Table of Contents

Starting from August 26th, 2020, all international business companies (IBCs) registered under Nevis Business Corporation Ordinance, 2017 (NBCO) and limited liability companies (LLCs) under Nevis Limited Liability Company Ordinance, 2017 are obliged to file simplified tax return for the first time and every year thereafter.

The next question might be what is in the form if my company is exempted from all taxes in SKN. By popping up these kinds of questions, you could miss some recent important updates in tax regimes of the Federation.

An overview of the recent tax changes

Since the OECD forum on harmful tax practices began in 1998, over 130 jurisdictions, including Saint Kitts and Nevis, have joined to promote a fair and transparent global tax environment. This, combined with St.Kitts’s placement on the EU’s blacklist of non-cooperative jurisdictions in early 2018, prompted immediate action to align with international tax governance practices while preserving the attractiveness of its offshore financial services sector.

On December 31, 2018, St.Kitts announced a significant amendment to the International Business Corporation (IBC) regime, removing what the OECD and EU considered a preferential tax regime. As of January 1, 2019, newly incorporated IBCs would no longer be exempt from taxes in St.Kitts, regardless of where they conducted their business—inside or outside of the jurisdiction.

Further changes to the IBC regulations were introduced in late 2019, which included a grandfathering provision allowing IBCs formed before 2019 to retain their tax exemption until June 30, 2021.

Following these amendments, a pressing question arose regarding how the tax status of an IBC would be determined moving forward. In March 2020, the Federation committed to amending the St.Kitts and Nevis Income Tax Act to clarify the definition of tax residency based on the location of central management and control or permanent establishment. This commitment was realized with the passage of the Income Tax (Amendment) Act, 2021, in March of this year.

Additionally, since August 2020, there has been a notable requirement for all IBCs and LLCs to file the Corporate Income Tax (CIT) 101 form annually, reflecting the evolving tax landscape in St.Kitts.

Tax residency and consequent tax treatment

Currently, a tax-resident company in St. Kitts and Nevis is taxed on its worldwide income, whereas a non-tax resident is only taxed on income earned within the Islands.

The tax residency of an International Business Company (IBC) or Limited Liability Company (LLC) is determined by its central place of control and management, primarily assessed by where the Board of Directors (BOD) meetings take place.

Key factors to consider regarding the significance of BOD meetings include:

- Strategic decisions made during the meeting

- The qualifications and relevance of participants in managing the company’s affairs

It is crucial to maintain proper documentation of these meetings to demonstrate your tax residency location to the tax authorities.

However, if the central place of control and management is in another country, an IBC or LLC may still face taxation in St.Kitts if it establishes a permanent presence in the Islands. The Inland Revenue Department (IRD) will consider factors such as the existence of an office, branch, factory, construction project, agent, or representative to determine taxable presence. Additionally, local employees and capital expenditures will be closely monitored by the IRD.

CIT 101 form – new filing requirement

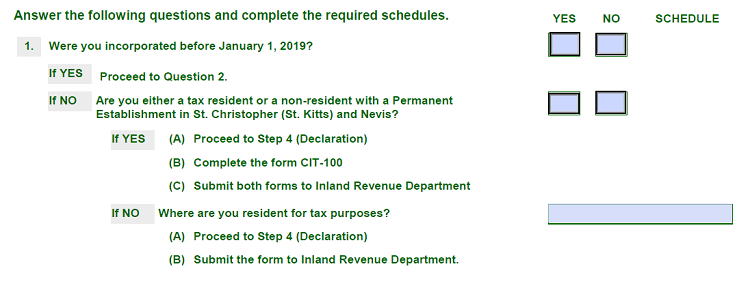

The CIT 101, or simplified tax return (STR), is a streamlined version of the corporate income tax return, requiring corporations to declare their tax residency.

All IBCs and LLCs, regardless of their tax residency status, must complete and submit the STR form to the Inland Revenue Department (IRD).

Part of the STR form

Non-resident companies in St. Kitts must also determine if they have a “Permanent Establishment” in the Islands. If so, they are required to complete the CIT 100 form to report their taxable income in SKN.

The company’s director/manager or authorized representatives shall be liable for the form completion and filing before due date.

Should you have any questions regarding CIT 101 form, kindly contact our service department via service@bbcincorp.com for clarification.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.