When it comes to running a successful business in Hong Kong, understanding financial health is non-negotiable. A balance sheet is more than just numbers—it’s a blueprint of your company’s financial standing. Whether you’re pitching to investors, applying for a loan, or making big decisions, your balance sheet holds the key.

This guide breaks down the essentials of a balance sheet, covers why it’s crucial, and provides tips to overcome common challenges. Mastering this skill can set your business apart—so let’s get started.

What exactly is a balance sheet?

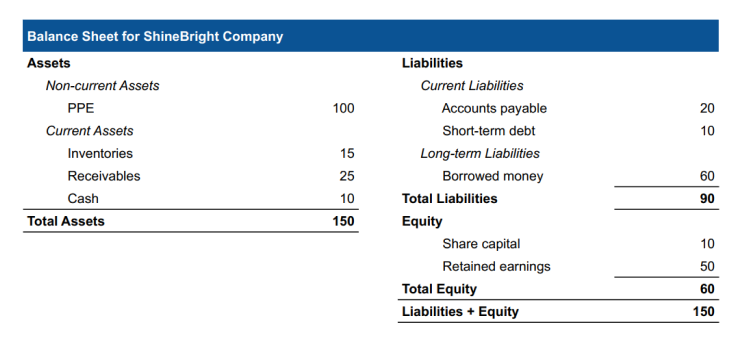

Your balance sheet is one of the fundamental financial statements of your business, alongside income statements and cash flow statements. It presents a snapshot of what your company owns, what it owes, and the stake invested in it, all on a specific date. Think of it as a three-part document highlighting assets, liabilities, and equity.

For your balance sheet to be accurate, both sides must balance out. In other words, the total value of assets should equal the combined value of liabilities and equity. When it does, it’s an indicator that everything has been accounted for accurately—hence giving you a true representation of your financials.

However, like any financial statement, a balance sheet has its limitations. A major drawback is its focus on a single date, capturing only past performance and current status, without forecasting future shifts. Recognizing these limitations is crucial to avoid basing decisions solely on this document.

Key components of Hong Kong balance sheet

A thorough understanding of these balance sheet components is essential for making informed decisions, paving the way for strategic planning and growth.

Assets

Assets represent everything your company owns that holds monetary value. These are split into two main categories:

- Current assets: Resources like cash, receivables, and inventory that can be converted into cash within a year.

- Non-current assets: Long-term investments or equipment, such as property, machinery, and intellectual property, meant to generate future profit.

Additionally, assets can be tangible (e.g., physical equipment or offices) or intangible (e.g., patents, copyrights, or goodwill). Both play critical roles in understanding the full extent of your company’s value.

Liabilities

Liabilities are your financial obligations as a company—what you owe others. These fall into two categories:

- Short-term liabilities: Payables due within 12 months, like rent, salaries, and supplier payments.

- Long-term liabilities: Loans, bonds, or leases that extend beyond one year.

Tracking liabilities effectively is crucial for debt management. Excessive short-term liabilities without adequate cash reserves might signal trouble, while manageable, well-optimized debt can accelerate growth without significant financial risk.

Equity

Equity represents the ownership stake held by founders or company shareholders. It is determined by subtracting liabilities from assets.

- Owner’s equity: This comprises direct investments made into the company and retained earnings, which are profits reinvested back into the business rather than distributed as dividends.

- Share capital: This is the total amount of money raised through the issuance of shares, calculated by dividing by their nominal value.

Equity reflects a company’s net worth and indicates its financial stability. It influences the distribution of profits between shareholders and reinvestment into the business. Strong equity signals to investors and stakeholders that the company is healthy and profitable, directly affecting the company’s market valuation.

Common challenges in preparing the balance sheet

Creating an accurate balance sheet isn’t always straightforward, especially in a dynamic market like Hong Kong’s, where economic conditions can change rapidly. Watch out for these roadblocks:

Valuation of assets

Determining the correct value of assets can be tricky, especially for items like inventory. Inventory valuation may require adjustments for obsolescence or damage, ensuring that the recorded value reflects current market conditions.

