Many individuals assume that trusts are reserved for those with significant wealth. In reality, anyone who intends to safeguard and manage personal assets can establish one. The structure enables assets to be distributed according to the settlor’s intentions while avoiding the time and expense associated with probate.

Even estates of modest value can benefit from the certainty and order that a trust provides.

Trust structures form an essential component of financial planning across many jurisdictions. Singapore has emerged as a leading destination for establishing trusts due to its well-defined legal framework, tax advantages, and high level of structural flexibility.

What is a trust? Today, we will examine the definition, the principal advantages of creating a trust in Singapore, and why the jurisdiction is widely regarded as a suitable choice for foreign entrepreneurs.

Key takeaways

- A trust allows a settlor to transfer assets to a trustee who manages them for beneficiaries, providing orderly distribution and long-term protection.

- Singapore is an international business hub with a clear legal framework, strong confidentiality, a reliable financial base, and many favorable tax advantages. In short, it is a preferred location for establishing trusts.

- Trusts support effective succession planning, safeguard wealth, and provide a structured way for global business owners to hold assets, including shares in Singapore companies.

What is a trust in Singapore?

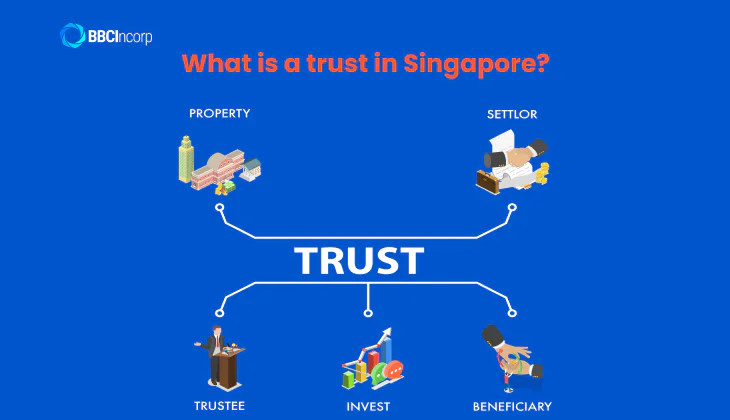

A Singapore trust refers to a legal arrangement in which a person or entity (known as the settlor) transfers assets, such as cash, properties, or investments, to a trustee who then manages and administers the assets for the benefit of one or more beneficiaries.

How does a Singapore trust work?

A Singapore trust is a robust and sophisticated legal vehicle that allows a settlor to transfer assets to a trustee for the benefit of designated beneficiaries. Trusts in Singapore are governed by the Trustees Act (Cap. 337), which stipulates a duty of care for trustees when carrying out specified responsibilities or acts, as well as safeguards ensuring trustees adhere to certain minimum standards when exercising their trustee powers.

The trustee is responsible for managing the trust assets and distributing income or principal to the beneficiaries in accordance with the terms of a trust deed. Settlors can designate a “protector” to oversee trustees and protect their trusts, ensuring that the trustees won’t abuse their authority.

With a reputation for stability and reliability, Singapore trusts provide a formidable tool for managing wealth, preserving assets, and achieving complex financial objectives.

How many types of trusts are there in Singapore?

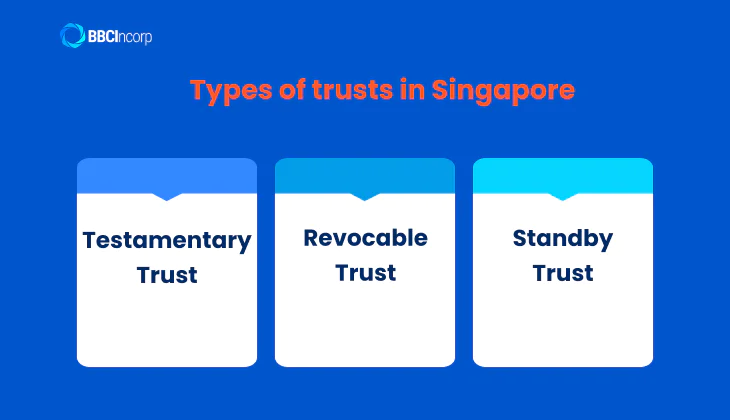

Various types of trusts serve different purposes and can be customized to suit specific needs. Additionally, there are specialized trusts, such as private family trusts, charitable trusts, and collective investment trusts, among others. Each is designed to cater to specific circumstances and requirements.

