Navigating the complexities of digital payments in Asia is essential for any global enterprise looking to expand into this vibrant region.

Understanding the flow of digital payments in Asia is not just an advantage—it’s essential for success. This is why Asia’s diverse payment systems, regulatory environments, and consumer behaviors present unique challenges that businesses must understand and manage effectively.

By gaining insights into these intricacies and adopting practical strategies, companies can ensure smoother financial transactions and build stronger relationships with local markets. It’s all about being prepared and adaptable in this dynamic landscape to truly tap into Asia’s immense growth potential.

The landscape of digital payments in Asia

The digital payments revolution in Asia is changing the way we handle transactions, making it important for businesses to keep up. Here’s a closer look at what’s happening and who the major players are:

Current trends and adoption rates

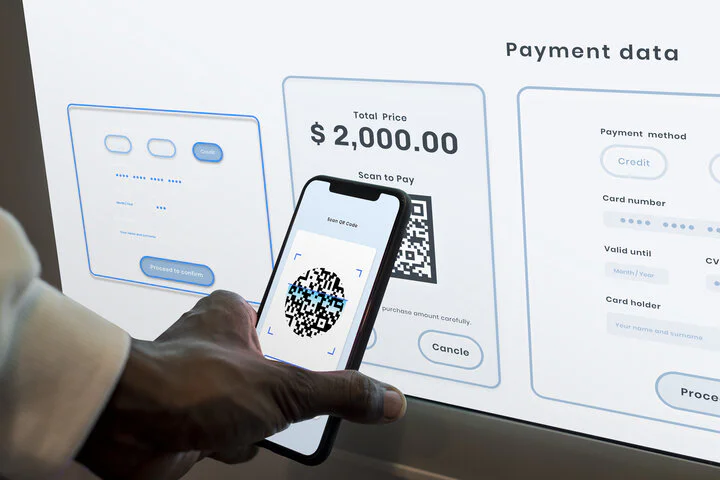

The digital payment landscape in Asia is evolving rapidly, with impressive adoption rates and innovative trends. Across major markets like China, India, and Southeast Asia, digital payments are becoming the norm, driven by the widespread use of mobile wallets, contactless payments, and QR code-based transactions.

For businesses considering company registration in major Asian hubs, adopting modern digital payment systems has become a strategic advantage—especially for e-commerce, retail, and cross-border trading activities.

According to McKinsey & Company, Asia accounts for over $900 billion in revenue in 2019 (nearly half of the worldwide total). Payments have become a cornerstone of Asia’s banking landscape, now comprising 44% of total banking revenues, up from just a third in 2007.

Consumers increasingly favor these convenient, fast, and secure payment methods over traditional cash and card transactions. This shift is not just about convenience; it’s about embracing a future where financial transactions are seamlessly integrated into daily life.

Major players and platforms

China leads the way with Alipay and WeChat Pay, which dominate the market and have made cashless transactions a way of life for millions. Alipay’s extensive ecosystem and WeChat Pay’s integration with the popular WeChat app collectively hold a substantial market share.

In India, Paytm is at the forefront, leveraging the country’s digital push to provide comprehensive payment solutions for a vast and diverse population.

For Southeast Asia, platforms like GrabPay and GoPay are expanding their services beyond ride-hailing to become key digital wallet providers. Each platform adapts to local preferences and regulatory environments, capturing significant market shares.

Additionally, for businesses in Singapore and Hong Kong, the dominant payment gateways include PayPal, Stripe, Airwallex, and Paymate.

These platforms collectively provide versatile and reliable solutions, especially when paired with the best logistics for Hong Kong trading businesses to ensure smooth delivery and fulfillment.

Key challenges in navigating digital payments in Asia

Navigating the digital payments landscape in Asia comes with its own set of challenges, from security concerns to technological infrastructure. Understanding and addressing these issues is crucial for businesses aiming to succeed in this diverse and dynamic region.

