- Understand paid-up capital singapore

- Legal regulations governing paid-up capital in Singapore

- Difference between paid-up capital and other types of capital

- Factors affecting the amount of paid-up capital

- Should the company's Paid-Up Capital be high or low?

- Common uses and restrictions of paid-up capital

- Process of changing the company’s paid-up capital

- How is paid-up capital recorded in accounting?

- Comprehensive Corporate Services by BBCIncorp

Paid-up capital is a financial metric that indicates the amount of capital a company has received from its shareholders in exchange for issued shares. It serves as a critical indicator of the financial foundation and the stability of a business.

What is paid-up capital in Singapore and how does it impact your business? Find out in this article to make strategic decisions on how to allocate resources for the growth and expansion of your company.

Key takeaways

- Paid-up capital Singapore refers to the actual amount shareholders contribute and is a key indicator of a company’s financial strength and credibility.

- Singapore’s no-par-value regime simplifies capital management, and paid-up capital requirements vary depending on industry-specific regulations.

- The appropriate level of paid-up capital depends on business needs, higher capital enhances creditworthiness, while lower capital offers more flexibility for startups.

- Paid-up capital can be increased, reduced or restructured, and all changes must be filed with ACRA to ensure accurate corporate records and full compliance.

- BBCIncorp supports businesses in managing capital structuring, statutory filings and ongoing compliance, helping companies stay aligned with Singapore’s regulatory standards.

Understand paid-up capital singapore

With its supportive business environment and investor-friendly policies, Singapore places great emphasis on paid-up capital. Besides being a statutory requirement, it also demonstrates the company’s commitment to sound financial management and provides an early indication of how financially prepared the company is to operate and meet its obligations.

What is paid up capital?

Paid-up capital refers to the total amount of capital that has been subscribed and paid by shareholders of a company in exchange for their ownership stake in the company.

The amount of paid-up capital not only reflects the initial investment made by the shareholders but also provides insights into the resources available to the company for its operations, expansion plans, and strategic initiatives.

Paid-up capital also represents the actual equity contributed by shareholders, forming part of the company’s shareholders’ equity rather than debt.

A higher level of paid-up capital generally reflects stronger shareholder commitment and confidence in the company’s long-term prospects.

Here are 5 things to keep in mind about paid-up capital

- It is the money the company gets from selling stocks directly to shareholders

- Paid-up capital is the actual amount received by the company when issuing shares, typically during incorporation or subsequent share allotments.

- Paid-up capital is an important aspect of a company’s capital structure, which includes both debt and equity financing.

- It is recorded on the company’s balance sheet as equity or shareholders’ equity

- There are two sources for paid-up capital: the par value of stock and excess capital

Additionally, paid-up capital strengthens the company’s initial financial position, giving it a more stable foundation to begin operations and meet early expenses.

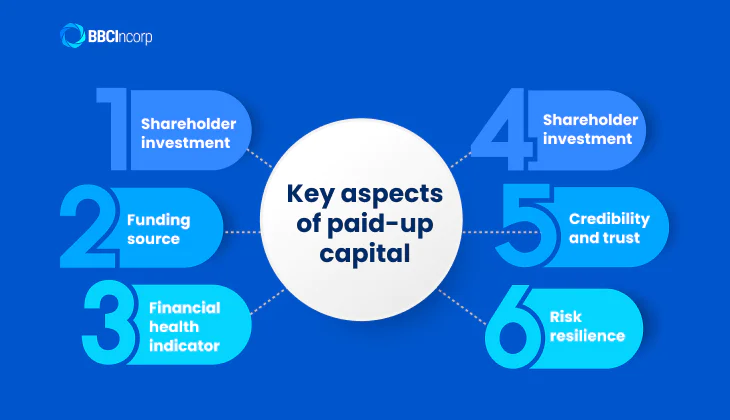

Key aspects of paid-up capital

While paid-up capital begins with a simple concept – money contributed by shareholders – it carries several implications for how a company is perceived and operates. From financial stability to creditworthiness, its impact is broader than many new founders expect. The points below outline the essential aspects of paid-up capital in Singapore.

- Shareholder investment: It represents the portion of share capital for which shareholders have fully paid.

- Funding source: It is a source of equity financing, meaning it is money the company does not have to pay back with interest, unlike debt.

- Financial health indicator: A higher paid-up capital often signals greater financial stability and confidence in the company’s prospects.

- Shareholder investment: It represents the portion of share capital for which shareholders have fully paid.

