Navigating Hong Kong’s tax landscape can feel complex, but one major advantage stands out to global business owners: the offshore tax exemption for Hong Kong-incorporated companies provides exemptions from profits tax on foreign-sourced profits.

In today’s article, we will explain offshore tax exemption in detail, discuss the essentials, and illustrate how it can benefit your Hong Kong businesses.

Hong Kong is a legal low-tax jurisdiction, not a zero-tax haven. Its offshore tax exemption follows the territorial principle. This means a Hong Kong company only pays profits tax on income sourced in Hong Kong. Meanwhile, foreign-sourced profits may qualify for an offshore tax exemption. Local profits face a tax rate from 8.25% to 16.5%.

Understandably, the framework distinguishes Hong Kong from classic tax havens like Belize, Seychelles, or the BVI. It also explains why many foreign entrepreneurs choose to establish companies in Hong Kong for its clear rules, predictable compliance requirements, and consistently low corporate tax burden.

Quick Note

If your business meets the conditions for offshore treatment, you must submit an Offshore Tax Claim (OTC) to the Inland Revenue Department. The IRD will review your contracts, operational flow, and supporting documents to confirm the source of income.

Only after this assessment will the IRD decide whether your profits qualify as offshore and are not chargeable to Hong Kong profits tax.

What is the Hong Kong offshore tax exemption?

Understanding how Hong Kong treats foreign-sourced profits is key for businesses looking to optimize their tax position.

Definition of Hong Kong offshore tax exemption

Under Hong Kong’s territorial tax system, only profits generated within the city are subject to taxation. Consequently, income derived entirely from operations conducted abroad can qualify for full Hong Kong corporate tax exemption. This framework provides clarity for companies planning cross-border transactions and international trade.

Impact on competitiveness

By limiting taxation on foreign-sourced income, Hong Kong enhances its appeal as a global business hub. The exemption encourages investment and regional expansion. Thus, it enables companies to retain more profits.

In practice, it helps businesses remain competitive internationally without compromising compliance with local regulations.

Eligibility and applicable entities

To qualify, a Hong Kong-incorporated company must demonstrate that all profits originate from activities carried out outside the city. Common examples include contracts with overseas clients, services delivered abroad, or products supplied through foreign agents.

Further, maintaining detailed records, contracts, and accounting documents is crucial to support the claim and ensure a smooth review process.

Benefits for business

Overall, the exemption lets companies reduce tax liabilities, reinvest savings, and strengthen their global position. Together with Hong Kong’s low domestic tax rates, absence of capital gains tax, and full foreign ownership options, the offshore exemption makes the city an attractive base for enterprises seeking success and long-term sustainability.

Note

For a deeper dive into why Hong Kong consistently ranks as a leading tax-competitive location, read our article Hong Kong Tax Haven: Interesting Facts You Might Not Know.

How does Hong Kong’s tax system work?

Hong Kong’s tax system is based on the territorial principle, meaning only profits earned from activities within Hong Kong are subject to profits tax. Income generated entirely from operations outside the territory may qualify for exemption if the companies can demonstrate that the profit-generating activities occur abroad.

Hong Kong profit tax rates comparison

Corporations

Hong Kong applies a two-tier system. The first HK$2 million of assessable profits is taxed at 8.25%. Profits above this threshold are taxed at 16.5%. This structure supports smaller companies while maintaining competitive rates for larger businesses.

Sole proprietorships and partnerships

Unincorporated businesses follow a similar progressive approach but generally face slightly lower effective rates. Their rates reflect the simpler structure and smaller scale of operations.

Offshore profits

Profits derived entirely from activities outside Hong Kong are fully exempt from profits tax, regardless of the type of entity. Approval requires demonstrating that the income-generating activities occur overseas and are well-documented.

The overall system allows companies of all sizes to retain more earnings from foreign operations. By combining low domestic tax rates with offshore exemptions, Hong Kong provides significant savings and enhances competitiveness for corporations, partnerships, and sole proprietors engaged in cross-border business.

Foreign-Sourced Income Exemption (FSIE) Framework

In response to EU concerns over untaxed passive income, the Hong Kong SAR Government proposed the revised foreign‑sourced income exemption regime in mid‑2022.

Under Hong Kong’s FSIE regime, only constituent entities (CE) of a multinational enterprise group are covered. Individuals and standalone local companies are not eligible.

Specified foreign-sourced income includes interest, dividends, intellectual property income, and disposal gains. By default, this income is considered to be sourced in Hong Kong and is subject to profits tax if received in Hong Kong, unless the entity meets specific exception conditions.

The main exception requirements are:

- Economic substance requirement: Applies to interest, dividends, and non-IP disposal gains. The entity must maintain an actual business presence in Hong Kong.

- Nexus requirement: Applies to qualifying intellectual property income and is based on research and development activities according to international standards.

- Participation requirement: Applies to foreign-sourced dividends or equity disposal gains. The entity must hold a minimum percentage of equity for at least twelve months and satisfy anti-abuse conditions.

