Submitting an annual return to the Companies Registry is a crucial obligation for all companies operating in Hong Kong. Much like renewing your business license and paying renewal fees, an annual return is essential to keep your company in compliance with the law and provide regular updates to the relevant authorities. This ensures the smooth continuation of your business operations.

If you own a business in Hong Kong, this brief guide will give you the essential information to effectively handle your annual return filing.

What is Hong Kong’s Annual Return?

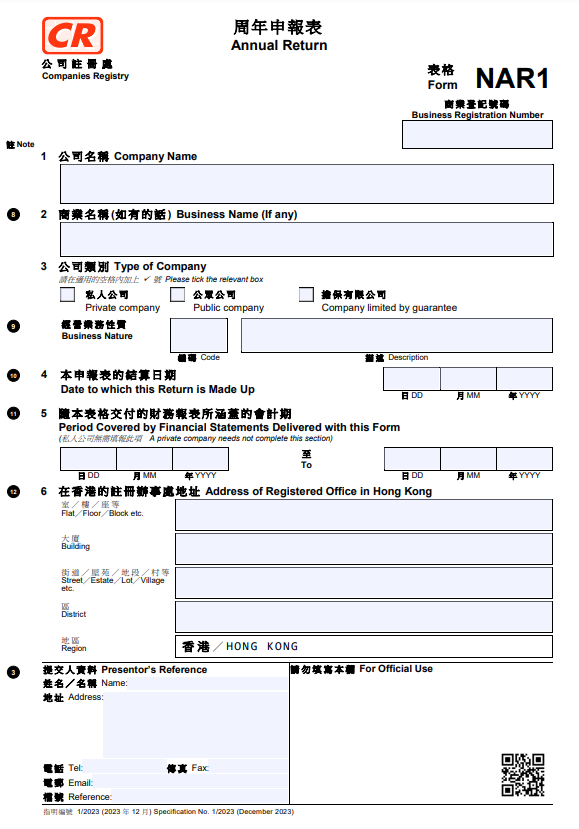

In Hong Kong, an Annual Return is a mandatory annual compliance requirement for all registered companies. This obligation entails the submission of Form NAR1, which provides updated information about the company’s shareholders, directors, and company secretary, as well as details about its registered office address and the share capital structure.

The primary purposes of filing the Annual Return (AR) are as follows:

- Ensure legal compliance: Submitting an AR is a legal requirement under the Companies Ordinance of Hong Kong. Failure to comply can result in penalties and legal consequences. Complying with this regulation is crucial to maintain your company’s good standing with local authorities.

- Maintain transparency and accountability: The AR ensures that both the Companies Registry and the general public have access to accurate and up-to-date information concerning the company’s ownership and management. This transparency fosters trust and credibility in the business landscape, providing assurance to stakeholders such as investors, creditors, and potential business partners that the company operates in a lawful and transparent manner.

- Keep track of historical records: Another purpose of the Annual Return is to create a historical record of the company’s key information. This record can be invaluable for reference and audit purposes, helping track changes in ownership, leadership, and other vital details over time.

What information to file in the Annual Return?

The information to be filed in the Annual Return Form NAR1 in Hong Kong can be categorized into the following key categories:

Company details

- Company name and registration number: This refers to the official name of the company as registered with the Companies Registry, along with its unique registration number.

- Registered office address: The official address where the company conducts its operations and receives official documents. It must be a physical location within Hong Kong.

- Date of incorporation: The date on which the company was officially incorporated. If the date of incorporation differs from the date when the business commenced its operations, both dates should be provided.

- Details of business activities: This section outlines the nature of your business activities such as e-commerce, food & beverage, and so on.

Shareholder information

This category includes comprehensive information about the company’s shareholders, such as:

- Names and addresses: The names and addresses of all shareholders, whether they are individuals or corporate entities.

- Shareholding structure: This section outlines the quantity and types of shares held by each shareholder, giving a clear picture of the ownership structure.

- Changes in share ownership: If any changes in share ownership occurred during the reporting period, they should be documented.

Director and company secretary information

This section provides personal details of the company’s directors and the company secretary. It’s crucial to maintain this information accurately as it helps in identifying the individuals responsible for managing and overseeing the company.

Share capital details

This covers details about the share capital the company has issued, the total number of shares, and the value of these shares. It helps in understanding the financial structure of the company.

Additional information

The Annual Return may also include other pertinent details such as

- The company’s financial statements;

- Information about any mortgages or charges on the company’s assets; and

- Any other relevant information that reflects the current status of the company.

These categories have already been specified in the official Form NAR1. All you have to do is download the form and complete it following the provided guidance.

Below is a sample of Form NAR1 for your reference:

How to submit your Hong Kong Annual Return?