- Credibility and trust: Banks, investors, and partners often view higher paid-up capital as a sign of stronger financial footing and greater shareholder commitment.

- Risk resilience: Companies with stronger paid-up capital bases may be better equipped to handle financial shocks, cash-flow shortages, or market disruptions.

Clarifying the concept of paid-up capital in Singapore

In Singapore, paid-up capital is the amount shareholders have actually contributed (cash or the money value of non-cash consideration) for the company’s issued shares. It sits in shareholders’ equity and changes when the company allots new shares (and receives consideration) or when partly-paid shares are fully paid and then reported to ACRA.

For new share issuances, companies must file a Return of Allotment. When amounts are paid/fully paid, they must file the “Notice to Update EROM & Paid-Up Share Capital” via BizFile Singapore.

Important: Singapore abolished the concepts of authorised share capital and par/nominal value under the 2005 legislative reforms (effective 30 January 2006).

As a result, there is no upper limit on the number of shares a company may issue, other than what is stated in its company constitution or approved by shareholders.

Companies therefore only manage two figures: issued share capital (what has been issued) and paid-up share capital (what has been paid).

Example (Singapore):

If ABC Pte. Ltd. issues 50,000 shares at SG$10 each and shareholders have paid SG$500,000, then issued share capital = SG$500,000 and paid-up share capital = SG$500,000. If only SG$250,000 has been paid so far, the paid-up is SG$250,000 until the balance is received and the company files the Notice to Update EROM & Paid-Up.

Paid-up capital Singapore is often viewed as a signal of financial commitment and resilience, especially by banks, investors, and business partners. As an additional note, companies with paid-up capital of at least SG$500,000 automatically become members of the Singapore Business Federation (SBF).

Legal regulations governing paid-up capital in Singapore

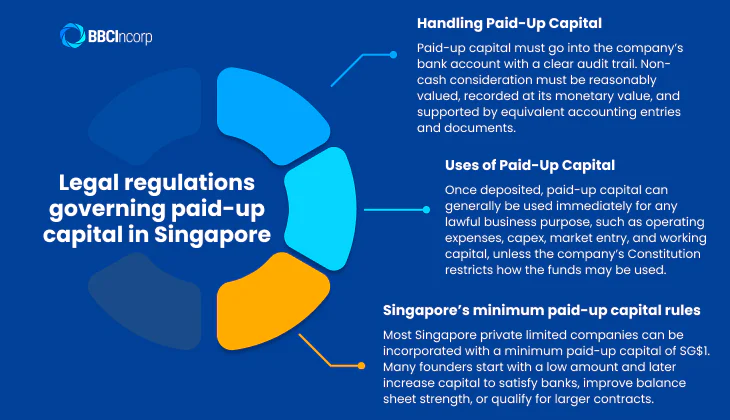

Handling Paid-Up Capital

Paid-up capital must be remitted into the company’s corporate bank account in cash or cash-equivalent, with a clear, traceable audit trail (payer, amount, date, purpose).

When shares are issued for non-cash consideration (e.g., services, IP, equipment), the company should document a reasonable valuation, record the consideration at its money value, and deposit an equivalent cash amount to reflect the paid-up position accurately in accounting records. Good practice is to retain valuation memos, invoices, agreements, and board approvals that show how the figure was determined.

After funds (or the cash-equivalent value) are received, the company should update the members’ register, issue share certificates, and lodge the relevant filings on BizFile+ within the prescribed timelines (e.g., Return of Allotment and, when applicable, Notice to Update EROM & Paid-Up Share Capital).

Although proof of payment is not uploaded during filing, firms must maintain complete supporting documents for potential reviews by banks, auditors, or regulators. Clear documentation also helps downstream processes such as bank KYC, grant applications, and investor due diligence.

Uses of Paid-Up Capital

Once deposited, paid-up capital can be used for any lawful business purpose unless your Constitution states otherwise. Typical uses include operating expenses (rent, payroll, vendors), capex (machinery, software licenses), market entry costs (marketing, compliance), and working capital to bridge receivables.

There is no statutory lock-up period in general—funds may be deployed immediately to execute the business plan, which is particularly helpful in a company’s early stages.

From a governance standpoint, remember that dividends come from profits, not by returning paid-up capital outside of a lawful reduction process. If the company becomes insolvent, paid-up capital—together with other assets—forms part of the estate available to repay creditors in accordance with priority rules.