From 1 January 2024, an amendment expanded the FSIE framework to cover disposal gains on all types of property, not only equity, and introduced intra-group transfer relief with safeguards against abuse. Entities can also request an advance ruling from the Inland Revenue Department to confirm they meet the economic substance conditions.

Note

For a more detailed overview, kindly see our guide on the Hong Kong tax system.

How can you qualify for tax exemptions in Hong Kong?

To qualify, businesses must demonstrate that the income is genuinely offshore, which is income earned from activities that take place entirely outside Hong Kong.

The amount can then be exempt from profits tax when the Inland Revenue Department accepts that the source is foreign. This forms the core of the qualification criteria for Hong Kong’s offshore tax exemption.

Who is qualified for an offshore claim?

A company becomes eligible only when its operations and reports show that the relevant profit generating activities occur outside Hong Kong. The Inland Revenue Department reviews each case through the profits tax return and a detailed questionnaire that examines how the business operates, where it operates, and how income is booked.

The authority issues the final decision through a written ruling, so the quality of documentation strongly influences the outcome. It’s important to note that the review focuses on the actual conduct of the business rather than the place of incorporation or the location of bank accounts.

Key factors to apply for an offshore claim include the following:

- The company has no active clients in Hong Kong and does not market or promote its services within the city.

- The company keeps no physical office in Hong Kong and employs no staff who perform core business activities there.

- Website hosting, servers, and operational infrastructure are situated outside Hong Kong.

- Contract negotiation, execution, and management take place outside Hong Kong, with directors or authorised persons from overseas.

- Sales, services, warehousing, and fulfillment occur entirely outside Hong Kong.

- Business records clearly trace how profits were generated abroad and demonstrate that all substantive activities occurred outside the city.

Because the Inland Revenue Department examines each case strictly, the company must optimize their structure and process flow with the support of a Certified Public Accountant.

When should you register for an offshore claim?

A company typically submits its offshore claim together with its first profits tax return, which usually occurs eighteen months after incorporation. Submitting at this stage allows the Inland Revenue Department to review complete and fresh documentation, including contracts, invoices, bank statements, and records showing where profit-generating activities take place.

If a company misses the first submission, it can still file later, but delayed claims may attract more scrutiny. Once the IRD accepts a claim and operations remain consistent, the exemption may continue for subsequent years without full reassessment.

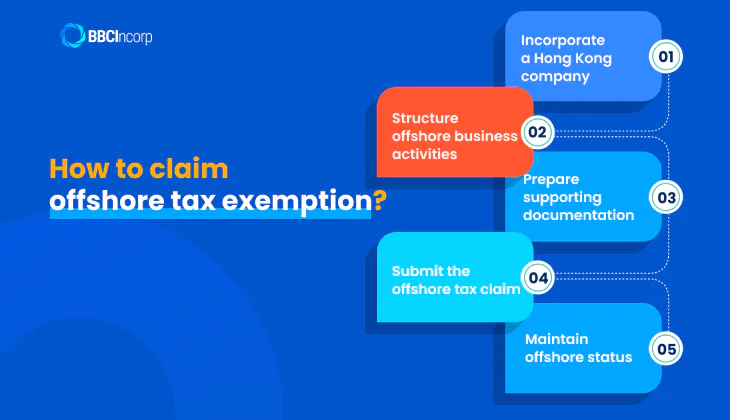

How to claim offshore profit tax exemption?

Securing offshore status in Hong Kong requires demonstrating that your company’s profits are generated outside the territory. This process involves careful planning, clear documentation, and compliance with the Inland Revenue Department’s requirements.

Step 1: Incorporate a Hong Kong company

Only a Hong Kong-incorporated business can apply for offshore tax exemption, so you must open a Hong Kong company first. The registration process includes:

- Choose a unique company name that meets Companies Registry requirements.

- Prepare incorporation documents, including the Articles of Association and the necessary form.

- Submit the documents to the Companies Registry for formal registration.

- Obtain a Business Registration Certificate from the Inland Revenue Department.

- Comply with statutory obligations such as maintaining proper accounting records, preparing annual financial statements, and completing audits where applicable.

Establishing your Hong Kong company provides the initial legal foundation to submit an Offshore Tax Claim.

Step 2: Structure offshore business activities

The Inland Revenue Department evaluates where profit-generating activities occur. To strengthen your claim:

- Conduct core operations such as sales, service delivery, and contract management outside Hong Kong

- Make sure the clients are primarily overseas

- Perform management and decision-making activities outside the city

- Maintain infrastructure, warehousing, or fulfillment outside Hong Kong

The focus is on the substance of operations rather than the location of directors or bank accounts.

Step 3: Prepare supporting documentation

Next, gather contracts, invoices, bank statements, correspondence, and operational records showing that profits are generated offshore. Audited financial statements should clearly separate offshore and Hong Kong-sourced income.

Well-organized documentation makes the review smoother and increases the likelihood of approval for Hong Kong offshore fund tax exemption.

Step 4: Submit the offshore tax claim

The claim is submitted with the company’s annual Profits Tax Return. The IRD may request clarifications on operations, client relationships, or financial transactions. A complete and consistent submission can result in approval for multiple years.

