Effective cash flow management stands as a crucial element of financial oversight. Whether you’re launching a new startup or are a seasoned entrepreneur, mastering cash flow statements is vital for sustaining and expanding your business.

This blog offers practical strategies for understanding, preparing, and managing cash flow statements, specifically tailored to Hong Kong’s distinctive business landscape. Join us to gain the essential tools for maintaining a healthy cash flow and fostering strategic growth.

Understanding cash flow statements in Hong Kong

A cash flow statement (CFS) is a vital financial document, alongside the income statement and balance sheet format, used by businesses to track cash movements over a certain period.

Unlike income statements, which include non-cash items, cash flow statements focus exclusively on liquidity, making them indispensable for informed operational decisions.

Why cash flow statement matter

For entrepreneurs in Hong Kong, where the business landscape is fast-paced and fiercely competitive, a cash flow statement is far more than an accounting formality—it’s a strategic guide to financial well-being. Here’s why it’s crucial:

- Ensure operational stability: It helps maintain sufficient funds to cover essential expenses like rent, salaries, and utilities. This aligns with proper how to keep records for small business practices, ensuring smooth day-to-day operations.

- Boost investor confidence: Investors and stakeholders closely examine cash flow statements to evaluate your business’s liquidity and viability, alongside reviewing your financial statement and overall financial health.

- Strategic decision-making: By closely monitoring your cash flow, you can determine when to scale back or take advantage of growth opportunities effectively.

Challenges in preparing cash flow statements

While cash flow statements are invaluable for business growth, preparing them can be challenging.

- Regulatory complexity: Hong Kong’s financial reporting standards, including the Hong Kong financial year deadlines, demand compliance to avoid penalties.

- Multinational operations: Managing cash flow across different currencies and exchange rates is challenging for multinational entities, particularly when expanding overseas or establishing subsidiaries in multiple countries.

- Time-consuming: Preparing a cash flow statement requires meticulous record-keeping, which can take up valuable time for busy entrepreneurs.

Components of a cash flow statement in Hong Kong

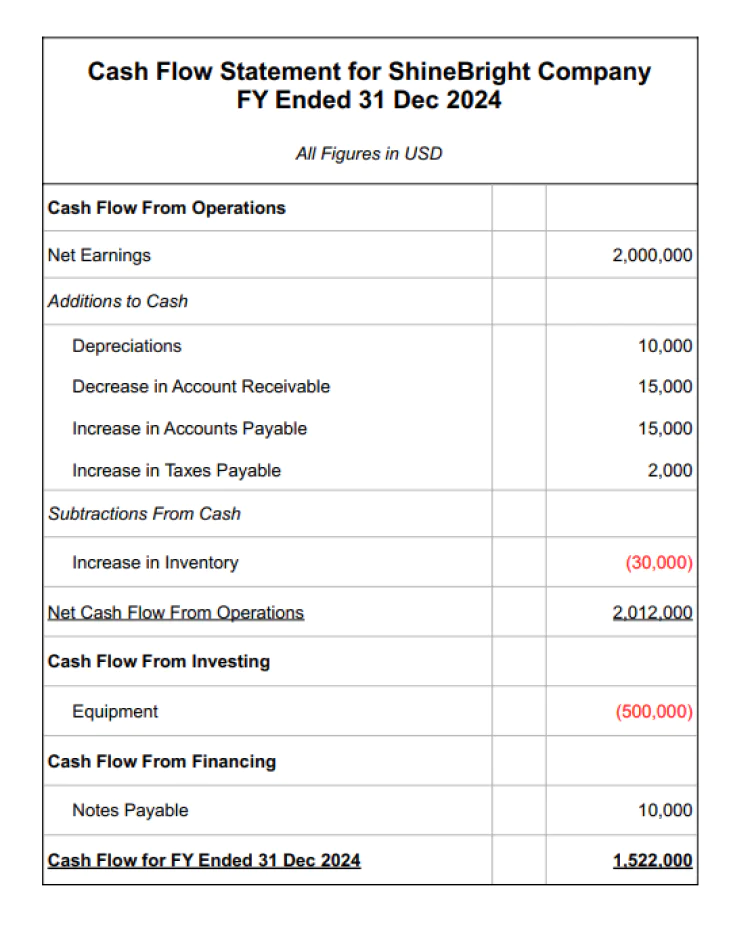

A cash flow statement is divided into three main components, each playing a vital role in monitoring financial activity.

