It’s never enjoyable to figure out how to close your business, but sometimes turning the page may bring you peace of mind and open the door to new opportunities ahead.

Although you may be familiar with the process of forming a company, such as filing for incorporation or acquiring a business license, you may not be aware of the proper legal procedure for closing a firm.

There is legal documentation to be completed, assets to be distributed, and employees to be paid. You’ll need to tie up these loose ends before you can go on with your plans for the future.

In this article, we will walk you through an essential guide to deregistering a business in Hong Kong.

What is Hong Kong company deregistration?

Company deregistration in Hong Kong, also known as company dissolution or striking off, is the process of officially closing a company’s operations and removing it from the Companies Registry in Hong Kong.

Not all Hong Kong companies can apply for deregistration. To be eligible, your company must satisfy the following criteria:

- Be a local private company/ a local company limited by guarantee, excluding those companies in section 749 (2) of the Companies Ordinance.*

- Be a defunct solvent company (no longer operating any business and has no debts or liabilities)

The terms “Defunct” and “Solvent” indicate a company is no longer operating any business and has no debts or liabilities.

Entities listed in section 749 (2) of the Companies Ordinance

- An authorized institution as defined by section 2(1) of the Banking Ordinance (Cap. 155)

- An insurer as defined by sections 2(1) and (2) of the Insurance Ordinance (Cap. 41); (Amended 12 of 2015 s. 167)

- A corporation licensed under Part V of the Securities and Futures Ordinance (Cap. 571) to conduct business in any regulated activity as defined by section 1 of Part 1 of Schedule 1 to that Ordinance

- An associated entity, within the meaning of Part VI of the Securities and Futures Ordinance (Cap. 571), of a corporation mentioned in paragraph (c)

- An approved trustee as defined by section 2(1) of the Mandatory Provident Fund Schemes Ordinance (Cap. 485)

- A company registered as a trust company under Part VIII of the Trustee Ordinance (Cap. 29)

- A company having a subsidiary that falls within the above categories

- A company that falls into the above categories at any time during the 5 years immediately before the application under section 750 is made

See more details here.

What are the different ways of closing a business?

Deregistration, along with striking off and winding up, are three typical methods used to dissolve a company in Hong Kong. Yet, each process bears a significant distinction in the requirements as well as steps to be entailed.

Deregistration

This strategy is popular among Hong Kong enterprises due to its simplicity and speedy completion. However, there are several standards you must meet to close your business in this manner.

Winding up

This strategy is used to close a firm that is not profitable and has unmanageable debts. A liquidator will be appointed to settle the accounts and collect the assets of the firm, ensuring that all obligations are paid off.

The winding-up procedure entails extra steps and multiple stakeholders, which might take up a lot of time and money.

Striking off

Unlike the other two methods, striking off is a statutory power given by the Registrar of Companies. In other words, a company is not able to make the application for striking off itself, but it depends on the Registrar.

When your Hong Kong company ceases to operate or do business, the Registrar will strike your company name from the Companies Register and dissolve it.

What are the reasons for Hong Kong company deregistration?

Although every business strives for success and long-term growth, there may be times when you must deregister your firm.

For your reference, below are some examples:

- Your company violates legislative responsibilities – i.e., inappropriate business management.

- Your company fails to conduct its business activities and is no longer profitable

- Your company cannot deal with the debts

- The shareholders of your company are having conflict and cannot cooperate

- The company is part of a corporate reorganization

Whatever the cause, you should not close down the company quickly and let the pieces fall where they may, or you may be burdened with problems, litigation, and debts.

How to deregister a company in Hong Kong?

To close down your Hong Kong firm, you must complete a set of sequential steps that include numerous requirements and criteria. Let’s find out!

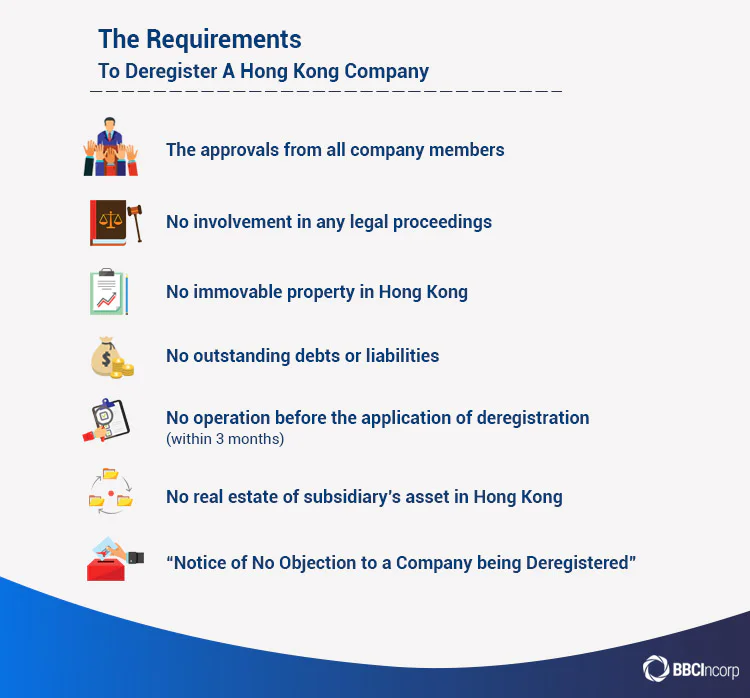

Requirements to deregister your company

Make sure you fulfill all the requirements before sending an application to deregister your company.