Below are a few common types of trusts in Singapore you should know about:

Testamentary Trust

A testamentary trust in Singapore refers to a type of trust that is created through a will and takes effect upon the death of the testator (the person making the will). This allows the testator to specify how their assets should be managed and distributed after their death.

The testator can designate one or more beneficiaries who will receive the assets held in the trust, and also appoint a trustee.

Testamentary trusts can be used for various purposes, such as providing for minor or disabled beneficiaries, protecting assets from creditors, or maintaining control over the distribution of assets over time. They are subject to the Wills Act and relevant laws, and the terms of the trust are specified in the testator’s will.

Several examples of testamentary trusts:

- Minor’s Trust for the financial needs of minor beneficiaries who are not of legal age to manage assets on their own.

- Special Needs Trust to provide for the care and support of a beneficiary with special needs, such as a disabled or mentally incapacitated individual.

- Spendthrift Trust that includes a spendthrift clause, which protects the trust assets from being accessed or depleted by the beneficiaries’ creditors or in case of their financial mismanagement.

Revocable Trust

A revocable trust, also known as a living trust or inter vivos trust, is a type of trust that can be modified, amended, or revoked by the settlor (the person creating the trust) during their lifetime.

Revocable trusts are often used for estate planning purposes, as they can help reduce estate taxes, avoid probate, which could be time-consuming and costly, and provide privacy, as the trust’s terms are not publicly disclosed.

One of the key advantages of a revocable trust is that it allows the settlor to retain control over the trust assets and make changes to the trust’s terms or beneficiaries as needed.

Revocable trusts can be:

- Collective investment trusts are regulated by the Monetary Authority of Singapore (MAS) under the Securities and Futures Act solely for investment purposes.

- Private family trusts are established by a family member who wishes to transfer assets to the trust for the benefit of their family members, such as providing education, healthcare, and support for their descendants.

Standby Trust

This type of trust can be viewed as a combination of testamentary trusts and living trusts. Until a particular event or trigger occurs, the trust remains dormant or inactive. Once that trigger occurs, the trust becomes operational, and assets are managed accordingly.

A standby trust can be used to provide for the care of a disabled or incapacitated family member, to protect assets in the event of the grantor’s incapacity, or to transfer assets to beneficiaries at a specific time.

In the event of the grantor’s (the one setting up the trust) death, the assets are “poured over” into the standby trust, which then becomes the primary trust to monitor and distribute the assets according to the trust document’s terms.

Key subjects of Singapore trusts

As Singapore trusts are widely recognized and favored for wealth management and estate planning, they are characterized by flexibility, confidentiality, and a robust legal framework, so it is crucial to gain a thorough understanding of the key factors.

Settlor

The settlor of the trust is the person who creates the trust and transfers assets to it. In Singapore, the settlor can be an individual or a corporation and is responsible for setting out the terms and conditions of the trust, which are recorded in a trust deed.

The settlor can also appoint a protector to oversee the trustee’s actions and ensure the trust is managed following the settlor’s wishes. The protector serves as an additional layer of protection for the beneficiaries and can intervene if necessary to safeguard their interests.

Trustee

The trustee is responsible for managing the trust assets and distributing the income and capital to the beneficiaries according to the terms of the trust deed. There are different types of trustees in Singapore, including private trustees, corporate trustees, and public trustees.

Private trustees are usually individuals appointed by the settlor, while corporate trustees are companies that specialize in providing trustee services.

These corporate trustees, typically Singapore trust companies, are licensed and regulated by the Monetary Authority of Singapore (MAS). They are required to comply with the Trust Companies Act and other relevant regulations.

One example of a corporate trustee in Singapore is the Trust Services division of DBS Bank. Specific services offered by DBS Trust Services include the establishment and management of private trusts, family trusts, charitable trusts, and unit trusts.

