Entrepreneurs must stay vigilant about their filing duties to uphold compliance with taxation regulations, especially in jurisdictions like Hong Kong with stringent laws. For Hong Kong business owners, an annual obligation is the filing of the employer’s return.

Navigating this process can be complex, given the involvement of various documents and requirements. For that reason, today’s article will delve into essential details surrounding this topic to help you safely stay in good standing.

What is Hong Kong Employer’s Return?

Employer’s Return, officially known as the “Employer’s Return of Remuneration and Pensions”, is one of the key Hong Kong annual compliance requirements imposed by the Inland Revenue Department (IRD) on employers.

This requirement involves employers providing specific information to the IRD regarding their employees’ remuneration and pension-related details.

The Employer’s Return is vital for both employers and employees because it ensures the accurate withholding and reporting of income tax to the tax authorities. Additionally, employers must report contributions such as the HK MPF contribution rate to ensure compliance with Hong Kong retirement regulations.

Key points of filing the Employer’s Return

Filing deadline

The standard employer tax return deadline is within one month from the date the IRD issued the forms, typically between April to mid-May. Missing this deadline can affect employee benefits like employee compensation insurance.

Information required

The ER must disclose information about each employee’s remuneration, including salaries, bonuses, allowances, and any other income-related items. It should also report the amount of tax withheld from employees’ salaries and contributions made to the Mandatory Provident Fund (MPF) or other retirement schemes. Employers must also report any dividends paid to shareholders if applicable, especially for employees who are also shareholders.

Submission options

Employers have the option to physically submit hard copies, electronically through IRD’s e-filing services, or a combination of these two formats. Accurate filing often requires referencing the concise guide to employment ordinance to ensure all statutory items are covered.

How to fulfill Employer’s Return obligations efficiently

To ensure compliance with Employers’ Return in Hong Kong, it’s crucial to keep the following points in mind:

Maintaining payroll records

For ease of the annual reporting process, Hong Kong employers are required to retain various documents for each employee, including employment contract Hong Kong, payroll records, tax documents, receipts, and invoices. These records should be preserved for years.

To achieve this efficiently, consider the following steps:

- Establishing clear and organized payroll procedures.

- Embracing electronic filing methods for streamlined record-keeping.

- Investing in reliable payroll systems to automate record maintenance.

- Seeking professional assistance to ensure adherence to best practices.

Reporting remuneration paid to an employee

Following the maintenance of these essential records, the employer must report remuneration paid to employees to the Inland Revenue Department through the Employer’s Return, and indicate if the end of contract occurred during the assessment year.

The detailed process for filing this tax return form will be discussed later in this article. For a thorough understanding, continue reading for valuable insights on the essential tasks associated with this annual report.

Penalties for non-compliance

Non-compliance with tax regulations in Hong Kong, including late filings, carries severe penalties.

In particular, employers who fail to meet the deadline for filing their tax returns without a reasonable excuse may face fines of up to HK$10,000. In such cases, the court may also compel the individual convicted to fulfill their obligations within a specified timeframe.

Which legal forms are required for ER filing?

The employer’s return encompasses two primary forms: Form BIR56A and Form IR56B.

These forms play a crucial role in the tax reporting process so that the government receives up-to-date information about employee remuneration. Thus, companies should be attentive to these forms to maintain accurate records with the IRD.

The breakdowns of these crucial forms are specified below for your better understanding.