Practically, maintaining an appropriate level of paid-up capital can improve supplier confidence, banking relationships, and borrowing terms, since it signals tangible shareholder commitment to the business.

Minimum Paid Up Capital Requirements in Singapore

For most private limited companies, the general minimum paid-up capital to incorporate is SG$1.00, which keeps entry friction low for both local and foreign founders. Many businesses start lean and increase paid-up capital later to meet banking expectations, strengthen balance-sheet signals, or support larger contracts.

However, some regulated sectors require higher minimum thresholds set by their supervising authoritietra (e.g., S$g (arins (aroundco with thSi, Monetary Autho, or AC), asrequi and mfit-and-proper tests, professional indemnity, or financial guarantees in add

Difference between paid-up capital and other types of capital

Understanding how paid-up capital singapore differs from other types of capital is essential for companies operating in Singapore.

While these terms may sound similar, each reflects a different stage of a company’s financing process and carries its own legal and accounting implications. Clarifying these distinctions helps business owners comply with ACRA requirements and better manage their company’s capital structure.

Paid-Up Capital vs. Share Capital

In Singapore, issued share capital refers to the total value of shares that a company has issued to its shareholders, while paid-up capital represents the portion of that issued share capital that shareholders have fully contributed.

Because Singapore no longer uses authorised capital or par value, the terms “share capital” and “issued share capital” generally refer to the same concept under the Singapore Companies Act.

Issued share capital reflects the number and value of shares a company has created and allotted. Paid-up capital, on the other hand, reflects the actual funds or non-cash assets received by the company. These two figures may be identical if all shares have been fully paid for, or they may differ when shareholders have outstanding unpaid amounts.

Example:

If a company issues 100,000 shares at SG$1 each, its issued share capital is SG$100,000. If shareholders have paid only SG$60,000 at that point, the company’s paid-up capital is SG$60,000. Once the remaining SG$40,000 is contributed and filed with ACRA, the paid-up capital becomes SG$100,000.

It is important to note that your initial paid-up capital amount is not just an internal figure; it is permanently recorded in your company’s official history.

Upon successful registration, the specific share capital details will appear directly on the Certificate of Incorporation Singapore issued by ACRA.

This document serves as the legal validation of the shareholders’ financial commitment and acts as the foundational proof of your business’s structure for banks and investors.

Paid-Up Capital vs. Authorised Capital

Authorised capital, also known as authorised share capital singapore, was traditionally defined as the maximum amount of capital that a company was permitted to raise by issuing shares.

However, Singapore abolished the concept of authorised capital and par value under the Companies Act 2005, which took effect on 30 January 2006. As a result, companies in Singapore no longer specify a maximum capital limit when registering a company.

Paid-up capital, by contrast, refers to the actual amount that shareholders have contributed for the shares issued to them. It represents real funds or money-value contributions that the company has received and can use for its operations.

Under the current regime:

- Companies can issue shares without being restricted by an authorised capital limit.

- Any capital increase simply requires issuing new shares and filing the necessary notifications with ACRA.

- Paid-up capital remains the key figure reflecting the company’s true financial commitment from shareholders.

Factors affecting the amount of paid-up capital

The amount of paid-up capital a company has in Singapore is influenced by a range of factors shaping its financial structure and operations, including:

Industry-specific considerations

Different industries may have specific capital requirements based on their nature of operations. Capital-intensive industries such as manufacturing, infrastructure development, or technology may require larger paid-up capital to support their operations, procure equipment, or invest in research and development.

How different natures of business affect capital requirements

Take construction companies operating in Singapore as an example. Their paid-up capital singapore would be higher primarily due to the substantial upfront costs involved in procuring construction machinery, acquiring land or property, and meeting regulatory compliance standards.

Additionally, the construction industry often operates on project-based contracts, where companies need to demonstrate financial stability and capacity to undertake large-scale projects, so maintaining a sufficient amount of paid-up capital is crucial.

Company size, growth prospects, and expansion plans

The size and growth prospects of a company play a significant role in determining its paid-up capital. Larger companies with ambitious growth plans may require substantial capital to fund expansions, acquisitions, or international ventures. Startups and small businesses, on the other hand, may have more modest capital requirements to initiate and sustain their operations.

Investor expectations and preferences

Investors, particularly those involved in capital-intensive industries, often have specific expectations and preferences regarding paid-up capital. They look for companies with sufficient capital investment to demonstrate financial stability, growth potential, and the ability to generate returns. This is what your decisions regarding paid-up capital will be affected by.