They also provide trustee support for corporate transactions, such as mergers and acquisitions, initial public offerings (IPOs), and corporate restructuring.

Public trustees, on the other hand, are appointed by the court to manage assets on behalf of beneficiaries who are minors or mentally incapacitated.

Beneficiaries

The beneficiaries are the individuals or entities entitled to receive income or capital from the trust. Beneficiaries can be either named or described in general terms in the trust deed, and their rights and entitlements are outlined in terms of the trust.

Beneficiaries in Singapore trusts have certain rights and entitlements, such as the right to receive income and/or capital from the trust, the right to be informed about the trust’s assets and transactions, and the right to enforce the terms of the trust.

Beneficiaries also have certain responsibilities, such as paying taxes on income received from the trust and reporting any changes in their details to the trustee.

The beneficiary should be someone you trust to manage the assets and carry out your wishes. Consider a family member, close friend, or professional advisor who has demonstrated responsibility and integrity.

Legal aspects of setting up a Singapore trust

Properly addressing all legal aspects of setting up a Singapore trust is critical to make sure that the trust is legally valid, enforceable, and effectively achieves the intended purposes of you as an individual or your business.

Compliance with legal requirements and taxation

Setting up a trust involves compliance with various legal requirements, including registration with relevant authorities, paying applicable fees, and filing relevant documents.

Singapore Trust Law

Singapore Trust Law refers to the legal framework governing trusts in Singapore. A trust is a legal arrangement where property or assets are held by one party (the trustee) for the benefit of another party (the beneficiary).

Singapore’s Trustees Act, which governs trusts, is the primary law. As part of the act, Singapore specifies the legal requirements for creating and monitoring trusts, including the powers, duties, and rights of trustees, as well as the process for appointing and removing trustees.

Additional legal regulations

Not only the Trustees Act, but Singapore has also enacted various other laws and regulations that affect trusts directly, such as the Trust Companies Act, the Business Trusts Act, the Civil Law Act, and, partially, the Income Tax Act, the Stamp Duties Act, and the Property Act.

In addition, trusts may have tax implications for the statutory income of trustees. Based on the specific type of trust and the income generated from it, the income tax will be charged to either the trustee or the beneficiary accordingly.

Do keep in mind that, in most cases, trusts such as foreign trusts, foreign charitable trusts, and similar entities will be eligible for exemptions, except certain foreign trusts stated in Section 5 of the Income Tax (Exemption of Income of Foreign Trusts) Regulations.

Trust deed

A trust deed, also known as a trust instrument or trust agreement, is a legal document that sets out the terms and conditions of a trust. It is typically created by the settlor (also known as the grantor or trustor), who is the individual or entity that establishes the trust. It outlines the rights, duties, and responsibilities of the trustee(s) and beneficiaries.

The settlor and trustee must create a trust deed and may require the presence of witnesses. This document needs to be drafted precisely, as it is the guiding document for the trustee(s) to carry out their fiduciary duties, and for the beneficiaries to understand their rights and interests in the trust.

Dispute resolution

In the context of business, disputes can arise between business partners, employees, customers, vendors, or other stakeholders. Effective dispute resolution is essential for maintaining a positive business environment and avoiding costly legal proceedings.

Disputes can arise concerning the operation of a trust, and it is important to have a mechanism in place for resolving such disputes. The trust deed should include provisions for dispute resolution, such as arbitration, negotiation, mediation, or litigation.

Conveniently, the Singapore government has established various institutions and organizations to facilitate dispute resolution, such as the Singapore Mediation Centre and the Singapore International Arbitration Centre.

Why establish your trust in Singapore?

Singapore is widely recognized as a reputable international financial center and a preferred jurisdiction for establishing trusts due to a range of benefits. Some of the advantages you might be interested in are listed below.

Confidentiality

Singapore trusts have a high degree of confidentiality as the trust deed and beneficiaries’ identities are not publicly disclosed. Trustees are bound by a legal duty of confidentiality, and breach of this duty can result in legal action against the trustee.

Nevertheless, there are circumstances under which information may need to be disclosed. For example, trustees may be required to provide information to regulatory authorities or law enforcement agencies in certain situations (for instance, a legal claim against the trust).

