Table of Contents

Dissolving a Delaware limited liability company

- Misconception: Delaware LLC dissolution, cancellation, and winding up

Many business owners in Delaware may come under a misconception about the term “dissolution” and “cancellation”. Even though both processes lead to the closure of the business, and have been used interchangeably in many cases, they are not the same.

In particular, you will see these terms included in a standard dissolution process of a Delaware limited liability company. Dissolution is commonly known as a general process of shutting down a business based voluntarily, which means ending the company’s operations under the agreement of company members. The winding-up process and cancellation are typical steps involved. Winding up of the company affairs is the procedure in which your Delaware LLC needs to close accounts, liquidate assets, allocate remaining property to LLC members, and complete other related duties.

Cancellation, the final stage, only comes after the completion of the winding-up process. A Cancellation Certificate (which must be approved by the Delaware Corporation Division) is the central point. Without this legal piece of paper, you will fail to cancel your limited liability company in Delaware.

- The reason why dissolving a Delaware LLC is important

Delaware LLC dissolution is considered the best way to free business owners from future liability, in event that they no longer be able to do business and wish to put an end to the company’s continuance. It is a widely-seen case that a Delaware company has gone out of its business but still be required to pay franchise tax, sustain the annual Registered Agent or comply with other liabilities to remain in its good standing status as per the State’s law.

And all of these requirements are derived from the absence of the official dissolution. You don’t tell the State that you are canceled, Delaware government, by default, supposes your company is inactive status in Delaware.

How to dissolve a Delaware LLC with 4 steps

Except for the court orders which cause the cessation of your Delaware business, below are 4 steps to easily shut down your Delaware LLC based on the company members’ approval (voluntarily). Let’s take a look!

Examine your Delaware LLC Operating Agreement first. If not provided yet, then get Member Consent to Dissolution

You’ve reached this stage, we are sure you all know what an LLC Operating Agreement is. In your company’s Operating Agreement, there is a possibility that the procedure concerning how to dissolve a Delaware LLC is well specified. If it is the case, just follow that guideline. It is the easiest way as the Agreement represents the majority of members in approval for cancellation. No need to hold a vote anymore!

Still, the case can be that the Operating Agreement of your company does not provide dissolution-related issues. So, you should call a meeting to take a vote among company owners, and ask for their consent to dissolution.

As prescribed in Title 6, Chapter 18, Subchapter VIII on Dissolution of Delaware Limited Liability Company, Delaware law does allow an LLC to be dissolved providing that there are more than two-thirds of the members in agreement to cancel the company.

It is highly recommended that members should have written consent. And after the voting meeting, the company needs to appoint a manager to proceed with dissolving Delaware LLC. Note that things get easier for LLCs formed as a single-member structure since the dissolution will attach only to your decision and your single vote.

Next, proceed with the winding-up procedure

There are dozens of things you need to complete when coming to the winding up. Winding up the company affairs is a prerequisite for starting the cancellation, the final step to legally dissolve your Delaware LLC.

Winding up simply means terminating all affairs of your business. Typical tasks to be involved in the winding-up procedure are:

- Paying off creditors, to-be-member creditors

- Liability resolution to current business bills, loans, contracts

- Settlement of franchise tax, late-paid federal tax, or other tax payments

- Closure of the company account

- File foreign qualification cessation forms with other related States (if applicable)

- Allocation of the remaining company assets

- Other pending or unsolved debts, obligations, and liabilities in connection with your LLCs in Delaware

In case your limited liability company has settled all relevant obligations and liabilities upon the winding-up procedure, the remaining assets of the company can be paid back among members corresponding to their contribution to the company.

