- What is a Private Limited Company (Pte. Ltd.)?

- What are the pros and cons of setting up a Private Limited Company?

- Pte. Ltd. versus other business structures: Key differences

- Requirements of a Private Limited Company Registration in Singapore

- How to set up a Private Limited Company in Singapore?

- Post-Incorporation checklist for a Private Limited Company in Singapore

- BBCIncorp - Comprehensive solutions for businesses

- Conclusion

A Private Limited Company (Pte. Ltd.) is the most popular business entity in Singapore, favored by entrepreneurs and investors alike for its strong liability protection, attractive tax incentives, and enhanced business credibility.

Pte. Ltd. is the favored business entity for many entrepreneurs and investors in Singapore due to its benefits in liability protection, tax incentives, and business credibility. Establishing a Pte. Ltd. Singapore provides a well-defined and trusted framework for running a business, making it an excellent choice for both startups and growing enterprises.

In this guide, we will explore what a Singapore Private Limited Company is, its key advantages, compliance requirements, and the step-by-step process of registration and operation. Whether you are a local or foreign investor, understanding these essentials will help you make informed decisions that support long-term business growth and regulatory compliance.

What is a Private Limited Company (Pte. Ltd.)?

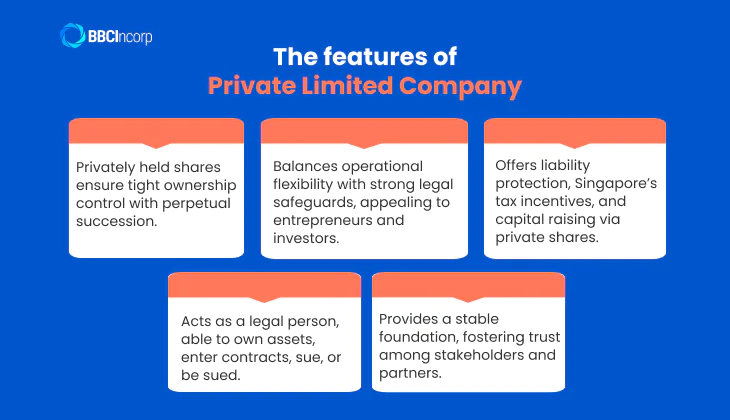

A Private Limited Company (Pte. Ltd. Singapore) is a separate legal entity, distinct from its owners, which provides shareholders with limited liability protection. Governed by the Accounting and Corporate Regulatory Authority (ACRA), it operates within a clear regulatory framework that ensures compliance with Singapore’s corporate laws.

One of its defining features is that shares are privately held and cannot be offered to the public, ensuring tighter control over ownership. It also enjoys perpetual succession, meaning the company continues to exist regardless of changes in shareholders or directors.

This structure strikes a balance between operational flexibility and strong legal safeguards, making it attractive to both entrepreneurs and investors.

Beyond liability protection, incorporating a Pte. Ltd. boosts business credibility, grants access to Singapore’s tax incentives, and allows capital to be raised through private share issuance — all of which support long-term growth.

Additionally, a Pte. Ltd. can own assets, enter into contracts, sue, and be sued in its own name, granting it the full capacity of a legal person. These attributes provide a stable foundation for operations, fostering trust among stakeholders, investors, and business partners.

For these reasons, many businesses opt for the Pte. Ltd. model to combine growth potential with strong compliance and effective risk management.

Compliance requirements for a Pte. Ltd. Company

Incorporating a private limited company in Singapore is only the beginning. To ensure long-term success and maintain good standing, businesses must meet specific compliance obligations set by regulatory authorities.

These include filing annual returns, submitting corporate tax returns, holding annual general meetings, and maintaining proper financial records.

Collectively, these requirements safeguard a company’s legal status, foster transparency, and strengthen the trust of shareholders, investors, and business partners in Singapore’s dynamic business environment.

- Filing Annual Returns: Companies must submit updated company information to the Accounting and Corporate Regulatory Authority (ACRA).

- Corporate Tax Filing: Companies are required to file income tax returns with the Inland Revenue Authority of Singapore (IRAS) and pay taxes based on their taxable income.

- Annual General Meeting: Pte. Ltd. companies must hold an annual general meeting (AGM) within 18 months of incorporation and subsequently once every calendar year to present financial statements and address company matters with shareholders.