These factors inherently influence the strategic choices and considerations that business owners need to weigh when determining the appropriate level of capital investment.

Should the company’s Paid-Up Capital be high or low?

Determining how much paid-up capital a company should maintain depends on its operational needs, growth strategy and the level of financial flexibility it aims to achieve. While Singapore allows incorporation with as little as SG$1, choosing a higher or lower paid-up capital can influence the company’s credibility, resilience and regulatory eligibility.

The sections below break down the practical implications of maintaining either a high or low paid-up capital.

Higher Company Paid Up Capital

A higher paid-up capital can strengthen the company’s position within Singapore’s business environment. Many businesses benefit from maintaining a larger capital base because it enhances financial credibility and reflects stronger shareholder commitment. When a company operates with higher paid-up capital, several advantages naturally emerge:

- Stronger credibility with banks, investors and business partners

- Higher likelihood of loan approval and more favourable financing terms

- Greater ability to absorb unexpected expenses or cash-flow disruptions

- Stronger perception of financial discipline and commitment from shareholders

- Automatic eligibility for Singapore Business Federation (SBF) membership for companies with paid-up capital ≥ SG$500,000

- Increased confidence when participating in tenders or forming partnerships

Despite these advantages, maintaining a higher paid-up capital may also present certain challenges. Companies should take note of the following before committing a large amount of capital upfront:

- Larger initial financial commitment required from shareholders

- Potential risk of locking in funds that may not be immediately needed

- Higher expectations for financial governance and transparency from stakeholders

- Reduced flexibility for early-stage businesses with limited resources

Lower Company Paid Up Capital

A lower paid-up capital can be ideal for starting a small business in Singapore that prioritizes flexibility and wants to reduce financial pressure during the early stages.

Maintaining minimal capital can offer several advantages, especially for companies with low operating costs or minimal financial risk. Some of the positive aspects include:

- Lower initial financial burden for founders

- Faster and simpler incorporation process

- Suitable for businesses with lean operating structures (e.g., consulting, digital services, freelancing)

- Allows founders to preserve cash for other operational needs

- Paid-up capital can be increased anytime through additional share allotments

However, operating with lower paid-up capital also brings certain limitations. Businesses should be aware of the following challenges:

- Lower perceived financial credibility among banks, investors and suppliers

- Difficulty obtaining loans or negotiating favourable payment terms

- Limited financial buffer to handle unexpected expenses

- Higher vulnerability to cash-flow fluctuations

- May not meet regulatory capital requirements for certain industries (e.g., finance, construction, travel agencies, employment agencies)

Common uses and restrictions of paid-up capital

Paid-up capital serves various purposes within a company and is also subject to certain restrictions.

Uses of paid-up capital

- Financing business operations

Paid-up capital can be used to cover the initial costs of starting a business, especially for startups, such as legal fees, office rentals, and other expenses. Effective utilization of paid-up capital during the early stages is vital for sustainable growth and long-term success.

Additionally, this source of capital provides the necessary financial resources to start and sustain day-to-day business operations. It covers expenses such as purchasing inventory, paying salaries, managing overhead costs, and fulfilling other operational requirements.

- Increasing credibility

Having substantial paid-up capital can build trust with customers, suppliers, and lenders, as it demonstrates the company’s ability to meet financial obligations and handle unexpected challenges.

- Funding expansion and growth

As your company aims to expand its footprint and explore new opportunities, paid-up capital can be instrumental. It enables businesses to invest in research and development, expand production capacities, enter new markets, and pursue strategic acquisitions or partnerships.

- Attracting talent

In several cases, your Singapore company will need to show a certain level of paid-up capital to apply for work visas for foreign employees. This has a considerable impact on your ability to attract talent from other countries.

- Conducting mergers and acquisitions

In these scenarios, the paid-up capital of the acquiring company showcases the financial capacity to undertake the acquisition, demonstrating its ability to absorb the target company’s operations, assets, and liabilities.

The paid-up capital of the target company can signify a stronger financial foundation, potentially commanding a higher valuation and providing reassurance to the acquiring company. Furthermore, paid-up capital can influence post-acquisition operations, particularly in terms of capital restructuring and integration efforts.

You should deploy your paid-up capital prudently, considering long-term value creation and sustainable growth. Effective capital allocation and disciplined financial management are key to maximizing the benefits of paid-up capital.