To ensure a successful submission of your Hong Kong Annual Return, it’s crucial to have a clear understanding of the key aspects involved, such as the deadline, potential penalties, and the official procedure.

Deadline for submitting the Annual Return

The Annual Return (AR)must be submitted once every calendar year. In Hong Kong, the submission deadline for a company’s AR is determined by its specific anniversary date.

Generally, a company is required to file its AR within 42 days following the anniversary of its date of incorporation, except for the first year.

The 42-day deadline is strict and not extendable by any authority, including the Registrar of Companies. You should utilize the government’s Annual Return Filing Calculator to determine your specific due date and ensure timely submission.

Kindly note that the filing obligation remains unchanged, regardless of whether there have been any updates to your company’s information from one year to the next.

Fines for late submission

Missing the 42-day deadline leads to fines ranging from HK$870 to HK$3,480, increasing with the length of the delay.

Additionally, late submission of the Annual Return can also result in legal actions and the potential striking off of the company from the register, so it is essential to meet the submission deadlines.

The procedure for annual return submission

The following procedure provides a general idea of the essential steps involved in this submission

Step 1: Choose the submission method

When submitting your annual return, you have two options

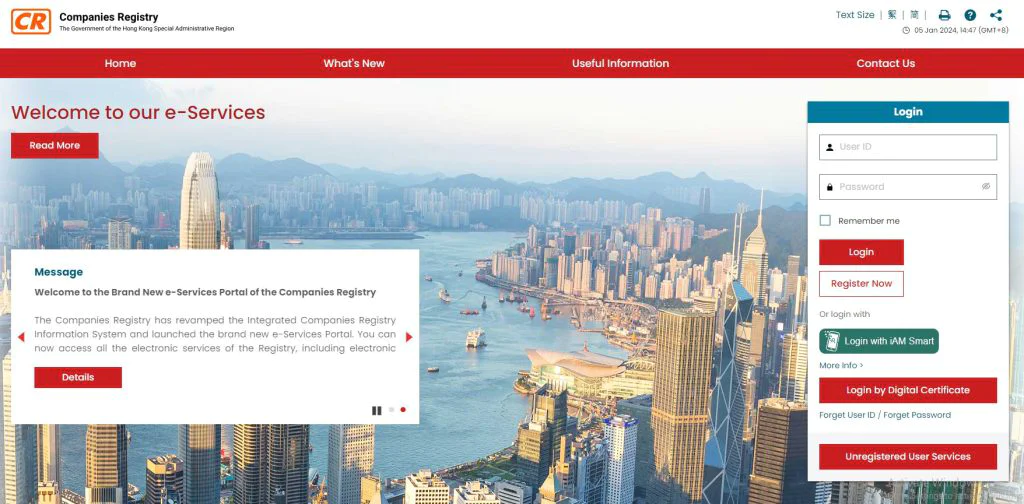

Online submission

You can use the e-Services portal to submit the NAR1 form and the necessary documents electronically.

Visit the e-Services website and create an account or log in if you already have one. Once logged in, navigate to the “Maintenance of Registered Particulars” section and select “Annual Return” to complete your filing.

In-person or postal submission

If you prefer this option, start by downloading and printing out Form NAR1. After filling out the form and getting it signed by your company director or company secretary, you can submit your documents in person or by postal mail to the following address: Companies Registry, 14th Floor, Queensway Government Offices, 66 Queensway, Hong Kong.

Need help with filing your Annual Return?

Look no further than BBCIncorp. Our team is here to make your annual return obligations hassle-free and ensure you never miss a deadline.

Explore our corporate secretarial services hong kong for comprehensive details, or simply chat with us for immediate support.

Step 2: Make filing payment

The filing fee for both private companies and companies limited by guarantee is set at HK$105

For electronic submissions, pay this fee online through the e-Services portal.

If submitting a hard copy, include a cheque payable to “Companies Registry” along with your documents.

Step 3: Maintain and update company records

Once you file your Annual Return, remember to keep a copy of the submitted Annual Return, along with all supporting documents, in your company’s records.

It’s also essential to maintain accurate and up-to-date company records and statutory documents throughout the year. If there are any changes in your company’s particulars (e.g., changes in directors, shareholders, or registered office address), promptly update these changes with the Companies Registry to ensure compliance with regulatory requirements.

Conclusion

Understanding and adhering to the Annual Return requirements in Hong Kong is vital for any business operating in the region. Compliance ensures that your company remains in good legal standing, avoiding penalties and legal complications.

Timely and accurate submission of these returns reflects positively on your business’s reliability and commitment to regulatory norms. It’s more than just a regulatory obligation; it’s a fundamental aspect of maintaining your business’s integrity and reputation in Hong Kong’s competitive business environment.

For further information relating to the Annual Return or business formation in Hong Kong, Feel free to contact us at service@bbcincorp.com.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.