Singapore is one of the most attractive business hubs in Asia.

The open economy and transparent regulatory framework are key factors behind its popularity.

Besides, Lion City offers a low tax rate and business-friendly nature, which makes it an awesome place for your business kickstart.

If you’re starting a company in Singapore, it’s important that you know all your option for company types.

In this blog, let’s walk you through the various types of companies in Singapore, as well as the pros and cons of each type. So you can get off to a great start!

Common types of companies in Singapore – What you should know

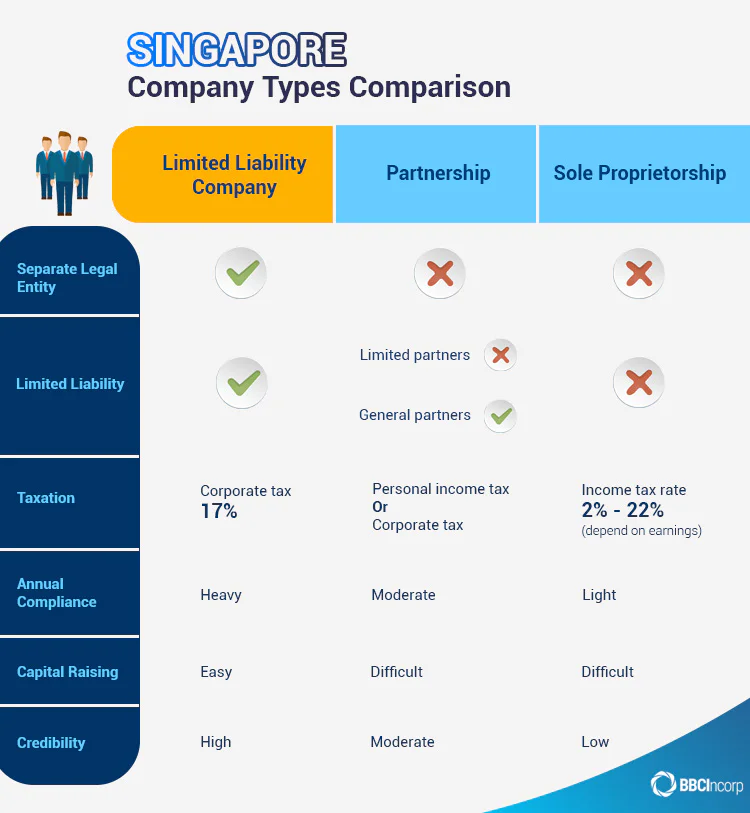

There are three common company types in Singapore, Limited Liability Company, Partnership, and Sole Proprietorship.

In this section, let’s tap into the specific features of each type.

Limited Liability Company

You might have heard about a Limited Liability Company or LLC more than once before.

It’s also a popular business entity in Singapore, which can be formed under the private or public sector:

- Private sector: Private limited company by shares and Exempt private company

- Public sector: Public company limited by shares and limited by guarantee

Advantages of Singapore LLC

- Limited liability: As the owner of a Singapore LLC, you only take responsibility for the liabilities equivalent to the value of shares you contribute to the company.

- Separate legal status: Your LLC is a separate and distinct legal entity. So it can sign contracts, acquire and own assets, sue, or be sued under its own name.

- Tax advantage: Your LLC is subject to an income tax rate of 17%. Besides, you’ll be eligible for a wide range of exemptions and reliefs from the government. This can reduce your tax burden significantly.

Disadvantages of Singpore LLC

Running an LLC means you have to handle the paperwork. Specifically, your compliance requirements for Singapore LLC include:

- Filing tax returns with IRAS

- Filing annual returns with ACRA

- Holding AGMs (Annual General Meetings)

- Submitting accounting reports

- Other duties as required by relevant competent authorities

Partnership

To establish a partnership, you’ll need at least 1 partner. Generally, a partnership does not have s separate legal entity. This means you and your partner will be jointly responsible for all company’s liabilities (unless you’re a limited partner).

To summarize, the three main forms of partnership in Singapore are:

- General partnership (GP)

- Limited partnership (LP)

- Limited liability partnership (LLP)

Key differences between GP, LP, and LLP

- Legal status: LLP is a separate legal entity, while GP and LP are not.

- Partner’s liability: If you form an LLP, you can be a limited partner or general partner. A limited partner has liability limited to the investment. Whereas a general partner has unlimited liability. For GP and LP, the partners would hold unlimited liabilities for any company’s matters and losses.

- Number of partners: A Singapore general partnership must have at least 2 partners, but cannot exceed 20. There is no maximum number of partners in an LP and LLP.

- Tax rates: If you’re in an LLP, you’ll pay personal income tax (for individuals) or corporate income tax (for corporations). A Singapore partnership has less chance to gain tax relief than an LLC.

- Compliance requirements: Your partnership compliance is simpler and more straightforward than that of an LLC in Singapore.

Sole proprietorship

You can register a sole proprietorship easily but managing and maintaining it can be quite challenging.