Restrictions on the use of paid-up capital

Regardless of how beneficial it is to manage your paid-up capital efficiently, there are restrictions on its usage, depending on the legal requirements of the country where it is incorporated.

In Singapore, paid-up capital can only be used for legitimate business purposes and cannot be distributed to shareholders as dividends or loans. Companies cannot use paid-up capital to buy back their shares, which would result in a company’s share capital reduction. Moreover, your usage would also be governed by the aforementioned legal regulations.

Generally, the restrictions encourage responsible financial practices, protect the interests of shareholders and creditors, and promote confidence in the integrity of the corporate sector; so they would do your business great help.

Your paid-up capital amount is not just a private figure; it becomes a matter of public record that enhances your corporate credibility. Potential investors and banks will typically verify this financial data by looking up your company profile using your Singapore Unique Entity Number (UEN).

As the standard identification for all entities in Singapore, this number allows stakeholders to conduct due diligence and confirm that the declared capital has been officially registered with ACRA.

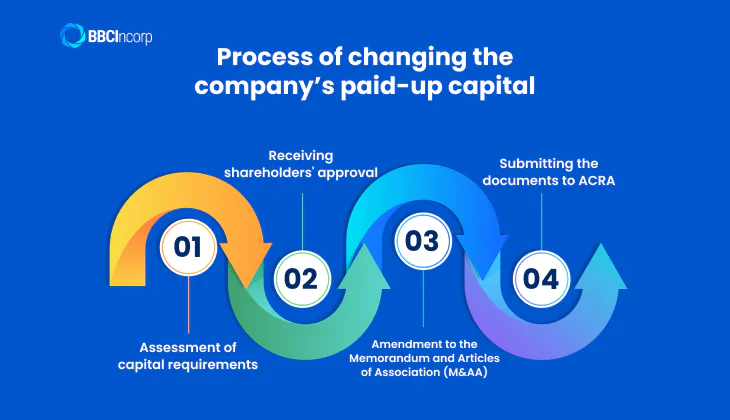

Process of changing the company’s paid-up capital

Changing the company’s paid-up capital in Singapore is a thorough process that requires careful evaluation and strategic planning. Here’s a breakdown of the steps involved:

Step 1: Assessment of capital requirements

The first step is to assess the company’s capital needs. Determine if there is a requirement to increase or decrease the paid-up capital based on the company’s financial position, growth plans, and operational demands.

Step 2: Receiving shareholders’ approval

Any change in paid-up capital requires the approval of the company’s shareholders. Convene a general meeting and present the proposed change to the shareholders for their consideration and approval. Shareholders’ approval may be obtained through a special resolution.

Step 3: Amendment to the Memorandum and Articles of Association (M&AA)

Once shareholders’ approval is obtained, the M&AA needs to be amended to reflect the changes in the paid-up capital. Prepare the necessary documentation, such as a resolution to amend the M&AA, and file it with the relevant authorities as per the jurisdiction’s regulations.

Step 4: Submitting the documents to ACRA

Ensure compliance with regulatory requirements by submitting the necessary filings of the Notice to Update EROM and Paid Up Share Capital (for increasing capital) or the Reduction of Share Capital by Special Resolution under S78E (for reducing capital) to ACRA.

After the application is approved, make sure to properly communicate the changes in paid-up capital to relevant stakeholders and update internal documents to reflect the revised paid-up capital accurately.

Enjoy greater efficiency with our hassle-free capital adjustment service

Seamlessly streamline your process, whether increasing or decreasing the paid-up share capital of your Singapore company, by working with our expert team and benefit from our share-related services. BBCIncorp’s corporation services allow you to focus on what truly matters, maximizing your business potential. Get in touch with us for more references.

How is paid-up capital recorded in accounting?

Paid-up capital appears in the shareholders’ equity section of a Singapore company’s balance sheet and represents the actual amount contributed by shareholders for issued shares.

Under Singapore’s no-par-value regime, paid-up capital is recorded as a single line item – “Paid-Up Share Capital” – without being split into par value and share premium.

This differs from accounting practices in some jurisdictions, where paid-up capital is shown across two separate equity lines (par value and additional paid-in capital). Singapore abolished par value and share premium in 2006, so these categories no longer apply.

In accounting terms, paid-up capital increases when the company issues new shares and receives the corresponding consideration. It may decrease only through an approved capital reduction under the Companies Act. Because paid-up capital forms part of shareholders’ equity, it strengthens the company’s net asset position and is often used to assess financial health, creditworthiness and regulatory eligibility.

