Offshore Company Registration in Delaware

Delaware Limited Liability Company (LLC)

Delaware Limited Liability Company (LLC)

Highly flexible corporate structure

At least one member required

No minimum registered/paid-up capital

Local registered office and registered agent required

Member’s liability only limited to their investment

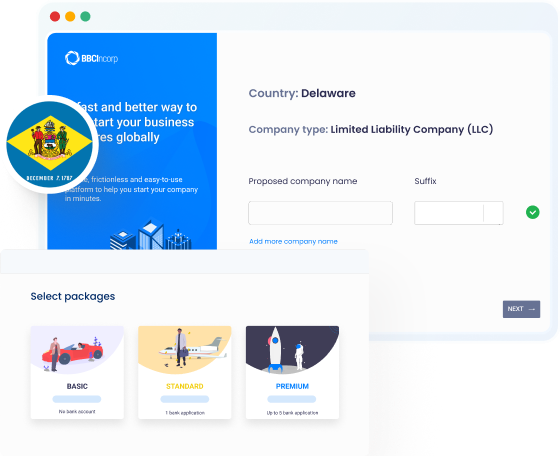

Delaware Company Formation Packages

Renewal services

Delaware LLC Renewal

With TaxHub, it is no longer a challenge fulfilling your Delaware LLC's tax filing as a non-US resident!

Exclusive offers for BBCIncorp clients:

- 10% discount code

- Free 30-minute CPA consultation

We connect directly with Wise to address any issues with your account

- Free transaction fee for the first transfer of up to GBP 1,000; or

- For the equivalent in other currencies

Fuel your startup growth with Mercury banking solutions

- Custom-made for your needs

- $500 cash-back reward for $10k spent on your debit card within 90 days

Simplify your international business transactions with Payoneer

- Free account opening and maintenance

- All transaction fees fixed at 1%

- Up to $500 cashback

Not sure which banks suit you?

Explore our all-inclusive banking guideline and figure out how to choose the most suitable option for your business.