A sole proprietorship is also known as a ‘one-man show’. This means you control the business on your own and take full responsibility for the company’s losses and liabilities.

Advantages

- Compliance requirements: A Singapore sole proprietorship has the slightest burden from maintenance requirements. Specifically, the two biggest duties that you need to handle include business renewal and submission of tax returns with IRAS.

- Low cost: You only have to pay business license fees and taxes for a sole proprietorship. Though it may vary across countries, the cost for a sole proprietorship is often minimum.

Disadvantages

- Legal status: The sole proprietorship does not have a separate legal entity

- Unlimited liability: As a sole proprietor, you shall personally be in charge of all arising debts, liabilities, and losses of your business.

- Taxation: You’ll have to pay personal income tax depending on the level of your earnings. For Singapore residents, the rate is between 0%-22%. For non-residents, you’ll pay a flat rate of 15%-22%

Registration of overseas companies in Singapore – Which options to consider

If you’re a foreign company planning to expand to Singapore, there’re various options you can choose from.

In the below section, let’s discover the three most common entity types for overseas companies.

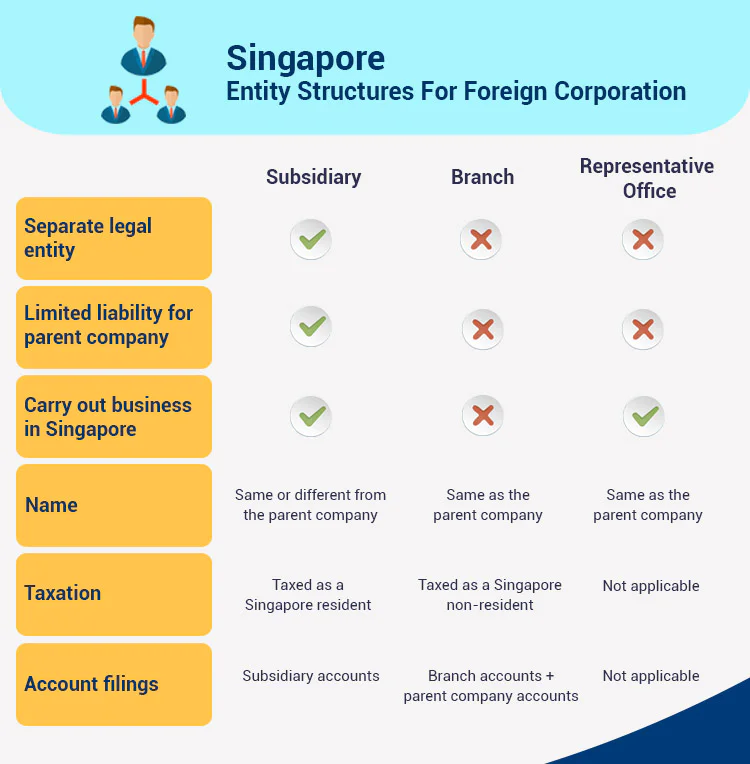

Subsidiary

If you form a subsidiary company, you’re basically a shareholder of the parent foreign company.

In Singapore, you can establish a subsidiary in the form of a private limited company.

As such, your subsidiary may also enjoy similar benefits and liabilities to a private limited company in Singapore.

Representative office

Let’s imagine you’re seeking business opportunities in Singapore, and you want to do some research on the market before officially penetrating.

In this case, forming an LLC or subsidiary may seem too much. Instead, you may want to consider setting up a representative office in Singapore.

Generally, this type of entity is used for conducting market research, promoting brand awareness, or testing the market.

Unlike a subsidiary, a RO has no legal distinction. This means your overseas parent company takes full liability for any losses from the office.

Moreover, your RO cannot carry out any profit-generating activities in Singapore.

Branch

A branch is an extension of a parent foreign company.

You’re allowed to conduct commercial activities as a branch. Still, this business type has no separate legal distinction. Thus, all liabilities of the branch will be taken by the parent company.

In addition, your branch is a non-resident for tax purposes in Singapore. So there’d be no tax reliefs or benefits granted.

Nevertheless, you can choose to set up your branch as a private limited company to enjoy the tax advantages from the government.

The right type of company in Singapore – How you should decide

Choosing the right type of company is like building a solid fountain for your future success.

Yet, each structure comes with different features, pros, and cons. So you need to weigh your options carefully and pick the one that works best for you.

You should also consider various factors before making your decision. For instance ownership, investment capital, tax advantage, and compliance requirements.

In the end, there’s no one-size-fits-all type of company. You cannot form a private company and expect to have full ownership and control over the management. Or set up a sole proprietorship but pay your tax as an LLC.

Simply work out your business needs, and have a clear and concise plan for operation and you should be good to go.

Need help to start your company in Singapore?

If this article has piqued your interest somewhat, and you’re ready to start your business structure of choice, you can always rely on our Singapore company formation service for a quick, stress-free experience.

Free ebook

Key matters for doing business in Singapore

Get all the details for doing business in Singapore with our guide

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.