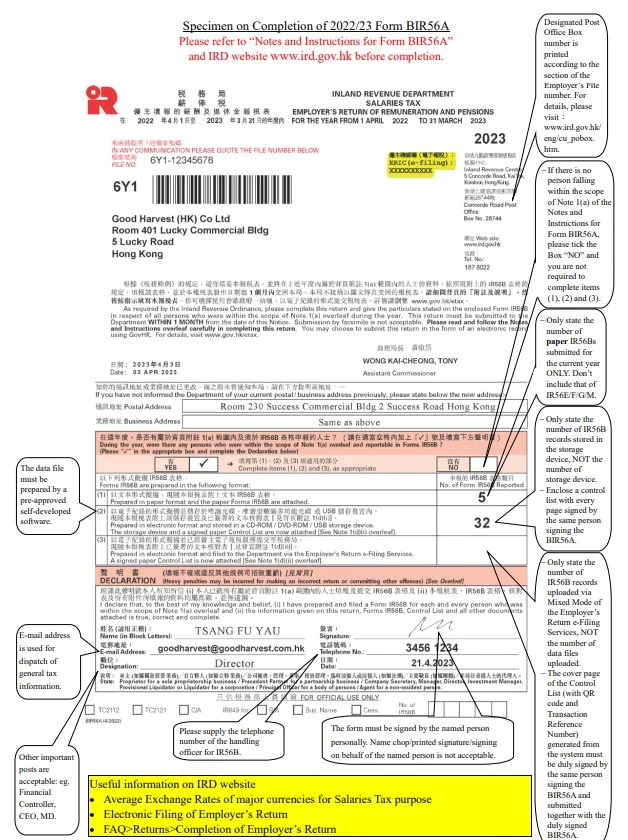

Form BIR56A

Form BIR56A is the form that employers must submit to cover the general information about the company, the officer in charge of the filing, and the total number of employees.

The common elements found in this form are:

- Company information: This section contains details about the company name, registered address, postal address, and other necessary identification.

- Filing person’s details: It includes the name, telephone number, designation, signature, and email address of the filing officer.

- Total number of Form IR56B: Employers must specify the total number of Form IR56B submitted for their employees, categorizing them into paper and electronic documents.

- The date when the employer’s return is submitted must be entered.

- Declaration by a director: This section includes a declaration made by a director of the company, along with their original signature.

Furthermore, when being filed physically, the BIR56A must be signed and submitted by an Authorized Signer based on the type of entity:

- For sole proprietorship: The form should be signed by the proprietor.

- For partnerships: It should be signed by a leading partner.

- For open-ended fund companies: The signatory can be a company secretary Hong Kong, manager, director, or investment manager.

- For corporations: The form must be signed by a provisional liquidator or liquidator.

- For the body of persons: The document shall be signed by a principal officer.

- For non-resident persons: An agent shall sign the form.

For a more comprehensive understanding, you can refer to a detailed sample of Form BIR56A provided by the IRD, which includes instructions for your reference.

Form IR56B

Form IR56B states the information about every employee of the company, including their salary, allowances, and tax details. This form requires more comprehensive data compared to the BIR56A.

What details does Form IR56B contain?

To comply with the requirements set forth by the Department, you are obligated to provide the following information on Form IR56B:

- Business information: This section includes details about the employer, such as the employer’s name, file number, and business name.

- Employee’s personal information: Form IR56B requires information about each employee, including their name, gender, marital status, identification card or passport number, address, job position, and the duration of their employment.

- Income during the year of assessment: This section requires the reporting of various income components for the employee, including salary, commission, benefits, pensions (for retired employees), salaries tax, and any other relevant income amounts.

- Information about the employee’s place of residence is required.

- If the employee has earned income from other employers, whether within or outside Hong Kong, this should be disclosed.

- Details of contributions made to the Mandatory Provident Fund (MPF) for the employee should be provided.

- This section allows for any additional comments or remarks relevant to the employee’s income and tax situation.

- The date when the form is submitted should be indicated.

- Name and signature of a director: The form must be signed by a director of the company, who is the same person as identified in Form BIR56A.

Depending on the nature of the business, additional criteria may need to be addressed, so make sure to refer to the official instructions on IRD’s site to avoid penalties.

Which employees are required to complete Form IR56B?

This document applies to the following categories of individuals:

- Employees (including non-Hong Kong residents) of a Hong Kong-based company whose total income exceeds the Basic Allowance relevant to the year of assessment.

- Directors, married persons, and part-time employees with income subject to salaries tax

- Employees of non-Hong Kong companies who have been assigned to a company for duties either overseas or within Hong Kong

- Individuals who have received pension payments or have accrued pension benefits.

- Other cases specified in the IRD’s guidelines on Form IR56B.

Additional forms for special cases

In addition to Form IR56B, other forms may be required for special cases, such as:

- Form IR56E: Used for reporting information about new employees.

- Form IR56F: In cases of an employee’s termination or death.