If you require support with updating your paid-up capital, issuing new shares or preparing ACRA filings, BBCIncorp can guide you through the process with clarity and full compliance.

Comprehensive Corporate Services by BBCIncorp

BBCIncorp delivers a comprehensive range of corporate services designed to support companies from incorporation through long-term compliance and operational growth. By combining regulatory expertise with technology-driven processes, we help businesses simplify administrative tasks, maintain accuracy in statutory filings and operate confidently within Singapore’s regulatory landscape.

Our service offerings cover the essential needs of both new and established companies, ensuring smooth setup, reliable compliance and scalable support as your business expands.

Our core business services include:

- Incorporation services: Digital-first incorporation solutions for locals, permanent residents and foreign entrepreneurs.

- Bank Account Opening Support: Guidance and coordination with local banks and reputable digital banking alternatives.

- Accounting, Auditing & Tax Filing: Outsourced accounting, tax reporting and annual compliance services.

- Corporate Secretarial Services: End-to-end entity management and ACRA compliance support.

- Immigration & Work Pass Services: Assistance with visas, work permits and expatriate relocation needs.

- Merchant Account Consulting: Support in setting up merchant accounts to strengthen online and offline payment capabilities.

- E-commerce Solutions: Services tailored for online sellers and global e-commerce operations.

With a client-centric approach, BBCIncorp focuses on clarity, efficiency and dependable service delivery, helping businesses navigate complexity and stay compliant with ease.

Understanding how paid-up capital functions, and how it is regulated, reported and strategically used, helps businesses operate with greater clarity and confidence in Singapore’s corporate environment.

Whether you are incorporating a new entity or restructuring an existing one, making informed decisions about paid-up capital Singapore ensures stronger compliance, better financial positioning and improved credibility with stakeholders.

With the right guidance and support, companies can establish a capital structure that aligns with both immediate operational needs and long-term growth objectives. For tailored assistance with capital structuring, corporate filings or any compliance matters, feel free to contact our team at service@bbcincorp.com.

Frequently Asked Questions

Does paid-up capital have to be paid in cash?

Yes, paid-up capital must ultimately be received in cash and deposited into the company’s corporate bank account.

If shares are issued for non-cash consideration (such as assets, services or intellectual property), the company must assign a monetary value to the consideration and record an equivalent cash amount as paid-up capital. This value must be justifiable and reflected properly in the company’s financial records.

What if the capital is not fully paid up?

If the capital is not fully paid up, the unpaid amount becomes a debt owed by the shareholder to the company. The company’s Constitution may provide consequences for non-payment, such as suspension of voting rights or forfeiture of shares.

The company may also issue calls on unpaid amounts, specifying how much, when, and how shareholders must pay. Failure to comply with a call may result in penalties stated in the Constitution.

How does paid-up capital affect borrowing capacity?

Higher paid-up capital demonstrates stronger shareholder commitment and improves the company’s equity position. Banks often view this as a positive credit factor, increasing the likelihood of loan approval, especially for unsecured, trade-based or partially secured facilities.

It does not guarantee approval, but it strengthens the company’s financial profile during credit assessment.

What Happens If You Don’t Meet Paid-Up Capital Requirements

In Singapore, most businesses only require SG$1 paid-up capital, so failing to meet capital requirements is uncommon.

However, certain regulated industries, such as finance, construction, travel agencies, fund management and employment agencies, require higher statutory minimum capital.

If a company does not meet the required minimum:

- It cannot legally carry out the regulated activity.

- It may be denied licence approval by the relevant authority.

- Existing licences or registrations may be suspended or revoked.

- The company may face fines or compliance penalties, depending on the regulator.

What Happens to Paid-Up Capital When a Company Shuts Down?

When a company shuts down, a liquidator will be appointed to wind up its affairs. During the process, the liquidator will realise (convert to cash) all company assets, including amounts representing paid-up capital, and use the proceeds to settle outstanding debts. Only if there is a surplus after paying all creditors will the remaining funds be distributed to shareholders.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- Understand paid-up capital singapore

- Legal regulations governing paid-up capital in Singapore

- Difference between paid-up capital and other types of capital

- Factors affecting the amount of paid-up capital

- Should the company's Paid-Up Capital be high or low?

- Common uses and restrictions of paid-up capital

- Process of changing the company’s paid-up capital

- How is paid-up capital recorded in accounting?

- Comprehensive Corporate Services by BBCIncorp

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.