- The deregistration is approved by all of your company’s member

- The company is not involved in any legal proceedings

- The company has no immovable property located in Hong Kong

- No outstanding debts or liabilities are available

- No operation or business has been conducted within 3 months before the application for deregistration

- In the case of a holding company, none of the subsidiary’s assets has immovable property located in Hong Kong

- The company has got a “Notice of No Objection to a Company being Deregistered” (also known as “Notice of No Objection”) delivered by the Commissioner of Inland Revenue

Deregistration process for a defunct solvent company in Hong Kong

The process can be completed in 2 steps as below:

Step 1: Obtain a Notice of No Objection issued by the Inland Revenue Commissioner

To apply for a “Notice of No Objection”, you need to fill in Form IR1263.

You can download it from the website of the Inland Revenue Department. Then, submit the form together with a non-refundable fee to the Inland Revenue Department.

Step 2: Deliver documents to the Companies Registry

After the receipt of the Notice of No Objection, you have to send the below documents to the Companies Registry:

- The original copy (hard copy, or certified copy if via electronic delivery) of the “Notice of No Objection”

- A completed Form NDR1, plus a required fee of HK$420 which is non-refundable in any case

- Additional information requirements may have in some cases

Company deregistration period in Hong Kong

If nothing goes wrong with your documents, you can receive a letter of approval for the deregistration application within 5 working days. The Company Registrar in the Hong Kong Gazette will publish a notice of the proposed deregistration.

During 3 months since the published date, if there has been no objection to your deregistration, then the Registrar will proceed to issue the second notice (the final one) to inform your business to be deregistered. In parallel to the final notice announced, the dissolved company is official.

Similarly, the applicant/nominated person in the application will receive the company deregistration advice.

Other considerations for company deregistration in Hong Kong

There are further considerations that you need to know before and after applying for your company deregistration in Hong Kong.

Disposal of company property

Before submitting your application, ensure that you have properly disposed of your company’s property.

In accordance with Hong Kong regulations, all the company’s property – including credit balance in the business bank accounts, landed property, or motor vehicles to name a few will be considered bona vacantia (i.e., vacant goods).

Upon the dissolution of your company, all of these assets must be held by the Hong Kong Government’s Special Administrative Region.

In case you still wonder about how to properly dispose of your business assets, you could take advice from professional experts for further information.

Annual returns requirements

Until your company is officially deregistered, you must continue to meet all compliance obligations under the Companies Ordinance. Simply put, after filing for deregistration, you must still retain the responsibilities below:

- Filing Annual Returns

- Notifying the Companies Registry of the situation of your address of registered office if any change occurs. In this case, you should deliver Form NR1 to report the changes

- Giving notices of change(s) of company secretary and director(s) as well as their particulars for registration. In this case, a Form ND2B should be delivered to report the changes

Notably, any Hong Kong company that fails to fulfill its statutory obligations must be liable for legal penalties. Make sure you are fully aware of all liabilities and relevant procedures to make your deregistration process run smoothly.

To get a better understanding of compliance duties for a company in Hong Kong, check out our article on Hong Kong Company Annual Compliance Requirements

Restoration of a deregistered company

If you’re wondering whether you can restore a deregistered company, the answer is yes. You must file an application with the Regional Trial Court (under Section 765(2) of the Companies Ordinance) and wait for around 2 months to receive results.

For further information on what papers to prepare and how to carry out this procedure, feel free to chat with one of our friendly consultants for practical advice.

Free ebook

Everything you need to start business in Hong Kong

Find out in a matter of minutes.

Conclusion

Company deregistration in Hong Kong is a very popular option for businesses when it comes to how to close a company affordably and quickly Yet, there are certain conditions for the eligibility of applicants that you should take into account.

It is also crucial to understand the process of dissolving your business, along with the statutory obligations involved as per the request of the Hong Kong Government.

For that reason, you should engage with reliable expert firms to help your business achieve a simple, transparent, and time-saving process.

Should you wish to receive help from a reliable expert for your company deregistration, don’t hesitate to contact us via email at service@bbcincorp.com, or drop us a live chat message!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.