Step 5: Maintain offshore status

To retain exemption, continue operating according to the declared offshore structure. Changes in operations, client base, or business structure may trigger re-examination, so keep consistent documentation and adherence to the territorial principle.

Assess your eligibility with our Offshore Claim Tool

Take control of your company’s tax planning with our Hong Kong Offshore Claim Tool. See which income types may qualify for offshore exemption and gain clarity on your situation today.

What happens if the IRD rejects an offshore tax exemption claim?

If the Inland Revenue Department (IRD) rejects your Hong Kong offshore claim, the profits in question are treated as Hong Kong-sourced and may be subject to the standard profits tax. The IRD can issue a tax assessment for the relevant period, including any interest on unpaid taxes.

Following a rejection, the IRD may request further documentation to examine the source of income more closely. This can include contracts, invoices, bank statements, correspondence, and operational records showing where business activities were conducted.

It’s crucial to note that companies have the right to appeal a rejected claim. The process begins with lodging an objection with the Commissioner of Inland Revenue, and, if necessary, escalating to the Board of Review or courts. Success depends on providing clear evidence that profits were earned outside Hong Kong.

Common pitfalls when claiming offshore status

Many businesses mistakenly assume all overseas sales are automatically exempt, but the IRD examines the location of profit-generating activities—such as where contracts are negotiated and executed—rather than just the customer’s location, and incorrect claims can trigger lengthy field audits and penalties.

Unlike salary tax (which is always charged on Hong Kong employment income) or property tax (levied on local rental income), offshore profits enjoy zero tax only when robust documentation is maintained throughout the year. To avoid surprises during IRD reviews, consider the practical tools covered in Streamlining Tax Compliance: Essential Digital Solutions For Businesses.

Maintaining thorough records from the outset is critical. Even after a rejection, proper documentation strengthens any future claim or appeal, and it will benefit you to engage a professional advisor from BBCIncorp. We offer comprehensive company services, including support for bookkeeping services Hong Kong, auditing, compliance, bookkeeping, and documentation.

Visit our website or get in touch with BBCIncorp team for any questions you may have on offshore tax exemption Hong Kong.

Conclusion

The offshore tax exemption Hong Kong allows companies to reduce profits tax on income earned entirely outside the territory.

As a company that operates abroad, serves international clients, and provides clear supporting documents, you can have your Offshore Tax Claims approved by the Inland Revenue Department. Simply submit the detailed contracts, invoices, and financial records to the IRD, and keep thorough documentation to support future applications or appeals.

To learn more information and take full advantage of this framework, work with BBCIncorp. Our team provides professional guidance in accounting, auditing, compliance, and record-keeping, helping your company secure offshore tax exemptions efficiently.

Send us an email via service@bbcincorp.com to optimize your Hong Kong operations, retain more profits, and expand your business internationally today.

Free ebook

Everything you need to start business in Hong Kong

Find out in a matter of minutes.

Frequently Asked Questions

How do I maintain offshore status?

To maintain offshore status in Hong Kong, your company must continue operating according to the structure declared in your Offshore Tax Claim. This includes filing annual Profits Tax Returns even if no Hong Kong-sourced income arises.

You must keep thorough financial records separating offshore and local profits, including contracts, invoices, bank statements, and operational documents. The company should retain records for at least seven years, as required by the IRD. Operational substance is crucial: core business activities, decision-making, and management should remain overseas, and your client base should be primarily foreign.

Changes in business operations, such as moving key functions to Hong Kong or taking on local clients, can trigger a reassessment.

What if you earn passive income?

Passive income, such as interest, dividends, royalties, or capital gains, is subject to the revised Foreign-Sourced Income Exemption (FSIE) rules.

For non-intellectual property income like dividends or interest, the entity must meet economic substance requirements, demonstrating real business operations abroad. Intellectual property income requires satisfying the nexus approach, showing research and development or IP activities occurred outside Hong Kong. Disposal gains or equity transactions fall under participation requirements.

Even if passive income is received in Hong Kong, proper documentation and adherence to FSIE criteria allow it to remain exempt.

Are there time limits for filing an offshore tax exemption claim with the IRD?

Yes. An Offshore Tax Claim must be submitted together with the company’s Profits Tax Return, typically the first return after incorporation, around 18 months later.

Make sure to submit timely applications so the IRD can assess the claim with complete and current documentation.

Delayed claims may attract additional scrutiny, require more supporting evidence, and could risk partial or full rejection. Once approved, the exemption can continue for subsequent years as long as the company maintains the declared offshore structure. The IRD requires all financial and operational records supporting the claim to be kept for at least seven years after the relevant transactions.

How should I plan for cross-border expansion?

When your Hong Kong company begins trading or establishing subsidiaries abroad, double taxation agreements become critical for crediting foreign taxes paid against any local liability, while careful structuring prevents unintended permanent establishment exposure.

Early planning also helps manage withholding tax on payments to non-residents and ensures compliance with both Hong Kong and foreign reporting rules such as FATCA or CRS.

For a complete checklist before going global, see our guide International Tax Obligations: What To Consider When Expanding Overseas.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.