Cash flow from operations

Cash flow from operations

This section captures the cash inflows and outflows directly tied to your primary business operations. Examples include payments from customers, salaries paid to employees, and supplier expenses. For Hong Kong businesses, this section is especially important for tracking the financial viability of day-to-day operations and complements the practices recommended by top accounting firm ranking experts.

Cash flow from investing

This part records transactions related to the acquisition or sale of assets, such as property, equipment, or investments. For startup owners in Hong Kong, where office space and tech infrastructure come at a premium, carefully managing investing activities can help avoid liquidity crunches.

Cash flow from financing

Financing activities include cash flows from borrowing, repaying loans, issuing shares, or paying dividends. With Hong Kong entrepreneurs frequently leveraging outside funding for growth, understanding financing cash flows is critical.

By analyzing cash flow from these three areas together, you can pinpoint the strengths and weaknesses of your financial strategy and take timely action.

Prepare cash flow statement with ease

With the help of BBCIncorp’s accounting services in Hong Kong, preparing a cash flow statement for your business can be a breeze, ensuring compliance with local regulations and tax requirements.

Methods for preparing cash flow statements

There are two methods for preparing a cash flow statement: direct and indirect. It is up to individual businesses to choose the most suitable one for their operations.

Direct method

The direct method of preparing a cash flow statement involves listing all cash transactions, including customer payments, operating expenses, and tax payments, item by item. This approach provides a detailed insight into where cash is coming from and how it is being used within the business. It allows stakeholders to clearly see the specific cash inflows and outflows for a given period.

However, this method requires meticulous and accurate bookkeeping to track each transaction, as well as keeping precise records, which can be resource-intensive, especially for startups with limited accounting resources. Despite the challenges, the direct method can offer valuable transparency into the financial health of a business by highlighting cash efficiency and areas for improvement.

Indirect method

The indirect method is a common approach to calculating cash flow, starting with your net income from the income statement. It involves adjusting for non-cash expenses, such as depreciation and amortization, which are accounting measures that do not involve actual cash transactions.

Additionally, this method takes into account changes in working capital components like accounts receivable, inventory, and accounts payable. By incorporating these adjustments, the indirect method offers a clearer picture of cash flow from operating activities.

This approach is often preferred by entrepreneurs and small business owners because it is generally faster and easier to prepare, aligning closely with standard accounting practices. Also, it provides valuable insights into how a company’s operational activities impact its cash position, aiding in better financial planning and decision-making.

Best practices for accurate preparation

Whichever method you choose, it’s important to follow best practices for accurate preparation:

Automate with tools

Utilizing accounting software like Xero or QuickBooks can greatly streamline your financial processes. These tools are particularly popular in Hong Kong due to their user-friendly interfaces and comprehensive features, which simplify tracking expenses and income, ensuring accuracy and efficiency.

Have a contingency plan

In Hong Kong’s dynamic business landscape, unexpected expenses can arise at any time. It’s wise to allocate a portion of your revenue as a buffer for these unforeseen costs. This proactive step helps safeguard your finances and ensures business continuity despite economic fluctuations.

Monitor frequently

Instead of waiting for the end of a quarter to assess your financial health, frequent reviews of cash flow are recommended. Monthly or even weekly assessments allow you to spot discrepancies and address issues promptly, preventing minor problems from escalating into major financial challenges.

Focus on cash flow projections

Developing accurate cash flow forecasts for the next 6–12 months is integral to aligning with your growth strategy. This forward-looking approach helps you anticipate and prepare for seasonal fluctuations, ensuring that you have the necessary resources to capitalize on opportunities and navigate potential downturns.

By adhering to these best practices, businesses can enhance their financial stability and position themselves for long-term success.

Take control of your cash flow today

Mastering cash flow management isn’t just about maintaining accurate records—it’s about empowering your business to thrive. From operating efficiently within Hong Kong’s challenging economic landscape to convincing investors of your financial stability, the strategies shared in this blog can set you on the right track.

If preparing or managing your cash flow statement still feels overwhelming, consider partnering with experts like BBCIncorp to simplify the process. Contact us via service@bbcincorp.com to unlock your entrepreneurial potential.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.