- Maintaining Financial Records: Accurate accounting records must be kept for a minimum of five years to support financial reporting and audits, ensuring transparency and compliance.

These essential compliance activities help safeguard the company’s legal status, promote transparency, and strengthen stakeholder confidence in Singapore’s competitive market.

Exemptions for a Private Limited Company in Singapore

Private Limited Companies in Singapore may qualify for specific exemptions that reduce compliance costs and administrative workload. These cover audits, financial statements, and taxation, helping eligible businesses save resources and focus more effectively on growth.

- Audit exemption: Small companies that meet at least two of the following criteria, including annual revenue not exceeding S$10 million, total assets not exceeding S$10 million, or having no more than 50 employees, are exempt from appointing an auditor.

- Financial statement exemption: Non-listed dormant companies with total assets under S$500,000 or exempt private companies with fewer than 20 shareholders (non-corporate) are not required to file financial statements, but must retain them internally.

Outsourcing accounting services can simplify this process. Explore now: Singapore accounting, auditing & tax filing service with BBCIncorp

- Tax exemption: Start-ups can enjoy a tax exemption of 75% on the first S$100,000 and 50% on the next S$100,000 of chargeable income for three years. After that, companies benefit from a partial exemption of 75% on the first S$10,000 and 50% on the next S$190,000.

What are the pros and cons of setting up a Private Limited Company?

Incorporating a Private Limited Company in Singapore offers several notable advantages, making it a preferred choice for many entrepreneurs and investors. However, like any business model, it also comes with certain drawbacks that should be carefully considered before incorporation.

Advantages

A Pte. Ltd. is the most common business structure in Singapore, largely because its advantages surpass those of other entity types. From attractive tax incentives and limited liability protection to greater ease in raising capital, this structure offers entrepreneurs a balanced mix of security, flexibility, and growth potential.

- Tax incentives

Private Limited Companies benefit from a low corporate tax rate of 17% and start-up tax exemptions, such as a 75% tax relief on the first S$100,000 of income for 3 years. Singapore’s single-tier tax system ensures that profits are not taxed again at the shareholder level, resulting in tax-exempt dividends and no capital gains tax. These benefits make Pte. Ltd. a popular choice.

- Limited liability protection

Shareholders’ liability is limited to their investment, protecting personal assets from business debts. This separation reduces financial risk compared to sole proprietorships or partnerships, where owners are personally liable.

- Ease of raising capital

A Pte. Ltd. can raise funds by issuing shares to new or existing investors, increasing paid-up capital. This flexibility helps businesses attract investment, support expansion, and build partnerships, including opportunities with foreign investors.

Disadvantages

Despite these benefits, there are some downsides to consider. Private limited companies face ongoing compliance requirements such as annual filings, audits (unless exempted) and strict governance rules, which can be time-consuming and costly.

Establishing and maintaining a Pte. Ltd. Singapore also involves higher administrative expenses compared to simpler business structures. Additionally, decision-making might be slower due to the involvement of multiple shareholders and directors, which can limit agility in some situations.

Understanding both the advantages and disadvantages enables business owners to make informed choices aligned with their goals.

Pte. Ltd. versus other business structures: Key differences

Choosing the right business structure is a critical decision for any entrepreneur in Singapore, as it determines the company’s legal standing, liability, taxation, and growth potential. While a Pte. Ltd. is often the preferred option, alternatives such as Sole Proprietorships, Partnerships, and Public Limited Companies each carry distinct features, advantages, and limitations.

| Feature | Private Limited Company | Sole Proprietorship | Partnership | Public Limited Company |

|---|---|---|---|---|

| Legal status | Separate legal entity | Not separate from owner | Not separate from partners | Separate legal entity |

| Liability | Limited to share capital | Unlimited personal liability | Unlimited joint liability | Limited to share capital |

| Taxation | Corporate tax, tax exemptions available | Personal income tax | Personal income tax | Corporate tax |

| Capital raising | Can issue shares to raise funds | Limited to owner’s funds | Limited to partners’ funds | Can raise capital from public |

| Ownership size | Less than 50 shareholders | 1 owner | Less than 20 partners | Unlimited shareholders |

| Continuity | Perpetual succession | No perpetual succession | No perpetual succession | Perpetual succession |

Overall, the Private Limited Company Singapore offers the best balance of legal protection, tax benefits, and growth opportunities among Singapore’s business structures. This makes it the preferred choice for most entrepreneurs and growing businesses.