Tax benefits

Singapore trusts offer various tax benefits, such as exemption from Singapore income tax on distributions to non-resident beneficiaries. Some of the key tax benefits of Singapore trusts include:

- Estate duty (a tax levied on the total value of an individual’s assets at the time of their death) exemption

- Favorable tax treatment for certain types of trusts (e.g., charitable trusts)

- Tax efficiency for non-resident beneficiaries: typically not subject to Singapore tax on their share of the trust’s income, capital gains, or distributions

- Capital gains tax exemption: Capital gains on the sale of assets held in a Singapore trust are generally exempt from tax in Singapore, regardless of whether the trust is resident or non-resident

It’s also important to consider the tax implications in the jurisdiction where the settlor and beneficiaries are tax residents, as well as any tax treaties that may apply.

Understand the tax basic

Gain more confidence

Efficiency in asset protection

Singapore trusts protect assets against creditors and potential legal claims, if any, through:

Separation of legal ownership and beneficial ownership

Assets held in a trust are owned by the trust, rather than the settlor or beneficiaries.

Creditor protection

The trust assets are held in trust for the beneficiaries and are not available to satisfy the debts of the settlor or beneficiaries.

Spendthrift provisions

Many Singapore trusts include spendthrift provisions, which limit the ability of beneficiaries to dispose of trust assets.

Irrevocability

Once a Singapore trust is established, it is generally irrevocable, meaning that the settlor cannot change or revoke the terms of the trust. Through the process, you can receive additional protection for the trust assets, as they are no longer considered the settlor’s property.

What is the cost of setting up a trust in Singapore?

When evaluating what is a trust, one important financial consideration is the minimum initial fund required to establish it. The fundamental cost varies depending on the type of trust, who the trustee is, and how you intend to use the trust.

In the case of private trusts managed by professional trust companies, there is no fixed standard minimum initial fund publicly disclosed across all providers. Some trustees may require tens of thousands of dollars, especially for active trusts or those holding substantial or complex assets.

Other providers may accept lower amounts, depending on the proposed asset structure, the complexity of administration, and risk.

For example, at Metis (a trust plan provider), the minimum single contribution is SG$30,000, and additional top-ups must be at least SG$10,000. It illustrates how minimum deposit requirements can be quite high when using structured trust‑plan products rather than simple foundational trusts.

On the other hand, for special‑needs trusts, the Special Needs Trust Company (SNTC) requires a clearly defined minimum initial sum of SG$5,000 to open a trust account. This is significantly lower than typical private trust thresholds. Moreover, SNTC’s fees are heavily subsidised by the Ministry of Social and Family Development (MSF).

After the subsidy, the effective setup fee becomes SG$150 (originally SG$1,500), and activation and annual fees can be as low as SG$40. SNTC offers sponsorship schemes as well, so that eligible families may receive support to meet the initial capital requirement.

In addition to the minimum initial fund, professional trustees such as Kensington Trust impose setup fees separately (e.g., for active trusts, it starts at SG$10,000, excluding the trust’s initial funding).

How to set up a Singapore trust

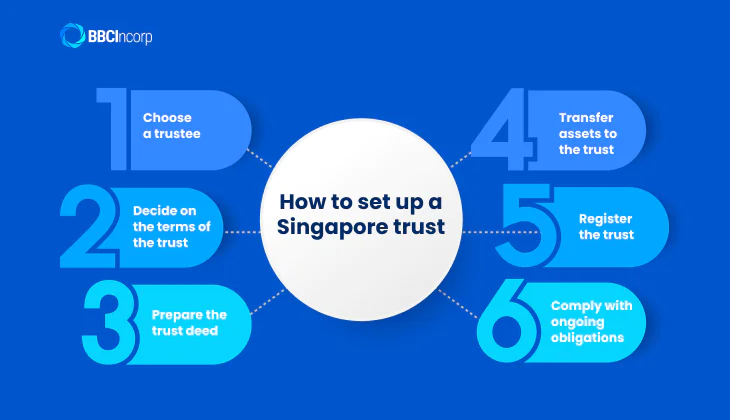

Establishing a Singapore trust requires careful consideration of the following steps:

Step 1: Choose a trustee

The trustee must be a Singapore resident individual or a Singapore-incorporated company. Suppose a trustee is a trust company providing trust services, it is generally required to be licensed and regulated by the Monetary Authority of Singapore (MAS) under the Trust Companies Act (TCA).

