as follows:

- Companies incorporated before October 17, 2017, are not required to file annual returns for the 2020 tax period.

- The following groups have a filing deadline of March 31, 2022:

- Grandfathered-in IBCs, incorporated before 17 Oct 2017, with the tax period from Jul to Dec 2021

- Non-exempt IBCs with the 2020 or 2021 basis year tax period

After this initial notice, all Belize companies will be required to file business tax returns annually. The annual tax filing deadline will be March 31 each year, unless an extension is granted by the Director General of the Belize Tax Service.

Please be aware that starting from the tax period ending March 31, 2023, taxpayers must file electronic tax returns with the Belize Tax Service Department (BTSD). Returns and payments will only be accepted online through the Integrated Revenue Information System (IRIS Belize).

If you have any questions about the Belize annual tax return or need assistance with the filing process, please feel free to reach out to us at service@bbcincorp.com.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.