Requirements of a Private Limited Company Registration in Singapore

The registration of a Private Limited Company in Singapore is governed by clearly defined statutory requirements. These requirements are designed to ensure that the company is legally constituted, properly managed, and aligned with the regulatory standards of Singapore’s corporate environment.

- Local director

Your company must have at least 1 director who is a Singapore resident. If you don’t have a suitable candidate, you can use a nominee-director service or become a local director yourself by obtaining an Employment Pass, which allows foreigners to hold director positions.

Note

Employment Pass application may take around 6 months, so a nominee director is needed until then.

- Company secretary

A company secretary must be appointed within six months of incorporation. The appointee must be a Singapore resident, and the position may not remain vacant for more than six consecutive months under the Companies Act.

- Registered office address

A local registered office address in Singapore is mandatory, and it may be separate from the company’s business premises.

- Paid-up capital

A minimum paid-up capital of one Singapore dollar is sufficient to register a Private Limited Company in Singapore.

- Shareholders

The company must have at least 1 shareholder, who can be an individual or a corporate entity. Shareholders may be local or foreign, and a shareholder can also serve as a director.

- Auditor

An auditor must be appointed within three months of incorporation unless your company qualifies for an audit exemption, typically applicable to small companies that meet certain criteria.

How to set up a Private Limited Company in Singapore?

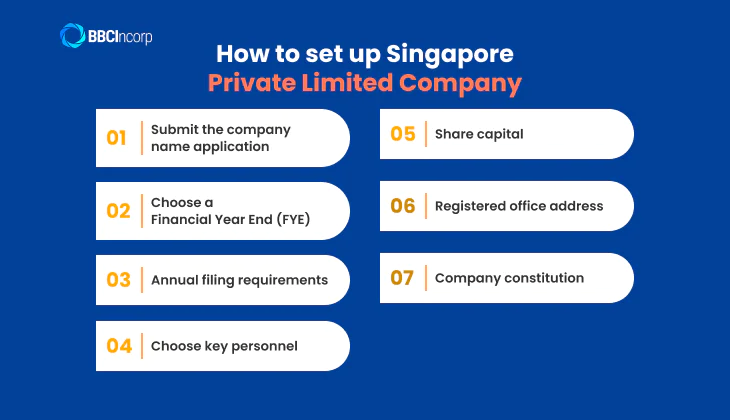

In Singapore, the registration of all business entities is overseen by the Accounting and Corporate Regulatory Authority (ACRA). To incorporate a Private Limited Company, entrepreneurs must comply with the prescribed procedures and statutory requirements. The process can be outlined in the following key steps:

Step 1: Submit the company name application

Begin by selecting a unique and appropriate company name. Submit your preferred name through ACRA’s online platform, BizFile+. The proposed name must not infringe on existing trademarks, violate the law, or be identical to another registered company. Once submitted, ACRA typically reviews and approves the name within 1 to 2 business days. You can reserve the approved name for 120 days, giving you sufficient time to complete the incorporation process.

Before registering, you should search on BizFile+ to confirm that the name is not already registered and ensure compliance with naming rules.

Step 2: Choose a Financial Year End (FYE)

Selecting the Financial Year End (FYE) is an important step as it defines the period for your company’s accounting and reporting cycle. For a Private Limited Company Singapore, you are required to hold your Annual General Meeting (AGM) within 6 months following the FYE, and file your Annual Return (AR) with ACRA within 7 months after the FYE date.

For instance, if your FYE falls on March 31, 2024, you should hold your AGM by September 30, 2024, and submit the AR by October 31, 2024.

If your Pte. Ltd. is non-listed, has issued share capital, and keeps a branch register overseas, there is a slight variation: the AGM must still be conducted within 6 months after the FYE, but the deadline for filing the AR is extended to 8 months after the FYE. This extension accommodates the additional administrative processes related to overseas operations.

Choosing an FYE that aligns with your business’s activity cycle or financial planning can lead to more efficient reporting and tax management.

Step 3: Annual filing requirements

Post-incorporation, compliance includes holding an AGM and filing the AR annually with ACRA. Even if your company is exempt from income tax filing by IRAS, you must still submit the AR as long as your business is active. Failure to file can result in penalties.

Step 4: Choose key personnel

When establishing a Singapore Private Limited Company, appointing qualified key personnel is essential for both legal compliance and smooth operations. Every company must have at least 1 director who is a resident of Singapore.