Security concerns

One of the primary challenges in digital payments is ensuring robust cybersecurity. The increasing prevalence of online transactions has made digital payment platforms a target for cyberattacks and fraud. Businesses must be vigilant against data breaches, phishing schemes, and other cyber threats.

Implementing advanced security measures, such as encryption, multi-factor authentication, and regular security audits, can help protect sensitive information and ensure secure transactions. Educating consumers about safe online practices also plays a vital role in mitigating security risks.

Currency exchange and cross-border payments

Managing currency exchange rates and cross-border transactions is another significant hurdle. Asia’s diverse economies mean dealing with multiple currencies, fluctuating exchange rates, and varying financial regulations. Understanding the HK tax system and other local compliance rules is critical to avoid legal and financial pitfalls.

To minimize these challenges, companies can use hedging strategies to protect against currency fluctuations, partner with reliable financial institutions for better exchange rates, and leverage fintech solutions that streamline cross-border payments. Additionally, understanding local regulations and compliance requirements is essential to avoid legal and financial pitfalls.

Technological infrastructure

The variability in technological infrastructure and internet penetration across Asian regions poses another challenge. While some areas boast advanced digital ecosystems, others may struggle with limited connectivity and outdated technology. This disparity can affect the consistency and reliability of digital payment experiences.

Businesses must invest in scalable and adaptable payment solutions that cater to varying levels of technological sophistication. Collaborating with local tech partners can also help address connectivity issues and enhance the overall digital payment infrastructure.

Successfully navigating these challenges requires a strategic approach and a deep understanding of the local market dynamics.

Strategies for effective digital payment integration

To successfully integrate digital payments into your business operations in Asia, adopting a strategic approach is essential. Here are key strategies to ensure seamless integration and optimize your payment processes.

Choosing the right payment providers

Selecting the right digital payment providers is crucial for aligning with your business needs and local market requirements. For companies building scalable e-commerce solutions, payment gateways must support high transaction volumes, multiple currencies, and seamless integration with online storefronts and ERP systems.

Consider factors such as transaction fees, compatibility with your existing systems, customer support quality, and the provider’s reputation. Providers with regional expertise are particularly valuable for start up business owners who may be unfamiliar with local regulations.

Localization of payment systems

Localization is key to meeting regional preferences and enhancing the customer experience. Different Asian countries have varied payment habits, from mobile wallets and QR codes in China to bank transfers and e-wallets in Southeast Asia. Adapting your payment systems to accommodate these preferences—by offering multiple payment options and integrating local currencies—can significantly improve customer satisfaction and conversion rates.

Tailoring your payment solutions to local customs and regulatory requirements not only facilitates smoother transactions but also builds trust with your customer base.

Ensuring compliance and security

Compliance and security are paramount when managing digital payments. Implement robust security measures to safeguard transactions and protect sensitive data from breaches and fraud. This includes employing encryption, multi-factor authentication, and regular security audits.

Staying updated with local regulations and ensuring that your payment systems comply with legal requirements is also crucial to avoid penalties and maintain operational integrity.

A notable example of effective digital payment integration is the partnership between BBCIncorp and Payoneer. Our collaboration delivers robust solutions designed to streamline your payment processes across diverse markets.

Choose BBCIncorp to leverage our expertise and the proven capabilities of Payoneer, ensuring a smooth, secure, and efficient digital payment experience. Contact us now for support on company banking services!

Conclusion

In wrapping up, it’s clear that mastering the intricacies of digital payments in Asia is not a simple task, but it’s a valuable opportunity for those who are prepared. Just as in any investment, success in this dynamic market requires a careful understanding of local nuances and a commitment to long-term strategy.

The potential here is significant, and with a disciplined approach—grounded in thorough research and adaptability—companies can turn this complexity into a competitive advantage. The key is to stay patient, informed, and strategically focused, allowing the rewards to follow.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.