- Form IR56G: For employees who leave Hong Kong permanently or for a period of time

- Form IR56M: For persons other than employees (in case of hiring freelancers)

The process of filing the Employer’s Return

Now that you have a grasp of the essential components to be included in the employer’s return, let’s delve into the steps below:

Step 1: Prepare payroll records and relevant forms

Start by reviewing your payroll records for each employee, which should include details such as salaries, bonuses, allowances, and other benefits. These records will serve as the basis for your Employers’ Returns.

You can obtain the necessary forms, Form BIR56A and Form IR56B, from the IRD. Generally, these forms are sent to your registered business address on April 1st of each year.

If you haven’t received Form BIR56A by mid-April, you can request it by completing Form IR6163. New Hong Kong companies may have to wait 3 to 6 months after their first audit for the IRD to issue these forms.

Step 2: Choose the filing format

Once your documents are ready, you have three options for filing your return:

- Submit Form BIR56A and Form IR56B in paper format.

- Submit Form BIR56A in paper format and provide a soft copy of all IR56B documents.

- Use the ER e-filing services to file both forms electronically.

Filing your Employer’s Return is simple with BBCIncorp

BBCIncorp offers corporate services to assist Hong Kong companies in adhering to legal obligations efficiently. Whether you need help with Employer’s Return filing or consulting, our accountants have got you covered.

Explore our services today for more details.

Step 3: File the Employer’s Return accordingly

Depending on your chosen filing format, there are three different processes to follow:

Filing all forms physically

For this option, you shall complete the forms provided by the IRD and send them to the Inland Revenue Centre at 5 Concorde Road, Kai Tak, Kowloon, Hong Kong.

If the original BIR56A form is lost or damaged, you can request a duplicate through the IRD’s website. It will take three working days for the Employer’s Return to be reissued, provided there is no change in the postal address.

Regarding the IR56B forms, you are allowed to:

- Use the forms sent by the IRD directly, or

- Download the template from the IRD website/ the Fax-A-Form Service and print them on white plain A4 size paper for completion.

Filing form BIR56A in hard copy and IR56B in soft copy

In this case, you will need to deliver the following documents to the IRD’s office address:

- A physical BIR56A form; and

- A soft copy of IR56B records on a CD-ROM/ DVD-ROM/ USB storage device with a duly signed Control List, prepared by a pre-approved self-developed software.

Please note that once submitted, the storage device will be retained as source documents at the IRD and, thus will not be returned to the business.

Filing the Employer’s Return through the ER e-filing services

If you decide to use the ER e-filing services, there are two available options:

(1) Online mode

You will need an eTax account for the Authorized Signer to log in and submit the tax return form from employers.

As an employer, you can submit the data file by the “Direct Keying” service or “Uploading”:

- Direct Keying: Employers can only perform submission of the BIR56A/IR6036B once a year with up to 30 sets of IR56B/M forms. Multiple submissions of IR56 form sets in a day are allowed.

- Uploading: Employers can submit data files containing up to 5,000 sets of IR56 forms (Forms IR56B and IR56F) prepared by the IR56 Forms Preparation Tool or pre-approved self-developed software.

(2) Mixed mode

For this choice, employers can appoint a person to upload data files containing up to 5,000 sets of IR56 forms. These forms can be prepared either through the IR56 Forms Preparation Tool (including Forms IR56B and IR56F) or a pre-approved self-developed software

Once the data file is successfully uploaded, the system generates a Control List with a QR Code and Transaction Reference Number, summarizing the IR56 forms stored in the file.

To complete the process, the Authorized Signer must sign the 1-page (Cover Page) Control List, along with a duly signed paper BIR56A, and then submit the document to the IRD.

Conclusion

In conclusion, meeting the obligation of filing the Employer’s Return is essential for every business owner in Hong Kong. Given the complexity of the documents involved, thorough attention is required to maintain good standing with the Inland Revenue Department.

For that reason, it is of utmost importance to always maintain accurate records of the employees’ tax-related information to stay compliant.

If you encounter challenges in understanding this obligation or have questions about operating your business in Hong Kong, our team is here to offer help. Contact our support team now via service@bbcincorp.com for timely assistance on your case.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.