This residency requirement can be met by a Singapore citizen, Permanent Resident, or foreigner holding valid work passes such as an Employment Pass or EntrePass. Directors must be 18 years or older and possess full legal capacity. Any individual who has been disqualified by law (such as an undischarged bankrupt) is prohibited from acting as a director.

It is important to understand that all directors bear equal responsibility for the company’s compliance with laws and regulations, regardless of how active they are in daily management. Even nominee directors carry full legal liability.

In addition to directors, a company secretary must be appointed within 6 months of registering the company. This role cannot be left vacant beyond that period without facing potential fines.

The company secretary must be a natural person residing in Singapore and cannot be the sole director of the company. The secretary’s duties include managing statutory registers, organizing official meetings, keeping accurate records, and ensuring the company meets filing requirements on time.

Step 5: Share capital

A minimum paid-up capital of S$1 is required at incorporation, which can be increased later. Shares can be fully or partially paid. Companies with at least S$500,000 paid-up capital automatically join the Singapore Business Federation (SBF).

Step 6: Registered office address

You must provide a registered office address in Singapore where all official communications are sent and company records kept. The address must be accessible to the public for at least three hours on business days but need not be the place of business operations. Using a virtual office address is common for startups to maintain a professional image while saving costs.

Step 7: Company constitution

The company constitution is a legal document outlining rules for company governance, rights and responsibilities of directors, secretaries, and shareholders, and details such as company name, registered address, business activities, share capital, and shareholder liabilities.

It must be submitted along with the registration application. You can adopt ACRA’s standard constitution or customize it to suit your needs.

Following these detailed steps ensures your Private Limited Company Singapore is correctly incorporated and fully compliant with Singapore’s business regulations.

Post-Incorporation checklist for a Private Limited Company in Singapore

The incorporation of a Private Limited Company in Singapore marks only the beginning of its corporate journey. To operate lawfully and establish a sound business foundation, companies are required to complete several post-incorporation formalities.

The following checklist outlines the key obligations that must be fulfilled to ensure compliance with regulatory requirements and readiness for commercial activities.

- Get a Certificate of Incorporation and Free Business Profile

These documents, issued by ACRA, confirm your company’s registration and provide key business information needed for legal and financial purposes.

- Licences and Permits

Many industries require specific licenses or permits before business activities can begin. Depending on your sector, you must identify and obtain the necessary approvals from relevant authorities to operate legally.

- Open a Corporate Bank Account

Separating your company’s finances from personal accounts is vital for transparency and effective financial management. Choose a bank suited to your business needs and prepare all required documentation, including your incorporation certificate and company constitution, to open a corporate account.

- Issue Share Certificates

Issuing share certificates to shareholders formalizes ownership and is a legal requirement. These documents are critical for record-keeping and future transactions, serving as proof of each shareholder’s stake in the company.

- Register Corppass

CorpPass is Singapore’s corporate digital identity system that grants authorized personnel secure access to government e-services. Registering for CorpPass enables your company to efficiently manage compliance filings and engage with governmental agencies online.

- Taxation Requirements

Registering with the Inland Revenue Authority of Singapore (IRAS) is crucial to meet tax obligations. This includes registering for Goods and Services Tax (GST) if your turnover exceeds the threshold, and ensuring timely submission of corporate tax returns.

- Register a Trademark

To protect your brand identity, registering a trademark secures exclusive rights to your company’s name, logo, or slogans. This safeguard prevents unauthorized use and strengthens your market position.

Observing the post-incorporation requirements is not merely a procedural formality but a fundamental responsibility of every Private Limited Company Singapore. By meeting these obligations in a timely and accurate manner, a company secures its legal compliance, strengthens its corporate reputation, and lays the groundwork for sustainable growth in Singapore’s dynamic business landscape.

BBCIncorp – Comprehensive solutions for businesses

BBCIncorp is dedicated to helping businesses navigate company formation and regulatory compliance efficiently, aligning our services with each client’s unique objectives. We provide end-to-end solutions that make incorporation and business operations seamless, saving both time and costs.

With extensive experience and a deep understanding of Singapore’s business environment and legal framework, BBCIncorp is a trusted partner supporting companies at every stage of their growth. We ensure full compliance with regulations to maintain sustainable and effective operations.

Our goal is to help clients succeed through professional, flexible, and personalized services tailored to their specific business strategies and goals.