Step 2: Decide on the terms of the trust

The settlor must decide on the terms of the trust, including the purpose of the trust, the assets to be held in the trust, the beneficiaries, and the distribution of trust assets.

Step 3: Prepare the trust deed

The settlor and trustee must prepare a trust deed, which sets out the terms of the trust. The trust deed must comply with the requirements of legislation about trusts and other relevant legislation in Singapore.

Depending on the specific requirements and circumstances of the trust, trust instruments such as wills, agreements, contracts, or other ancillary documents may be used in conjunction with the trust deed.

Quick Note

While trust instruments like wills, agreements, and contracts may be used alongside a trust deed to clarify or specify certain aspects of a trust, a trust deed is generally the primary legal document that establishes the existence and terms of a trust.

Step 4: Transfer assets to the trust

The settlor must transfer assets to the trust, which will then be held by the trustee for the benefit of the beneficiaries.

Step 5: Register the trust

While registration of trusts is not mandatory in Singapore, it may be beneficial to register the trust with the Accounting and Corporate Regulatory Authority (ACRA) for tax and regulatory purposes.

Step 6: Comply with ongoing obligations

Once a trust is established, the trustee must fulfill ongoing obligations, including filing tax returns, maintaining accounting records, and distributing assets according to the terms of the trust. Since trusts are complex legal structures, consulting a qualified legal professional is essential.

Furthermore, costs for creating and managing a Singapore trust can vary depending on its complexity and the services required.

Conclusion

Setting up a trust in Singapore is a reliable way to manage and protect assets while providing long-term financial security for beneficiaries. Through today’s article, we have defined what is a trust, why you should establish a trust in Singapore, and the steps to register your Singapore trust. Trusts in this jurisdiction benefit from a low-tax environment and an extensive network of double tax treaties.

Although setting up and running a trust can be intricate and time-consuming, professional advice helps simplify the process and ensures compliance with local regulations.

For personalized advice or further information on starting a Singapore business, kindly leave us a message at service@bbcincorp.com. We are ready to provide timely assistance.

Frequently Asked Questions

How long does it take to set up a trust in Singapore?

A trust in Singapore usually takes between two and four weeks to set up, depending on structure, asset type, and the complexity of instructions to the trustee. The process involves defining the trust deed, identifying beneficiaries, arranging asset transfers, and completing due diligence checks required under local regulations. More sophisticated arrangements that include cross-border assets, corporate shareholdings, or special governance provisions may take longer because trustees must verify ownership, confirm compliance requirements, and assess potential risks.

It is advisable to engage with an experienced Singapore trustee to streamline documentation, ensure all regulatory checks are completed, and reduce delays during the onboarding stage.

What are common misconceptions about trusts?

A frequent misconception is that trusts serve only high-net-worth families. In reality, many individuals use them for succession planning, asset protection, and smooth wealth transfer. Another misconception is that trusts automatically reduce taxes; tax outcomes depend on trust type, assets, and jurisdiction.

Some people also assume trustees have unrestricted control, when trustees must follow the trust deed and act in the beneficiaries’ best interests. Others believe trusts completely shield assets from legal claims, but courts may set aside structures established to evade creditors or obligations. Understanding these limitations helps people use trusts correctly and avoid compliance risks.

What is the difference between a revocable and an irrevocable trust in Singapore?

A revocable trust allows the settlor to change, amend, or dissolve the structure at any time. Flexibility lets the settlor retain control but limits protection because assets remain effectively accessible to the settlor and may not achieve strong separation for estate or creditor purposes.

An irrevocable trust cannot be altered once created, giving the trustee full responsibility to manage assets under the deed. This provides stronger protection, clearer succession planning, and better long-term stability. In Singapore, both forms follow the same legal principles, but the choice depends on the level of control, asset protection, and planning objectives.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.