Bring your next business venture online

Streamlined process

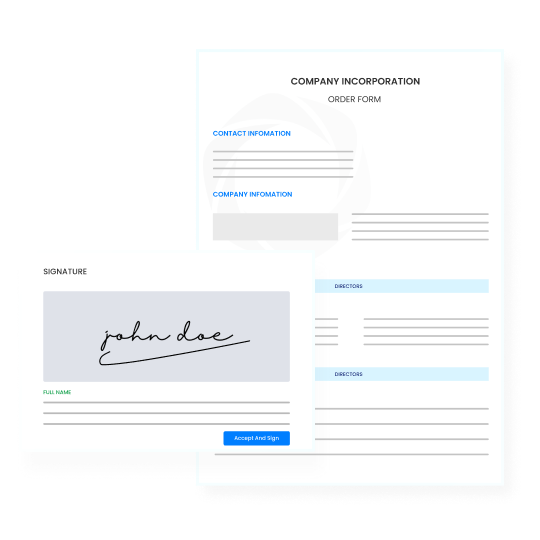

E-signature

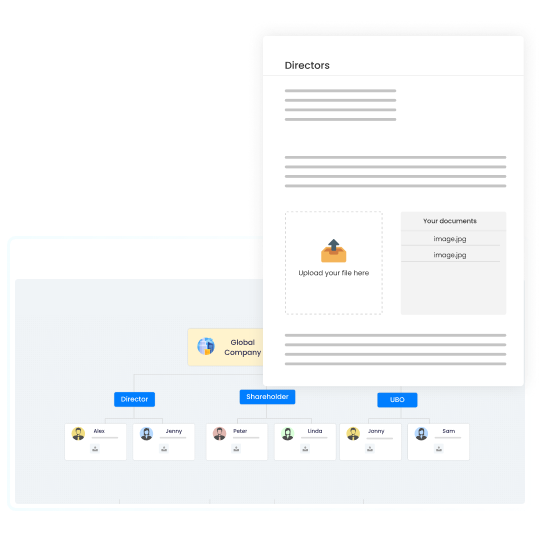

Digitized KYC

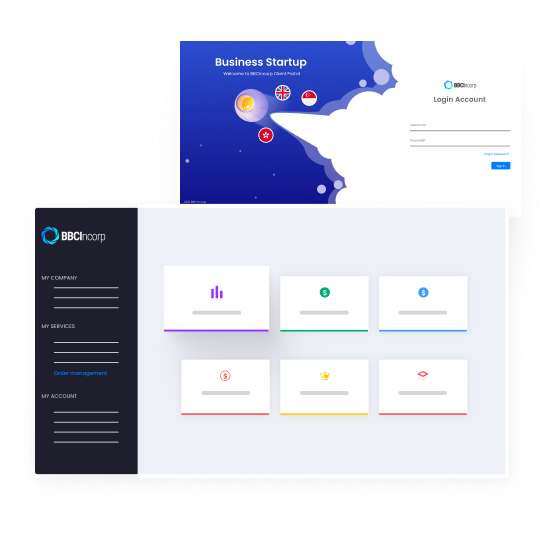

Centralized management portal

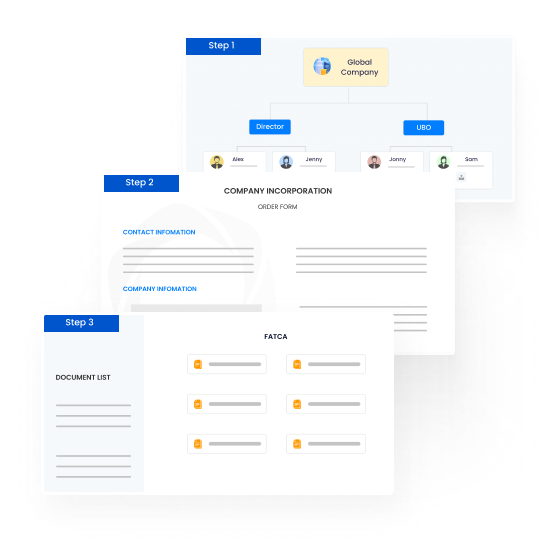

Delaware Company Incorporation Process

Create your orders

Enter our online order platform for a smooth onboarding experience. We have different packages and add-on services that match your goals. All information is protected with 256-bit encryption to ensure a secure Delaware company setup.

Make payment

You can settle payment for services via flexible payment options including debit/credit card of Visa, Master, Amex or Bank Transfer. After you complete payments, we will provide you a checklist of required information for Delaware company registration.

Collect and verify KYC documents

Once we've received your payment, our customer service will contact you to process the necessary paperwork. We'll guide you to properly prepare documents for incorporation in Delaware via KYC online form. You can also access our digital Client Portal to proceed with the incorporation steps and keep track of the process anytime, anywhere.

Complete your company registration

Electronic documents will be ready within 2 working days after incorporation. The corporate kit will be couriered to you within 3 to 7 days.

KYC Documents Checklist

The following proofs are required for all company members including Directors (or Managers for LLCs), Shareholders (or Members for LLCs), Ultimate Beneficial Owners (UBOs), and Contact persons.

To establish the identity of a corporation or entity, it is necessary to provide company documents and proofs of its members.

*Note that the list provided, while comprehensive, may not encompass all requirements.

For further personalized consultations tailored to your specific case, please reach out to our support team anytime

Need more help to set up your business in Delaware

Frequently Asked Questions on How to Open a Company in Delaware

Does a Delaware LLC need to pay the state corporate income tax?

No. There is no state corporate tax for income generated from outside Delaware.

In addition, there will be no state tax, local sales tax, or tax on interest, royalty and other similar taxes applied on a Delaware offshore LLC.

Which business lines need licenses to incorporate in Delaware?

Your business lines would be required to obtain certain licenses and permits from state agencies, federal agencies, or even both, to legally incorporate in Delaware.

Examples of such business activities: agriculture, alcohol, automobile, aviation, transportation, banking, child care, consumer protection, building/constructions, health, lottery, manufacturing, special events, and so on.

What are the compliance requirements for an LLC in Delaware?

After successfully incorporating your Delaware company, you should stay on top of compliance requirements to maintain good standing. Key obligations include:

- All Delaware companies must retain a registered agent to provide a local address and handle service of process.

- Limited Liability Companies, Limited Partnerships, and General Partnerships are required to pay an annual franchise tax of US$300, typically due by 1 June each year.

- Delaware LLCs are not required to file an annual report.

For a complete overview of your Delaware LLC’s legal obligations, don't hesitate to read our compliance guide. You can chat with BBCIncorp team for more information on our Delaware incorporation services as well.

Is a registered agent required when forming a company in Delaware?

Yes. Having and retaining a registered agent in the State of Delaware is mandatory to all business entities.

Note that the registered agent is required to have a local physical address in the state.

Is my company information in Delaware kept confidential?

Yes. Delaware laws provide companies registered in the State with a high level of privacy. This means all relevant identities and personal details of privately held corporate business owners are not made publicly available. Names, addresses of Delaware LLC’s members and managers are kept undisclosed as well.

Do I need a business license to sell online in Delaware?

Yes, acquiring a business license is essential for every business operating in the state of Delaware. Online businesses may only be required to obtain the Delaware state business license because Delaware has no sales tax. If you also need a local license for your online business, check with your city or county.

Do I need a business bank account for Amazon FBA?

While it is not required, there are several benefits to doing so. A Delaware business bank account helps with organization and record-keeping for your business expenses and income, it can also provide added credibility when working with potential partners or investors, and so on.

Do I need a business license to sell on Etsy in Delaware?

In Delaware, it is required to have a business license if you are conducting any type of business activity, including selling on Etsy.

Can I open an LLC in Delaware without living there?

Yes, you can form a Delaware LLC without living in the state or even the United States. Delaware law allows non-residents to establish and own LLCs, and this is why it became a popular choice for international entrepreneurs and investors. However, every Delaware LLC is required to have a registered agent with a physical address in Delaware to receive legal and official documents. You can hire BBCIncorp as your professional registered agent service to meet this requirement.

Once the LLC is formed, non-resident owners can manage the company remotely, open bank accounts, and conduct business globally.