How BBCIncorp can help

We offer free banking support for any of our packages, which includes preparing bank account applications and arranging interviews with your chosen banks.

Chat with us or drop a message via service@bbcincorp.com to let us know about your specific case.

Reliable compliance partner

At BBCIncorp, we believe compliance is a shared responsibility. As your trusted partner, we ensure you never face the complexities of regulatory requirements alone.

Whether you are a startup or an established business, our team provides proactive support to keep your company aligned with Singapore’s legal standards. This partnership approach means you have expert guidance every step of the way, reducing risks and enabling smoother business operations.

Tailored services to match your goals

Every business is unique, and so are its compliance needs. BBCIncorp offers personalized solutions that align with your specific objectives. Our goal is to make compliance efficient and supportive of your growth strategy. From the initial Company Incorporation to ongoing governance, we customize our services to fit your business size, industry, and expansion plans, ensuring regulatory duties enhance rather than hinder your success.

Smooth company incorporation and secretarial support

For foreign investors and local entrepreneurs, navigating company incorporation in Singapore can be challenging. BBCIncorp eases this process with comprehensive services, including a local registered address and nominee director options when needed.

Once incorporated, our expert Company Secretary Services manage statutory compliance duties such as maintaining company registers, preparing board resolutions, filing annual returns, and managing AGMs/EGMs. Our digital compliance calendar and client portal keep you informed about deadlines and simplify communication, allowing you to focus on your core business.

Expert assistance with corporate bank accounts

Opening a corporate bank account in Singapore often involves strict verification and documentation. BBCIncorp’s Merchant Account Consulting and bank account opening support help clients navigate these challenges.

We assist in selecting the right bank, preparing documents, and coordinating both online and in-person application procedures. This hands-on approach significantly increases approval rates and saves valuable time, enabling your company to operate seamlessly with reliable payment solutions in place.

Ongoing Compliance and Advisory

Compliance is not a one-time event but an ongoing obligation. BBCIncorp provides continuous support through personalized compliance advice, updating you on regulatory changes, and advising on risk management tailored to your company’s profile.

Our services extend to Accounting, Auditing & Tax Filing, ensuring your financial records are accurate, audits are efficiently managed, and tax obligations are met punctually. With BBCIncorp’s expert guidance, you can confidently adapt to regulatory shifts and focus resources on scaling your business without compliance worries.

With this comprehensive suite of services, BBCIncorp ensures that from your company’s inception to everyday operations, you have a reliable partner dedicated to meeting your compliance needs smoothly and efficiently. Our commitment is to empower your business to thrive within Singapore’s regulatory framework while achieving your strategic goals.

Conclusion

Let’s wrap it up! The best way for setting up a Private Limited Company in Singapore (Pte. Ltd.) is to use incorporation services. They will help you fulfill all the minimum requirements to register a new company. If everything goes smoothly, you can expect the company to be formed in just one day.

To maintain a Private Limited Company in Singapore, you will need to pay certain annual fees, hold annual general meetings (exemption possible), and file certain reports to the government. These tasks can be done by yourself or entrusted to an authorized agent.

BBCIncorp can get everything done for you! Contact our friendly consultant now!

Frequently Asked Questions

How much does it cost to set up a Private Limited Company in Singapore?

The cost and services for registering a Private Limited Company in Singapore vary depending on your specific requirements. BBCIncorp offers tailored service packages to suit different needs. Please contact us for a detailed consultation and personalized quote.

How long does the process of incorporating a Private Limited Company in Singapore take?

Typically, the approval of your company name and registration can be completed within one day; however, if further approvals are required, the process may extend from 14 to 60 days.

How to take money out of a Private Limited Company?

Directors or shareholders can receive dividends, salaries, or directors’ fees to withdraw money from a Private Limited Company. Dividends are distributed according to the company’s profits and each shareholder’s equity, whereas salaries and fees are compensation for services provided.

It is important that any withdrawals align with the company’s financial status and adhere to tax laws and legal regulations.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is a Private Limited Company (Pte. Ltd.)?

- What are the pros and cons of setting up a Private Limited Company?

- Pte. Ltd. versus other business structures: Key differences

- Requirements of a Private Limited Company Registration in Singapore

- How to set up a Private Limited Company in Singapore?

- Post-Incorporation checklist for a Private Limited Company in Singapore

- BBCIncorp - Comprehensive solutions for businesses

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.