Similarly, fixed assets need careful depreciation calculations, which involve choosing the appropriate method and useful life estimates to reflect the asset’s true worth over time.

Liability recognition

Identifying and recording all liabilities, including contingent liabilities, can be complex. This process requires a thorough understanding of contractual obligations and potential future outflows.

Liabilities may include loans, accounts payable, and deferred taxes. Contingent liabilities, such as pending lawsuits or potential warranty claims, require careful assessment to determine their likelihood and potential financial impact.

Currency fluctuations

For businesses operating internationally, fluctuating currency exchange rates can significantly impact the valuation of foreign assets and liabilities. These fluctuations can lead to significant adjustments in the balance sheet, affecting the company’s financial position.

It is essential to implement strategies to manage currency risk, such as hedging, to stabilize financial reporting and minimize the effects of exchange rate volatility.

Regulatory compliance

Adhering to different accounting standards, such as Generally Accepted Accounting Principles (GAAP) or Hong Kong Financial Reporting Standards (HKFRS), requires detailed knowledge and diligent application.

These standards can vary significantly between jurisdictions, adding complexity to the preparation process. Staying updated with changes in regulatory frameworks and ensuring compliance with local laws and international guidelines is crucial for accurate and legally compliant financial reporting.

Overcome accounting challenges with BBCIncorp

With a team of experienced professionals, BBCIncorp’s accounting services in Hong Kong help streamline your company’s financial reporting, including preparation of balance sheet, income statement, and cash flow statement.

Practical tips for accurate preparation of balance sheet

Here are some practical tips to ensure the accuracy of your balance sheet:

Keep accurate records: Consistently updating your financial records throughout the accounting period to prevent last-minute errors and ensure all transactions are accounted for. Use accounting software or maintain a detailed ledger to track every financial movement, no matter how small.

Reconcile accounts regularly: Regular reconciliation of your accounts is essential. This involves comparing your internal financial records with external documents like bank statements, credit card statements, and supplier invoices. Doing this regularly helps catch discrepancies early and maintains the integrity of your financial data.

Classify assets correctly: Properly categorizing assets is vital for accurately representing your financial position. Differentiate between current and non-current assets and liabilities, and ensure everything is placed in the right category. This classification helps stakeholders understand the liquidity and solvency of the business.

By staying organized and proactive with these practices, you can create a balance sheet that truly reflects your business’s financial health. A well-prepared balance sheet is not just a regulatory requirement but also a valuable tool for strategic planning and decision-making.

Why Your Balance Sheet Reflects More Than Just Numbers

Under the Companies Ordinance (Cap. 622), every Hong Kong private company must prepare a balance sheet (together with profit & loss account) that gives a true and fair view for each financial year end, with directors signing a statement confirming compliance before laying the accounts before shareholders or filing with the Annual Return.

Accurate business recordkeeping—including invoices, bank statements, and contracts retained for at least seven years—is the foundation for a reliable balance sheet and becomes critical when a 2nd tier audit firm HK performs its statutory audit or when the Inland Revenue Department requests supporting documents during tax enquiries.

Getting the financial year end date right (usually the anniversary of incorporation unless changed via Form NDR1) also determines your filing deadlines, so aligning it early with your accountant avoids last-minute pressure.

Build a strong financial foundation today

Your Hong Kong balance sheet is more than just a compliance requirement—it’s a tool to unlock smarter decisions and growth opportunities. By breaking down its components, monitoring risks, and addressing challenges, you can command your business with confidence.

Don’t leave this critical document to guesswork. Whether you’re a startup founder or a seasoned business owner, we can help you understand the nuances of your balance sheet, streamline your processes, and drive business growth. Get in touch with us via service@bbcincorp.com to learn more about our accounting services and how we can support your business’s financial success.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.