Finally, the cancellation process

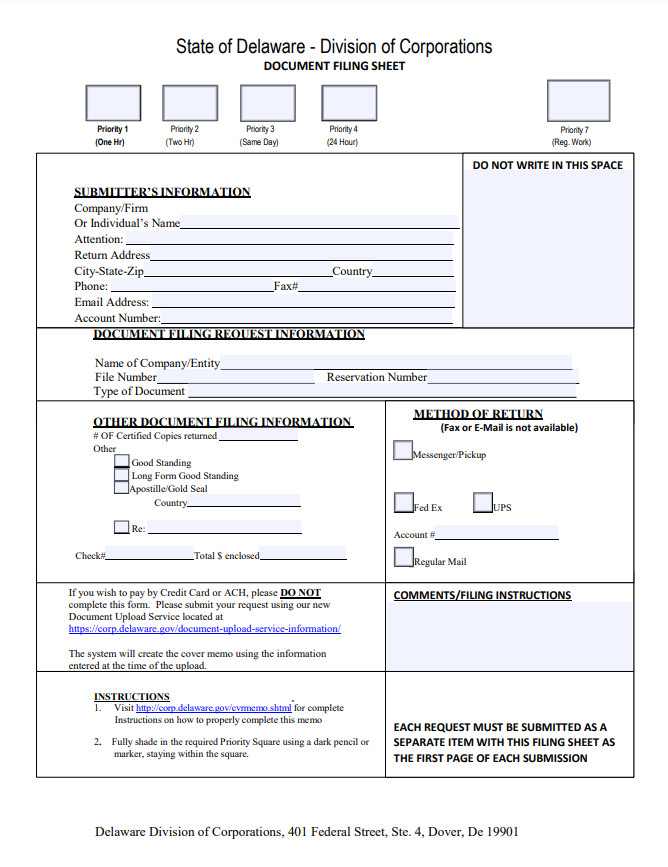

The supposed-to-be final step concerning how to dissolve a Delaware LLC is to file a form for the Certificate of Cancellation, together with a Corporate Cover Letter with the Division of Corporations.

- Certificate of Cancellation

You can download the form template on the Delaware website or contact BBCIncorp consultants. There must be an authorized representative who is an LLC member to sign the Certificate. You need to pay the Delaware LLC dissolution fee as well. Typically, the filing fee is $200. Proof showing your settlement of franchise tax must also be included.

Upon dissolution, you must provide the following information on your certificate of cancellation:

(1) the LLC name

(2) the filing date of the certification

(3) the name of each registered series (if any of the registered series owned by the LLC has not been canceled)

(4) the future effective date of cancellation

(5) Related information of the filing person

- Cover Letter

You must send a Cover Letter along with the form for the Cancellation Certificate. There is no required fee for filing the Cover Letter. An important note is that you will only need to send the Cover Letter in case you choose to file via email. The template for a cover letter is as below:

Note

Filing the Certificate of Cancellation for Delaware LLCs can be done via email or online.

The online filing does NOT require a Cover Letter to be sent along and the filing fee for both documents must be paid with the form.

You can receive the stamped certificate 2 to 3 weeks after the receipt, but you can still pay extra money for the expedited services provided by the Delaware government.

You’ve almost done – just close the EIN and file a federal report with IRS (if applicable)

Post-cancellation step is to resolve certain liabilities at the federal level of relevant Delaware LLCs.

You are required to submit a letter to the IRS for invalidating the Employer Identification Number (aka EIN) of your company. This is a 9-digit number provided by the IRS for defining the tax account of employers and other business owners without employees in the US. In addition to the company name and address, you will need to provide the IRS with a copy of the Cancellation of the Certificate you have obtained.

Moreover, you may also need to file final returns in connection with your tax classification with the IRS, or obey the instructions to cancel your registered LLCs in other states of the US if you are related to such requirements.

The Bottom Line

Dissolving a Delaware limited liability company is straightforward. Four main steps to follow include: obtaining member consent if you cannot find it in the LLC operating agreement, proceeding with the winding-up procedure, filing the Certificate of Cancellation, and finally resolving remaining obligations at the federal level if your company is applicable.

To save time and effort on Delaware LLC dissolution, it is strongly recommended that you engage a trusted corporate service provider like BBCIncorp to ensure a smooth and hassle-free procedure. Feel free to contact us or drop a message via service@bbcincorp.com for any questions you may have.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.